Earnings summaries and quarterly performance for EXPONENT.

Executive leadership at EXPONENT.

Catherine Corrigan

President and Chief Executive Officer

Brad James

Group Vice President

Brian Kundert

Chief Human Resources Officer

John Pye

Vice President for Global Offices and Innovation

Joseph Rakow

Group Vice President

Joseph Sala

Group Vice President

Maureen Reitman

Group Vice President

Richard Reiss

Group Vice President

Richard Schlenker

Executive Vice President, Chief Financial Officer and Corporate Secretary

Board of directors at EXPONENT.

Research analysts who have asked questions during EXPONENT earnings calls.

Andrew Nicholas

William Blair & Company

5 questions for EXPO

Joshua Chan

UBS Group AG

3 questions for EXPO

Tobey Sommer

Truist Securities, Inc.

3 questions for EXPO

Jasper Bibb

Truist Securities

2 questions for EXPO

Josh Chan

UBS

2 questions for EXPO

Tomo Sano

J.P. Morgan

2 questions for EXPO

Karandeep Singhania

UBS Group

1 question for EXPO

Tyler Barishaw

Truist Securities

1 question for EXPO

Recent press releases and 8-K filings for EXPO.

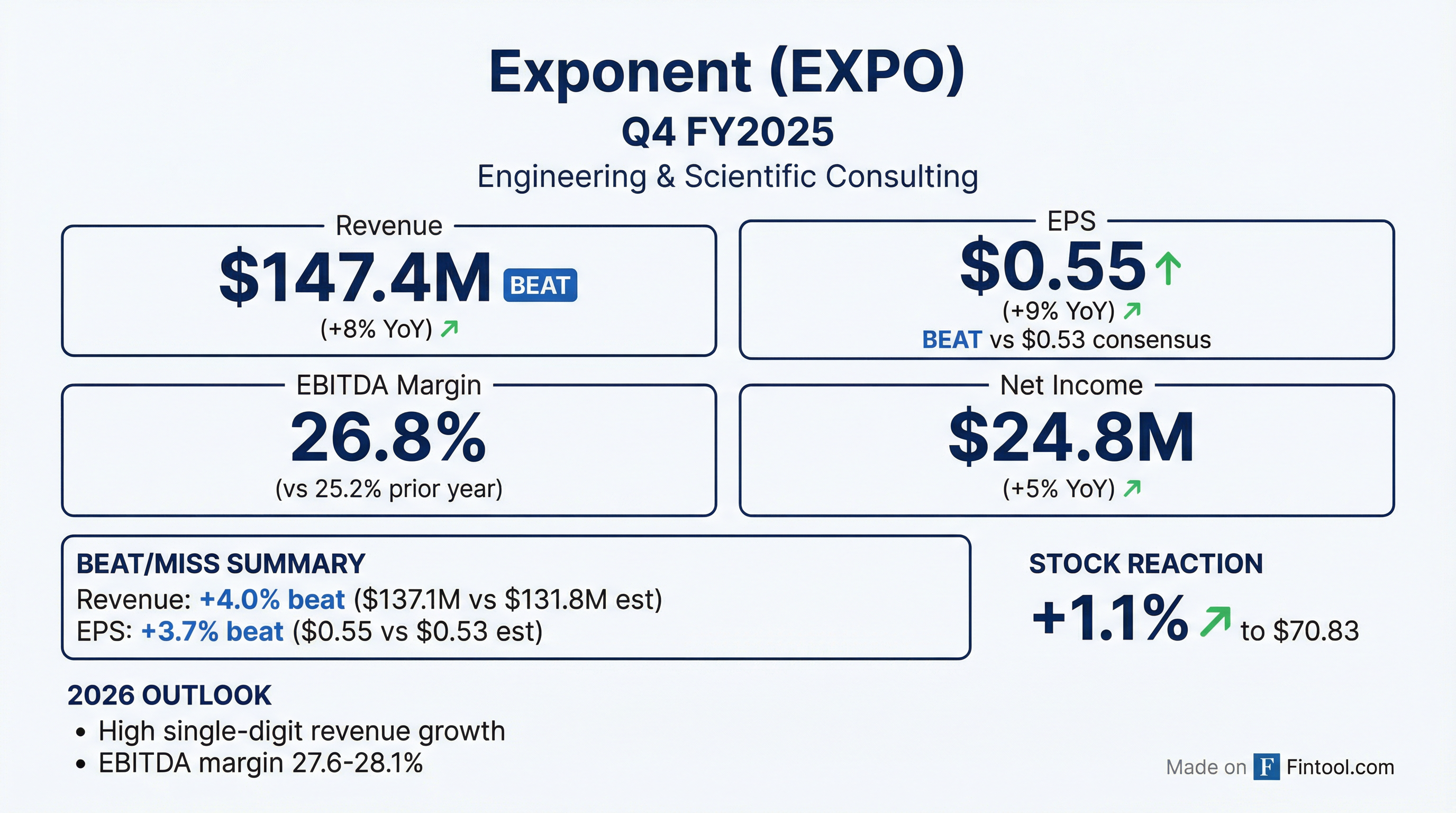

- Exponent reported Q4 2025 net revenues of $129.4 million, a 5% increase year-over-year, and diluted EPS of $0.49. For the full year 2025, net revenues grew 4% to $536.8 million, with diluted EPS at $2.07.

- The company returned $14.9 million to shareholders through dividend payments and repurchased $25.1 million of common stock in Q4 2025. Full-year 2025 shareholder returns included $61.5 million in dividends and $97.8 million in stock repurchases.

- For fiscal year 2026, Exponent anticipates net revenues to grow in the high single digits and projects an EBITDA margin between 27.6% and 28.1% of net revenues.

- Growth in 2025 was driven by proactive engagements in consumer electronics and utility risk management, alongside reactive services. Future demand is expected from the increasing integration of AI and complex technologies in various sectors, including consumer electronics, energy, and transportation.

- For Q4 2025, Exponent reported revenues of $147.4 million, an 8% increase year-over-year, and earnings per share (EPS) of $0.49, a 7% increase year-over-year.

- For the full fiscal year 2025, revenues grew 4% to $582.0 million, while EPS decreased 2% to $2.07.

- The company declared a quarterly dividend of $0.31 and, from 2020 to 2025, returned $306 million through dividends and $331 million through share repurchases (approximately 4.2 million shares) to shareholders.

