Earnings summaries and quarterly performance for FIRST HAWAIIAN.

Executive leadership at FIRST HAWAIIAN.

Robert Harrison

Chairman, President and Chief Executive Officer

Alan Arizumi

Vice Chairman, Wealth Management Group

Darlene Blakeney

Executive Vice President and Chief Lending Officer (Wholesale Banking)

James Moses

Vice Chairman and Chief Financial Officer

Joel Rappoport

Executive Vice President, General Counsel and Secretary

Lea Nakamura

Executive Vice President and Chief Risk Officer

Neill Char

Vice Chairman, Retail Banking and Consumer Products Group

Board of directors at FIRST HAWAIIAN.

Research analysts who have asked questions during FIRST HAWAIIAN earnings calls.

Anthony Elian

JPMorgan

7 questions for FHB

David Feaster

Raymond James

7 questions for FHB

Timur Braziler

Wells Fargo

7 questions for FHB

Kelly Motta

Keefe, Bruyette & Woods

6 questions for FHB

Andrew Terrell

Stephens Inc.

5 questions for FHB

Janet Lee

TD Cowen

4 questions for FHB

Jared Shaw

Barclays

4 questions for FHB

Matthew Clark

Piper Sandler

4 questions for FHB

Andrew Liesch

Piper Sandler

3 questions for FHB

Jared David Shaw

Barclays Capital

2 questions for FHB

Charlie Driscoll

KBW

1 question for FHB

Charlie Driscoll

Keefe, Bruyette & Woods

1 question for FHB

Liam Coohill

Raymond James

1 question for FHB

Recent press releases and 8-K filings for FHB.

