Earnings summaries and quarterly performance for FLOWSERVE.

Executive leadership at FLOWSERVE.

Scott Rowe

Chief Executive Officer

Alice DeBiasio

President, Flow Control Division

Amy Schwetz

Chief Financial Officer

Brian Boukalik

Chief Human Resources Officer

Lamar Duhon

President, Flowserve Pumps Division

Scott Vopni

Chief Accounting Officer

Susan Hudson

Chief Legal Officer and Corporate Secretary

Board of directors at FLOWSERVE.

Research analysts who have asked questions during FLOWSERVE earnings calls.

Deane Dray

RBC Capital Markets

10 questions for FLS

Joseph Giordano

TD Cowen

10 questions for FLS

Damian Karas

UBS

6 questions for FLS

Michael Halloran

Baird

6 questions for FLS

Nathan Jones

Stifel, Nicolaus & Company, Incorporated

6 questions for FLS

Andrew Kaplowitz

Citigroup

5 questions for FLS

Brett Linzey

Mizuho Securities

5 questions for FLS

Andrew Obin

Bank of America

4 questions for FLS

Mike Halloran

Robert W. Baird & Co. Incorporated

4 questions for FLS

Saree Boroditsky

Jefferies

4 questions for FLS

Amit Mehrotra

UBS

2 questions for FLS

Andres

Stifel

2 questions for FLS

Andy Kaplowitz

Citigroup Inc.

2 questions for FLS

Jose Solca

Citi

2 questions for FLS

Nathan Jones

Stifel

2 questions for FLS

Eric Look

Mizuho Financial Group, Inc.

1 question for FLS

Joseph Ritchie

Goldman Sachs

1 question for FLS

Recent press releases and 8-K filings for FLS.

- Flowserve achieved 500 basis points of margin improvement over the last three years, surpassing its 2027 target framework.

- The company set new 2030 targets, aiming for mid-single-digit organic sales growth, 20% operating income, and double-digit adjusted EPS growth, with annual margin expansion of approximately 100 basis points.

- Strategic programs like the 80/20 initiative, which became fully operational across all product business units in 2025, are driving margin expansion but also contributed to a 100 basis point revenue headwind in the second half of 2025 and are anticipated to have a similar impact in the first half of 2026.

- In 2025, Flowserve booked $400 million in nuclear business, predominantly from life extensions, and the recent acquisition of Trillium's valve division is projected to increase the company's content on new nuclear reactors by 15%-20%.

- Flowserve has set new 2030 targets, aiming for mid-single-digit organic sales growth, 100 basis points of annual operating income expansion to reach 20% operating income, and double-digit adjusted EPS growth.

- The company achieved 500 basis points of margin improvement over the last three years, driven by operational excellence and the 80/20 program, which was fully implemented across all product business units in 2025.

- The 80/20 program is causing a revenue headwind of approximately 100 basis points in the first half of 2026, leading to roughly flat revenue compared to 2025 for that period, while the aftermarket business is expected to grow at mid- to high-single digits.

- Flowserve's "3D Strategy" has reduced oil and gas exposure to just over 30%. The company booked $400 million in nuclear orders in 2025 and anticipates a $10 billion opportunity over 10 years in the nuclear sector, with the Trillium acquisition increasing content per new reactor by 15-20%.

- Flowserve announced new 2030 financial targets, including mid-single-digit organic sales growth, 100 basis points of operating income expansion per year to reach 20% operating income, and double-digit Adjusted EPS growth.

- The company's 80/20 program, launched in 2024, has driven significant margin improvement but is causing a 100 basis points revenue headwind in the first half of 2026, leading to flat to slightly down revenue in Q1 2026.

- Flowserve's "3D Strategy" (diversify, decarbonize, digitize) has reduced energy (formerly oil and gas) exposure from over 40% to just over 30%, with a target of 25%-30%. The acquisition of Trillium's valve division is expected to increase content on a new nuclear reactor by 15%-20%, bringing total content to $115-$120 million per reactor.

- The aftermarket business is growing at mid- to high-single digits, providing stable growth, and the RedRaven IoT offering has become a profit center in 2026 with 2,500 installations.

- Flowserve delivered outstanding financial performance in 2025, achieving its long-term margin targets two years ahead of plan, with 300 basis points of adjusted operating margin expansion and 38% adjusted EPS growth. The company also returned $365 million to shareholders through dividends and share repurchases.

