Earnings summaries and quarterly performance for GCM Grosvenor.

Executive leadership at GCM Grosvenor.

Board of directors at GCM Grosvenor.

Research analysts who have asked questions during GCM Grosvenor earnings calls.

Crispin Love

Piper Sandler

6 questions for GCMG

William Katz

TD Cowen

5 questions for GCMG

Kenneth Worthington

JPMorgan Chase & Co.

4 questions for GCMG

Christoph Kotowski

Oppenheimer & Co. Inc.

2 questions for GCMG

Jeff Smith

William Blair

2 questions for GCMG

Ken Worthington

JPMorgan

2 questions for GCMG

Bill Katz

TD Securities

1 question for GCMG

Jeff Schmitt

William Blair & Company, L.L.C.

1 question for GCMG

Stephanie Ma

Morgan Stanley

1 question for GCMG

Tyler Mulier

William Blair & Company

1 question for GCMG

Recent press releases and 8-K filings for GCMG.

- GCM Grosvenor reported strong results for the fourth quarter and full year 2025, including record fundraising of $10.5 billion and a larger pipeline for 2026.

- The individual investor wealth channel is a major strategic priority, currently comprising 5% of capital, with significant growth opportunities through new products and distribution efforts.

- The company emphasizes a diversified portfolio and identifies infrastructure and private credit as its fastest-growing strategies with durable growth prospects.

- GCMG has excess capacity for capital deployment and anticipates continued operating margin expansion, while its unrealized carried interest balance represents a significant asset (approximately 20% of total enterprise value at year-end 2025).

- GCM Grosvenor (GCMG) manages $91 billion in AUM, with over 70% of client relationships in customized separate accounts, which have a 90% re-up rate.

- The company achieved record fundraising of $10.5 billion in 2025 across all investment verticals, and its pipeline for 2026 is larger than the previous year.

- GCMG is on track to meet its long-term goals for FRE growth and Adjusted Net Income by 2028, with expectations for continued margin expansion and excess capacity to deploy more capital.

- A major strategic priority is the wealth channel, currently representing 5% of capital, with new product launches including an infrastructure interval fund and a planned private equity product.

- The firm's unrealized carried interest (Carry at NAV) is a significant asset, valued at approximately $478 million as of December 31, representing roughly 20% of total enterprise value, with expectations for future growth.

- GCM Grosvenor reported record fundraising of $10.5 billion in 2025 and expects continued strong performance with a larger pipeline for 2026 than the previous year.

- The company's business model is primarily based on over 70% customized separate accounts, which contributes to a 90% client re-up rate and stable, long-term relationships.

- The wealth channel business is a major strategic priority, currently representing only 5% of capital but offering significant growth opportunities through new product launches and partnerships.

- The unrealized carried interest balance stood at $478 million as of December 31, 2025, and is anticipated to have a good first quarter in 2026.

- Infrastructure has been the fastest-growing strategy for several years and is expected to continue its high growth rates.

- GCM Grosvenor reported record fundraising of $10.5 billion for the year and $3.5 billion for the quarter, driven by strong performance fees from its Absolute Return Strategies (ARS) business for the full year, which were realized in Q4.

- The firm's fee-related earnings (FRE) margin increased by a couple of hundred basis points, and it is tracking well towards its goals of doubling FRE from 2023 to 2028 and achieving $1.20 adjusted net income per share for 2028.

- Strategic growth initiatives include a strong focus on the wealth channel, with new distribution partnerships like Grove Lane Partners and the launch of new funds, and the insurance channel, which contributed over 10% of capital raised last year.

- GCM Grosvenor manages $87 billion of AUM and identifies infrastructure and private credit as its two fastest-growing verticals.

- GCM Grosvenor reported record fundraising of $10.5 billion for the year and $3.5 billion for the quarter, leading to a 14% stock increase on the day of the announcement.

- The firm achieved a couple of hundred basis points increase in its fee-related earnings (FRE) margin and saw a significant jump in unrealized carry at net asset value.

