Earnings summaries and quarterly performance for GENMAB.

Research analysts who have asked questions during GENMAB earnings calls.

Asthika Goonewardene

Truist Securities

6 questions for GMAB

Yaron Werber

TD Cowen

6 questions for GMAB

Jonathan Chang

Leerink Partners

5 questions for GMAB

Matthew Phipps

William Blair

5 questions for GMAB

Rajan Sharma

Goldman Sachs Group, Inc.

5 questions for GMAB

Qize Ding

Redburn Atlantic

4 questions for GMAB

Xian Deng

Berenberg

4 questions for GMAB

Michael Schmidt

Guggenheim Securities

3 questions for GMAB

Suzanne van Voorthuizen

Kempen & Co

3 questions for GMAB

Ben Jackson

Jefferies

2 questions for GMAB

James Gordon

JPMorgan Chase & Co.

2 questions for GMAB

Judah Frommer

Morgan Stanley

2 questions for GMAB

Mattias Häggblom

Handelsbanken

2 questions for GMAB

Sarah Bukhari

Guggenheim Partners

2 questions for GMAB

Victor Floch

BNP Paribas

2 questions for GMAB

Vikram Purohit

Morgan Stanley

2 questions for GMAB

Zain Ebrahim

JPMorgan

2 questions for GMAB

Emily Field

Barclays

1 question for GMAB

Etzer Darout

BMO Capital Markets

1 question for GMAB

Peter Verdult

Citigroup Inc.

1 question for GMAB

Sachin Jain

Bank of America

1 question for GMAB

Yifeng Liu

HSBC

1 question for GMAB

Recent press releases and 8-K filings for GMAB.

