Earnings summaries and quarterly performance for FIRST COMMONWEALTH FINANCIAL CORP /PA/.

Executive leadership at FIRST COMMONWEALTH FINANCIAL CORP /PA/.

T. Michael Price

President and Chief Executive Officer

Brian Sohocki

Executive Vice President and Chief Credit Officer

James Reske

Executive Vice President and Chief Financial Officer

Jane Grebenc

Executive Vice President and Chief Revenue Officer; President, First Commonwealth Bank

Michael McCuen

Executive Vice President and Chief Banking Officer

Norman Montgomery

Executive Vice President, Business Integration Group Manager

Board of directors at FIRST COMMONWEALTH FINANCIAL CORP /PA/.

Aradhna Oliphant

Director

Bart Johnson

Director

David Greenfield

Director

Gary Claus

Director

Jon Gorney

Chair of the Board

Joseph DiVito Jr.

Director

Julie Caponi

Director

Luke Latimer

Director

Ray Charley

Director

Stephen Wolfe

Director

Todd Brice

Director

Research analysts who have asked questions during FIRST COMMONWEALTH FINANCIAL CORP /PA/ earnings calls.

Daniel Tamayo

Raymond James Financial, Inc.

6 questions for FCF

Karl Shepard

RBC Capital Markets

6 questions for FCF

Manuel Navas

D.A. Davidson & Co.

6 questions for FCF

Matthew Breese

Stephens Inc.

6 questions for FCF

Kelly Motta

Keefe, Bruyette & Woods

5 questions for FCF

Frank Schiraldi

Piper Sandler

2 questions for FCF

Charlie Driscoll

Keefe, Bruyette & Woods

1 question for FCF

Dan Cardenas

Janney Montgomery Scott

1 question for FCF

Daniel Cardenas

Janney Montgomery Scott LLC

1 question for FCF

Recent press releases and 8-K filings for FCF.