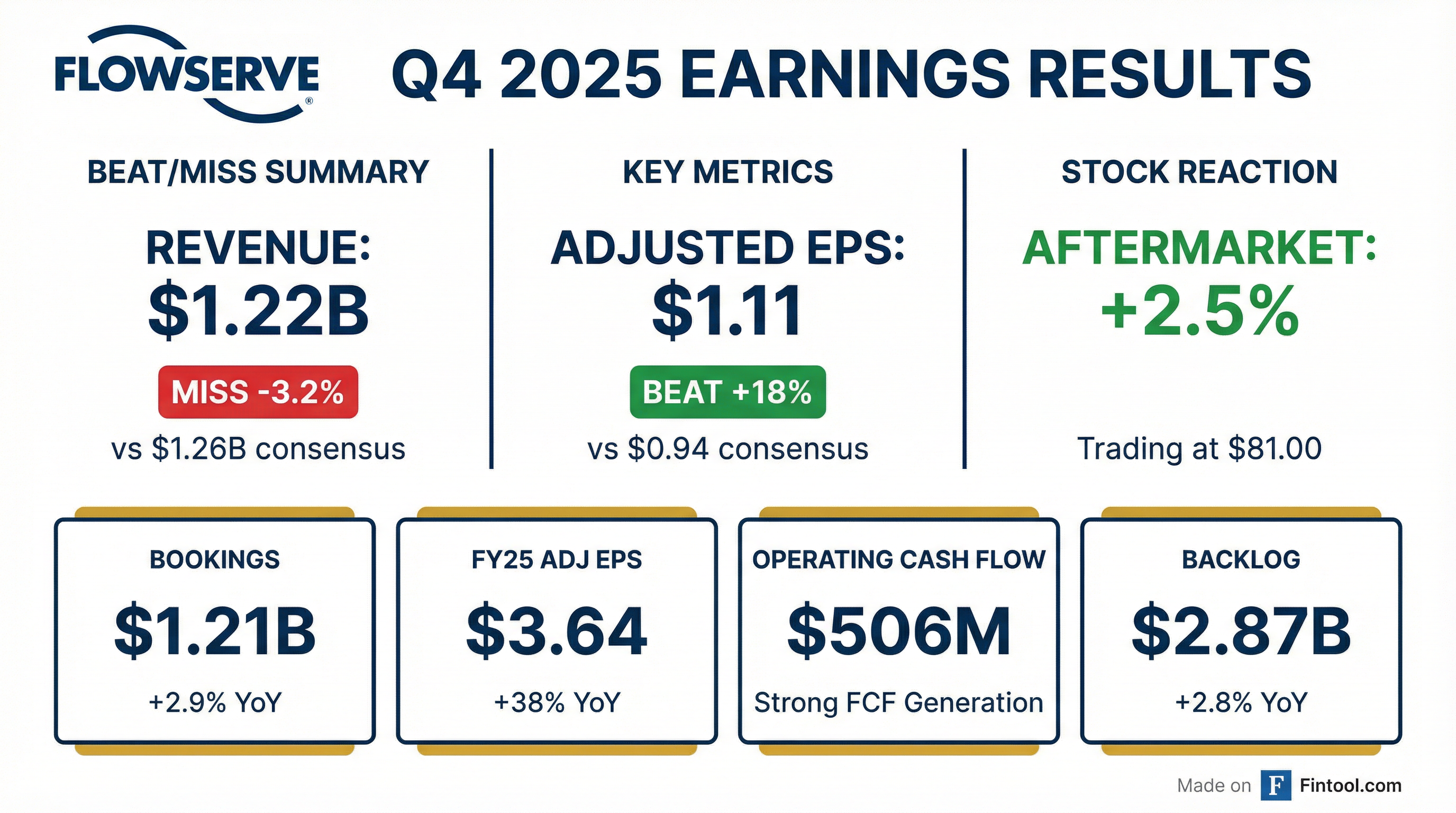

- For Q4 2025, bookings were $1.2 billion, a 3% increase versus the prior year period, driven by 10% growth in aftermarket bookings to $682 million. Additionally, Flowserve signed a definitive agreement to acquire the valve and actuation business from Trillium Flow Technologies.

- For 2026, Flowserve expects total reported sales growth of 5%-7% and adjusted EPS of $4-$4.20, representing a 13% midpoint increase over 2025, with approximately 100 basis points of adjusted operating margin expansion.

- The company established new 2030 long-term financial targets, aiming for a mid-single digit organic sales CAGR, 20% adjusted operating margins, and a double-digit adjusted EPS CAGR from 2025.

- Flowserve reported strong Q4 2025 results, with total revenues growing 4% year-over-year to $1.2 billion and adjusted EPS increasing 59% to $1.11. The adjusted operating margin expanded 420 basis points to 16.8%, surpassing the 2027 long-term target.