- Strategic priorities for growth include the wealth channel, which is seeing new distribution partnerships and fund launches, and continued expansion in infrastructure and private credit.

- GCM Grosvenor is tracking well towards its 2028 goals of doubling FRE from 2023 levels and achieving $1.20 adjusted net income per share.

- GCM Grosvenor announced record fundraising of $10.5 billion for the year and $3.5 billion for the fourth quarter, with a pipeline that is bigger than a year ago, indicating optimism for 2026.

- The firm demonstrated operating leverage with a couple of hundred basis points increase in fee-related earnings (FRE) margin and is tracking well towards its 2028 goals of doubling FRE and achieving $1.20 adjusted net income per share.

- Key strategic growth areas include the wealth channel, which saw unique developments and significant fundraising contributions, and the insurance channel, which accounted for over 10% of capital raised last year.

- GCM Grosvenor maintains a low SaaS exposure of approximately 4% of AUM and holds a significant near $900 million in carry at net asset value (NAV), representing about 20% of its total enterprise value.

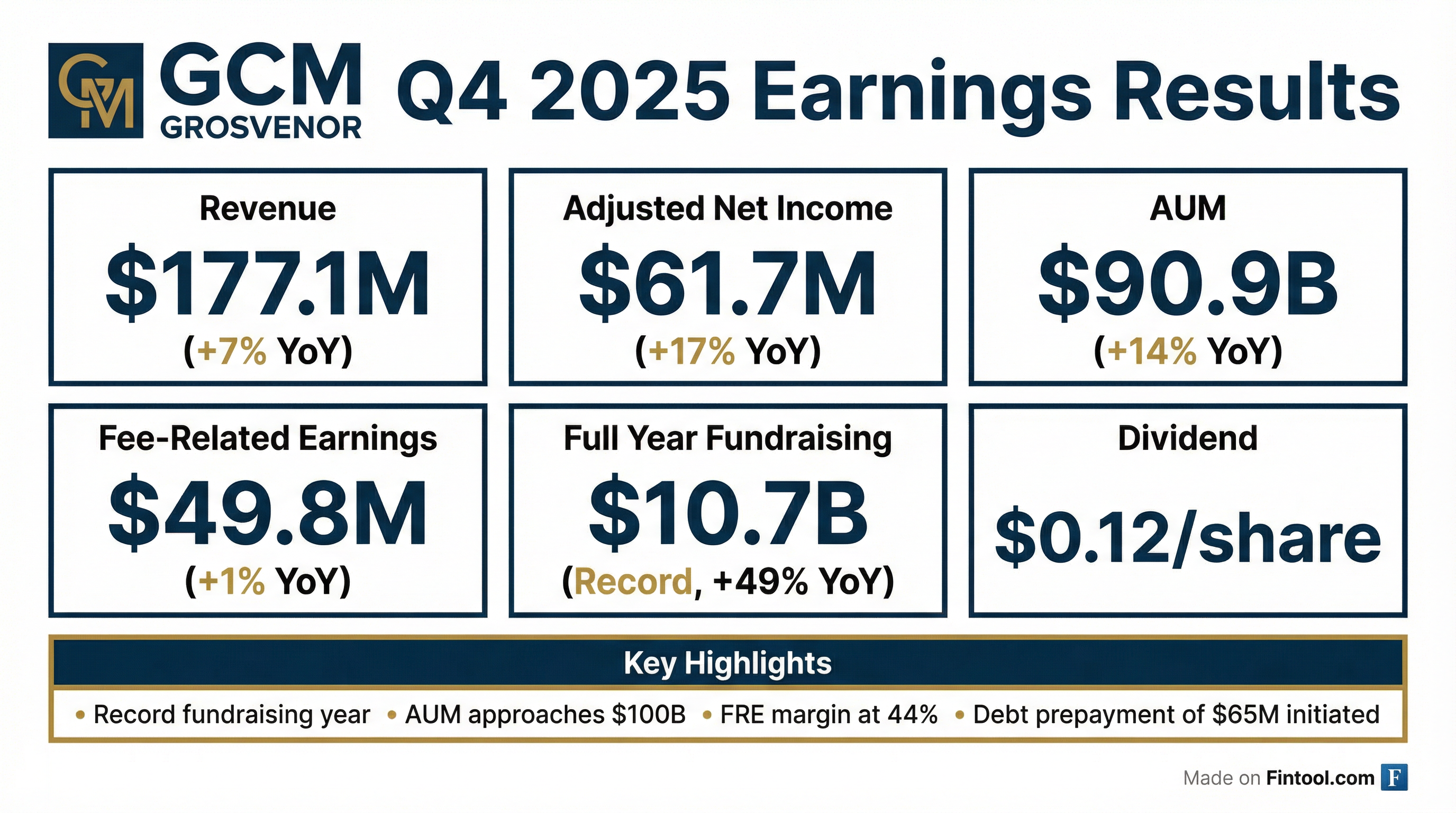

- GCM Grosvenor reported strong financial results for 2025, with Fee-Related Earnings up 11%, Adjusted EBITDA up 15%, and Adjusted Net Income up 18% compared to 2024, achieving a 44% Fee-Related Earnings margin.

- The company achieved record fundraising in 2025, raising $10.7 billion in total capital, with $3.5 billion in the fourth quarter, and ended the year with a record $91 billion in Assets Under Management (AUM), a 14% increase year-over-year.

- The firm's gross unrealized carried interest balance reached an all-time high of $949 million, with approximately $478 million belonging to the firm, representing a 14% increase from the end of 2024.

- GCM Grosvenor announced an additional $35 million for share buybacks, bringing the total authorization to $91 million, and is repaying $65 million of its term loan. For Q1 2026, the company expects ARS management fees to increase by approximately 5% from Q4 2025.

- GCM Grosvenor reported strong financial results for full year 2025, with GAAP Net Income attributable to GCM Grosvenor Inc. increasing 143% to $45.4 million and Diluted EPS rising 1300% to $0.42. The company's Assets Under Management (AUM) grew 14% to $90.9 billion, and Fee-Paying AUM (FPAUM) increased 12% to $72.5 billion as of December 31, 2025.