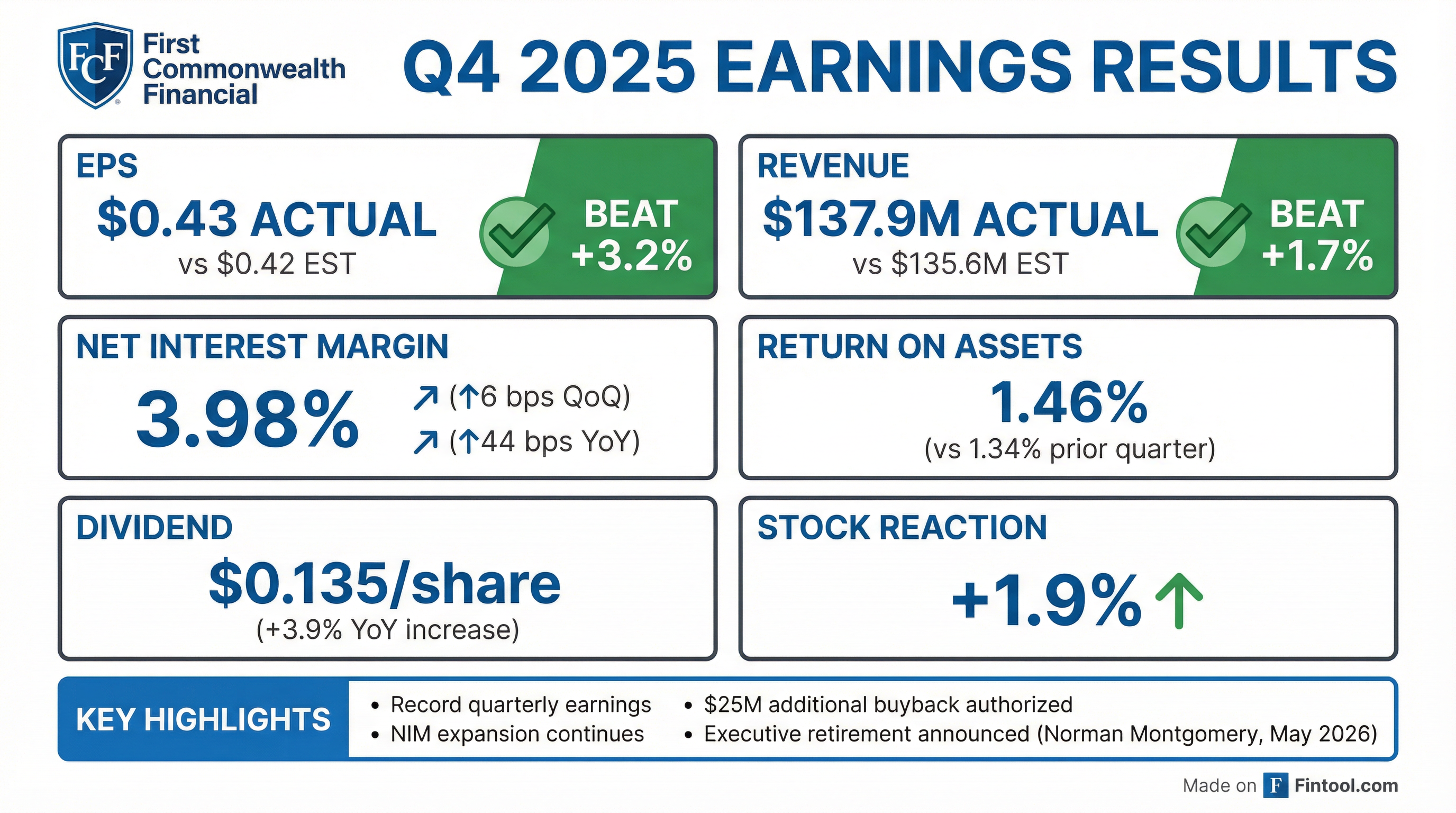

- Core EPS for Q4 2025 was $0.43, an increase of $0.04 from the previous quarter.

- The net interest margin increased by 6 basis points from the previous quarter to 3.98% in Q4 2025.

- Average deposits grew by $72.0 million, or 2.8% annualized, and total loans increased $28.6 million, or 1.2% annualized, from the previous quarter.

- The company repurchased 1,451,296 shares for an aggregate value of $23.1 million during Q4 2025, and the Board approved additional share repurchase programs totaling $50 million in December 2025 and January 2026.

- Core Pre-tax pre-provision income was $63.2 million, and the TCE ratio stood at 9.7% in Q4 2025.

- First Commonwealth Financial Corporation (FCF) reported Q4 2025 core EPS of $0.43 per share, with a net interest margin (NIM) expanding to 3.98%, a core return on assets (ROA) of 1.45%, and a core efficiency ratio of 52.8%.

- For the full year 2025, core EPS was $1.53, and net interest income grew by $47.2 million year-over-year to $427.5 million.

- The company repurchased $23.1 million of its stock in Q4 2025 and authorized an additional $25 million in share repurchase authority, with expected quarterly activity capped at approximately $25 million-$30 million.

- FCF designated approximately $225 million in commercial loans as held for sale at year-end 2025, primarily from the Philadelphia market, which is expected to improve liquidity and capital ratios upon consummation.

- Management anticipates a near-term dip of 5-10 basis points in NIM in Q1 2026, followed by gradual improvement to end 2026 at around 4%.

- First Commonwealth Financial Corporation reported Q4 2025 core EPS of $0.43 per share and a net interest margin (NIM) that expanded to 3.98%. For the full year 2025, core EPS was $1.53, and net interest income grew by $47.2 million year-over-year to $427.5 million.

- The company expects a near-term dip in NIM in Q1 2026 (estimated 5-10 basis points) due to variable rate loan adjustments, followed by gradual improvement, ending 2026 at around 4%.

- Average deposits grew 2.8% annualized in Q4 2025, and total loans grew 1.2% annualized. For 2025, loan growth was 8.2% annualized (or 5% without the CenterBank acquisition), and average deposit growth was 6.1% (or 4.2% without CenterBank). The company expects loan growth of 5%-7% (without CenterBank) to continue in 2026.

- FCF repurchased $23.1 million of its stock in Q4 2025 and announced an additional $25 million share repurchase authority, with quarterly activity capped at approximately $25 million-$30 million.

- A portfolio of approximately $225 million in commercial loans was designated as held for sale, representing an exit from the Philadelphia MSA market, which is expected to improve liquidity and capital ratios if consummated.

- First Commonwealth Financial Corporation reported Q4 2025 core EPS of $0.43 per share, with a net interest margin (NIM) expanding to 3.98%, a core return on assets (ROA) of 1.45%, and a core efficiency ratio of 52.8%.

- For the full year 2025, core EPS was $1.53, and net interest income increased by $47.2 million year-over-year to $427.5 million.

- The company repurchased $23.1 million of its stock (1.4 million shares) in Q4 2025, and the board authorized an additional $25 million in share repurchase authority, with an expectation to repurchase approximately $25 million-$30 million per quarter.

- Management anticipates a near-term NIM dip of 5-10 basis points in Q1 2026, followed by gradual improvement to end 2026 around 4%.

- FCF designated $225 million in commercial loans as held for sale, representing a strategic exit from the Philadelphia market.

- First Commonwealth Financial Corporation reported net income of $44.9 million and diluted earnings per share of $0.43 for the fourth quarter of 2025, an increase of $3.5 million and $0.04 per share from the previous quarter. For the full year 2025, net income was $152.3 million and diluted EPS was $1.47.

