Earnings summaries and quarterly performance for Datadog.

Executive leadership at Datadog.

Olivier Pomel

Chief Executive Officer

Adam Blitzer

Chief Operating Officer

Alexis Lê-Quôc

Chief Technology Officer

David Galloreese

Chief People Officer

David Obstler

Chief Financial Officer

Kerry Acocella

General Counsel and Secretary

Sean Walters

Chief Revenue Officer

Yanbing Li

Chief Product Officer

Board of directors at Datadog.

Research analysts who have asked questions during Datadog earnings calls.

Mark Murphy

JPMorgan Chase & Co.

8 questions for DDOG

Raimo Lenschow

Barclays

8 questions for DDOG

Sanjit Singh

Morgan Stanley

8 questions for DDOG

Koji Ikeda

Bank of America

6 questions for DDOG

Brent Thill

Jefferies

5 questions for DDOG

Ittai Kidron

Oppenheimer & Company

5 questions for DDOG

Andrew Sherman

Cowen

3 questions for DDOG

Brad Reback

Stifel

3 questions for DDOG

Gray Powell

BTIG

3 questions for DDOG

Howard Ma

Guggenheim Securities, LLC

3 questions for DDOG

Jake Roberge

William Blair & Company, L.L.C

3 questions for DDOG

Kasthuri Rangan

Goldman Sachs

3 questions for DDOG

Mike Cikos

Needham & Company, LLC

3 questions for DDOG

Alex Zukin

Wolfe Research LLC

2 questions for DDOG

Eric Keith

KeyBank

2 questions for DDOG

Fatima Boolani

Citi

2 questions for DDOG

Gabriela Borges

Goldman Sachs

2 questions for DDOG

Karl Keirstead

UBS

2 questions for DDOG

Karl Kierstad

UBS

2 questions for DDOG

Kash Rangan

Goldman Sachs

2 questions for DDOG

Matt Hedberg

RBC

2 questions for DDOG

Matthew Hedberg

RBC Capital Markets

2 questions for DDOG

Peter Weed

Bernstein

2 questions for DDOG

Ryan MacWilliams

Barclays

2 questions for DDOG

S. Kirk Materne

Evercore ISI

2 questions for DDOG

Todd Coupland

CIBC

2 questions for DDOG

Adam Tindle

Raymond James

1 question for DDOG

Andrew DeGasperi

BNP Paribas

1 question for DDOG

Eric Heath

KeyBanc Capital Markets

1 question for DDOG

Gregg Moskowitz

Mizuho

1 question for DDOG

Jacob Roberge

William Blair

1 question for DDOG

Matthew Martino

Goldman Sachs

1 question for DDOG

Michael Cikos

Needham & Company

1 question for DDOG

Patrick Colville

Scotiabank

1 question for DDOG

Patrick Walravens

Citizens JMP

1 question for DDOG

Recent press releases and 8-K filings for DDOG.

- Datadog reported strong revenue growth from $603 million in 2020 to $3.4 billion in 2025, alongside increasing non-GAAP operating profit and free cash flow margins, with a long-term operating margin goal of 25%+.

- The company significantly increased its non-GAAP R&D spend from $0.14 billion in 2020 to $1.05 billion in 2025, supporting its dual AI strategy of integrating AI into its platform ("AI for Datadog") and providing observability for AI stacks ("Datadog for AI").

- Datadog expanded its customer base from 14,200 in 2020 to 32,700 in 2025, demonstrating strong gross revenue retention of 97%+ and increasing multi-product adoption, with 84% of customers using 2+ products in 2025.

- Datadog's market share grew from 0.4% in 2016 to 14% in 2025, targeting a large and growing Observability market estimated at $28 billion in 2026E.

- Datadog is deeply integrating AI into its platform ("AI for Datadog") and providing solutions for customers developing AI applications ("Datadog for AI"), aiming to make customers significantly more productive.

- The company has expanded its platform from one product in 2015 to 25 products for over 30,000 customers, handling trillions of events per hour. This expansion has increased its Total Addressable Market (TAM) to over $100 billion by addressing new markets like security and software delivery.

- Datadog continues to grow its customer base, now serving over 32,000 customers, including 34 customers spending over $10 million (growing over 60%). The land-and-expand model drives approximately three-quarters of annual ARR growth from existing customers.

- Datadog reaffirmed its long-term non-GAAP operating margin target of 25%+. In the last year, the company achieved a non-GAAP operating margin of 22% and a cash flow margin of 27%.

- Datadog reported $1.6 billion ARR in infrastructure monitoring and over $1 billion ARR each in log management and the end-to-end APM and DEM suite, as of early February 2026.

- The company is heavily investing in AI, having launched the Bits AI SRE Agent in 2025, which has since run over 100,000 investigations for customers, with more than 2,000 customers using it in January 2026.

- Datadog has expanded its Total Addressable Market (TAM) to over $100 billion by adding security, software delivery, service management, and product analytics, with its security products surpassing $100 million in revenue one quarter ago.

