Earnings summaries and quarterly performance for COHERENT.

Executive leadership at COHERENT.

Jim Anderson

Chief Executive Officer and President

Giovanni Barbarossa

Chief Strategy Officer

Ilaria Mocciaro

Senior Vice President, Chief Accounting Officer and Corporate Controller

Julie Eng

Chief Technology Officer

Rob Beard

Chief Legal and Global Affairs Officer and Secretary

Sherri Luther

Chief Financial Officer and Treasurer

Board of directors at COHERENT.

David Motley

Director

Elizabeth Patrick

Director

Enrico DiGirolamo

Board Chair

Howard Xia

Director

Joseph Corasanti

Director

Lisa Neal-Graves

Director

Michael Dreyer

Director

Michelle Sterling

Director

Patricia Hatter

Director

Sandeep Vij

Director

Shaker Sadasivam

Director

Stephen Pagliuca

Director

Stephen Skaggs

Director

Research analysts who have asked questions during COHERENT earnings calls.

Karl Ackerman

BNP Paribas

6 questions for COHR

Samik Chatterjee

JPMorgan Chase & Co.

6 questions for COHR

Simon Leopold

Raymond James

6 questions for COHR

Thomas O’Malley

Barclays Capital

5 questions for COHR

Christopher Rolland

Susquehanna Financial Group

4 questions for COHR

George Notter

Jefferies

4 questions for COHR

Meta Marshall

Morgan Stanley

4 questions for COHR

Ezra Weener

Jefferies LLC

3 questions for COHR

Michael Mani

Bank of America

3 questions for COHR

Ruben Roy

Stifel Financial Corp.

3 questions for COHR

Ryan Koontz

Needham & Company, LLC

3 questions for COHR

Atif Malik

Citigroup Inc.

2 questions for COHR

Jack Egan

Charter Equity Research

2 questions for COHR

Papa Sylla

Citi

2 questions for COHR

Vivek Arya

Bank of America Corporation

2 questions for COHR

Blayne Curtis

Jefferies Financial Group

1 question for COHR

Papa Talla Sylla

Citigroup

1 question for COHR

Richard Shannon

Craig-Hallum Capital Group LLC

1 question for COHR

Recent press releases and 8-K filings for COHR.

