Earnings summaries and quarterly performance for EQUINOR.

Research analysts who have asked questions during EQUINOR earnings calls.

Biraj Borkhataria

Royal Bank of Canada

9 questions for EQNR

Martijn Rats

Morgan Stanley

9 questions for EQNR

Henri Patricot

UBS

8 questions for EQNR

Kim Fustier

HSBC

8 questions for EQNR

Paul Redman

BNP Paribas

8 questions for EQNR

Teodor Sveen-Nilsen

SpareBank 1 Markets

8 questions for EQNR

Matthew Lofting

JPMorgan

7 questions for EQNR

Peter Low

Redburn Atlantic

7 questions for EQNR

Irene Himona

Sanford C. Bernstein

6 questions for EQNR

Jason Gabelman

TD Cowen

6 questions for EQNR

John Olaisen

ABG Sundal Collier

6 questions for EQNR

Michele Della Vigna

Goldman Sachs

6 questions for EQNR

James Carmichael

Berenberg

5 questions for EQNR

Christopher Kuplent

Bank of America

4 questions for EQNR

Naisheng Cui

Barclays

4 questions for EQNR

Steffen Evjen

DNB ASA

4 questions for EQNR

Alastair Syme

Citigroup

3 questions for EQNR

Alejandro Vigil

Santander

3 questions for EQNR

Yoann Charenton

Sanford C. Bernstein & Co.

3 questions for EQNR

Kris Copeland

Bank of America Corporation

2 questions for EQNR

Lydia Rainforth

UBS

2 questions for EQNR

Matt Lofting

JPMorgan Chase & Co.

2 questions for EQNR

Nash Kiwi

Barclays PLC

2 questions for EQNR

Vidar Lyngvær

Danske Bank

2 questions for EQNR

Anders Rosenlund

SEB

1 question for EQNR

Giacomo Romeo

Jefferies

1 question for EQNR

Recent press releases and 8-K filings for EQNR.

- Equinor ASA announced the first tranche of its 2026 share buy-back programme on February 4, 2026, with the tranche running from February 5 to no later than March 30, 2026.

- From February 16 to February 20, 2026, the company purchased 645,764 own shares at an average price of NOK 268.8827 per share.

- As of February 20, 2026, accumulated buy-backs under this tranche total 1,417,208 shares at an average price of NOK 266.2044, for a total value of NOK 377,266,999.53.

- Following these transactions, Equinor ASA owns a total of 61,943,420 own shares, corresponding to 2.42% of its share capital.

- Equinor ASA announced the first tranche of its 2026 share buy-back programme on February 4, 2026, with transactions scheduled from February 5 to no later than March 30, 2026.

- Between February 5 and February 6, 2026, the company purchased a total of 265,944 own shares at an average price of NOK 258.6132 per share.

- Following these transactions, Equinor ASA owns a total of 60,505,387 own shares, which corresponds to 2.37% of its share capital (including shares under its share savings programme).