- As of December 31, 2025, Exponent employed 900+ consulting staff, including 650+ doctoral-level professionals, and achieved a technical utilization of 73% for FY 2025.

- Exponent concluded 2025 with Q4 net revenues increasing 5% to $129.4 million and full-year net revenues growing 4% to $536.8 million. Net income for Q4 was $24.8 million ($0.49 per diluted share), while full-year net income decreased 3% to $106 million ($2.07 per diluted share).

- For 2026, the company anticipates high single-digit net revenue growth for both the first quarter and the full year. The full-year EBITDA margin is projected to be 27.6%-28.1% of net revenues, and average technical full-time equivalent employees are expected to increase 4%-5%.

- Growth in Q4 2025 was driven by increased demand for user research in consumer electronics and risk management in the utility sector, alongside failure analysis and dispute-related engagements across energy, construction, transportation, and life sciences. The company views AI as a net benefit, driving demand in safety-critical applications and energy infrastructure.

- In 2025, Exponent returned $61.5 million to shareholders through dividend payments and repurchased $97.8 million of common stock.

- Exponent reported Q4 2025 total revenues of $147.4 million, an increase of 7.8% compared to Q4 2024, with diluted EPS of $0.49.

- For fiscal year 2025, total revenues increased 4.2% to $582.0 million, and diluted EPS was $2.07.

- The company's Board of Directors increased the quarterly cash dividend from $0.30 to $0.31 per share, payable on March 20, 2026.

- Exponent provided fiscal year 2026 guidance, anticipating revenues before reimbursements to grow in the high-single digits and EBITDA to be 27.6% to 28.1% of revenues before reimbursements.

- During fiscal year 2025, Exponent paid $61.5 million in dividends and repurchased $97.8 million of common stock.

- For the fourth quarter of 2025, Exponent's total revenues increased 7.8% to $147.4 million, and net income rose to $24.8 million ($0.49 per diluted share).

- For fiscal year 2025, total revenues grew 4.2% to $582.0 million, with net income reported at $106.0 million ($2.07 per diluted share).

- Exponent announced an increase in its quarterly cash dividend from $0.30 to $0.31 per share, payable on March 20, 2026, and repurchased $97.8 million of common stock during fiscal year 2025.