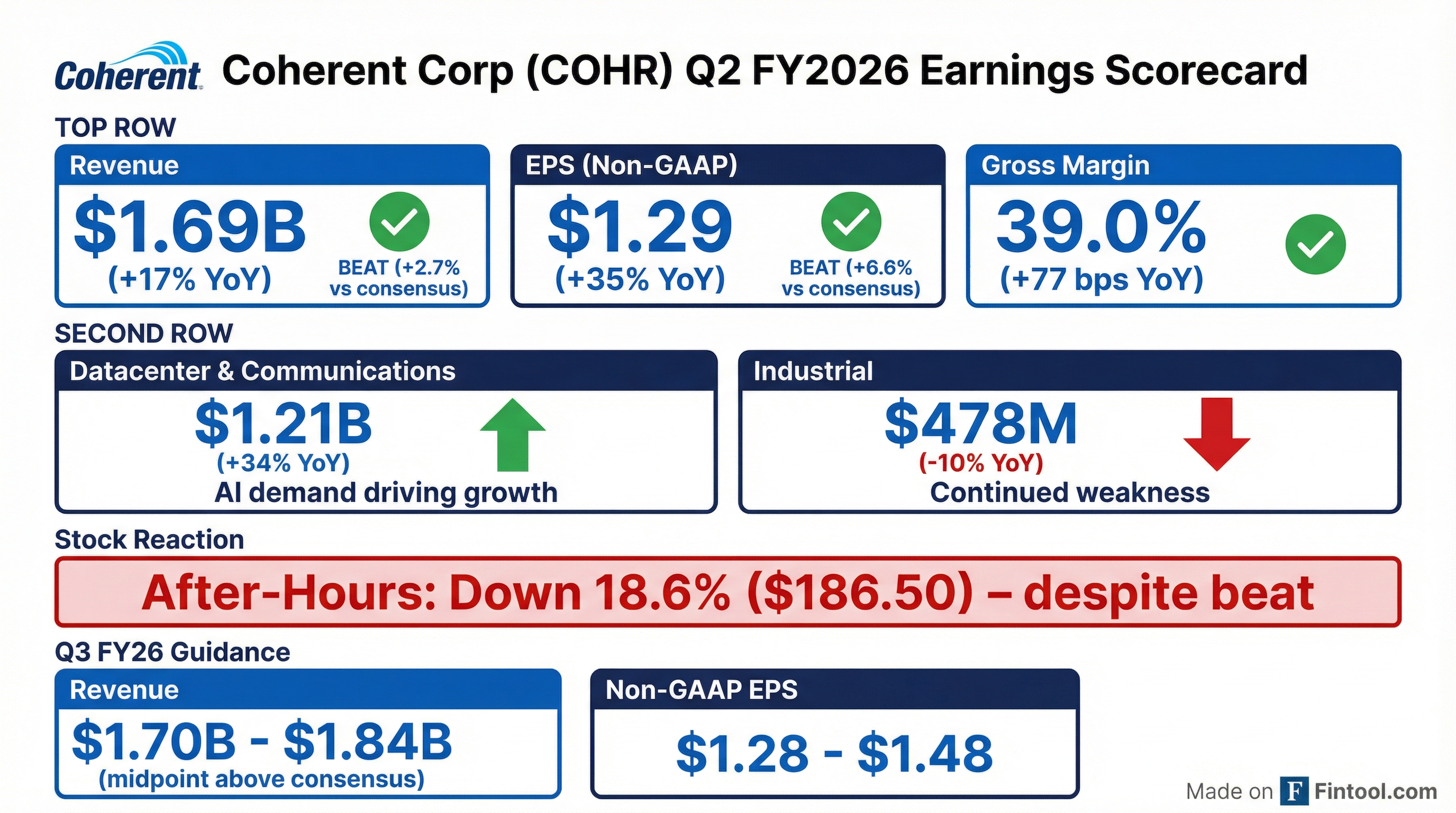

- Coherent reported Q2 2026 revenue of $1.69 billion, an increase of 17% year-over-year, and non-GAAP EPS of $1.29, up 35% year-over-year. Pro forma revenue, excluding a recently divested business, increased 22% year-over-year.

- The company provided Q3 2026 guidance, expecting revenue between $1.7 billion and $1.84 billion and non-GAAP EPS between $1.28 and $1.48.

- Growth was primarily driven by strong demand from AI data centers, with the data center business seeing 14% sequential growth and a book-to-bill ratio exceeding 4x in Q2. Key growth drivers include 800G and 1.6T transceivers, OCS, and CPO solutions.

- Coherent is rapidly expanding its production capacity, aiming to double internal indium phosphide capacity by the fourth quarter of this calendar year, with current wafer starts already at 80% of that target. This expansion is expected to support significant revenue growth and margin expansion.

- The company completed the sale of its Munich product division, which is expected to be immediately accretive to gross margin and EPS, and plans to use the proceeds to reduce debt.

- Coherent (COHR) reported strong financial results for Q2 2026, with revenue of $1.69 billion, representing a 17% year-over-year increase, and non-GAAP diluted earnings per share of $1.29, up from $0.95 in the year-ago quarter. The non-GAAP gross margin expanded to 39%.

- The company completed the sale of its product division in Munich, Germany, which is anticipated to be immediately accretive to both gross margin and EPS. This divestiture, along with other operational streamlining, led to exiting 10 sites in the past quarter, bringing the total to 33 sites over approximately six quarters.

- Coherent is experiencing "extraordinary" demand and visibility, particularly within its data center business, evidenced by a book-to-bill ratio exceeding 4x. The company is aggressively expanding its Indium Phosphide capacity, aiming to double it by the end of the calendar year, and foresees a sustained supply-demand imbalance for Indium Phosphide.

- The ramp-up of 1.6T transceivers is expected to be margin accretive due to higher average selling prices and gross margins compared to 800G products. Additionally, the company noted a strong pickup in Semicap orders.

- Coherent reported strong Q2 2026 results, with revenue of $1.69 billion (up 22% year-over-year pro forma) and non-GAAP EPS of $1.29 (up 35% year-over-year), driven by the AI build-out and demand in data center and communications.

- For Q3 2026, the company expects revenue between $1.7 billion and $1.84 billion and non-GAAP EPS between $1.28 and $1.48. Management anticipates sustained strong revenue growth over coming quarters, with fiscal 2027 revenue growth exceeding fiscal 2026.

