Earnings summaries and quarterly performance for CGI.

Research analysts who have asked questions during CGI earnings calls.

JD

Jérome Dubreuil

Desjardins Group

3 questions for GIB

Also covers: ALYAF, BCE, QBCRF +3 more

Richard Tse

National Bank Financial

3 questions for GIB

Also covers: DCBO, LSPD, NVEI +2 more

SP

Stephanie Price

CIBC World Markets

3 questions for GIB

Also covers: BCE, DCBO, DSGX +6 more

ST

Surinder Thind

Jefferies Financial Group

3 questions for GIB

Also covers: ASGN, CLVT, CSGP +25 more

SS

Suthan Sukumar

Stifel Financial Corp.

3 questions for GIB

Also covers: DCBO, LSPD, SANG +1 more

TM

Thanos Moschopoulos

BMO Capital Markets

3 questions for GIB

Also covers: CLS, LSPD, OTEX

KK

Kevin Krishnaratne

Scotiabank

2 questions for GIB

Also covers: DCBO, DSGX, EGLXF +4 more

Robert Young

Canaccord Genuity

2 questions for GIB

Also covers: CLS, DCBO, DSGX +2 more

Divya Goyal

Scotiabank

1 question for GIB

Also covers: ALYAF, CNXC, GLOB +2 more

PT

Paul Treiber

RBC Capital Markets

1 question for GIB

Also covers: BB, CLS, DSGX +2 more

Recent press releases and 8-K filings for GIB.

