Earnings summaries and quarterly performance for GULFPORT ENERGY.

Executive leadership at GULFPORT ENERGY.

John Reinhart

President and Chief Executive Officer

Lester Zitkus

Senior Vice President, Land

Matthew Rucker

Executive Vice President, Chief Operating Officer

Michael Hodges

Executive Vice President, Chief Financial Officer

Michael Sluiter

Senior Vice President, Reservoir Engineering

Patrick Craine

Executive Vice President, Chief Legal and Administrative Officer and Corporate Secretary

Board of directors at GULFPORT ENERGY.

Research analysts who have asked questions during GULFPORT ENERGY earnings calls.

Carlos Escalante

Wolfe Research

5 questions for GPOR

Zach Parham

JPMorgan Chase & Co.

5 questions for GPOR

Noah Hungness

Firm Not Mentioned in Transcript

4 questions for GPOR

Peyton Dorne

UBS

3 questions for GPOR

Bertrand Donnes

Truist Securities

2 questions for GPOR

Jacob Roberts

TPH & Co.

2 questions for GPOR

Nicholas Pope

Roth Capital

2 questions for GPOR

Noel Gonzalez

Bank of America

2 questions for GPOR

Timothy Rezvan

KeyBanc Capital Markets Inc.

2 questions for GPOR

Brian Velie

Capital One Securities, Inc.

1 question for GPOR

David Deckelbaum

TD Cowen

1 question for GPOR

Douglas George Blyth Leggate

Wolfe Research

1 question for GPOR

Gabriel Daoud

Cowen

1 question for GPOR

Jake Roberts

TPH&Co.

1 question for GPOR

Jonathan Mardini

KeyBanc Capital Markets

1 question for GPOR

Neal Dingman

William Blair

1 question for GPOR

Neal Dingmann

Truist Securities

1 question for GPOR

Tim Rezvan

KeyBanc Capital Markets

1 question for GPOR

Recent press releases and 8-K filings for GPOR.

