Earnings summaries and quarterly performance for HAEMONETICS.

Executive leadership at HAEMONETICS.

Christopher Simon

President and Chief Executive Officer

Frank Chan

Executive Vice President, Chief Operating Officer

James D'Arecca

Executive Vice President, Chief Financial Officer

Laurie Miller

Senior Vice President, Chief Human Resources Officer

Michelle Basil

Executive Vice President, General Counsel

Roy Galvin

Executive Vice President, Chief Commercial Officer

Board of directors at HAEMONETICS.

Research analysts who have asked questions during HAEMONETICS earnings calls.

Andrew Cooper

Raymond James

6 questions for HAE

Anthony Petrone

Mizuho Group

6 questions for HAE

Marie Thibault

BTIG

6 questions for HAE

Michael Petusky

Barrington Research

5 questions for HAE

Rohin Patel

JPMorgan Chase & Co.

5 questions for HAE

Joanne Wuensch

Citigroup Inc.

4 questions for HAE

Craig Bijou

Bank of America Securities

3 questions for HAE

David Rescott

Baird

3 questions for HAE

Michael Matson

Needham & Company

3 questions for HAE

Mike Matson

Needham & Company, LLC

3 questions for HAE

David Turkaly

Citizens JMP

2 questions for HAE

Lawrence Solow

CJS Securities, Inc.

2 questions for HAE

Anthony Occhiogrosso

Citigroup Inc.

1 question for HAE

Kristen Stewart

CL King & Associates

1 question for HAE

Larry Solow

CJS Securities

1 question for HAE

Recent press releases and 8-K filings for HAE.

- Haemonetics Corporation has received U.S. Food and Drug Administration (FDA) 510(k) clearance for its NexSys PCS Plasma Collection System with Persona PLUS technology.

- Persona PLUS is the next generation of Haemonetics' proprietary Persona technology, designed to tailor plasma collections to each donor for improved average plasma volume per donation.

- Clinical data supporting the clearance showed that Persona PLUS delivered a mid-single digit percent increase of plasma per donation over Persona.

- This innovation aims to help plasma collectors scale operations efficiently and cost-effectively, lowering cost-per-liter and enhancing yields safely, addressing the growing demand for plasma-derived therapies.