- Only 53% of customers currently use all three core pillars (Infrastructure Monitoring, Log Management, and APM/DEM), presenting a significant upsell opportunity as customers using all three pillars spend 15 times more.

- The company maintains a high R&D investment, allocating 30% of revenues (over $1 billion in FY 2025) back into R&D, which is approximately 3X that of its closest peer.

- Datadog invested over $1 billion in R&D in 2025 and plans to continue investing approximately 30% of revenues into R&D, alongside the launch of AI agents like Bits AI SRE to enhance productivity and incident resolution.

- The company is expanding its platform beyond core observability into new markets such as security, software delivery, service management, and product analytics, projecting a total addressable market (TAM) of over $100 billion.

- Datadog's land-and-expand model continues to drive growth, resulting in a 42% compound annual growth rate over time, with over 32,000 customers and 34 customers spending over $10 million.

- Key product areas like Flex Logs are approaching $100 million ARR and growing rapidly, while Cloud SIEM has achieved 18x growth in five years, demonstrating successful market penetration and expansion.

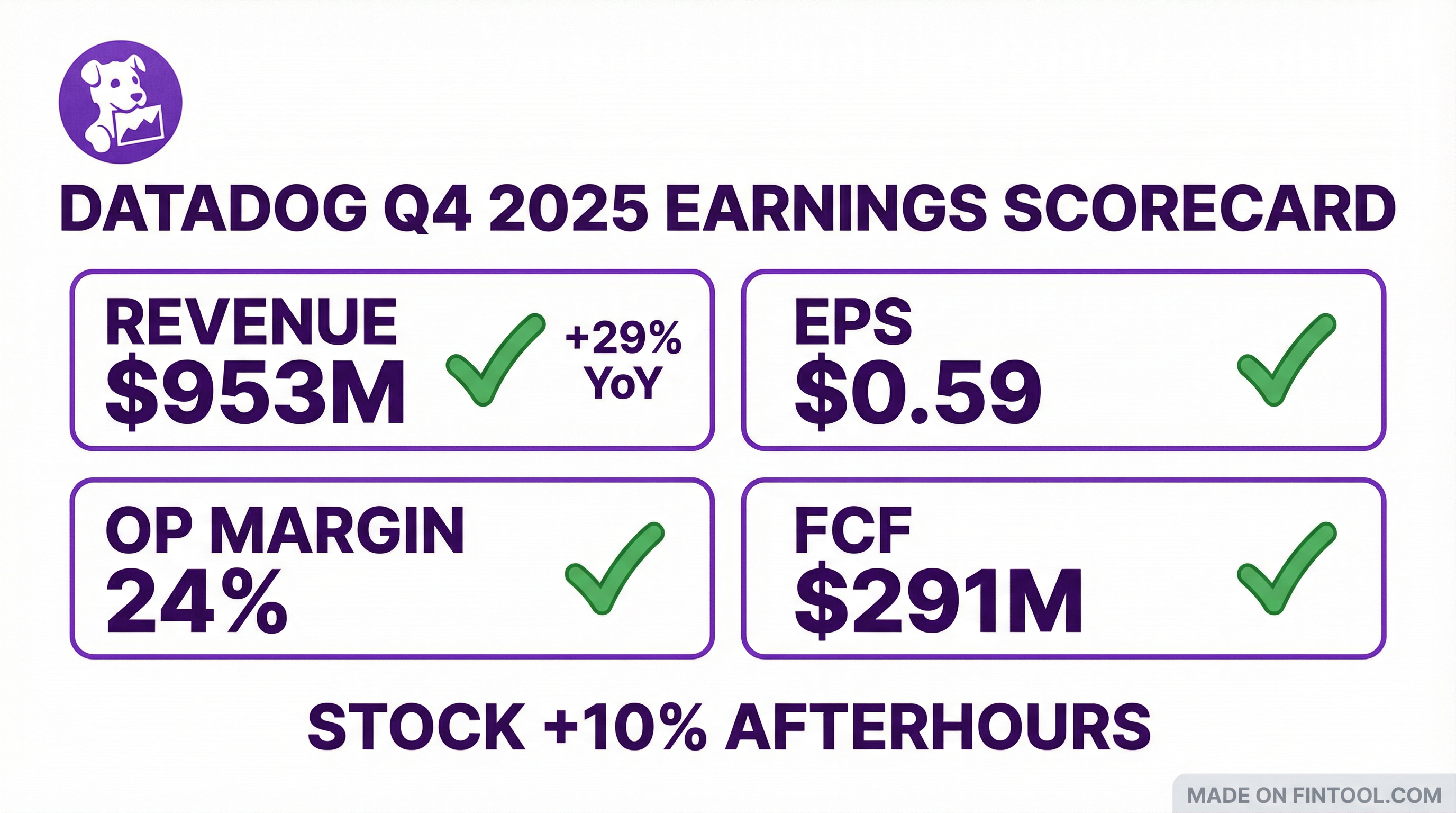

- Datadog reported strong Q4 2025 financial results, with revenue of $953 million, a 29% increase year-over-year, surpassing guidance. Bookings reached a record $1.63 billion, up 37% year-over-year, including 18 deals over $10 million in TCV.

