Earnings summaries and quarterly performance for FIRST MERCHANTS.

Executive leadership at FIRST MERCHANTS.

Mark Hardwick

Chief Executive Officer

Chad Kimball

Chief Risk Officer

John Martin

Chief Credit Officer

Joseph Peterson

Chief Commercial Officer

Michael Stewart

President

Michele Kawiecki

Chief Financial Officer

Stephan Fluhler

Chief Information Officer

Steven Harris

Chief Human Resources Officer

Board of directors at FIRST MERCHANTS.

Clark Kellogg

Director

Gary Lehman

Director

Howard Halderman

Director

Jason Sondhi

Director

Jean Wojtowicz

Chair of the Board

Kevin Johnson

Director

Michael Becher

Director

Michael Fisher

Director

Michael Rechin

Vice Chair of the Board

Mung Chiang

Director

Patrick Fehring

Director

Susan Brooks

Director

Research analysts who have asked questions during FIRST MERCHANTS earnings calls.

Damon Del Monte

Keefe, Bruyette & Woods

8 questions for FRME

Daniel Tamayo

Raymond James Financial, Inc.

8 questions for FRME

Nathan Race

Piper Sandler & Co.

8 questions for FRME

Brian Martin

Janney Montgomery Scott

7 questions for FRME

Brendan Nosal

Hovde Group, LLC

5 questions for FRME

Terry McEvoy

Stephens Inc.

4 questions for FRME

Terence McEvoy

Stephens Inc.

3 questions for FRME

Brandon Nussbaum

Hobby Group

1 question for FRME

Recent press releases and 8-K filings for FRME.