GIB Announces Q1 FY 2026 Results and Shareholder Meeting Outcomes

GIB

Earnings

Share Buyback

Proxy Vote Outcomes

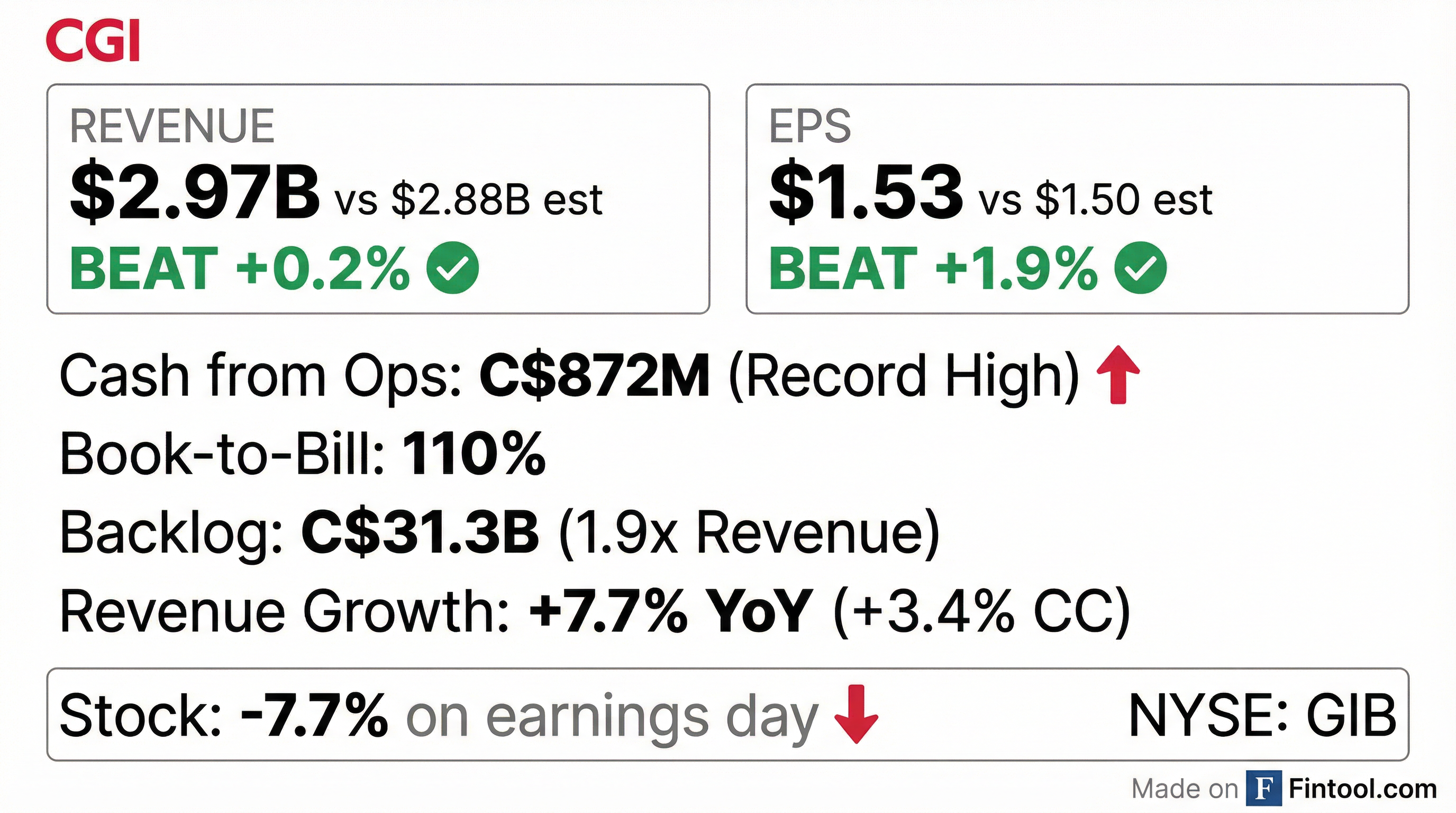

- For Q1 FY 2026, CGI reported revenue of $4.1 billion, an increase of 7.7% year-over-year, and diluted EPS of CAD 2.03, up 5.7% year-over-year. Bookings reached $4.5 billion, resulting in a 110% book-to-bill ratio and a $31.3 billion backlog.

- For fiscal year 2025, CGI's revenue increased 8.4% and adjusted earnings per share rose 8.9% year-over-year. The company invested $1.8 billion in accretive acquisitions and returned $1.4 billion to shareholders through buybacks and dividends.

- At the Annual General Meeting on January 28, 2026, all 13 nominated directors were elected, and PricewaterhouseCoopers was reappointed as auditor. The board also approved the renewal of its normal course issuer bid program to purchase up to 19 million shares by February 2027 and declared a quarterly cash dividend of $0.17 per share.

- CGI completed five accretive acquisitions in fiscal 2025 and continues to invest in its business, including AI. The company anticipates continuing improvement for the rest of the year , with 60% of its business derived from recurring revenue.

Jan 28, 2026, 4:00 PM

CGI Reports Q1 FY 2026 Results and Outlines Strategic Priorities at AGM

GIB

Earnings

Share Buyback

M&A

- CGI announced Q1 FY 2026 revenue of $4.1 billion, an increase of 7.7% year-over-year, with diluted EPS of CAD 2.03 (up 5.7%), and bookings of $4.5 billion for a 110% book-to-bill ratio. For fiscal year 2025, revenue increased 8.4%, adjusted EBIT margin was 16.4%, and adjusted EPS grew 8.9% year-over-year.

- The Board of Directors approved the renewal of its normal course issuer bid program until February 2027, authorizing the purchase of up to 19 million shares, and declared a quarterly cash dividend of $0.17 per share payable on March 20, 2026. In FY 2025, $1.4 billion was returned to shareholders through buybacks and dividends.

- The company's strategy focuses on four key streams, including accretive acquisitions (five completed in FY 2025) and managed services, which are seen as countercyclical drivers, with significant investments in AI.

- 13 nominees were proposed for election to the Board of Directors, following Mr. Frank Witter's decision not to seek re-election, and PricewaterhouseCoopers was proposed for reappointment as the company's auditor.