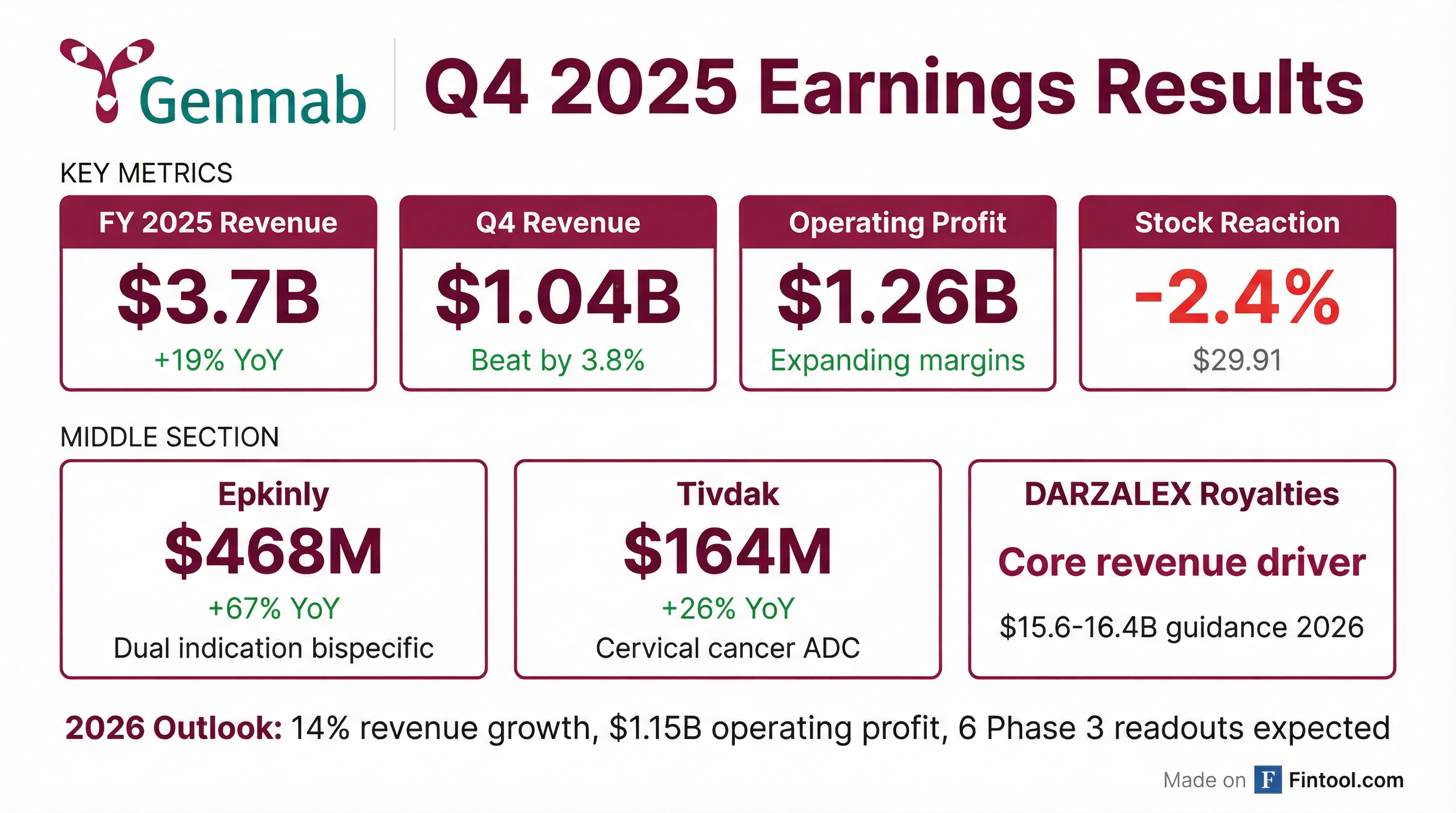

- Genmab reported a 19% increase in total revenue to $3.7 billion in 2025, with proprietary medicine sales growing 54% year-over-year to $632 million, accounting for approximately 28% of total revenue growth, and an operating profit of $1.26 billion.

- For 2026, the company expects 14% total revenue growth at the midpoint and an operating profit of $1.15 billion at the midpoint, with DARZALEX net sales projected between $15.6 billion and $16.4 billion.

- In 2025, EPKINLY received FDA approval in second-line follicular lymphoma, and TIVDAK expanded its availability in Japan and Europe, becoming the first ADC approved in recurrent or metastatic cervical cancer in the E.U., U.K., and Japan.

- The acquisition of Merus enhanced Genmab's late-stage portfolio with petosemtamab, and the company anticipates up to six potentially registrational data readouts in 2026 for EPKINLY, Rina-S, and petosemtamab, which could set the stage for multiple product launches and line extensions in 2027.

- Genmab's pipeline is currently comprised of 45% ADC, 50% DuoBody-based (bispecific), and 5% HexaBody-based technologies, following three recent IND filings for a bispecific antibody, an ADC, and a bispecific with HexaBody technology.

- In 2025, Genmab achieved total revenue growth of 19%, reaching $3.7 billion, and expanded operating profit to $1.26 billion.

- Sales of proprietary medicines increased 54% year-over-year to $632 million in 2025, with Epkinly sales reaching $468 million (up 67% year-over-year) and Tivdak sales at $164 million (up 26% year-over-year).

- For 2026, the company projects 14% total revenue growth at the midpoint and $1.15 billion in operating profit at the midpoint.

- 2025 was marked by the acquisition of Merus, which enhanced the late-stage portfolio with petosemtamab, and significant positive momentum for Epkinly following its FDA approval in second-line follicular lymphoma.

- 2026 is anticipated to be a pivotal year, with expectations for up to six potentially registrational data readouts for Epkinly, Rina-S, and petosemtamab, setting the stage for multiple product launches and line extensions in 2027.

- Genmab reported 2025 total revenue of $3.7 billion, a 19% increase, and an operating profit of $1.26 billion.

- Sales from proprietary medicines grew 54% year-over-year to $632 million, driven by Epkinly sales of $468 million (up 67%) and Tivdak sales of $164 million (up 26%).

- For 2026, Genmab expects 14% total revenue growth and $1.15 billion in operating profit at the midpoint, with DARZALEX net sales projected between $15.6 billion-$16.4 billion.

- The company advanced its late-stage pipeline in 2025 through the acquisition of Merus for petosemtamab, FDA approval for Epkinly in second-line follicular lymphoma, and expanded development for Rina-S. Up to 6 potentially registrational data readouts are anticipated in 2026.

- Genmab completed a $5.5 billion debt offering, with $4.1 billion fixed, and aims to reduce gross leverage below 3x by the end of 2027.

- Genmab A/S published its 2025 Annual Report on February 17, 2026, detailing its financial performance for the year and providing a financial outlook for 2026.

- For 2025, Genmab reported revenue of $3,720 million, a 19% increase from 2024, and an operating profit of $1,263 million (excluding acquisition-related expenses). Royalty revenue increased by 23% to $3,102 million.

- Key business achievements in 2025 included the FDA approval of EPKINLY® for follicular lymphoma, Tivdak® approvals in Europe and Japan, and the acquisition of Merus N.V..

