Earnings summaries and quarterly performance for GRIFFON.

Executive leadership at GRIFFON.

Board of directors at GRIFFON.

Cheryl L. Turnbull

Director

H. C. Charles Diao

Director

Henry A. Alpert

Director

James W. Sight

Director

Jerome L. Coben

Lead Independent Director

Kevin F. Sullivan

Director

Lacy M. Johnson

Director

Louis J. Grabowsky

Director

Michelle L. Taylor

Director

Samanta Hegedus Stewart

Director

Research analysts who have asked questions during GRIFFON earnings calls.

Sam Darkatsh

Raymond James & Associates, Inc.

6 questions for GFF

Trey Grooms

Stephens Inc.

6 questions for GFF

Collin Verron

Deutsche Bank

5 questions for GFF

Julio Romero

Sidoti & Company, LLC

5 questions for GFF

Lee Jagoda

CJS Securities

5 questions for GFF

Tim Wojs

Robert W. Baird & Co. Incorporated

4 questions for GFF

Bob Laback

CJS Securities, Inc.

2 questions for GFF

Jeff Stevenson

Loop Capital Markets

2 questions for GFF

Julio Romero

Sidoti & Company

2 questions for GFF

Robert Schultz

Baird

2 questions for GFF

Bob Labick

CJS Securities

1 question for GFF

Jeffrey Stevenson

Loop Capital Markets LLC

1 question for GFF

Joshua Wilson

Raymond James Financial, Inc.

1 question for GFF

Timothy Wojs

Robert W. Baird & Co.

1 question for GFF

Recent press releases and 8-K filings for GFF.