Jan 28, 2026, 4:00 PM

CGI Reports Q1 FY 2026 Results and FY 2025 Performance at AGM

GIB

Earnings

Dividends

Share Buyback

- CGI announced Q1 fiscal 2026 results, including revenue of $4.1 billion, up 7.7% year-over-year, and bookings of $4.5 billion, representing a 110% book-to-bill ratio. Diluted EPS was CAD 2.03, an increase of 5.7% year-over-year, with cash provided by operating activities at CAD 872 million.

- For fiscal year 2025, CGI reported an 8.4% increase in revenue, an adjusted EBIT margin of 16.4%, and an 8.9% increase in adjusted earnings per share. Bookings reached $17.6 billion, and cash from operations totaled $2.2 billion.

- The company's capital allocation strategy includes investing in the business, pursuing accretive acquisitions (with $1.8 billion invested in FY 2025 and five acquisitions completed), and returning capital to shareholders through share buybacks and dividends ($1.4 billion in FY 2025).

- CGI's board approved the renewal of its normal course issuer bid program until February 2027, authorizing the purchase of up to 19 million shares, and declared a quarterly cash dividend of $0.17 per share payable on March 20, 2026.

- Management anticipates continuing improvement for the rest of the year, noting gradual improvements in some industries and geographies, and plans to remain very active in its share repurchase program due to perceived undervaluation of its stock.

Jan 28, 2026, 4:00 PM

GIB Announces Strong Q1 2026 Financial Results and Strategic Progress

GIB

Earnings

Share Buyback

M&A

- GIB reported Q1 2026 revenue of $4.1 billion, an increase of 7.7% year-over-year, or 3.4% when excluding the impact of foreign exchange.

- Adjusted EBIT for the quarter was CAD 655 million, resulting in a 16.1% margin, and adjusted diluted EPS was $2.12, an 8% accretion compared to Q1 last year.

- Bookings reached CAD 4.5 billion in Q1 2026, achieving a book-to-bill ratio of 110%, with the trailing twelve-month book-to-bill also at 110%. The contracted backlog stood at CAD 31.3 billion.

- The company generated $872 million in cash from operations and deployed capital by investing CAD 106 million in business acquisitions and CAD 577 million in stock buybacks.

- GIB continues to advance its AI strategy, with approximately 40% of consultants now possessing expertise in advanced AI and data, more than double the number from the previous year.

Jan 28, 2026, 2:00 PM

CGI Reports Q1 Fiscal 2026 Results with Revenue Growth and Strong Bookings

GIB

Earnings

Share Buyback

M&A

- CGI reported Q1 Fiscal 2026 revenue of $4.1 billion, marking a 7.7% year-over-year increase, or 3.4% in constant currency.

- Adjusted diluted EPS grew 8% year-over-year to $2.12, with adjusted net earnings reaching $461 million.

- The company achieved CAD 4.5 billion in bookings, leading to a 110% book-to-bill ratio, and generated $872 million in cash from operations.

- CGI continued its capital deployment, investing CAD 106 million in acquisitions and CAD 577 million in share buybacks, while also approving a quarterly dividend of CAD 0.17 per share.

- Two mergers were completed in the quarter, expanding presence in Europe and North America, and the NCIB program was renewed to allow repurchase of up to 19 million shares by February 2027.

Jan 28, 2026, 2:00 PM

CGI Inc. announces Q1 2026 results

GIB

Earnings

Share Buyback

Dividends

- CGI Inc. reported Q1 fiscal 2026 revenue of $4.1 billion, an increase of 7.7% year-over-year (or 3.4% excluding foreign exchange impacts).

- Adjusted EBIT was CAD 655 million for a margin of 16.1%, and diluted EPS was $2.12, representing an 8% accretion compared to Q1 last year.

- Bookings for the quarter reached CAD 4.5 billion, resulting in a book-to-bill ratio of 110%, and the contracted backlog grew to CAD 31.3 billion.