- Key growth drivers include 800G and 1.6T transceivers, new OCS and CPO solutions, and a pickup in the industrial business led by Semicap. Coherent is rapidly expanding 6-inch indium phosphide production capacity to meet demand, aiming to double it by Q4 calendar year.

- Coherent Corp. reported Q2 FY26 revenue of $1.69 billion, marking a 22% increase year-over-year, with non-GAAP diluted earnings per share of $1.29, up 35% year-over-year.

- The significant revenue growth was primarily driven by the Datacenter & Communications segment, which saw a 34% increase year-over-year and comprised 72% of total revenue in Q2 FY26.

- For Q3 FY26, Coherent Corp. projects revenue to be between $1.70 billion and $1.84 billion and non-GAAP diluted earnings per share to range from $1.28 to $1.48.

- Coherent Corp. reported Q2 FY26 revenue of $1.69 billion, marking a 17% year-over-year increase (or 22% pro forma adjusted for the sale of the Aerospace & Defense business), primarily driven by strong demand in the datacenter and communications segment.

- For Q2 FY26, GAAP diluted EPS grew 71% year-over-year to $0.76, and non-GAAP diluted EPS increased 35% year-over-year to $1.29.

- The company achieved a GAAP gross margin of 36.9% (up 145 bps year-over-year) and a non-GAAP gross margin of 39.0% (up 77 bps year-over-year).

- Coherent Corp. provided Q3 FY26 guidance, projecting revenue between $1.70 billion and $1.84 billion and non-GAAP EPS between $1.28 and $1.48.

- CEO Jim Anderson anticipates continued strong growth in the datacenter and communications segment through fiscal 2027, supported by production capacity expansion and improving demand in the Industrial segment.

- Coherent Corp. reported Q2 FY26 revenue of $1.69 billion, marking a 17% year-over-year increase (or 22% on a pro forma basis adjusted for the sale of the Aerospace & Defense business).

- Q2 FY26 GAAP diluted EPS increased 71% year-over-year to $0.76, while non-GAAP diluted EPS rose 35% year-over-year to $1.29.

- Gross margins expanded in Q2 FY26, with GAAP gross margin at 36.9% (up 145 bps Y/Y) and non-GAAP gross margin at 39.0% (up 77 bps Y/Y).

- For Q3 FY26, the company anticipates revenue between $1.70 billion and $1.84 billion and non-GAAP diluted EPS between $1.28 and $1.48.

- Management highlighted strong demand in the datacenter and communications segment as a key driver for Q2 revenue growth and expects continued strong growth through fiscal 2027.

- Coherent Solutions has closed a strategic investment led by IceLake, a private investor specializing in partnerships with high-growth services companies.

- The transaction, initially revealed in September 2025, received all necessary regulatory authorizations by December 22, 2025.

- This partnership will provide additional resources to expand global delivery capacity, invest further in advanced technologies, and support the company's continued growth.

- Coherent Solutions, founded in 1995, is a global digital engineering company employing approximately 2,000 digital engineers across Europe and Latin America.

- Coherent Solutions has closed a strategic investment from IceLake, a private equity firm specializing in high-growth business services organizations.

- The transaction, initially announced in September 2025, has now received all necessary regulatory approvals.

- This collaboration provides Coherent Solutions with additional resources to expand global delivery capacity, invest further in advanced technical capabilities, and support the company's continued growth.

- Coherent Solutions has completed a strategic investment led by IceLake, a private equity firm specializing in high-growth business service providers.

- The transaction, initially announced in September 2025, officially closed on December 22, 2025, after receiving all required regulatory approvals.

- This partnership is expected to provide additional resources for Coherent Solutions to expand its global delivery capacity, invest further in advanced technical capabilities, and support its continuous growth.

- Coherent Solutions and IceLake have closed a strategic investment, which was previously announced in September 2025 and has received all necessary regulatory approvals.

- IceLake, a private equity firm, has invested in Coherent Solutions, a global digital engineering firm founded in 1995 with approximately 2,000 professionals across Europe and Latin America.

- This partnership will provide Coherent Solutions with additional resources to expand global delivery capacity, invest in advanced technical capabilities, and support its continued growth.

Quarterly earnings call transcripts for COHERENT.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more