Earnings summaries and quarterly performance for CVR ENERGY.

Executive leadership at CVR ENERGY.

David L. Lamp

President and Chief Executive Officer

C. Douglas Johnson

Executive Vice President and Chief Commercial Officer

Dane J. Neumann

Executive Vice President, Chief Financial Officer, Treasurer and Assistant Secretary

Jeffrey D. Conaway

Vice President, Chief Accounting Officer & Corporate Controller

Mark A. Pytosh

Executive Vice President—Corporate Services

Melissa M. Buhrig

Executive Vice President, General Counsel and Secretary

Michael H. Wright, Jr.

Executive Vice President and Chief Operating Officer

Board of directors at CVR ENERGY.

Research analysts who have asked questions during CVR ENERGY earnings calls.

Manav Gupta

UBS Group

6 questions for CVI

Matthew Blair

Tudor, Pickering, Holt & Co.

5 questions for CVI

John Royall

JPMorgan Chase & Co.

3 questions for CVI

Neil Mehta

Goldman Sachs

3 questions for CVI

Paul Cheng

Scotiabank

3 questions for CVI

Alexa Petrick

Goldman Sachs

2 questions for CVI

Adam Alexander Wijaya

Goldman Sachs

1 question for CVI

Recent press releases and 8-K filings for CVI.

- CVR Energy, Inc. reported a net income of $90 million and Adjusted EBITDA of $393 million for the full year 2025.

- The Petroleum Segment's adjusted refining margin for 2025 was $694 million, or $10.45 per throughput barrel, with a consolidated crude throughput utilization of 81%. The adjusted margin capture for FY 2025 was 46%, influenced by a major turnaround at Coffeyville and increased Renewable Identification Numbers (RINs) prices.

- The company projects total capital expenditures for 2026 to be between $200 million and $240 million, with no planned turnarounds in the Petroleum Segment.

- CVR Energy anticipates a constructive refining macro environment in 2026, driven by a decline in U.S. operable refining capacity and slowing global capacity additions.