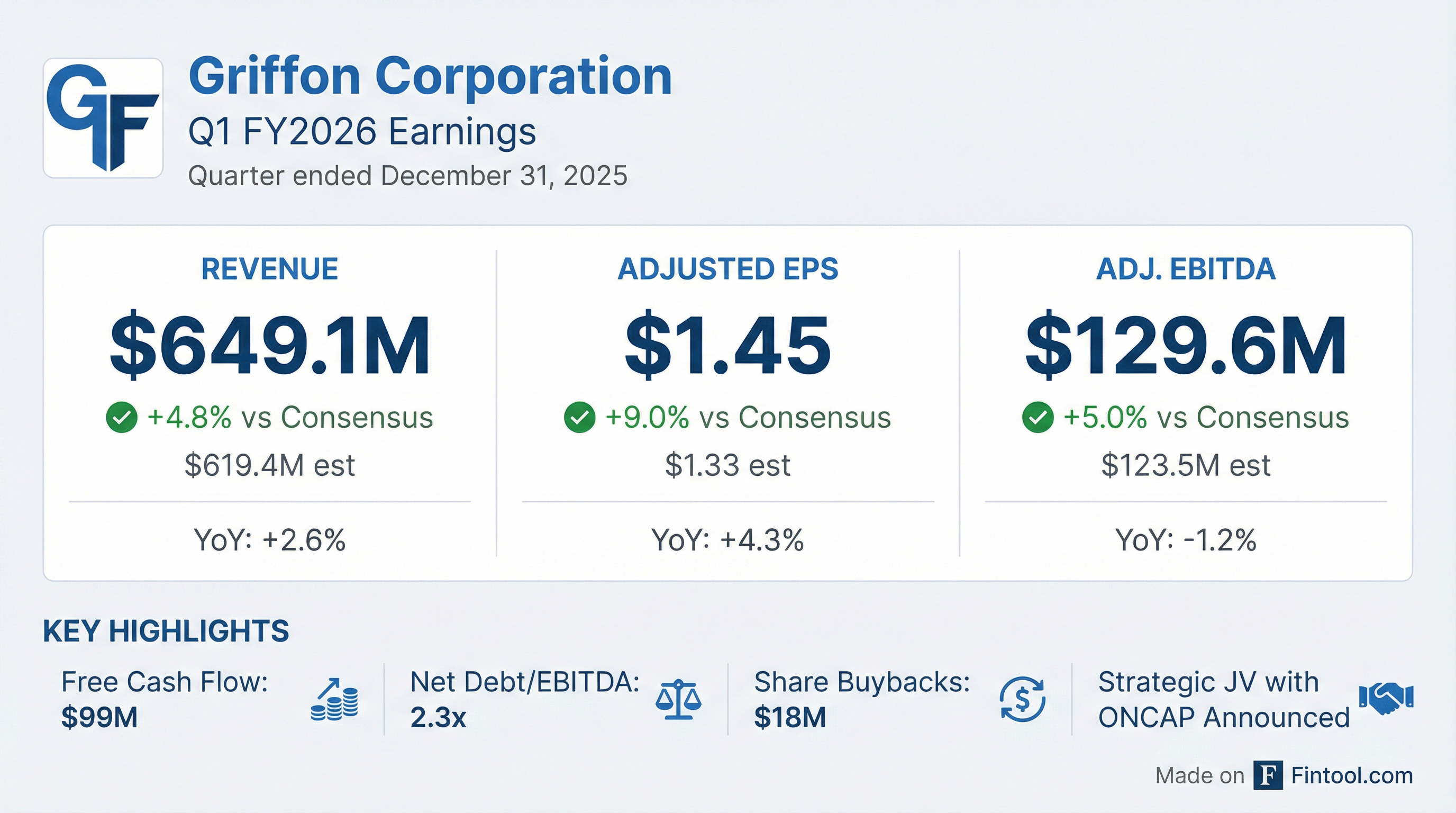

- Griffon Corporation reported Q1 2026 revenue of $649 million, a 3% increase compared to the prior year quarter, with adjusted EBITDA of $145 million and adjusted net income of $66 million or $1.45 per share.

- The company announced a joint venture with ONCAP, combining Griffon's Ames North America with ONCAP's global hand tool businesses, for which Griffon will receive $100 million in cash and $160 million in second lien debt from the JV, retaining a 43% ownership stake. This, along with other strategic actions, will transform Griffon into a pure-play building products company.

- For its continuing operations, Griffon updated its fiscal year 2026 outlook, expecting $1.8 billion in revenue and $520 million in adjusted EBITDA.

- In Q1 2026, Griffon repurchased $18 million of its stock and authorized a regular quarterly dividend of $0.22 per share. As of December 31, 2025, net debt was $1.26 billion, with a net debt to EBITDA leverage of 2.3 times.

- Griffon reported Q1 2026 revenue of $649 million, a 3% increase year-over-year, with Adjusted EBITDA of $145 million and $99 million in free cash flow.

- The company formed a joint venture with ONCAP for its AMES North America business, receiving $100 million in cash and $160 million in second lien debt while retaining a 43% ownership stake.

- Griffon will review strategic alternatives for AMES Australia and U.K., and integrate Hunter Fan (which generated $211 million in revenue in FY 2025) into its Home and Building Products segment.

- Starting Q2 2026, AMES North America, Australia, and U.K. will be reported as discontinued operations, with an expected FY 2026 EBITDA of $60 million for these businesses.

- For continuing operations, Griffon updated its FY 2026 guidance to $1.8 billion in revenue and $520 million in Adjusted EBITDA. The company also repurchased $18 million of stock and authorized a $0.22 per share quarterly dividend.

- For the trailing twelve months (TTM) ended December 31, 2025, Griffon reported $2.537 billion in revenue and $520.7 million in Adjusted EBITDA.

- The company's Adjusted EPS from continuing operations for the TTM ended December 31, 2025, was $5.71.

- As of December 31, 2025, Griffon's net debt was $1.269 billion, with a net debt to EBITDA leverage ratio of 2.3x.

- Griffon's capital allocation strategy includes returning capital to shareholders, with $280 million remaining for share buybacks after purchasing $578 million in shares since April 2023, and a focus on reducing leverage.

- For FY2026, the company expects its Home and Building Products (HBP) EBITDA margin to be 30+% and its Consumer and Professional Products (CPP) EBITDA margin to be ~10%.

- Griffon Corporation reported Q1 2026 revenue of $649 million, a 3% increase year-over-year, with adjusted EBITDA of $145 million and adjusted net income of $66 million or $1.45 per share. The company also generated $99 million in free cash flow.

- The company announced the formation of a joint venture for its Ames North America business with ONCAP, from which Griffon will receive $100 million in cash proceeds and $160 million in second lien debt while retaining a 43% ownership stake. This transaction, along with the combination of Hunter Fan with the Home and Building Products segment, will transform Griffon into a pure-play building products company.

- For fiscal year 2026, Griffon expects revenue from continuing operations to be $1.8 billion and adjusted EBITDA to be $520 million.

- In Q1 2026, Griffon repurchased $18 million of its stock and authorized a regular quarterly dividend of $0.22 per share. Net debt was $1.26 billion, with a net debt to EBITDA leverage of 2.3 times as of December 31, 2025.

- Griffon Corporation reported Q1 2026 revenue of $649.1 million, a 3% increase compared to the prior year quarter. Net income totaled $64.4 million, or $1.41 per diluted share, while adjusted net income was $66.3 million, or $1.45 per share.