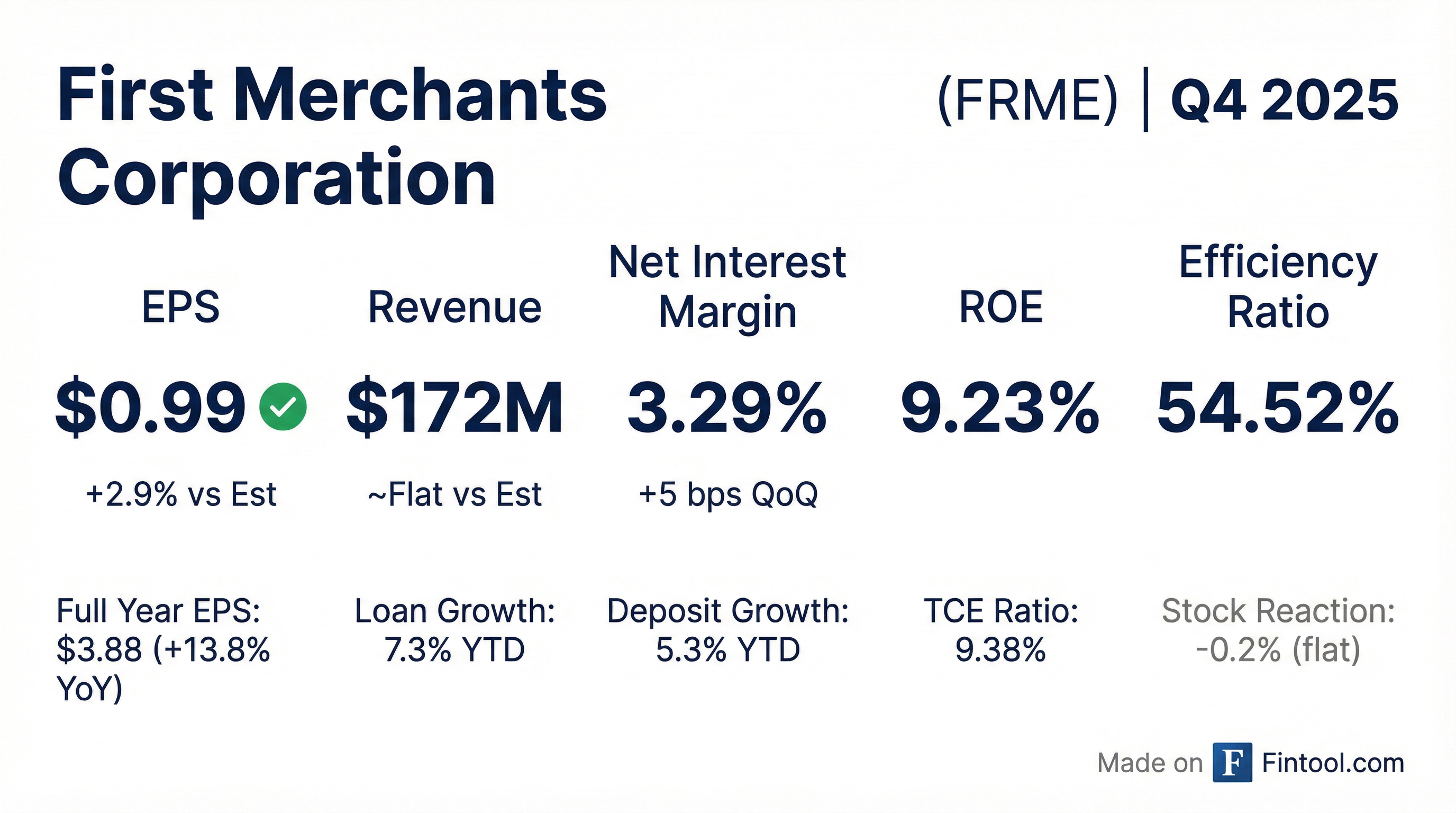

- First Merchants Corporation reported Net Income Available to Common Stockholders of $56.6 million and diluted earnings per share of $0.99 for Q4 2025. For the full year 2025, Net Income Available to Common Stockholders reached $224.1 million with diluted EPS of $3.88, marking 13.8% EPS growth over the prior year.

- The company achieved significant loan growth, with total loans increasing by $938.8 million, or 7.3%, for the full year 2025, reaching $13.8 billion.

- First Merchants maintained a strong capital position with a Tangible Common Equity Ratio of 9.38% and a Total Risk-Based Capital Ratio of 13.41% as of December 31, 2025. The efficiency ratio was 54.52% for Q4 2025 and 54.54% for the full year.

- The company repurchased 271,953 shares totaling $10.4 million in Q4 2025 and received regulatory approval for the acquisition of First Savings Financial Group, Inc., expected to close on February 1, 2026, adding approximately $2.4 billion in assets.

- First Merchants Corporation achieved record net income of $224.1 million and record diluted earnings per share of $3.88 for the full year 2025, representing a 13.8% increase from the prior year.

- The company concluded 2025 with record total assets of $19 billion, record total loans of $13.8 billion, and record total deposits of $15.3 billion.

- All regulatory and shareholder approvals have been secured for the acquisition of First Savings Group, which adds approximately $2.4 billion of assets and is set to close on February 1st, 2026. The company plans to sell the entire First Savings bond portfolio, valued at about $250 million, upon closing.

- For 2026, First Merchants anticipates mid-single-digit loan growth (6-8%) , double-digit non-interest income growth (10%) on a standalone basis , and a core non-interest expense increase of 3-5% , with the efficiency ratio projected to remain under 55%.

- The company repurchased 1.2 million shares for $46.9 million in 2025 and plans to continue aggressive share buybacks in 2026, viewing it as the best short-term strategy given current valuation.

- First Merchants Corporation achieved record total assets of $19 billion, record total loans of $13.8 billion, and record total deposits of $15.3 billion in Q4 2025. For the full year 2025, the company delivered record net income of $224.1 million and record diluted earnings per share of $3.88.

- The company received all regulatory and shareholder approvals for the acquisition of First Savings Group, which adds approximately $2.4 billion of assets and is scheduled to close on February 1st, 2026. Integration is planned for May, with 27.5% annualized cost savings expected to be fully realized in the second half of 2026.

- For 2026, First Merchants expects mid-single-digit loan growth and double-digit non-interest income growth. Core non-interest expense is budgeted to increase 3%-5% year-over-year, and the efficiency ratio is projected to remain below 55%.

- In Q4 2025, the company repurchased 272,000 shares for $10.4 million, bringing total share repurchases for 2025 to over 1.2 million shares for $46.9 million. Management intends to be aggressive with buybacks if the stock price remains at current levels.

- First Merchants Corporation reported record full-year 2025 results, with net income of $224.1 million and diluted earnings per share of $3.88, an increase of 13.8% year-over-year. The company ended the year with record total assets of $19 billion, record total loans of $13.8 billion, and record total deposits of $15.3 billion. For Q4 2025, net income totaled $56.6 million or $0.99 per share.

- The acquisition of First Savings Group, which adds approximately $2.4 billion of assets and expands presence into Southern Indiana and the Louisville MSA, received all necessary approvals and is scheduled to close on February 1st, 2026. The company achieved robust loan growth of 5.8% annualized linked-quarter and 7.3% for the full year , alongside strong Q4 deposit growth of 11.4% annualized.

- In Q4 2025, the company repurchased 272,000 shares for $10.4 million, with total 2025 repurchases exceeding 1.2 million shares for $46.9 million. For 2026, management projects mid-single to high single-digit loan growth and double-digit non-interest income growth , with the efficiency ratio expected to remain below 55% post-integration.

- First Merchants Corporation achieved record full-year results for 2025, reporting net income available to common stockholders of $224.1 million and diluted EPS of $3.88.

- For the fourth quarter of 2025, diluted earnings per common share totaled $0.99, with net income available to common stockholders at $56.6 million.

- The company demonstrated significant growth, with total loans increasing by $938.8 million (7.3%) and total deposits rising by $773.2 million (5.3%) during 2025.