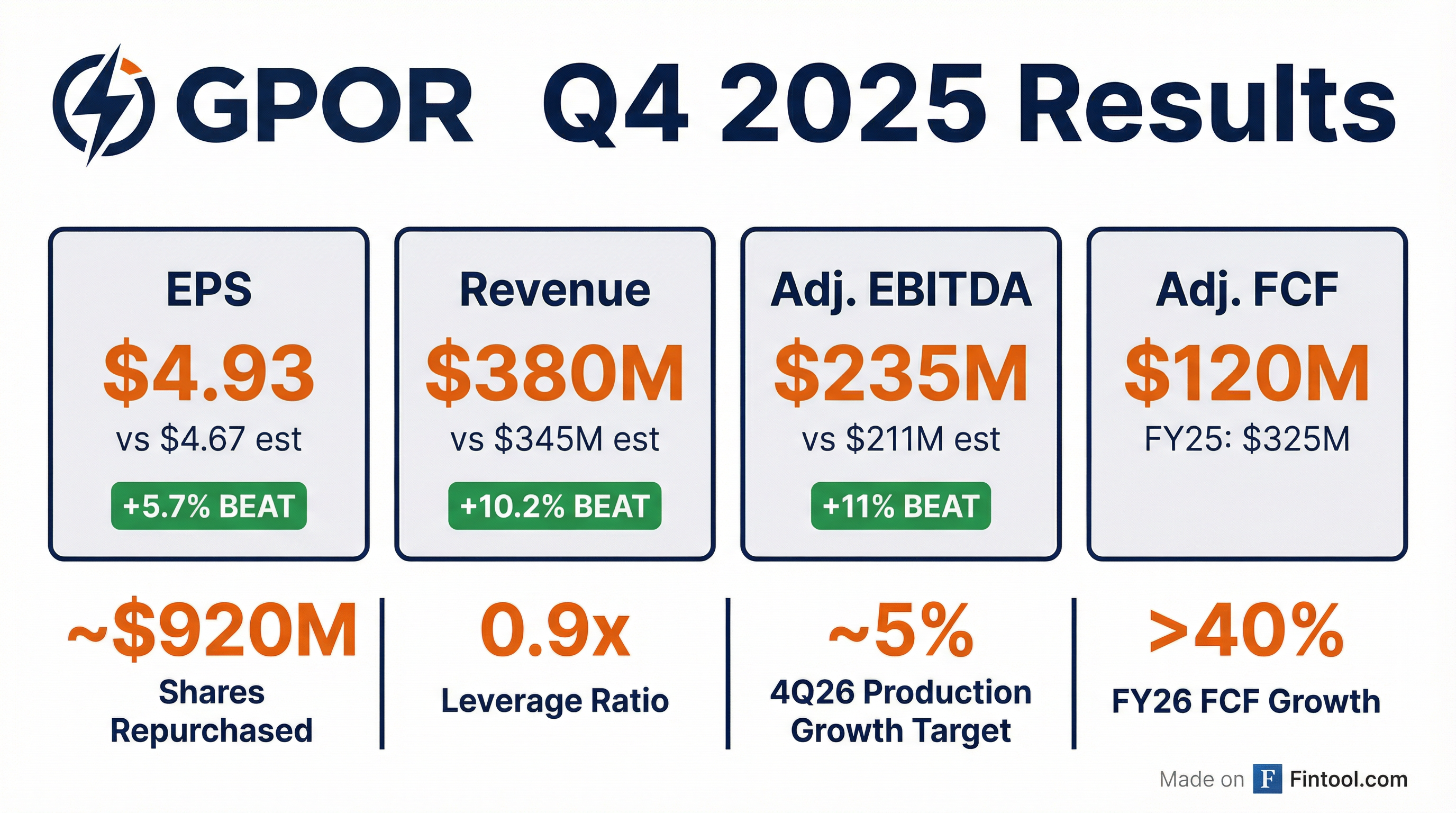

- Gulfport Energy reported Adjusted EBITDA of $235 million and Adjusted Free Cash Flow of $120 million for Q4 2025, maintaining a year-end net leverage of 0.9x.

- The company projects a 2026 capital spend in the range of $400 million-$430 million, with over 75% of the turn-in-line program weighted towards high-return Utica dry gas and wet gas developments.

- Gulfport forecasts 2026 production to be 1.03 to 1.055 billion cubic feet equivalent per day, which is relatively flat compared to the full-year 2025 average of 1.04 Bcfe/d, but anticipates Q4 2026 production to increase approximately 5% over Q4 2025.

- The company plans to deploy more than $140 million towards share repurchases in Q1 2026, following the repurchase of 665,000 shares for approximately $135 million in Q4 2025.

- Gulfport expects significant growth in Adjusted Free Cash Flow in 2026, driven by improving natural gas price realizations and a forecasted natural gas differential of $0.15-$0.30 per MCF below NYMEX Henry Hub for the full year.

- Gulfport Energy reported Adjusted EBITDA of $235 million and $120 million of Adjusted Free Cash Flow for Q4 2025, maintaining a strong financial position with net leverage of 0.9x at year-end.

- For 2026, the company projects a total capital spend of $400 million-$430 million and plans to allocate over $140 million to share repurchases in Q1 2026, following $135 million in repurchases during Q4 2025.

- GPOR forecasts 2026 production to be 1.03 to 1.055 billion cubic feet equivalent per day, with over 75% of its development efforts concentrated in the high-return dry gas and wet gas windows of the Utica.

- The discretionary acreage acquisition program, with a total investment of approximately $100 million, is expected to conclude in Q1 2026, adding over two years of core drilling inventory.

- Gulfport Energy reported strong Q4 2025 financial results, including $235 million in Adjusted EBITDA and $120 million in Adjusted Free Cash Flow, ending the year with a leverage ratio of 0.9x.

- For 2026, the company projects total capital expenditures between $400 million and $430 million and forecasts production of 1.03 to 1.055 billion cubic feet equivalent per day, which is relatively flat compared to the full year 2025 average.

- Gulfport plans to deploy more than $140 million towards share repurchases in Q1 2026, following $135 million in repurchases during Q4 2025.

- The company anticipates 2026 per unit operating costs to be in the range of $1.23 to $1.34 per MCFE and expects a tighter natural gas differential of $0.15-$0.30 per MCF below NYMEX Henry Hub, representing a 25% improvement over 2025.

- Gulfport Energy reported adjusted free cash flow of $324.7 million for FY 2025 and maintained a strong financial position with ~$806 million in liquidity and ~0.9x leverage as of December 31, 2025.

- The company continued its shareholder return program, having repurchased ~$920 million of common stock as of December 31, 2025, under its $1.5 billion authorization, and plans to repurchase more than $140 million in 1Q2026.

- For FY 2026, Gulfport Energy provided guidance for total net equivalent production of 1.030 - 1.055 Bcfe/day and total capital expenditures of $400 - $430 million, with adjusted free cash flow estimated to increase >40% year-over-year.

- Gulfport Energy reported full year 2025 net income of $427.8 million and adjusted EBITDA of $878.5 million, generating $324.7 million in adjusted free cash flow.