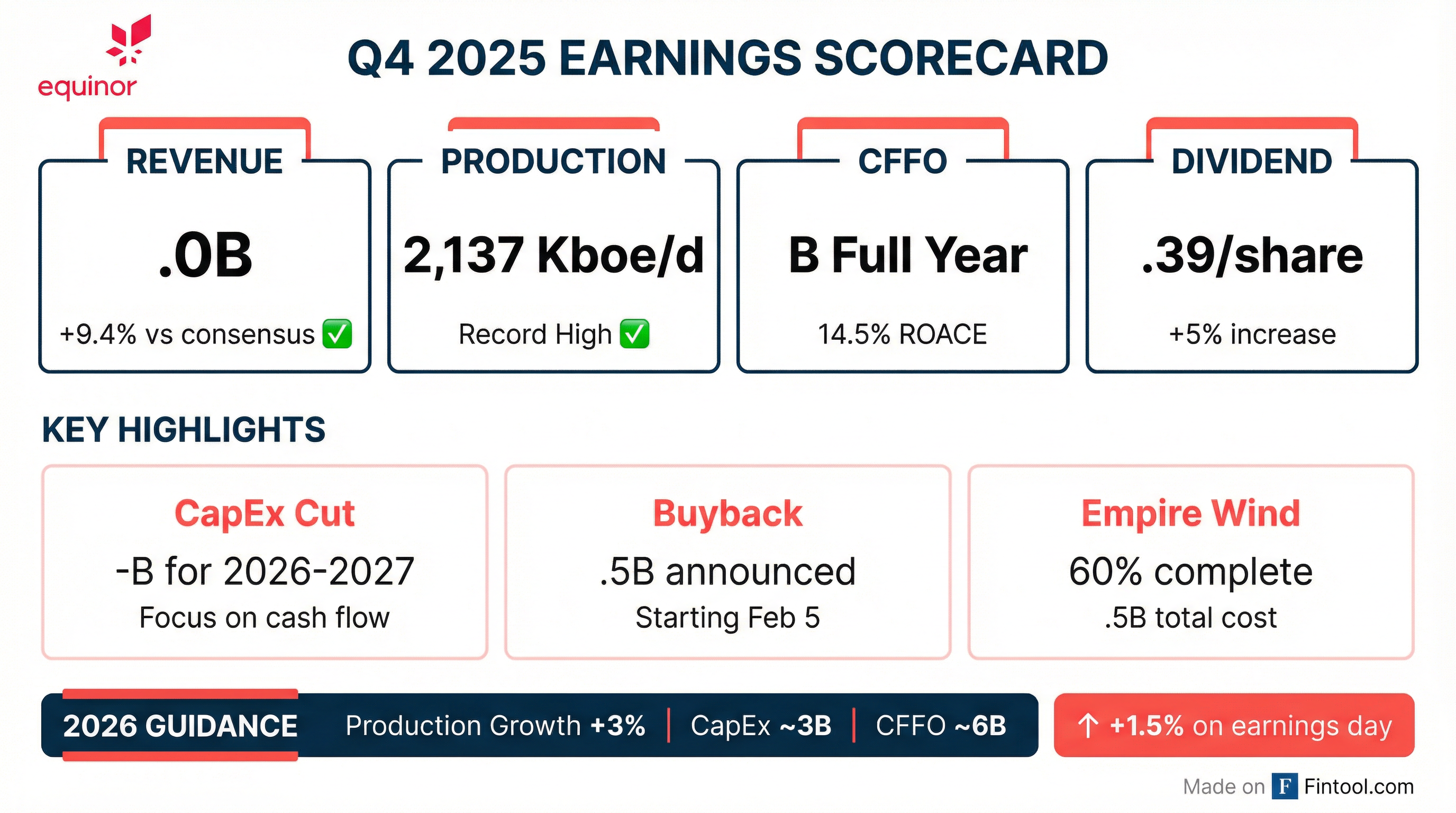

- Equinor reported a Q4 2025 adjusted operating income of USD 6.20 billion and full-year 2025 adjusted EPS of USD 2.47.

- Total equity production reached 2,198 mboe per day in Q4 2025, up 6% from the prior year, contributing to a record high full-year production of 2,137 mboe per day.

- The company's net debt to capital employed adjusted ratio increased to 17.8% at the end of Q4 2025 from 12.2% at the end of Q3 2025.

- Equinor announced a 2026 organic capital expenditure estimate of approximately USD 13 billion and expects oil & gas production to grow around 3% compared to 2025.

- A new share buy-back programme of up to USD 375 million will commence on February 5, 2026.

- Equinor will commence the first tranche of its 2026 share buy-back programme on February 5, 2026.

- The total share buy-back programme for 2026 is for up to USD 1.5 billion, which includes shares to be redeemed from the Norwegian State.

- The first tranche is valued at up to USD 375 million, with up to USD 123.75 million to be purchased in the market, and is scheduled to conclude no later than March 30, 2026.

- The purpose of the programme is to reduce the issued share capital, with shares purchased in the first tranche to be cancelled at the annual general meeting in May 2026, and the Norwegian State will participate to maintain its 67% ownership share.

- Equinor delivered record high production in 2025, achieving a Return on Average Capital Employed of 14.5% and $18 billion in cash flow from operations after tax.