- Adjusted EBITDA for Q1 2026 was $129.6 million, representing a 1% decrease from the prior year quarter.

- The company announced significant strategic actions, including a definitive agreement to form a joint venture for CPP's AMES U.S. and Canada businesses and the exploration of strategic alternatives for AMES Australia and UK businesses. Additionally, Hunter Fan will be combined with the HBP segment, and AMES U.S., Canada, Australia, and UK will be reported as discontinued operations starting in Q2 2026.

- As a result of these strategic actions, Griffon updated its fiscal 2026 outlook, expecting revenue from continuing operations to be $1.8 billion and Adjusted EBITDA to be $520 million.

- During the quarter ended December 31, 2025, Griffon generated free cash flow of $99.3 million and repurchased 0.2 million shares of common stock for a total of $18.1 million.

- Griffon Corporation reported Q1 fiscal 2026 revenue of $649.1 million, a 3% increase compared to the prior year quarter, with adjusted net income of $66.3 million or $1.45 per share.

- Adjusted EBITDA for Q1 fiscal 2026 was $129.6 million, a 1% decrease from the prior year quarter, and the company generated free cash flow of $99.3 million.

- The company announced strategic actions, including a joint venture with ONCAP for CPP's AMES U.S. and Canada businesses and the combination of Hunter Fan with the HBP segment; AMES U.S., Canada, Australia, and UK will be reported as discontinued operations starting in Griffon's fiscal second quarter.

- Griffon updated its fiscal year 2026 outlook, expecting revenue from continuing operations to be $1.8 billion and Adjusted EBITDA to be $520 million (excluding unallocated costs).

- Griffon Corporation is forming a joint venture with ONCAP, combining Griffon’s AMES U.S. and Canada businesses with ONCAP’s Venanpri Tools. Griffon will receive $100 million in cash proceeds and $161 million in second lien debt from the joint venture, holding a 43% equity interest.

- The company is initiating a comprehensive review of strategic alternatives for its AMES Australia and AMES United Kingdom operations. AMES Australia is expected to generate approximately $40 million of adjusted EBITDA in fiscal 2026.

- Hunter Fan Company, currently within the Consumer and Professional Products segment, will be combined with the Home and Building Products segment.

- These actions are intended to streamline Griffon into a pure-play, residential and commercial, North American building products company. As a result, AMES U.S., Canada, Australia, and UK will be reported as discontinued operations starting with Griffon's second quarter 2026 reporting.

- ONCAP and Griffon Corporation have entered into a definitive agreement to form a joint venture.

- The joint venture will combine Venanpri Group's Bellota Tools, Corona, and Burgon & Ball with Griffon’s AMES Companies businesses to create a leading global provider of hand tools, home organization solutions, and lawn and garden products.

- ONCAP affiliates will hold a 57% equity interest, and Griffon will hold a 43% equity interest in the joint venture.

- The transaction is expected to close by the end of June 2026.

- Griffon Corporation reported fourth-quarter revenues of $662.18 million, surpassing market expectations by approximately 5%, though earnings per share were $1.54, slightly missing estimates.

- The company's financial health is robust, with a current ratio of 2.7 and a debt-to-equity ratio of 25.43, and it generated $323 million in free cash flow during 2025 to support dividends and share buybacks.

- Analysts have given Griffon an all-out 'strong buy' rating, with a median 12-month price target of $100, approximately 33% above the current share price.

- Griffon's full-year 2026 EBITDA guidance midpoint is $590 million, exceeding analyst estimates of $549.6 million, with a free cash flow margin improving to 9.4% from 8% year-over-year.

- Griffon Corporation reported Q4 2025 revenue of $662 million and adjusted EBITDA of $138 million, both consistent with the prior year, with adjusted net income at $71 million or $1.54 per share.

- For the full fiscal year 2025, the company generated $323 million in free cash flow, which was used to repurchase 1.9 million shares for $135 million at an average price of $70.99, reduce debt by $116 million, and increase its regular quarterly dividend by 22% to $0.22 per share.

- The Home and Building Products (HBP) segment maintained strong performance in FY 2025 with $1.6 billion in revenue and an EBITDA margin of 31.2%, while the Consumer and Professional Products (CPP) segment saw its EBITDA margin increase by over 200 basis points despite a 10% revenue decrease.

- For fiscal year 2026, Griffon expects revenue to be consistent with 2025 at $2.5 billion and adjusted EBITDA in the range of $580 million to $600 million, with HBP EBITDA margin expected to exceed 30% and CPP margin targeted at approximately 10%.

Quarterly earnings call transcripts for GRIFFON.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more