Earnings summaries and quarterly performance for EXTREME NETWORKS.

Executive leadership at EXTREME NETWORKS.

Board of directors at EXTREME NETWORKS.

Research analysts who have asked questions during EXTREME NETWORKS earnings calls.

David Vogt

UBS Group AG

8 questions for EXTR

Ryan Koontz

Needham & Company, LLC

7 questions for EXTR

Christian Schwab

Craig-Hallum Capital Group

6 questions for EXTR

Eric Martinuzzi

Lake Street Capital Markets

6 questions for EXTR

Dave Kang

B. Riley Financial

5 questions for EXTR

Mike Genovese

Rosenblatt Securities

4 questions for EXTR

Timothy Horan

Oppenheimer & Co. Inc.

4 questions for EXTR

Chris Schwab

Craig-Hallum Capital Group LLC

2 questions for EXTR

Dave King

B. Riley

2 questions for EXTR

Michael Genovese

Rosenblatt Securities Inc.

2 questions for EXTR

Tomer Zilberman

Bank of America

2 questions for EXTR

Ryan Koons

Needham & Co

1 question for EXTR

Recent press releases and 8-K filings for EXTR.

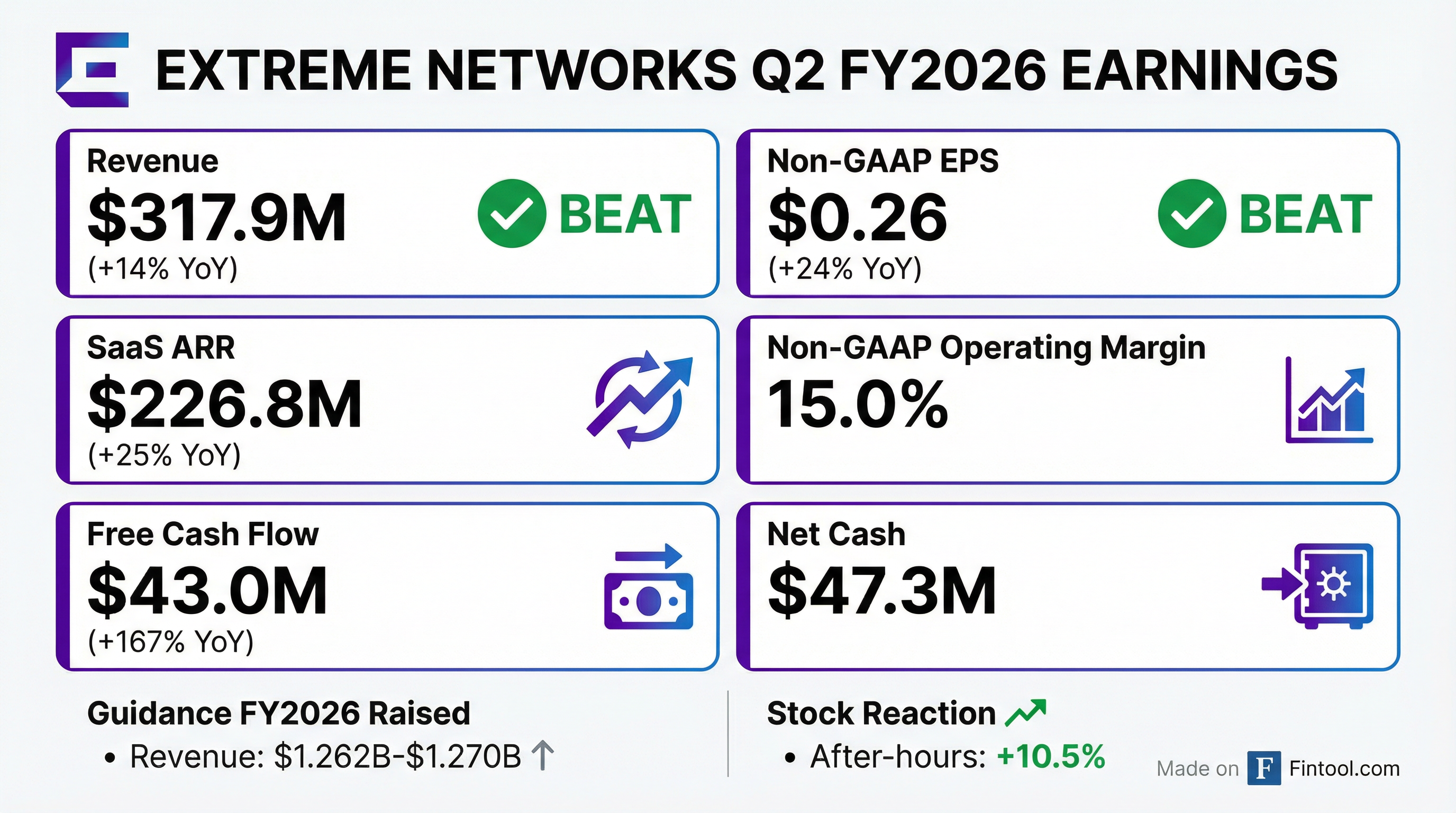

- Extreme Networks reported Q2 2026 revenue of $318 million, a 14% year-over-year increase, and EPS of $0.26, a 24% year-over-year improvement, both exceeding guidance.

- The company achieved its seventh consecutive quarter of revenue growth, with SaaS ARR increasing 25% year-over-year to $227 million, driven by its AI-powered Platform One and competitive wins, leading to market share gains.

- For Q3 2026, revenue is expected to be between $309 million and $314 million, with EPS between $0.23 and $0.25. The full fiscal year 2026 revenue guidance was raised to $1,262 million - $1,270 million, representing 11% year-over-year growth at the midpoint, with EPS projected between $0.98 and $1.02.

- Non-GAAP gross margin was 62% in Q2 2026, and while Q3 and Q4 gross margins are expected to be temporarily impacted by lower-margin professional services for large deployments, the company anticipates product gross margin improvement and maintains its long-term gross margin goal of 64%-66%.

- Extreme Networks reported Q2 Fiscal Year 2026 revenue of $318 million, a 14% year-over-year increase, marking its seventh consecutive quarter of revenue growth.

- Earnings per share (EPS) for Q2 2026 reached $0.26, representing a 24% year-over-year improvement from the prior year quarter.

- The company's SaaS Annual Recurring Revenue (ARR) grew 25% year-over-year to $227 million, driven by strong Platform One subscriptions.