- For 2026, the company anticipates total reported sales growth of 5%-7% and adjusted EPS between $4.00-$4.20, representing a 13% midpoint increase from 2025. Adjusted operating margin is expected to expand by approximately 100 basis points.

- Flowserve has signed a definitive agreement to acquire the Trillium Valves business, which is expected to contribute to reported sales growth and strengthen its position in the nuclear and traditional power markets. Organic bookings are projected to grow mid-single digits in 2026, driven by aftermarket momentum and growth in the power and general industries markets.

- Flowserve reported $506 million in operating cash flow for full year 2025, a 19% increase versus 2024, and achieved 300 basis points of expansion in adjusted operating margins, reaching its 2027 margin targets two years ahead of schedule. The company also delivered 38% adjusted EPS growth in 2025.

- For 2026, Flowserve expects total reported sales growth of 5%-7% (with 1%-3% organic sales growth), approximately 100 basis points of adjusted operating margin expansion, and adjusted earnings per share of $4-$4.20, representing a 13% midpoint increase over 2025. Bookings are projected to grow mid-single digits.

- The company signed a definitive agreement to acquire the valve and actuation business from Trillium Flow Technologies, aiming to strengthen its valve and actuation portfolio and expand its global reach in attractive end-markets like nuclear. Flowserve also established new 2030 long-term financial targets, including a mid-single digit organic sales CAGR and 20% adjusted operating margins by 2030, alongside a double-digit adjusted EPS CAGR from 2025.

- Flowserve provided Q4 2025 guidance with Adjusted EPS of $2.25 - $2.35, Adjusted Revenue Growth of 4% - 6%, Adjusted Operating Margin Expansion of +100 - +150 bps, and Free Cash Flow Conversion of ~100%. This guidance is based on key assumptions including bookings growth of 4% - 6% and continued strong aftermarket demand.

- For the full year 2024, Flowserve reported Adjusted Diluted EPS of $2.63.

- In FY 2025, the Flowserve Pumps Division achieved Adjusted Operating Income of $636,589 thousand, and the Flow Control Division reported Adjusted Operating Income of $228,747 thousand.

- For Q4 2025, the Flowserve Pumps Division's Adjusted Operating Income was $174,754 thousand, and the Flow Control Division's Adjusted Operating Income was $77,240 thousand.

- The FY 2025 bookings mix for the Pumps Division was 69% Aftermarket (AM) and 31% Original Equipment (OE), while the Flow Control Division's mix was 27% AM and 73% OE.

- Flowserve reported strong Q4 2025 adjusted operating margin of 16.8% and adjusted EPS of $1.11, contributing to full-year 2025 adjusted EPS of $3.64 and $506 million in cash from operations.

- The company initiated full-year 2026 guidance, forecasting total sales growth of 5% to 7% and adjusted EPS between $4.00 and $4.20.

- Flowserve signed a definitive agreement to acquire Trillium Flow Technologies’ Valves Division (TVD) for $490 million in cash, a transaction expected to close mid-year 2026 and be accretive to adjusted operating income in 2026. TVD had annualized revenues of approximately $200 million in 2025.

- The company also established 2030 financial targets, aiming for a mid-single digit organic sales CAGR, approximately 20% adjusted operating margin, and double-digit adjusted EPS CAGR.

- Flowserve Corporation reported strong fourth quarter 2025 adjusted EPS of $1.11 and full year 2025 adjusted EPS of $3.64, with full year bookings reaching $4.7 billion and cash from operations at $506 million.

- The company initiated full year 2026 guidance, forecasting total sales growth of 5% to 7% and adjusted EPS of $4.00 to $4.20.

- Flowserve announced a definitive agreement to acquire Trillium Flow Technologies’ Valves Division.

- New 2030 financial targets were established, including a mid-single digit organic sales CAGR, approximately 20% adjusted operating margin, and double-digit adjusted EPS CAGR.

- Flowserve Corporation has signed a definitive agreement to acquire Trillium Flow Technologies’ Valves Division (TVD) for $490 million in cash.

- The transaction is expected to close mid-year 2026 and is anticipated to be accretive to adjusted operating income in 2026, excluding anticipated synergies.

- TVD is projected to have annualized revenues of approximately $200 million with adjusted EBITDA margins in the high teens, and the purchase price represents approximately 12.3x TVD’s 2025 adjusted EBITDA.

- This acquisition is intended to accelerate Flowserve's power end-market growth strategy, strengthen its valve and actuation product portfolio, and enhance service capabilities, particularly in nuclear and traditional power generation.

Fintool News

In-depth analysis and coverage of FLOWSERVE.

Quarterly earnings call transcripts for FLOWSERVE.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more