- First Merchants maintained a robust capital position, evidenced by a Common Equity Tier 1 Capital Ratio of 11.70% and a Tangible Common Equity to Tangible Assets Ratio of 9.38%. The company also repurchased 1,211,224 shares totaling $46.9 million year-to-date in 2025.

- Regulatory approval was secured for the acquisition of First Savings Financial Group, Inc., which is anticipated to add approximately $2.4 billion in assets and is expected to close on February 1, 2026.

- First Merchants Corporation achieved record full-year 2025 net income available to common stockholders of $224.1 million and diluted EPS of $3.88.

- For the fourth quarter of 2025, diluted earnings per common share totaled $0.99 (GAAP) and $0.98 (adjusted), compared to $1.10 (GAAP) and $1.00 (adjusted) in the fourth quarter of 2024.

- The Corporation reported a robust capital position as of December 31, 2025, with a Common Equity Tier 1 Capital Ratio of 11.70% and a Tangible Common Equity to Tangible Assets Ratio of 9.38%.

- Total loans grew by $938.8 million, or 7.3%, and total deposits increased by $773.2 million, or 5.3%, during the last twelve months ending December 31, 2025.

- The company repurchased 1,211,224 shares totaling $46.9 million year-to-date and received regulatory approval for the acquisition of First Savings Financial Group, Inc., with closing expected on February 1, 2026.

- First Merchants Corporation reported Q3 2025 earnings per share of $0.98 and a year-to-date return on assets of 1.22%.

- The company achieved 9% year-to-date loan growth, including $268 million in commercial loan growth (10% annualized) during Q3 2025.

- On September 25, First Merchants announced the acquisition of First Savings Financial Group, which will add approximately $2.4 billion in assets and expand its presence into Southern Indiana.

- The tangible common equity ratio increased to 9.18% in Q3 2025, and the company repurchased $6.5 million in shares during the quarter.

- Management anticipates Q4 2025 core expenses to be consistent with Q3 and projects a 2 basis point margin decline for each 25 basis point rate cut.

- First Merchants (FRME) reported $0.98 earnings per share for Q3 2025, with a year-to-date return on assets of 1.22% and a core efficiency ratio of 54.56%. The company achieved 9% loan growth for the quarter, with total loan balances increasing by $289 million or 8.7% annualized.

- The company announced the acquisition of First Savings Financial Group on September 25, which is expected to add approximately $2.4 billion in assets and expand its presence into Southern Indiana. This acquisition is anticipated to close mid-first quarter 2026.

- The tangible common equity ratio increased to 9.18%, and the common equity tier one ratio stood at 11.34%. Asset quality remained solid, with non-performing loans declining from $72 million to $68.9 million, and a robust reserve coverage ratio of 1.43%. The company repurchased 162,474 shares totaling $6.5 million in Q3 2025.

- The net interest margin was stable at 3.24% in Q3 2025, though the total cost of deposits increased 14 basis points to 2.44%. Management anticipates a few basis points of margin compression in Q4 2025 if expected rate cuts occur, with each 25 basis point cut potentially leading to about two basis points of margin decline.

- First Merchants Corporation reported net income available to common stockholders of $56.3 million and diluted earnings per common share of $0.98 for the third quarter of 2025.

- The company announced the acquisition of First Savings Financial Group, Inc. on September 25, 2025, in an all-stock transaction valued at approximately $241.3 million, which will add approximately $2.4 billion in assets.

- The Corporation maintained a robust capital position with a Common Equity Tier 1 Capital Ratio of 11.34% and a Tangible Common Equity to Tangible Assets Ratio of 9.18% in Q3 2025.

- Total loans grew $288.8 million, or 8.7% annualized, and total deposits increased $72.4 million, or 2.0% annualized, on a linked quarter basis.

- First Merchants repurchased 939,271 shares totaling $36.5 million year-to-date, including 162,474 shares totaling $6.5 million repurchased during the third quarter of 2025.

- Creative Realities, Inc. (CRI) has entered into a share purchase agreement to acquire Cineplex Digital Media (CDM) for CAD 70 million in cash, with the acquisition expected to close in October 2025.

- CDM reported sales of just under CAD $56 million in 2024 and is projected to grow by 25% in 2025, with over 60% of its revenue being recurring.

- CRI will finance the acquisition through a combination of debt and preferred equity, including a $36 million senior term loan and $30 million of convertible preferred equity.

- The acquisition is anticipated to double CRI's size, provide at least $10 million in annualized cost synergies by the end of 2026, and is expected to be accretive to earnings almost immediately.

- On a pro-forma adjusted basis, CRI's 2026 revenue is projected to exceed USD $100 million, with Adjusted EBITDA margins in the high teens, eventually exceeding 20% once all synergies are realized.

Quarterly earnings call transcripts for FIRST MERCHANTS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more