Earnings summaries and quarterly performance for Dynatrace.

Executive leadership at Dynatrace.

Rick McConnell

Chief Executive Officer

Bernd Greifeneder

Executive Vice President, Chief Technology Officer

Dan Zugelder

Executive Vice President, Chief Revenue Officer

Jim Benson

Executive Vice President, Chief Financial Officer and Treasurer

Stephen McMahon

Executive Vice President, Chief Customer Officer

Board of directors at Dynatrace.

Research analysts who have asked questions during Dynatrace earnings calls.

Sanjit Singh

Morgan Stanley

8 questions for DT

Andrew Sherman

Cowen

6 questions for DT

Brad Reback

Stifel

6 questions for DT

Patrick Colville

Scotiabank

6 questions for DT

Eric Heath

KeyBanc Capital Markets

5 questions for DT

Keith Bachman

BMO Capital Markets

5 questions for DT

Matthew Hedberg

RBC Capital Markets

5 questions for DT

Raimo Lenschow

Barclays

5 questions for DT

Brent Thill

Jefferies

4 questions for DT

Koji Ikeda

Bank of America

4 questions for DT

Fatima Boolani

Citi

3 questions for DT

Howard Ma

Guggenheim Securities, LLC

3 questions for DT

Mike Cikos

Needham & Company, LLC

3 questions for DT

Pinjalim Bora

JPMorgan Chase & Co.

3 questions for DT

Ryan MacWilliams

Barclays

3 questions for DT

William Power

Baird

3 questions for DT

Andrew Nowinski

Wells Fargo

2 questions for DT

Gray Powell

BTIG

2 questions for DT

Itay Kidjon

Oppenheimer & Co. Inc.

2 questions for DT

Ittai Kidron

Oppenheimer & Company

2 questions for DT

Jacob Roberge

William Blair

2 questions for DT

Jake Rivera

William Blair

2 questions for DT

Matt Hedberg

RBC

2 questions for DT

Matthew Martino

Goldman Sachs

2 questions for DT

Miller Jump

Truist

2 questions for DT

Noah Herman

JPMorgan Chase & Co.

2 questions for DT

Will Power

Robert W. Baird & Co.

2 questions for DT

Anthony Stoss

Craig-Hallum Capital Group LLC

1 question for DT

Arthur Chu

Bank of America

1 question for DT

DeShaun Fontenot

Wells Fargo

1 question for DT

Joshua Tilton

Wolfe Research

1 question for DT

Kash Rangan

Goldman Sachs

1 question for DT

Kasthuri Rangan

Goldman Sachs

1 question for DT

Mark Murphy

JPMorgan Chase & Co.

1 question for DT

Michael Cikos

Needham & Company

1 question for DT

Robbie Owens

Piper Sandler

1 question for DT

W. Miller Jump

Truist Securities

1 question for DT

Recent press releases and 8-K filings for DT.