- For 2026, the company anticipates 3% oil and gas production growth and has reduced its CapEx outlook for 2026 and 2027 by approximately $4 billion, primarily in power and low carbon. Organic CapEx is guided at $13 billion for 2026 and $9 billion for 2027.

- The company announced a $1.5 billion share buyback program for 2026 and increased its quarterly cash dividend to $0.39 per share, representing an increase of more than 5%.

- Equinor aims to reduce its unit production cost to $6 per barrel and achieve a 10% OpEx reduction in 2026. Cash flow from operations after tax is expected to be around $16 billion in 2026, growing to $18 billion in 2027 at flat price assumptions.

- Equinor reported strong performance in 2025, achieving record high production of 2,137,000 barrels per day (up 3.4% from last year), $18 billion in cash flow from operations after tax, and a 14.5% Return on Average Capital Employed.

- The company announced a reduction in its CapEx outlook for 2026 and 2027 by approximately $4 billion, primarily within power and low carbon, while maintaining stable investments of around $10 billion annually in oil and gas.

- For 2026, Equinor expects production growth of around 3%, cash flow from operations after tax of approximately $16 billion, and CapEx of around $13 billion.

- Equinor aims to strengthen free cash flow by reducing its unit production cost to $6 per barrel and targeting a 10% OpEx reduction in 2026.

- The company outlined its capital distribution plans, including an ambition to grow the quarterly cash dividend by two cents per share annually and a $1.5 billion share buyback program for 2026.

- Equinor reported strong 2025 performance, achieving an industry-leading return on average capital employed of 14.5% and $18 billion in cash flow from operations after tax, with $9 billion distributed to shareholders.

- The company reduced its CapEx outlook for 2026 and 2027 by $4 billion, guiding approximately $13 billion for 2026 and $9 billion for 2027, while expecting around 3% production growth in 2026.

- Equinor anticipates cash flow from operations after tax of about $16 billion in 2026, rising to $18 billion in 2027, and aims for a 10% OpEx reduction and a unit production cost of $6 per barrel in 2026.

- The company plans to grow its quarterly cash dividend by $0.02 per share annually, reaching $0.39 per share, and announced a $1.5 billion share buyback program for 2026.

- Strategic capital allocation will primarily focus on the Norwegian Continental Shelf (almost 60% of investments) and international oil and gas (30%), with limited new capital commitments for low-carbon solutions and power beyond sanctioned projects.

- Equinor ASA's fourth tranche of the 2025 share buy-back programme, announced on October 29, 2025, is scheduled to run from October 30, 2025 to no later than February 2, 2026.

- From December 22 to December 26, 2025, Equinor ASA purchased 605,000 own shares at an average price of NOK 232.0085 per share, totaling NOK 140,365,133.00.

- Cumulatively, under this tranche, Equinor ASA has bought back 11,585,791 shares at an average price of NOK 237.0062 per share, amounting to a total value of NOK 2,745,904,525.62.

- Following these transactions, Equinor ASA holds a total of 55,943,984 own shares, which corresponds to 2.19% of its share capital.

- Equinor ASA announced an update on its share buy-back programme for employee and management share-based incentive programs, which is scheduled to run from February 14, 2025, to January 15, 2026.

- The total purchase amount under the program is NOK 1,992,000,000, with a maximum of 19,080,000 shares to be acquired.

- On December 10, 2025, Equinor ASA purchased 747,336 own shares at the Oslo Stock Exchange at an average price of NOK 232.8268 per share.

- Total buy-backs under the program, including previously disclosed amounts, accumulated to 7,330,562 shares with a total transaction value of NOK 1,817,998,910.

- Following these transactions, Equinor ASA owns a total of 53,066,260 own shares, corresponding to 2.08% of its share capital.

- Equinor ASA announced a cash dividend of USD 0.37 per share for the second quarter 2025.

- The NOK cash dividend per share is NOK 3.7324, based on an average USDNOK fixing rate of 10.0875.

- The cash dividend is scheduled to be paid on November 26, 2025, to shareholders on Oslo Børs and holders of American Depositary Receipts (ADRs) on the New York Stock Exchange.

Fintool News

In-depth analysis and coverage of EQUINOR.

Quarterly earnings call transcripts for EQUINOR.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more