Earnings summaries and quarterly performance for CVR ENERGY.

Executive leadership at CVR ENERGY.

David L. Lamp

President and Chief Executive Officer

C. Douglas Johnson

Executive Vice President and Chief Commercial Officer

Dane J. Neumann

Executive Vice President, Chief Financial Officer, Treasurer and Assistant Secretary

Jeffrey D. Conaway

Vice President, Chief Accounting Officer & Corporate Controller

Mark A. Pytosh

Executive Vice President—Corporate Services

Melissa M. Buhrig

Executive Vice President, General Counsel and Secretary

Michael H. Wright, Jr.

Executive Vice President and Chief Operating Officer

Board of directors at CVR ENERGY.

Research analysts who have asked questions during CVR ENERGY earnings calls.

Manav Gupta

UBS Group

4 questions for CVI

John Royall

JPMorgan Chase & Co.

3 questions for CVI

Matthew Blair

Tudor, Pickering, Holt & Co.

3 questions for CVI

Neil Mehta

Goldman Sachs

3 questions for CVI

Paul Cheng

Scotiabank

3 questions for CVI

Adam Alexander Wijaya

Goldman Sachs

1 question for CVI

Recent press releases and 8-K filings for CVI.

- CVR Energy, Inc. (CVI) announced the pricing of a private placement for $600 million of 7.500% Senior Notes due 2031 and $400 million of 7.875% Senior Notes due 2034.

- The total $1 billion offering is expected to close on February 12, 2026.

- The company intends to use the net proceeds to repay its senior secured term loan facility, redeem all outstanding 8.500% Senior Notes due 2029, and redeem $217 million of 5.750% Senior Notes due 2028.

- CVR Energy, Inc. intends to offer $1 billion in aggregate principal amount of senior unsecured notes due 2031 and 2034 in a private placement, subject to market conditions.

- The net proceeds from this offering, along with cash on hand or borrowings, are planned to repay approximately $157 million of its senior secured term loan, redeem $600 million of its 8.500% Senior Notes due 2029, and redeem $217 million of its 5.750% Senior Notes due 2028.

- In December 2025, the company reverted its Renewable Diesel Unit (RDU) at the Wynnewood refinery to hydrocarbon processing service due to unfavorable economics, resulting in approximately $2 million in asset write-downs and $62 million in additional depreciation charges for the fourth quarter of 2025.

- Effective January 1, 2026, the Renewables Segment is no longer a reportable segment due to the RDU reversion.

- CVR Energy announced its intention to offer $1 billion in aggregate principal amount of senior unsecured notes due 2031 and 2034 through a private placement.

- The company plans to use the net proceeds from this offering to repay its senior secured term loan facility.

- Additionally, the proceeds will be used to redeem all outstanding 8.500% Senior Notes due 2029 and $217 million of its 5.750% Senior Notes due 2028.