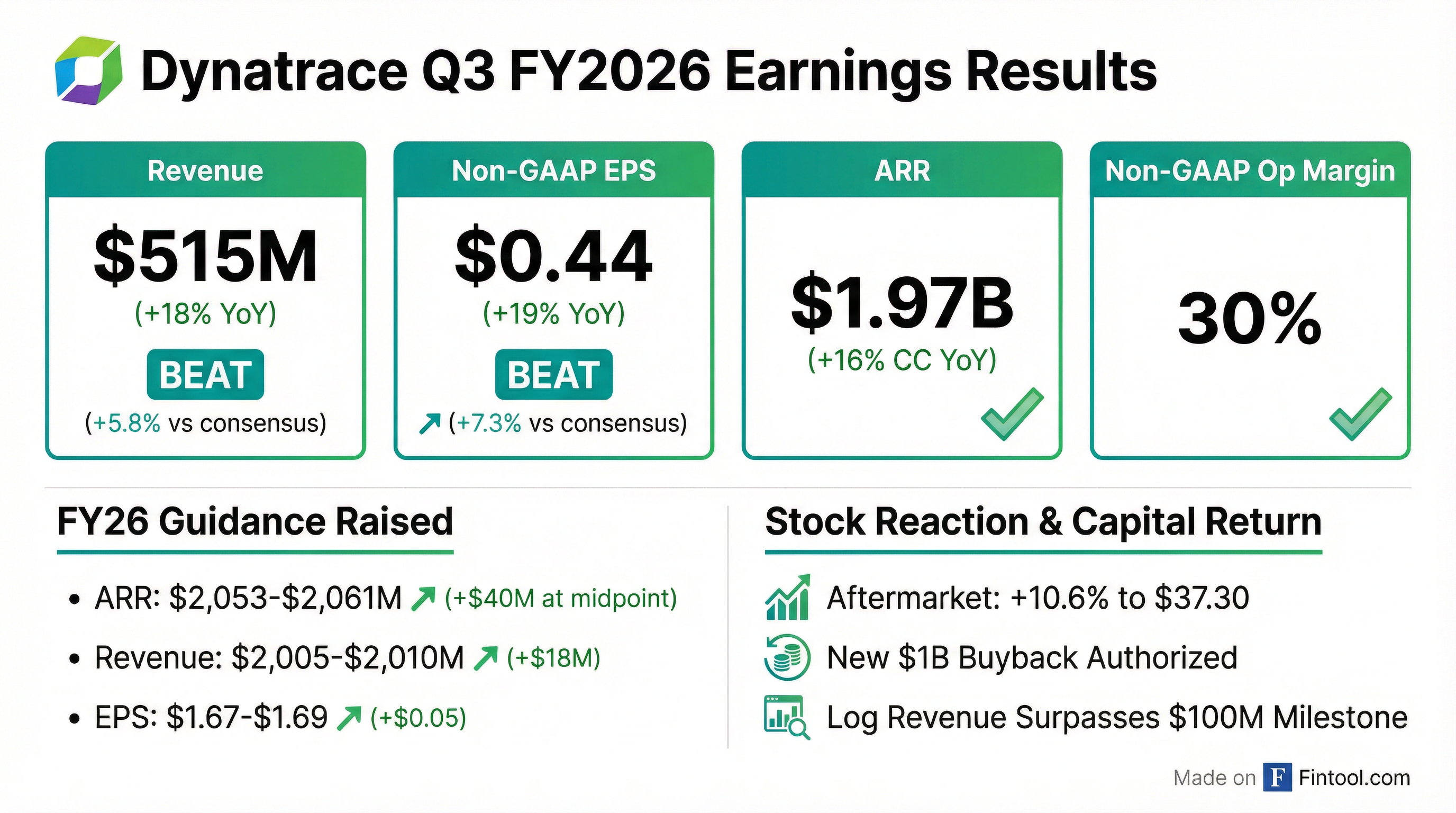

- Dynatrace reported Q3 FY 2026 total revenue of $515 million and subscription revenue of $493 million, with Annual Recurring Revenue (ARR) reaching $1.97 billion.

- The company maintained strong profitability, with a TTM Q3-26 Non-GAAP Operating Margin of 29% and a TTM Q3-26 Pre-tax Free Cash Flow Margin of 30%.

- Dynatrace updated its FY 2026 guidance, now projecting ARR between $2,053 million and $2,061 million and total revenue between $2,005 million and $2,010 million, reflecting an increase from prior expectations.

- In 2026, the company launched Dynatrace Intelligence, the industry's first agentic operations system, and its log management & analytics surpassed $100 million of annualized consumption revenue.

- Dynatrace delivered very strong Q3 fiscal 2026 results, exceeding guidance across all key metrics, with ARR reaching $1.97 billion (16% growth) and total revenue of $515 million (16% growth).

- The company achieved its third consecutive quarter of double-digit net new ARR growth, with $75 million (adjusted for FX) in Q3, and its annualized logs consumption surpassed $100 million.

- Dynatrace's board authorized a new $1 billion share repurchase program, doubling the size of the previous program, reflecting confidence in the business and long-term growth opportunities.

- The company raised its full-year guidance for fiscal 2026, including ARR growth to 15.5%-16% (expecting to surpass $2 billion in ARR), total revenue growth to 16%, and Non-GAAP EPS to $1.67-$1.69 per diluted share.

- Dynatrace delivered strong Q3 fiscal 2026 results, with ARR reaching $1.97 billion (up 16%) and total revenue at $515 million (up 16%), both exceeding guidance.

- The company raised its full-year fiscal 2026 guidance, now expecting ARR growth of 15.5%-16% (surpassing $2 billion), 16% total revenue growth, and Non-GAAP EPS of $1.67-$1.69 per diluted share.

- Dynatrace's board authorized a new $1 billion share repurchase program, doubling the size of its previous program, after substantially completing the prior $500 million program.

- The company achieved its third consecutive quarter of double-digit net new ARR growth, which was $75 million (up 11% year-over-year adjusted for foreign exchange movements).

- Strategic highlights include surpassing $100 million in annualized logs consumption (growing over 100% year-over-year), the introduction of Dynatrace Intelligence for AI-powered observability, and the acquisition of DevCycle.