- The company saw accelerated revenue growth from its broad-based customers (excluding AI natives) at 23% year-over-year in Q4, up from 20% in Q3, alongside continued strong adoption among AI-native customers, with approximately 650 customers in this group.

- Customer engagement remains high, with 84% of customers using two or more products and 9% using 10 or more products by the end of Q4 2025. Datadog released over 400 new features in 2025, with a significant focus on AI capabilities such as the Bits AI SRE agent and LLM observability.

- Free cash flow for Q4 2025 was $291 million, achieving a 31% free cash flow margin, while the operating margin stood at 24%.

- For Q1 2026, Datadog projects revenue between $951 million and $961 million, representing 25%-26% year-over-year growth, with non-GAAP operating income expected to be between $195 million and $205 million.

- Datadog reported strong Q4 2025 financial results, with revenue of $953 million, a 29% year-over-year increase, and bookings of $1.63 billion, up 37% year-over-year. The company also achieved $291 million in free cash flow with a 31% margin.

- Customer metrics showed continued growth, ending Q4 with 32,700 customers and 4,310 customers generating 90% of ARR (those with $100,000 or more in ARR). Product adoption remains high, with 84% of customers using two or more products.

- The company emphasized its AI initiatives, including the general availability of Bits AI SRE agent and expanded LLM observability capabilities, with about 5,500 customers utilizing Datadog AI integrations.

- Datadog provided a positive outlook for 2026, projecting Q1 2026 revenue between $951 million and $961 million and full fiscal year 2026 revenue between $4.06 billion and $4.1 billion. Non-GAAP net income per share is expected to be $0.49-$0.51 for Q1 2026 and $2.08-$2.16 for FY 2026.

- Datadog reported Q4 2025 revenue of $953 million, an increase of 29% year-over-year, driven by broad-based positive trends and accelerated growth from AI-native customers.

- The company achieved record bookings of $1.63 billion, up 37% year-over-year, and ended Q4 with approximately 32,700 customers, including 4,310 with an ARR of $100,000 or more.

- Datadog generated free cash flow of $291 million with a 31% margin and maintained a trailing 12-month net revenue retention of approximately 120%.

- In 2025, Datadog released over 400 new features and capabilities, significantly advancing its AI roadmap with products like Bits AI SRE agent and LLM observability, now used by approximately 5,500 customers for AI integrations.

- For fiscal year 2026, Datadog expects revenues between $4.06 billion and $4.1 billion, representing 18%-20% year-over-year growth, and non-GAAP operating income between $840 million and $880 million.

- Datadog's Q4 revenue reached $953 million, marking 29% year-over-year growth, with non-GAAP EPS of $0.59, surpassing expectations.

- The company ended fiscal 2025 with $4.47 billion in cash and marketable securities and generated $1,050 million in operating cash flow and $915 million in free cash flow.

- Remaining performance obligation (RPO) surged to $3.46 billion, an increase of 52% year-over-year, indicating substantial contracted backlog growth.

- While Q1 revenue guidance exceeded estimates, full-year revenue and adjusted EPS forecasts were slightly below Wall Street expectations.

- Datadog plans to host an Investor Day on February 12 to provide further details on long-term targets and product strategy.

- Datadog reported strong financial performance for Q4 2025, with revenue growing 29% year-over-year to $953 million, and for fiscal year 2025, revenue increased 28% year-over-year to $3.43 billion.

- The company achieved non-GAAP operating income of $230 million (24% margin) for Q4 2025 and $768 million (22% margin) for fiscal year 2025. Non-GAAP diluted net income per share was $0.59 for Q4 2025 and $2.05 for fiscal year 2025.

- Datadog generated substantial cash flow in fiscal year 2025, with $1.05 billion in operating cash flow and $915 million in free cash flow.

- Customer growth remained robust, with 603 customers generating $1 million or more in ARR as of December 31, 2025, marking a 31% increase from the previous year.

- For Q1 2026, Datadog projects revenue between $951 million and $961 million, and for fiscal year 2026, revenue is expected to be between $4.06 billion and $4.10 billion.

- Datadog reported Q4 2025 revenue of $953 million, marking a 29% year-over-year increase, and fiscal year 2025 revenue of $3.43 billion, up 28% year-over-year.

- For Q4 2025, non-GAAP operating income was $230 million with a 24% margin, and non-GAAP diluted EPS was $0.59. For fiscal year 2025, non-GAAP operating income reached $768 million with a 22% margin, and non-GAAP diluted EPS was $2.05.

- The company's customer base with $1 million or more in Annual Recurring Revenue (ARR) grew to 603 as of December 31, 2025, representing a 31% increase from the prior year.

- Datadog provided fiscal year 2026 revenue guidance between $4.06 billion and $4.10 billion, and non-GAAP net income per share guidance between $2.08 and $2.16.

Quarterly earnings call transcripts for Datadog.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more