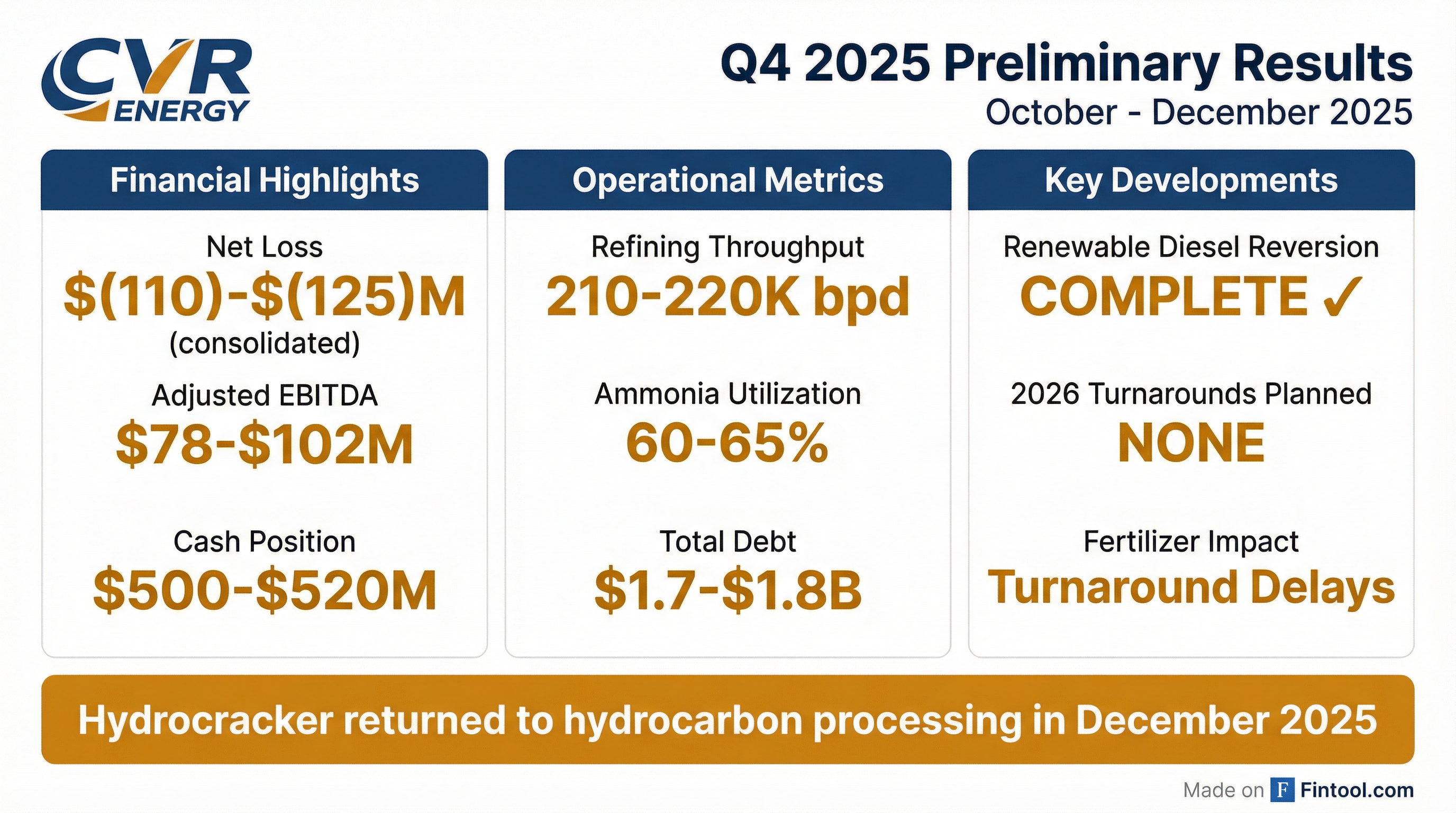

- CVR Energy anticipates a consolidated net loss for Q4 2025 of approximately $110–$125 million, primarily due to accelerated depreciation from the Wynnewood renewable diesel unit's conversion back to hydrocarbon processing and reduced nitrogen fertilizer production.

- Despite the Q4 setback, the company expects full-year 2025 net income of about $81–$96 million and adjusted EBITDA near $380–$404 million.

- The company completed the Wynnewood conversion in December and foresees no planned turnarounds in its petroleum segment for 2026, supporting a positive outlook for the coming year.

- CVR Energy maintains stable liquidity with approximately $500–$520 million in cash.

- CVR Energy, Inc. announced preliminary estimated financial results for the fourth quarter and full-year 2025.

- For Q4 2025, the company expects a consolidated net loss attributable to CVR Energy stockholders between $(120) million and $(105) million. This loss was impacted by accelerated depreciation from the reversion of the renewable diesel unit and reduced nitrogen fertilizer production and sales volumes.

- Preliminary estimated full-year 2025 net income attributable to CVR Energy stockholders is between $17 million and $32 million.

- Preliminary estimated EBITDA for Q4 2025 is between $40 million and $60 million, and for full-year 2025 is between $580 million and $600 million.

- The company anticipates no planned turnarounds in its Petroleum segment in 2026.

- CVR Energy announced preliminary estimated consolidated net loss attributable to stockholders for the fourth quarter of 2025 ranging from $(120) million to $(105) million, while full-year 2025 net income is estimated between $17 million and $32 million.

- The estimated Q4 2025 loss was primarily due to accelerated depreciation associated with the reversion of the Wynnewood renewable diesel unit to hydrocarbon processing and reduced nitrogen fertilizer production and sales volumes from a planned turnaround and delayed startup at the Coffeyville facility.