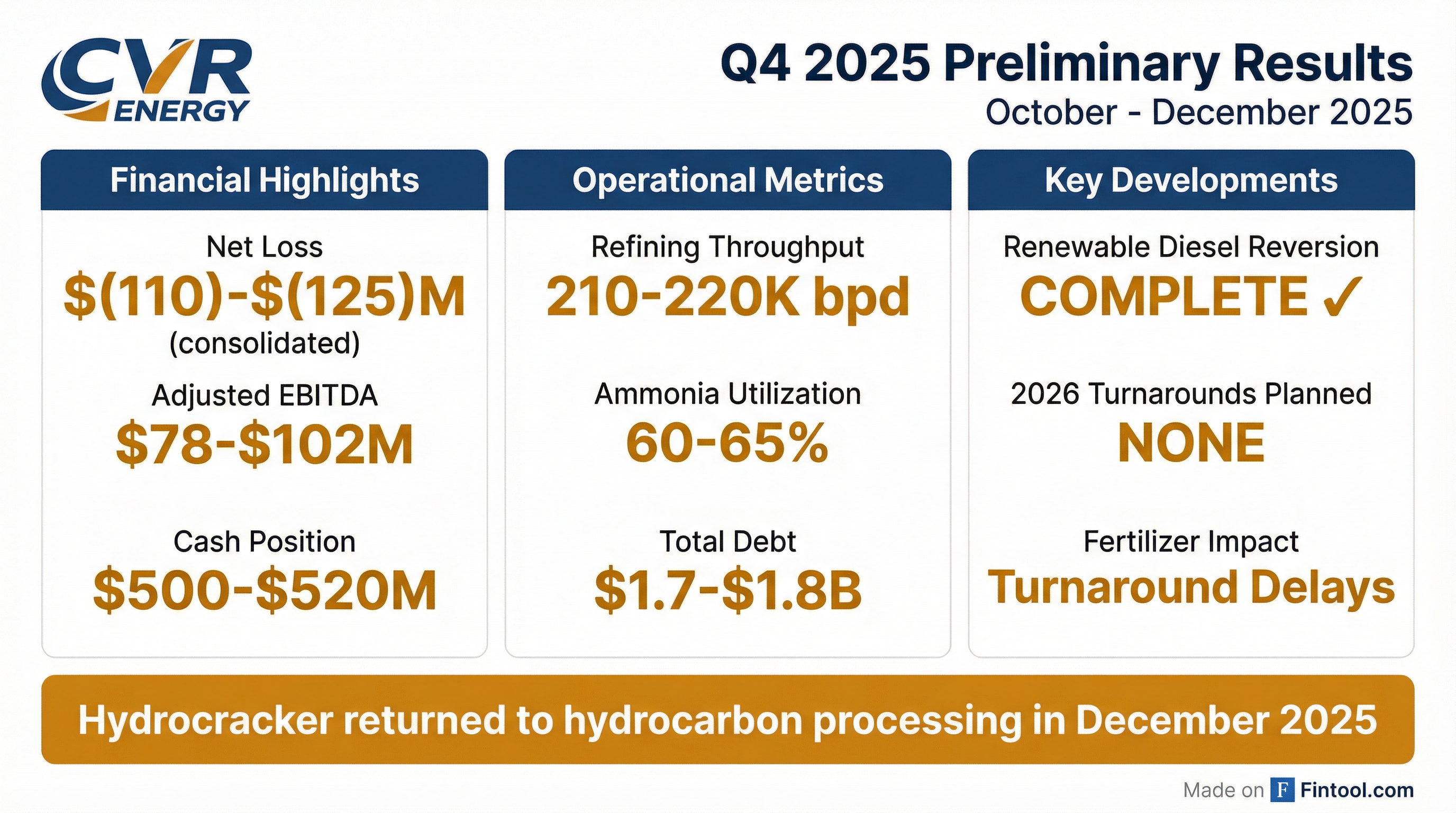

- CVR Energy reported a consolidated net loss of $116 million and EBITDA of $51 million for Q4 2025, while achieving a full-year 2025 consolidated net income of $90 million and EBITDA of $591 million.

- The company provided Q1 2026 guidance including petroleum total throughput of 200-215 thousand barrels per day and fertilizer ammonia utilization rates of 95%-100%.

- Strategic initiatives include ramping up Western Canadian Select (WCS) processing at Coffeyville to 20,000 barrels per day and pursuing a more proactive, disciplined approach to M&A in both refining and fertilizer segments.

- CVR Energy reduced debt by over $165 million in 2025 and, subsequent to year-end, completed a $1 billion senior notes offering and upsized its ABL facility to $550 million to extend debt maturity and enhance liquidity.

- The company aims to return a sustainable dividend to shareholders, with a clear path to further debt reduction being a key consideration.

- CVR Energy reported a consolidated net loss of $116 million and EBITDA of $51 million for Q4 2025, while full-year 2025 saw a consolidated net income of $90 million and EBITDA of $591 million.

- Q4 2025 results were affected by accelerated depreciation from the reversion of the Wynnewood renewable diesel unit to hydrocarbon processing and extended downtime at the Coffeyville fertilizer facility.

- Subsequent to year-end, CVR Energy completed a $1 billion senior notes offering to refinance debt and upsizing its ABL facility, contributing to a $165 million debt reduction in 2025.

- The company provided Q1 2026 guidance, estimating petroleum segment throughput of 200-215 thousand barrels per day and fertilizer segment ammonia utilization of 95%-100%.

- CEO Mark Pytosh highlighted strategic priorities including commercial optimization, a proactive yet disciplined approach to M&A in both refining and fertilizer, and a commitment to a sustainable dividend return.

- CVR Energy reported a consolidated net loss of $116 million and EBITDA of $51 million for the fourth quarter of 2025, with full-year 2025 consolidated net income of $90 million and EBITDA of $591 million.

- The company is implementing strategic initiatives, including the reversion of the renewable diesel unit at Wynnewood back to hydrocarbon processing and plans to ramp up Western Canadian Select (WCS) processing at Coffeyville to 20,000 bbl per day.

- CVR Energy reduced debt by over $165 million in 2025 and subsequently completed a $1 billion senior notes offering to extend its debt maturity profile and upsized its asset-based lending facility to $550 million.

- For Q1 2026, the company estimates petroleum throughput of 200-215 thousand bbl per day and fertilizer ammonia utilization of 95%-100%.