- The firm achieved record fundraising of $10.7 billion in full year 2025, representing a 49% increase compared to the prior year.

- GCM Grosvenor returned capital to shareholders through $56.3 million in share repurchases during 2025 and approved an incremental $35.0 million share repurchase authorization in February 2026. Additionally, the Board approved a $0.12 per share dividend payable in March 2026 and initiated prepayment of $65.0 million of outstanding debt in February 2026.

- GCM Grosvenor reported strong financial results for 2025, with Fee-Related Earnings (FRE) up 11%, Adjusted EBITDA up 15%, and Adjusted Net Income up 18% compared to 2024, achieving a 44% FRE margin.

- The company ended 2025 with a record $91 billion in Assets Under Management (AUM), a 14% increase year-over-year, driven by a record $10.7 billion in capital raised, including $3.5 billion in Q4 2025.

- For Q1 2026, private markets management fees are expected to be consistent with Q4 2025, while Absolute Return Strategies (ARS) management fees are projected to increase by approximately 5% from Q4 2025.

- The board approved an additional $35 million for share buybacks, bringing the total authorization to $91 million, and the company is prepaying $65 million of its term loan to reduce leverage.

- GCM Grosvenor reported strong financial results for 2025, with Fee-Related Earnings up 11%, Adjusted EBITDA up 15%, and Adjusted Net Income up 18% compared to 2024, achieving a 44% Fee-Related Earnings margin.

- The firm ended 2025 with a record $91 billion in Assets Under Management (AUM), a 14% increase year-over-year, and achieved a record fundraising year by raising $10.7 billion in total capital.

- The company increased its share buyback authorization by $35 million, bringing the total available for repurchases to $91 million, and is prepaying $65 million of its term loan.

- GCM Grosvenor remains on track to achieve its 2028 targets of over $280 million in Fee-Related Earnings and more than $1.20 in adjusted net income per share.

Quarterly earnings call transcripts for GCM Grosvenor.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more