- Non-GAAP gross margin was 62% in Q2 2026, with an operating margin of 16% and adjusted EBITDA of $52.4 million.

- For Q3 2026, revenue is projected to be between $309 million and $314 million. The company also expects to grow profit faster than revenue for the full fiscal year 2026, with approximately 20% profitability growth on double-digit revenue growth.

- Extreme Networks reported Q2 2026 revenue of $318 million, a 14% year-over-year increase, and EPS of $0.26, a 24% year-over-year improvement, with both metrics exceeding guidance.

- The company raised its full fiscal year 2026 revenue guidance to a range of $1,262 million-$1,270 million, representing 11% year-over-year growth at the midpoint, and expects EPS of $0.98-$1.02. Profit growth is projected at around 20% for the year.

- While Q3 2026 gross margins are expected to be 61%-61.4% due to larger professional services deployments, product gross margins are anticipated to improve in Q3 and for the remainder of FY 2026.

- Key growth drivers include a major end-of-life refresh cycle, changes to Cisco's partner program, the HP-Juniper merger, and new AI requirements, contributing to SaaS ARR accelerating to 25% year-over-year growth.

- Extreme Networks reported Q2 2026 total revenue of $318.0 million and Non-GAAP EPS of $0.26, marking its seventh consecutive quarter of sequential revenue growth.

- The company achieved strong profitability with a Non-GAAP Gross Margin of 62.0% and a Non-GAAP Operating Margin of 15.0% in Q2 2026, alongside Adjusted EBITDA of approximately $52 million.

- Recurring revenue streams showed significant growth, with SaaS ARR reaching $227 million, up 25% year-over-year, and total deferred recurring revenue at $628 million, an increase of 9% year-over-year.

- Extreme Networks generated $43 million in Free Cash Flow and ended Q2 2026 with Net Cash of $47 million.

- For Q3 2026, the company provided guidance for revenue between $309.1 million and $314.1 million and Non-GAAP EPS between $0.23 and $0.25.

- Extreme Networks reported Q2 fiscal year 2026 revenue of $317.9 million for the period ended December 31, 2025, representing a 14% year-over-year increase and 2.5% quarter-over-quarter growth.

- The company's SaaS Annual Recurring Revenue (ARR) increased by 25% year-over-year to $226.8 million.