- CVR Energy reported a net loss attributable to stockholders of $110 million, or $1.10 per diluted share, for the fourth quarter of 2025, and net income of $27 million, or $0.27 per diluted share, for the full-year 2025.

- EBITDA was $51 million for Q4 2025 and $591 million for full-year 2025, while Adjusted EBITDA was $91 million for Q4 2025 and $393 million for full-year 2025.

- The company completed the reversion of the Renewable Diesel Unit (RDU) at the Wynnewood Refinery back to hydrocarbon processing service in December 2025, which resulted in $62 million of accelerated depreciation in Q4 2025 and $93 million for full-year 2025.

- CVR Energy prepaid $75 million in principal of its Term Loan in December 2025, and reported consolidated cash and cash equivalents of $511 million and total debt of $1.8 billion at December 31, 2025.

- For the first quarter of 2026, the company anticipates Petroleum Segment total throughput between 200,000 and 215,000 barrels per day and a Nitrogen Fertilizer Segment ammonia utilization rate between 95% and 100%.

- CVR Energy reported a net loss attributable to stockholders of $110 million for the fourth quarter of 2025, and net income attributable to stockholders of $27 million for the full-year 2025.

- The company's EBITDA was $51 million and Adjusted EBITDA was $91 million for the fourth quarter of 2025, while full-year 2025 saw EBITDA of $591 million and Adjusted EBITDA of $393 million.

- In December 2025, the Renewable Diesel Unit (RDU) at the Wynnewood Refinery was reverted back to hydrocarbon processing service, which included $62 million of accelerated depreciation in Q4 2025 and $93 million for full-year 2025.

- As of December 31, 2025, consolidated cash and cash equivalents were $511 million, and consolidated total debt and finance lease obligations amounted to $1.8 billion. The company prepaid $75 million in principal of the Term Loan in December 2025.

- For the first quarter of 2026, total capital expenditures are projected to be between $56 million and $68 million.

- CVR Energy reported a net loss of $110 million (GAAP loss of $1.10 per share, adjusted loss of $0.80 per share) for Q4 2025, with quarterly revenue of $1.81 billion.

- The adjusted loss of $0.80 per share beat consensus estimates of $0.84, and quarterly revenue of $1.81 billion surpassed estimates by approximately 4.09%.

- The Q4 loss was primarily driven by a $62 million accelerated depreciation charge related to reverting the Wynnewood renewable diesel unit to hydrocarbon processing, ongoing renewables losses, and fertilizer segment disruptions.

- For the full year 2025, the company reported a profit of $27 million and an increase in EBITDA to $591 million.

- CVR Energy, Inc. completed the issuance of $600 million in 7.500% Senior Notes due 2031 and $400 million in 7.875% Senior Notes due 2034 on February 12, 2026, for a total aggregate principal amount of $1 billion.

- Interest on both series of notes will be paid semi-annually in arrears on February 15 and August 15, with the first payment scheduled for August 15, 2026.

- The notes are fully and unconditionally guaranteed on a senior unsecured basis by most of the company's domestic subsidiaries.

- CVR Energy, Inc. (CVI) announced the pricing of a private placement for $600 million of 7.500% Senior Notes due 2031 and $400 million of 7.875% Senior Notes due 2034.

- The total $1 billion offering is expected to close on February 12, 2026.

- The company intends to use the net proceeds to repay its senior secured term loan facility, redeem all outstanding 8.500% Senior Notes due 2029, and redeem $217 million of 5.750% Senior Notes due 2028.

- CVR Energy, Inc. intends to offer $1 billion in aggregate principal amount of senior unsecured notes due 2031 and 2034 in a private placement, subject to market conditions.

- The net proceeds from this offering, along with cash on hand or borrowings, are planned to repay approximately $157 million of its senior secured term loan, redeem $600 million of its 8.500% Senior Notes due 2029, and redeem $217 million of its 5.750% Senior Notes due 2028.

- In December 2025, the company reverted its Renewable Diesel Unit (RDU) at the Wynnewood refinery to hydrocarbon processing service due to unfavorable economics, resulting in approximately $2 million in asset write-downs and $62 million in additional depreciation charges for the fourth quarter of 2025.

- Effective January 1, 2026, the Renewables Segment is no longer a reportable segment due to the RDU reversion.

Quarterly earnings call transcripts for CVR ENERGY.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more