- The company's profitability for Q4 2025 included a return on average assets (ROAA) of 1.46% and a net interest margin (FTE) of 3.98%, which increased six basis points from the prior quarter.

- A quarterly dividend of $0.135 per share was declared, representing a 3.9% increase from the fourth quarter of 2024. The company also repurchased 1,451,296 shares during Q4 2025, and an additional $25.0 million of share repurchase authority was authorized in January 2026.

- For the full year 2025, average deposits grew $580.1 million (6.1%) and total loans grew $743.7 million (8.2%) compared to the prior year.

- First Commonwealth Financial Corporation reported net income of $44.9 million and diluted earnings per share of $0.43 for the fourth quarter of 2025, and $152.3 million and $1.47 respectively for the full year 2025.

- The company declared a quarterly common stock dividend of $0.135 per share, representing a 3.9% increase from the fourth quarter of 2024.

- An additional $25.0 million of share repurchase authority was authorized in January 2026, following the repurchase of 1,451,296 shares at a weighted average price of $15.94 during the fourth quarter of 2025.

- The net interest margin (FTE) for the fourth quarter of 2025 was 3.98%, an increase of six basis points from the prior quarter, and the core efficiency ratio was 52.84%.

- Asset quality in Q4 2025 included a provision for credit losses of $7.0 million and net charge-offs of $11.3 million, with nonperforming loans increasing by $3.1 million to $91.8 million.

- First Commonwealth Financial Corporation (FCF) reported strong Q3 2025 financial performance, with return on assets improving to 1.34% and net interest margin expanding 9 basis points to 3.92%.

- The company achieved 4% growth in average deposits and a 7 basis point decline in the cost of deposits to 1.84%, alongside a 5.7% increase in loans.

- Credit quality improved, with non-performing loans declining to 0.91% , despite $5.5 million in charge-offs from a dealer floor plan fraud and $2.8 million from the sale of acquired Center Bank loans. The remaining $16 million floor plan exposure is expected to be largely resolved by year-end.

- FCF repurchased approximately 625,000 shares at an average price of $16.81 in Q3 2025, with $20.7 million remaining in share repurchase authorization for the rest of 2025.

- Management anticipates near-term net interest margin pressure of approximately 5 basis points in Q4 2025 due to expected Fed rate cuts, but projects a recovery to roughly 3.9% in 2026. Expenses are expected to grow by about 3% next year.

- FCF reported Core EPS of $0.39 for Q3 2025, an increase of $0.01 from the previous quarter.

- The net interest margin for Q3 2025 was 3.92%, marking a 9 basis point increase from the previous quarter.

- Total loans increased by $183.7 million, or 5.7% annualized, and average deposits grew by $102.7 million, or 4.0% annualized, from the previous quarter.

- Provision expense was $11.3 million, a $2.4 million increase from the previous quarter (excluding Day-1 non-PCD provision), and net charge-offs increased by $9.5 million to $12.2 million.

- The company repurchased 625,483 shares with an aggregate value of $10.5 million during the quarter.

- First Commonwealth Financial Corporation reported net income of $41.3 million and diluted earnings per share of $0.39 for the third quarter of 2025, an increase of $7.9 million and $0.07 per share, respectively, from the prior quarter.

- The company's net interest margin (FTE) expanded to 3.92% in Q3 2025, an increase of 9 basis points from the previous quarter and 36 basis points from Q3 2024.

- Provision for credit losses increased to $11.3 million in Q3 2025, up from $8.9 million in the previous quarter (excluding acquisition Day-1 non-PCD provision), and net charge-offs totaled $12.2 million, a significant increase of $9.5 million from the prior quarter.

- First Commonwealth declared a common stock quarterly dividend of $0.135 per share, representing a 3.9% increase from Q3 2024, and repurchased 625,483 shares during the third quarter of 2025.

- First Commonwealth Financial Corporation reported GAAP net income of $41.3 million and diluted earnings per share of $0.39 for the third quarter of 2025, an increase from $33.4 million and $0.32 per share in the prior quarter.

- The company's net interest margin (FTE) expanded to 3.92% in Q3 2025, up 9 basis points from the prior quarter and 36 basis points from Q3 2024, while the core efficiency ratio improved to 52.3%.

- The Board of Directors declared a common stock quarterly dividend of $0.135 per share, representing a 3.9% increase from the third quarter of 2024, and the company repurchased 625,483 shares during Q3 2025.

- Asset quality showed nonperforming loans decreasing to $88.7 million at September 30, 2025, a $10.8 million decrease from the previous quarter, although net charge-offs increased to $12.2 million.

Quarterly earnings call transcripts for FIRST COMMONWEALTH FINANCIAL CORP /PA/.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more