- The company generated $872 million in cash from operations and deployed capital including CAD 106 million in business acquisitions, CAD 577 million in stock buybacks, and CAD 37 million in dividends.

- Management expects sequential improvement in future quarters, with early indications of an uptick in demand for Systems Integration and Consulting (SI&C), and a pipeline of SI&C opportunities up over 40% year-over-year.

Jan 28, 2026, 2:00 PM

CGI Reports Q1 2026 Results with Revenue Growth and Strong Bookings

GIB

Earnings

M&A

Share Buyback

- GIB reported Q1 2026 revenue of $4.1 billion, an increase of 7.7% year-over-year (3.4% excluding foreign exchange impact), with adjusted EBIT of $655 million (16.1% margin) and diluted EPS of $2.12.

- Bookings for the quarter reached $4.5 billion, resulting in a book-to-bill ratio of 110%, and the contracted backlog grew to $31.3 billion.

- The company generated $872 million in cash from operations and deployed capital by investing $106 million in business acquisitions and $577 million in stock buybacks.

- The U.S. Federal shutdown impacted U.S. operations and bookings in the quarter, though a sequential improvement is anticipated.

- GIB continues to advance its AI strategy, with 65% of its IP solutions incorporating AI-enabled intelligent automation and 40% of consultants possessing advanced AI and data expertise.

Jan 28, 2026, 2:00 PM

CGI Reports Strong Q1 Fiscal 2026 Results and Renews Share Buyback Program

GIB

Earnings

Share Buyback

Dividends

- CGI reported Q1 Fiscal 2026 revenue of $4.08 billion, an increase of 7.7% year-over-year, with diluted EPS of $2.03, up 5.7%.

- The company generated $871.9 million in cash from operating activities, representing 21.4% of revenue, and achieved bookings of $4.47 billion for a book-to-bill ratio of 109.5%.

- As of December 31, 2025, backlog stood at $31.32 billion.

- CGI's Board authorized the renewal of its Normal Course Issuer Bid to repurchase up to 18,975,360 Class A subordinate voting shares and approved a quarterly cash dividend of $0.17 per share.

- Long-term debt and lease liabilities increased to $4.29 billion as of December 31, 2025, mainly due to a $923.9 million senior unsecured notes issuance in March 2025, leading to net debt of $3.45 billion.

Jan 28, 2026, 12:32 PM

CGI reports Q1-F2026 results

GIB

Earnings

Share Buyback

Debt Issuance

- CGI reported Q1-F2026 revenue of $4.08 billion, an increase of 7.7% year-over-year (or 3.4% in constant currency).

- Diluted EPS grew 5.7% year-over-year to $2.03, and adjusted diluted EPS increased 7.6% to $2.12 in Q1-F2026.

- The company generated $871.9 million in cash from operating activities (21.4% of revenue) and secured $4.47 billion in bookings, resulting in a 109.5% book-to-bill ratio.

- As of December 31, 2025, backlog reached $31.32 billion, while net debt increased to $3.45 billion (up from $1.57 billion last year), leading to a net debt-to-capitalization ratio of 25.7%.

Jan 28, 2026, 11:30 AM

CGI Renews Normal Course Issuer Bid

GIB

Share Buyback

- CGI's Board of Directors has authorized the renewal of its Normal Course Issuer Bid (NCIB), which will allow the company to purchase for cancellation up to 18,975,360 Class A Shares, representing approximately 10% of its public float as of January 23, 2026.

- The renewed NCIB is expected to commence on February 6, 2026, and will conclude on the earlier of February 5, 2027, or when the maximum number of shares has been acquired.

- As of January 23, 2026, under the current NCIB that began on February 6, 2025, CGI had repurchased 12,945,271 Class A Shares at a weighted average price of $133.10 per share, for a total consideration of $1,722,951,291.23.

Jan 28, 2026, 11:25 AM

Quarterly earnings call transcripts for CGI.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more