- GAAP diluted EPS for Q2 2026 was $0.06, while Non-GAAP diluted EPS reached $0.26.

- Extreme Networks ended Q2 2026 with a cash balance of $219.8 million and net cash of $47.3 million. The company also raised its revenue outlook for fiscal year 2026 and provided Q3 2026 Non-GAAP EPS guidance of $0.23 - $0.25 and FY 2026 Non-GAAP EPS guidance of $0.98 - $1.02.

- Extreme Networks reported Q2 FY2026 revenue of $317.9 million, marking its seventh consecutive quarter of sequential growth and an increase of 14% year-over-year.

- SaaS Annual Recurring Revenue (ARR) grew 25.2% year-over-year to $226.8 million for Q2 FY2026, which ended December 31, 2025.

- The company's non-GAAP diluted EPS for Q2 FY2026 was $0.26, compared to $0.21 in the prior year quarter.

- Extreme Networks raised its revenue outlook for fiscal year 2026, now targeting total net revenue between $1,262.0 million and $1,270.0 million.

- Extreme Networks is reportedly exploring a potential cash-and-stock acquisition of Ruckus Networks from CommScope, with a value that could exceed $1 billion.

- This contemplated deal would bolster Extreme's enterprise wireless portfolio by adding Ruckus’s Wi-Fi access points, switches, and cloud management.

- CommScope is selling assets to repay debt and is reorganizing its business, making Ruckus a likely divestiture candidate.

- Extreme Networks' financial profile, relevant to pursuing a deal over $1 billion, includes a market capitalization around $2.1 billion, trailing-12-month sales of about $1.18 billion, a gross margin of ~61.6%, and a net margin of ~0.73%.

- Extreme Networks, Inc. (EXTR) provided its detailed financial outlook for the full fiscal year 2026, ending June 30, 2026, on November 10, 2025.

- For FY26, the company projects GAAP total net revenue between $1,247.0 million and $1,264.0 million, with GAAP diluted earnings per share in the range of $0.28 to $0.32.

- Non-GAAP guidance for FY26 includes total net revenue between $1,247.0 million and $1,264.0 million, non-GAAP operating margin between 14.6% and 14.8%, and non-GAAP diluted earnings per share between $0.99 and $1.02.

- Extreme Networks (EXTR) projects double-digit revenue growth for the current year and aims to grow profitability by over 20% annually for the next three to four years, targeting long-term gross margins of 64-66% and operating margins of 22-24%.

- The company's SaaS Annual Recurring Revenue (ARR) is projected to grow from $200 million to $650 million over the next four years, representing a 30% year-over-year growth. Recurring revenue is expected to increase from 36% to 41% of total revenue, contributing to a 100 basis point margin improvement.

- Extreme Networks is a leader in the cloud-managed networking segment, growing at 24% (twice the market rate). The company is strategically positioned for the AI networking market, which is anticipated to grow at a 72% CAGR over the next five years and comprise $19 billion of the campus networking market.

- Their Platform One strategy, central to their offerings, includes two key AI "moats": a unified data architecture and proprietary model-agnostic technology for cost-effective, real-time query processing. This platform is enabling early adopters to gain up to 300,000 hours of capacity annually through AI-driven efficiencies.

- New commercial models, such as those with zero hardware cost of goods sold for Extreme, generate 80-85% margins on bundled software and Platform One offerings. The support attach rate is expected to significantly increase from 60-70% to approximately 95% over four years.

- Extreme Networks projects double-digit product and overall revenue growth with earnings growth in the 20% range over the next five years, updating its EPS guidance to a minimum of $0.99 up to $1.02. The company also targets 64%-66% gross margins and 22%-24% operating margins.

- The company's SaaS Annual Recurring Revenue (ARR) is expected to grow from $200 million today to $650 million over the next four years, representing 30% year-over-year growth. Recurring revenue is projected to increase from 36% to 41% of total revenue over time.

- Extreme Networks is strategically focused on AI and its Platform ONE offering, positioning itself as a leader in the cloud-managed market and the rapidly growing AI networking for campus market, which is projected to have a 72% CAGR over the next five years.

- New commercial models, including the Subscription Private Offer (ESPO) and MSP programs, are driving 14% of new subscription bookings and yield 80%-85% margins on the software component by decoupling hardware.

- A $200 million share buyback program was in place as of July 1st.

Quarterly earnings call transcripts for EXTREME NETWORKS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more