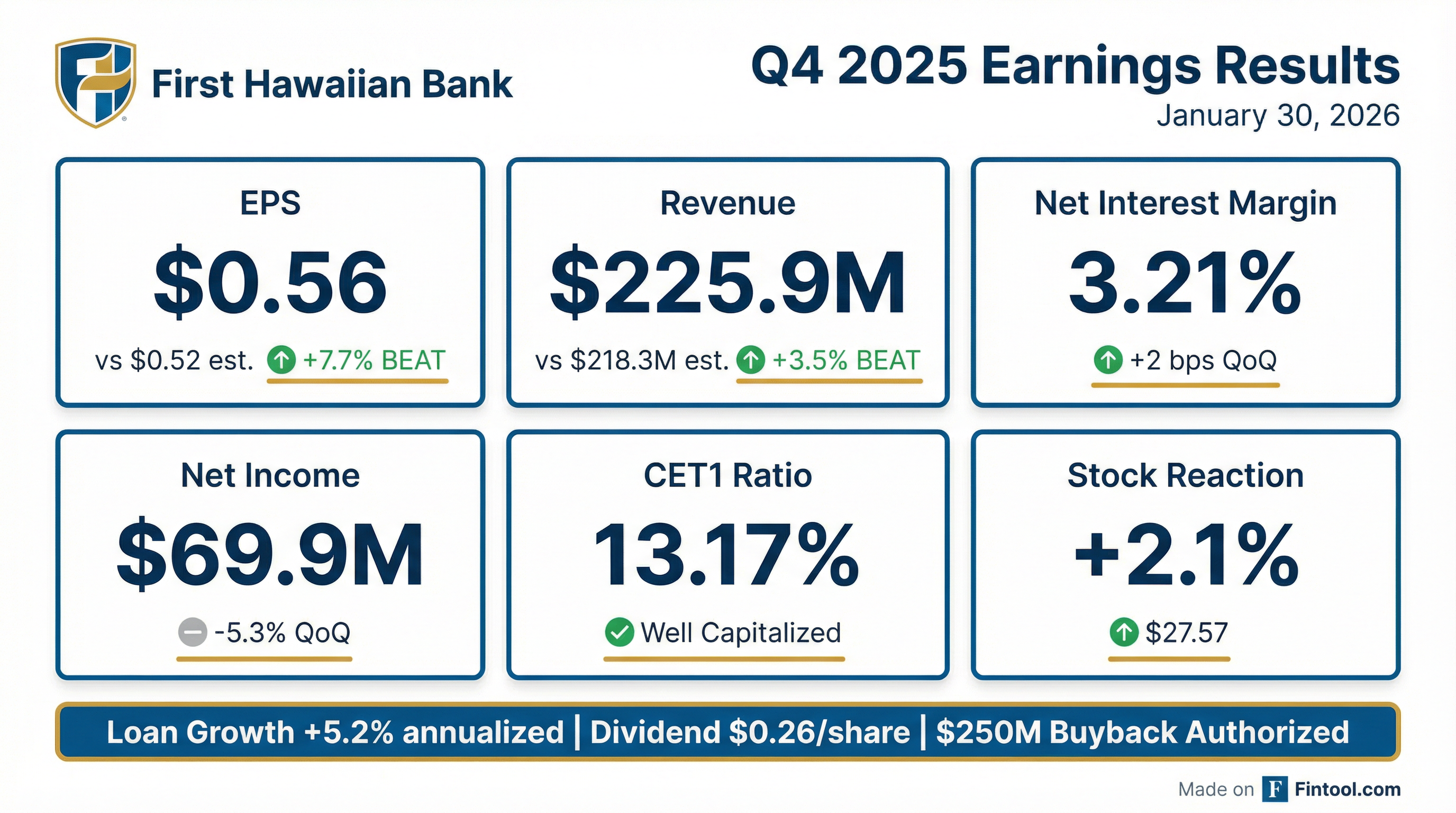

- First Hawaiian, Inc. (FHB) reported net income of $69.9 million and diluted EPS of $0.56 for Q4 2025, contributing to a full-year 2025 net income of $276.3 million. The company achieved a Return on Average Tangible Common Equity (ROATCE) of 16.27% for the full year 2025.

- As of December 31, 2025, FHB maintained a strong balance sheet with $24.0 billion in assets, $20.5 billion in deposits, and $14.3 billion in loans. The CET1 capital ratio stood at 13.17% for Q4 2025, reflecting a robust capital position.

- The company demonstrated strong asset quality with an Allowance for Credit Losses (ACL) to total loans of 1.18% and a Net Charge-Off (NCO) rate of 0.14% for Q4 2025.

- FHB returned approximately $230 million to shareholders in 2025, including a Q4 2025 dividend of $0.26 per share and $26 million in share repurchases. The company has a current repurchase authorization of up to $250 million.

- Net income for Q4 2025 was $69.9 million, with diluted earnings per share of $0.56.

- The Net Interest Margin (NIM) increased by 2 basis points to 3.21% in Q4 2025, driven by deposit repricing.

- Total loans and leases grew by $183.1 million to $14,312.5 million as of December 31, 2025, while total deposits decreased by $213.9 million to $20,515.7 million, primarily due to a decline in public deposits.

- The company repurchased approximately 1.0 million shares for $26 million and authorized a new $250 million stock repurchase program; a $0.26 per share dividend was also declared.

- Asset quality remained strong, though the Net Charge-Off (NCO) rate increased to 0.14% and Non-Performing Assets (NPA) rose to $44.4 million in Q4 2025.

- First Hawaiian Inc. reported a return on average tangible equity of 15.8% for Q4 2025 and 16.3% for the full year, with net interest income of $170.3 million and a NIM of 3.21%.

- The company saw total loan growth of $183 million (5.2% annualized) in Q4 2025, primarily in C&I loans, and a net increase in deposits of $214 million, with the total cost of deposits falling to 1.29%.

- Credit quality remained robust, with net charge-offs of $5 million (14 basis points of total loans and leases) for the quarter and an annual net charge-off rate of 11 basis points.

- First Hawaiian announced a new $250 million stock repurchase authorization without a specific timeframe, after completing its prior $100 million 2025 authorization.

- For full year 2026, guidance includes loan growth of 3%-4%, a full year NIM in the 3.16%-3.18% range, non-interest income of about $220 million, and expenses of approximately $520 million. The effective tax rate is expected to normalize to about 23.2%.

- First Hawaiian Bank reported a return on average tangible equity of 15.8% for Q4 2025 and 16.3% for the full year.

- Net interest income was $170.3 million in Q4 2025, with the Net Interest Margin (NIM) expanding to 3.21%, up 2 basis points from the prior quarter.

- Total loans grew $183 million (or 5.2% annualized) in Q4 2025, driven by C&I loans, while deposits increased by $214 million. The bank also repurchased approximately 1 million shares and authorized a new $250 million stock repurchase program.

- For the full year 2026, the bank expects loan growth in the 3%-4% range, NIM between 3.16%-3.18%, non-interest income of about $220 million, and expenses around $520 million.