- Genmab provided a 2026 revenue guidance range of $4,065 million to $4,395 million (mid-point $4,230 million) and an operating profit guidance range of $900 million to $1,400 million (mid-point $1,150 million).

- Genmab A/S announced that worldwide net trade sales of DARZALEX® (daratumumab) in 2025 totaled USD 14,351 million.

- These sales were comprised of USD 8,266 million from the U.S. and USD 6,085 million from the rest of the world.

- Genmab receives royalties on these worldwide net sales from Johnson & Johnson.

- Genmab announced positive topline results from the Phase 3 EPCORE DLBCL-1 trial for epcoritamab monotherapy in patients with relapsed/refractory Diffuse Large B-cell Lymphoma (DLBCL).

- The trial demonstrated a statistically significant improvement in progression-free survival (PFS) (HR: 0.74 [95% CI 0.60 to 0.92]), along with improvements in complete response rate, duration of response, and time to next treatment.

- This marks the first Phase 3 study to show PFS improvement for a CD3xCD20 T-cell engaging bispecific monotherapy in relapsed or refractory DLBCL.

- However, overall survival (OS) (HR: 0.96 [95% CI 0.77 to 1.20]) did not reach statistical significance in the study.

- Genmab and AbbVie will engage global regulatory authorities to discuss next steps for epcoritamab, which is already approved in over 65 countries for certain lymphoma indications.

- Genmab announced positive topline results from the Phase 3 EPCORE DLBCL-1 trial for epcoritamab in patients with relapsed/refractory diffuse large B-cell lymphoma (DLBCL).

- The trial demonstrated a statistically significant improvement in progression-free survival (PFS) with epcoritamab monotherapy (HR: 0.74 [95% CI 0.60 to 0.92]).

- This marks the first Phase 3 study to show improved PFS for a CD3xCD20 T-cell engaging bispecific monotherapy in this patient population.

- Genmab and AbbVie will engage global regulatory authorities to discuss next steps for epcoritamab based on these results.

- Genmab announced positive topline results from the Phase 3 EPCORE DLBCL-1 trial for epcoritamab in patients with relapsed or refractory diffuse large B-cell lymphoma (DLBCL).

- The trial demonstrated a statistically significant improvement in progression-free survival (PFS) (HR: 0.74 [95% CI 0.60 to 0.92]), making it the first Phase 3 study to show such improvement in this patient population with a CD3xCD20 T-cell engaging bispecific monotherapy.

- Genmab and AbbVie will engage global regulatory authorities to discuss the next steps for epcoritamab based on these results.

- Genmab is positioned for sustainable long-term growth with a diversified revenue base and a powerful late-stage pipeline, including nine medicines on the market after the acquisition of Merus.

- 2026 is anticipated to be a transformational year with up to six potential registrational data readouts for three high-impact late-stage programs: Epkinly, Rina-S, and petosemtamab, setting the stage for multiple important product launches and line extensions in 2027.

- Epkinly demonstrated phase III superiority in follicular lymphoma and has three phase III trials in diffuse large B-cell lymphoma with data expected in 2026, aiming to significantly increase its addressable patient population.

- Rina-S is designed to broaden eligibility in folate receptor alpha-targeted treatment, with encouraging anti-tumor activity in ovarian and endometrial cancers and ongoing phase III trials.

- Petosemtamab, acquired through Merus, shows compelling data in head and neck cancer, with top-line data from phase III trials expected in the second half of 2026.

- Genmab begins 2026 with a diversified revenue base from nine marketed medicines and a late-stage portfolio positioned for sustainable long-term growth into the 2030s.

- The company anticipates a catalyst-rich 2026 with up to six potential registrational data readouts for key assets: Epkinly, Rina S, and Petosemtamab, which could lead to multiple product launches and line extensions starting in 2027.

- Epkinly demonstrated phase three superiority over standard of care in follicular lymphoma and is expected to have three phase three data readouts in diffuse large B-cell lymphoma in 2026, aiming to significantly expand its addressable patient population.

- Petosemtamab, acquired through Merus, achieved a 63% response rate in combination with Pembro in first-line head and neck cancer, more than triple the standard of care, with top-line phase three data anticipated in the second half of 2026.

- Genmab is financially profitable and is strategically transforming into a fully integrated biotech, focusing on operational efficiencies and disciplined investment in high-priority programs.

Quarterly earnings call transcripts for GENMAB.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more