- The company completed the reversion of the renewable diesel unit in December 2025 and anticipates no planned turnarounds in its Petroleum segment in 2026.

- Preliminary estimated Adjusted EBITDA for Q4 2025 is between $78 million and $102 million, and for full-year 2025, it is between $380 million and $404 million.

- CVR Energy's subsidiaries prepaid $75 million in principal of its senior secured term loan facility on December 31, 2025, reducing the total outstanding principal to approximately $165 million.

- The company announced preliminary consolidated capital spending estimates for 2026 ranging from $200 million to $240 million.

- Estimated capital expenditures for 2026 by segment are $130 million to $145 million for Petroleum, $60 million to $75 million for Nitrogen Fertilizer, and $10 million to $20 million for Other.

- This capital spending plan reflects CVR Energy's commitment to its deleveraging strategy and focus on projects that support safe, reliable operations while selectively investing in targeted growth projects.

- CVR Energy intends to revert its Wynnewood hydrocracker from renewable diesel service back to hydrocarbon processing in December 2025, while retaining the ability to return to renewable diesel service in the future.

- As of Q3 2025, the company reported a total liquidity position of approximately $830 million, which included $514 million in cash and $316 million in availability under its ABL. Additionally, CVR Energy made a combined $90 million repayment on its Term Loan in June and July 2025, reducing the remaining balance to $232 million.

- The EPA affirmed previous grants of Small Refinery Exemptions (SREs) for Wynnewood Refining Company, LLC (WRC) and granted 100% waivers for 2019 and 2021, and 50% waivers for 2020, 2022, 2023, and 2024 compliance periods. This decision reduced WRC's balance sheet obligation by over 420 million RINs, resulting in an obligation of 90 million RINs as of September 30, 2025.

- For Q3 2025, the Petroleum Segment reported a Refining Margin of $708 million, while the Renewables Segment's Renewables Margin was $0 million.

- The estimated total capital expenditure budget for 2025 is between $58 million and $65 million, including approximately $17 million for a planned turnaround at the Coffeyville facility in Q4 2025.

- CVR Energy reported Q3 2025 consolidated net income of $401 million and earnings per share of $3.72, with EBITDA of $625 million, which included a $488 million benefit associated with small refinery exemptions for the 2019 through 2024 compliance years.

- The company decided to revert the renewable diesel unit at Wynnewood back to hydrocarbon processing during the next scheduled turnaround in December due to profitability challenges, recognizing $31 million of accelerated depreciation in Q3 2025 and anticipating approximately $62 million in Q4 2025.

- For Q4 2025, the petroleum segment is estimated to have total throughputs of 200,000 to 215,000 barrels per day, and the fertilizer segment's ammonia utilization rate is projected to be 80% to 85% due to a planned turnaround at the Coffeyville facility.

- The estimated accrued RFS obligation on the balance sheet was $93 million at September 30th, representing 90 million RINs, and the company expects to purchase approximately $100 million worth of RINs by the end of March 2026 if a 50% waiver for 2025 is granted. Additionally, CEO Dave Lamp announced his retirement, with this being his last earnings call.

- CVR Energy reported Q3 2025 consolidated net income of $401 million and EBITDA of $625 million, which included a $488 million benefit associated with small refinery exemptions (SREs) granted for the 2019 through 2024 compliance years.

- The company announced its decision to revert the renewable diesel unit at Wynnewood back to hydrocarbon processing during the next scheduled turnaround in December, citing profitability challenges due to the loss of the blenders’ tax credit and increased soybean oil prices. This decision resulted in $31 million of accelerated depreciation in Q3, with an anticipated additional $62 million in Q4.

- For Q4 2025, the petroleum segment estimates total throughputs of 200,000 to 215,000 barrels per day, and the fertilizer segment expects an ammonia utilization rate of 80% to 85% due to a planned turnaround.

- CVR Energy ended Q3 2025 with a consolidated cash balance of $670 million and total liquidity of approximately $830 million, and intends to prioritize paying down its term loan, which has a current principal balance of $235 million.

- CEO David Lamp announced that this would be his last earnings call before his retirement.

Quarterly earnings call transcripts for CVR ENERGY.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more