- Dynatrace delivered strong Q3 fiscal 2026 results, with ARR reaching $1.97 billion (representing 16% growth) and total revenue of $515 million (up 16%), exceeding guidance across all key metrics.

- The company raised its full-year fiscal 2026 guidance, now expecting ARR growth between 15.5%-16% (surpassing $2 billion), total revenue growth at 16%, and non-GAAP EPS in the range of $1.67-$1.69.

- Key business achievements included three consecutive quarters of double-digit net new ARR growth (Q3 net new ARR was $75 million), annualized logs consumption surpassing $100 million, and the introduction of Dynatrace Intelligence.

- The board authorized a new $1 billion share repurchase program, doubling the size of the previous program, reflecting confidence in the business and long-term growth opportunities.

- Dynatrace reported Q3 fiscal year 2026 financial results (ended December 31, 2025) with total revenue of $515 million, an 18% increase year-over-year, and total ARR of $1,972 million, a 20% increase year-over-year.

- For Q3 FY2026, the company achieved a GAAP operating margin of 14% and a non-GAAP operating margin of 30%.

- Dynatrace raised its full-year fiscal 2026 guidance, with expected total revenue between $2,005 million and $2,010 million and non-GAAP net income per diluted share between $1.67 and $1.69.

- A new $1 billion share repurchase program was authorized, following the near completion of the prior $500 million program, under which $495 million was used to repurchase 10.6 million shares through February 6, 2026.

- Dynatrace exceeded the high end of its guidance across all top-line growth and profitability metrics for the third quarter of fiscal year 2026, ending December 31, 2025.

- For Q3 FY2026, the company reported total ARR of $1,972 million, an increase of 20% (16% on a constant currency basis), and total revenue of $515 million, up 18% (16% on a constant currency basis).

- Dynatrace achieved a GAAP Operating Margin of 14% and a Non-GAAP Operating Margin of 30% in Q3 FY2026, with non-GAAP net income per share of $0.44.

- The company raised its full-year fiscal 2026 guidance, now anticipating total revenue between $2,005 million and $2,010 million and non-GAAP net income per diluted share between $1.67 and $1.69.

- A new $1 billion share repurchase program was authorized by the Board of Directors, following the near completion of the previous $500 million program, under which $495 million of stock had been repurchased through February 6, 2026.

- Dynatrace announced enhanced developer experience and agentic AI capabilities at its Perform conference, aiming to transform observability into an intelligent control layer for software delivery.

- Key product enhancements include frontend observability with Real User Monitoring (RUM), expanded mobile diagnostics, and Live Debugger updates.

- The company is advancing its observability platform into an active system of control, partly through the acquisition of DevCycle.

- Dynatrace announced Dynatrace Intelligence, which fuses deterministic and agentic AI, and Dynatrace Intelligence Agents designed for closed-loop autonomous outcomes across IT and business operations.

- The company unveiled expanded cloud operations capabilities through new cloud-native integrations across Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP).

- Dynatrace also launched enhanced developer experiences to transform observability into an active system of control for cloud and AI-native software delivery, and advanced Real User Monitoring (RUM) capabilities for improved user experience optimization.

- Dynatrace has expanded its collaboration with Google Cloud, becoming a launch partner for Gemini Enterprise and Gemini CLI extensions to power the next generation of AI innovation.

- The Dynatrace Gemini CLI Extension provides developers with immediate access to observability and root-cause analysis directly within their terminal.

- Gemini Enterprise connects AI agents directly to Dynatrace’s observability platform via Google’s A2A protocol, enabling real-time collaboration to detect, resolve, and prevent issues.

- To simplify adoption, Dynatrace's AI-driven integrations are now available through the Google Cloud Marketplace.

- Dynatrace is among the first observability partners with a Google-validated A2A and Gemini Enterprise-compatible agent, reinforcing its leadership in AI-powered observability and agentic architectures.

- CEO Rick McConnell noted no significant change in the macro spend environment for enterprise-oriented software.

- Dynatrace's logs business has grown from single-digit millions to nearly $100 million in consumption in one year, growing at well over 100% annually.

- The company's go-to-market strategy, focused on large strategic accounts, resulted in a 45% year-over-year increase in pipeline and a 53% year-over-year increase in seven-figure ACV deals last quarter.

- The Dynatrace Platform Subscription (DPS) now accounts for 70% of Annual Recurring Revenue (ARR) and is used by over 50% of customers, broadening platform access and facilitating rapid growth in areas like log management.

- Dynatrace aims to re-accelerate ARR growth by FY 2027, while committing to maintaining current margin levels and using resources to accelerate growth.

Quarterly earnings call transcripts for Dynatrace.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more