- For fiscal year 2026, the company anticipates revenues before reimbursements to grow in the high-single digits and EBITDA to be 27.6% to 28.1% of revenues before reimbursements.

- Exponent delivered a strong third quarter 2025, with net revenues increasing 10% to $137.1 million and net income rising to $28 million, or $0.55 per diluted share.

- The company experienced robust growth in reactive engagements, up 18%, driven by dispute-related work across energy, transportation, life sciences, and construction sectors, while proactive engagements were approximately flat.

- For Q4 2025, Exponent expects net revenues to grow in the low to mid-single digits and EBITDA to be 26%-27% of net revenues, noting a 7% revenue headwind due to a shorter quarter compared to the prior year.

- The board approved a $100 million increase in the stock repurchase program, following $40 million in common stock repurchases during Q3 2025.

- Exponent is actively engaged in early-stage initiatives tied to transformative technologies like Artificial Intelligence, which is driving growth in failure analysis and human-machine interaction studies across both reactive and proactive segments.

- Exponent reported strong Q3 2025 financial results, with net revenues increasing 10% to $137.1 million and diluted earnings per share of $0.55.

- This performance was driven by 18% growth in reactive engagements, particularly in the energy, transportation, and life sciences sectors, contributing to a 74.1% utilization rate and a 6% realized rate increase.

- For Q4 2025, the company expects low to mid-single-digit net revenue growth and an EBITDA margin of 26% to 27%, while raising its full-year 2025 EBITDA margin expectation to 27.4% to 27.65%.

- The board approved a $100 million increase to the stock repurchase program, following $40 million in common stock repurchases in Q3, and the company anticipates 4% to 6% headcount growth in 2026 to support demand in areas like AI and digital health.

- Exponent delivered strong Q3 2025 financial results, with net revenues increasing 10% to $137.1 million and diluted earnings per share (EPS) rising to $0.55 compared to the prior year period.

- The company's double-digit net revenue growth was primarily driven by increasing demand for reactive engagements, which saw an 18% growth in Q3 2025, particularly in dispute-related work across the energy, transportation, life sciences, and construction sectors.

- For the full year 2025, Exponent maintained its guidance for low single-digit net revenue growth but raised its EBITDA margin expectation to 27.4% to 27.65% of net revenues.

- The board approved a $100 million increase in the current stock repurchase program, adding to the $21.6 million available as of October 3, 2025.

- Looking ahead to Q4 2025, the company expects net revenue growth in the low to mid-single digits, noting a 7% revenue headwind due to a shorter 13-week quarter compared to the 14-week Q4 2024.

- For Q3 2025, Exponent reported a 10% increase in Earnings per share to $0.55 and an 8% increase in Revenues to $147.1 million compared to Q3 2024.

- EBITDA for Q3 2025 grew 8% to $38.8 million, with the EBITDA Margin at 28.3%.

- Year-to-date (as of October 3, 2025), Revenues increased by 3% to $434.6 million, while Earnings per share decreased by 5% to $1.58 compared to the same period in 2024.

- The company saw a 4% increase in billable hours to 376,000 and a 3% increase in technical full-time equivalent employees to 976 in Q3 2025 compared to Q3 2024.

- Exponent maintains a quarterly dividend of $0.30.

- Exponent, Inc. reported strong third-quarter fiscal year 2025 financial results, with total revenues increasing 8% to $147.1 million and revenues before reimbursements increasing 10% to $137.1 million compared to the third quarter of 2024. Net income for the quarter rose to $28.0 million, or $0.55 per diluted share.

- For the first three quarters of fiscal year 2025, total revenues increased 3% to $434.6 million and revenues before reimbursements increased 3% to $407.4 million. However, net income decreased to $81.2 million, or $1.58 per diluted share, compared to the same period in 2024.

- The company's Board of Directors declared a quarterly cash dividend of $0.30 per share for Q4 2025 and increased its share repurchase authorization by $100 million, which is in addition to the $21.6 million available as of October 3, 2025.

- Exponent maintained its revenue guidance and raised its margin guidance for the full fiscal year 2025, anticipating low single-digit growth in revenues before reimbursements and EBITDA of 27.4% to 27.65% of revenues before reimbursements. For the fourth quarter of 2025, the company expects revenues before reimbursements to grow in the low to mid-single digits and EBITDA to be 26.0% to 27.0% of revenues before reimbursements.

Quarterly earnings call transcripts for EXPONENT.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more