- For full year 2025, total net production was 1.04 Bcfe per day, consistent with 2024, and total net liquids production rose approximately 29% to 18.7 MBbl per day.

- The company repurchased approximately 1.8 million shares for $336.3 million in 2025 and plans to repurchase over $140 million in Q1 2026, with $579.6 million remaining in its authorization.

- For 2026, Gulfport forecasts total capital expenditures of $400 million to $430 million, with full year net daily equivalent production between 1.030 and 1.055 Bcfe per day and net daily liquids production increasing approximately 5%.

- As of December 31, 2025, liquidity was $806.1 million, and the company aims to maintain leverage at approximately 1.0x or below.

- Gulfport Energy reported full year 2025 net income of $427.8 million, adjusted EBITDA of $878.5 million, and adjusted free cash flow of $324.7 million.

- For the full year 2025, the company delivered total net production of 1.04 Bcfe per day and incurred total capital expenditures of $463.2 million.

- The company's total proved reserves increased approximately 7% to 4.3 Tcfe at year-end 2025.

- For full year 2026, Gulfport forecasts net daily equivalent production in the range of 1.030 to 1.055 Bcfe per day and total capital expenditures between $400 million and $430 million.

- Gulfport expects adjusted free cash flow to grow meaningfully in 2026 and plans to repurchase more than $140 million of common stock during Q1 2026.

- Gulfport Energy reported Q3 2025 net production of 1,119.7 MMcfe/day, an 11% increase over Q2 2025, with full-year 2025 guidance set at approximately 1,040 MMcfe/day.

- For Q3 2025, the company generated $103.4 million in adjusted free cash flow, contributing to $204.6 million year-to-date.

- Gulfport repurchased $76.3 million in common stock during Q3 2025, bringing total repurchases to ~$785.3 million as of September 30, 2025, and plans to repurchase an additional ~$125 million in Q4 2025.

- The company's leverage stood at 0.81x as of September 30, 2025, with ~$903 million in liquidity.

- Gross undeveloped inventory increased by over 40% since year-end 2022, now estimated at ~700 gross locations providing approximately 15 years of net inventory.

- Gulfport Energy delivered strong financial results in Q3 2025, with adjusted EBITDA of approximately $213 million and adjusted free cash flow of approximately $103 million. Average daily production increased by 11% over Q2 2025, reaching 1.12 billion cubic feet equivalent per day, and the company maintains a full-year production forecast of approximately 1.04 billion cubic feet equivalent per day.

- The company significantly expanded its inventory, increasing gross undeveloped inventory by over 40% since year-end 2022 to approximately 700 gross locations. This expansion, driven by Ohio Marcellus viability and U development validation, brings total net inventory to roughly 15 years with breakevens below $2.50 per MMBtu.

- Gulfport completed the redemption of its preferred equity for approximately $31.3 million and repurchased 438,000 shares of common stock for approximately $76.3 million during Q3 2025.

- Looking ahead, the company plans to allocate an incremental $125 million towards common stock repurchases in Q4 2025, while maintaining an ATT leverage ratio forecasted to be at or below 1 times at year-end 2025.

- For the third quarter of 2025, Gulfport Energy reported net income of $111.4 million and adjusted EBITDA of $213.1 million.

- The company's total net production reached 1,119.7 MMcfe per day in Q3 2025, contributing to $103.4 million of adjusted free cash flow.

- Gulfport expanded its undeveloped Marcellus inventory by approximately 125 gross locations, representing an increase of about 200% in Ohio Marcellus inventory, and unlocked 20 gross Utica dry gas locations.

- The updated full-year 2025 outlook forecasts net daily equivalent production of approximately 1.04 Bcfe per day and total base capital expenditures of approximately $390 million.

- Gulfport plans to repurchase approximately $325 million of its outstanding equity during 2025, with $125 million specifically allocated for the fourth quarter of 2025.

- Gulfport Energy reported net income of $111.4 million and adjusted EBITDA of $213.1 million for the third quarter of 2025, generating $103.4 million of adjusted free cash flow.

- The company delivered total net production of 1,119.7 MMcfe per day, an 11% increase over Q2 2025, and net liquids production of 22.0 MBbl per day, a 15% increase over Q2 2025.

- Gulfport expanded its undeveloped Marcellus inventory by approximately 125 gross locations, representing a 200% increase in Ohio Marcellus inventory, and unlocked 20 gross Utica dry gas locations through U-development.

- The company repurchased approximately $76.3 million of common stock in Q3 2025 and plans to allocate an additional $125 million for repurchases in Q4 2025, contributing to an expected total of $325 million for full-year 2025.

Quarterly earnings call transcripts for GULFPORT ENERGY.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more