- Credit quality remained strong, with net charge-offs at $5 million (or 14 basis points of total loans and leases) in Q4 2025, and an allowance for credit losses of $168.5 million.

- Net income for Q4 2025 was $69.9 million with diluted earnings per share of $0.56.

- Total loans and leases increased by $183.1 million in Q4 2025, while total deposits decreased by $213.9 million.

- The company declared a $0.26 per share dividend and repurchased approximately 1.0 million shares of common stock at a cost of $26 million.

- FHB provided a 2026 outlook, projecting full-year loan growth of 3% to 4% and a net interest margin between 3.16% and 3.18%.

- First Hawaiian Bank reported a strong Q4 2025, with return on average tangible equity at 15.8%, net interest income growing to $170.3 million, and net interest margin expanding to 3.21%.

- Total loans grew $183 million (or 5.2% annualized) in Q4 2025, primarily driven by C&I loans, while retail and commercial deposits increased by $233 million.

- For the full year 2026, the company expects loan growth in the 3%-4% range, net interest margin (NIM) between 3.16%-3.18%, non-interest income of about $220 million, and expenses around $520 million.

- The bank repurchased approximately 1 million shares in Q4 2025 and announced a new $250 million stock repurchase authorization without a specific timeframe.

- First Hawaiian, Inc. reported net income of $69.9 million, or $0.56 per diluted share, for the fourth quarter ended December 31, 2025.

- The company's total loans and leases increased by $183.1 million to $14.3 billion as of December 31, 2025, while total deposits decreased by $213.9 million to $20.5 billion compared to the prior quarter.

- The net interest margin for Q4 2025 increased by 2 basis points to 3.21%.

- The Board of Directors declared a quarterly cash dividend of $0.26 per share and adopted a new stock repurchase program for up to $250.0 million of its common stock.

- In Q4 2025, the company repurchased approximately 1.0 million shares at a total cost of $26.0 million, with total repurchases for 2025 reaching $100.0 million.

- First Hawaiian reported net income of $69.9 million, or $0.56 per diluted share, for the quarter ended December 31, 2025.

- The company's Board of Directors declared a quarterly cash dividend of $0.26 per share.

- A $250.0 million stock repurchase program was adopted by the Board of Directors.

- Total loans and leases increased by $183.1 million to $14.3 billion, while total deposits decreased by $213.9 million to $20.5 billion as of December 31, 2025.

- The net interest margin for the fourth quarter of 2025 increased 2 basis points to 3.21%.

- Net income increased in the third quarter of 2025, driven by higher net interest and non-interest income, with the effective tax rate returning to a more normalized 23.2%.

- Net Interest Income (NII) was $169.3 million, an increase of $5.7 million from the prior quarter, and the Net Interest Margin (NIM) expanded by eight basis points to 3.19%.

- Total loans declined by $223 million in Q3 2025, primarily in C&I, but the company anticipates strong originations in Q4, expecting to end the year approximately flat to year-end 2024.

- The company repurchased approximately 965,000 shares for $24 million during the quarter, with $26 million remaining under the approved 2025 stock repurchase plan authorization.

- Credit metrics remained strong, with quarter-to-date net charge-offs at $4.2 million or 12 basis points of total loans and leases, and non-performing assets (NPAs) at 26 basis points at quarter-end.

- First Hawaiian Inc. reported increased net income in Q3 2025, with net interest income rising to $169.3 million and net interest margin (NIM) expanding by eight basis points to 3.19%.

- Total deposits grew by approximately $500 million in Q3 2025, driven by commercial and public operating accounts, while loans declined by $223 million primarily due to reduced dealer flooring balances and corporate line of credit paydowns. The company anticipates loan balances to be flat to year-end 2024 by the end of 2025.

- The company repurchased approximately 965,000 shares for $24 million during the quarter, with $26 million remaining under the 2025 stock repurchase plan.

- Credit quality remained strong, with Q3 2025 net charge-offs at $4.2 million (12 basis points of total loans and leases), despite a $30.1 million increase in classified assets attributed to a single customer.

- Management expects positive NIM momentum in Q4 2025, projecting the margin to advance a few basis points from the September run rate of 3.16%, and anticipates full-year expenses to be below $506 million.

Quarterly earnings call transcripts for FIRST HAWAIIAN.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more