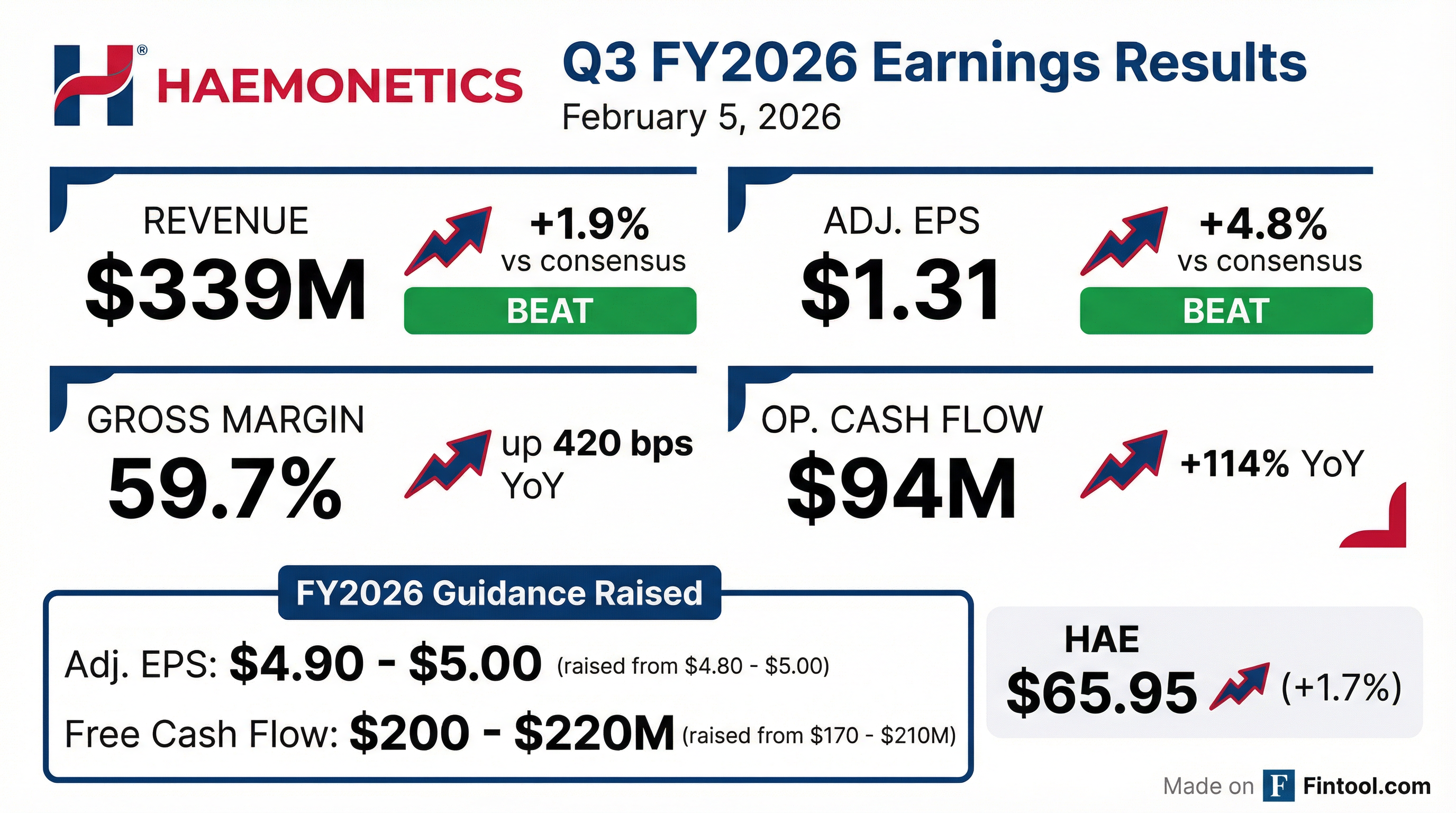

- HAE delivered a strong Q3 2026 with revenue of $339 million and adjusted earnings per share of $1.31, leading to a raise in full-year revenue, earnings, and free cash flow guidance. Year-to-date, adjusted operating margin expanded 200 basis points to 25.7%.

- Growth was driven by NexSys and TEG, which delivered outsized growth, and a strong plasma business benefiting from share gains and double-digit collection volume growth.

- While interventional technology revenue declined 12% in Q3, the company expects this segment to return to growth in FY 2027, supported by the anticipated MVP XL label expansion and the US launch of PerQseal Elite from the Vivisure acquisition.

- The company's capital allocation priorities include organic growth investments, debt reduction, and opportunistic share buybacks.

- Haemonetics (HAE) reported Q3 Fiscal 2026 adjusted EPS of $1.31, a 10% increase year-over-year, with an adjusted operating margin of 26.3%.

- The company achieved 8% organic ex-CSL revenue growth in Q3 Fiscal 2026, contributing to total net revenues of $339.0 million.

- Cash generation was strong, with free cash flow increasing 151% year-over-year to $94 million in Q3 Fiscal 2026, and a free cash flow to adjusted net income conversion ratio of 121%.

- Haemonetics updated its full-year Fiscal 2026 guidance, projecting adjusted EPS between $4.90 and $5.00 and free cash flow between $200 million and $220 million.

- Subsequent to quarter-end, the company acquired Vivasure Medical in January 2026 and bought back approximately 360,000 shares of HAE common stock.

- Haemonetics reported Q3 2026 revenue of $339 million and adjusted earnings per share of $1.31, contributing to year-to-date revenue of $988 million and adjusted EPS of $3.67.

- The company raised its full-year fiscal 2026 guidance, now expecting total reported revenue to decline by 1%-3% and organic revenue ex-CSL to grow by 8%-10%. Adjusted EPS guidance was updated to $4.90-$5.00 per share.

- Plasma organic growth ex-CSL accelerated to 20% in the quarter, and Blood Management Technologies grew 8%. Interventional Technologies revenue declined 12% in Q3 but is anticipated to return to growth in FY 2027.

- Free cash flow for Q3 was $74 million, bringing the year-to-date total to $165 million, leading to a raised full-year free cash flow guidance of $200-$220 million.

- Subsequent to quarter end, Haemonetics acquired Vivasure for $61 million to enhance its interventional technologies portfolio, with a planned commercial launch of PerQseal Elite in fiscal 2027.

- Haemonetics reported Q3 2026 revenue of $339 million, bringing year-to-date revenue to $988 million, with organic growth ex-CSL of 8% in the quarter and 10% year-to-date.

- Adjusted earnings per share increased 10% in Q3 to $1.31 and 11% year-to-date to $3.67. The company generated $74 million in free cash flow in Q3, bringing year-to-date free cash flow to $165 million.

- Full-year fiscal 2026 guidance was raised for adjusted EPS to $4.90-$5.00 per share, free cash flow to $200 million-$220 million, reported revenue to a decline of 1%-3%, and organic revenue ex-CSL to 8%-10%.

- Plasma performance accelerated with 20% organic growth ex-CSL in Q3, while Blood Management Technologies delivered solid growth of 8%. Interventional Technologies declined 12% in Q3 but is expected to return to growth in FY 2027.

- Subsequent to quarter end, Haemonetics acquired Vivisure for $61 million to strengthen its interventional technologies portfolio and repurchased approximately 360,000 shares for $25 million.

- Haemonetics Corporation reported Q3 fiscal 2026 revenue of $339 million, a 2.7% decrease year-over-year, with adjusted earnings per diluted share of $1.31. Year-to-date fiscal 2026 revenue was $988 million, down 4.1%, and adjusted earnings per diluted share was $3.67.

- The company raised its fiscal 2026 guidance for adjusted earnings per diluted share to $4.90 – $5.00 (previously $4.80 – $5.00) and for free cash flow to $200 million – $220 million (previously $170 million – $210 million).

- Gross margin improved to 59.7% in Q3 fiscal 2026 (from 55.5% in Q3 fiscal 2025) due to higher margin offerings and product innovation. Organic ex-CSL revenue grew 7.5% in Q3 fiscal 2026, primarily driven by Plasma and Blood Center businesses.

- Haemonetics expects to achieve an 8% total revenue compound annual growth rate and 770 basis points of adjusted operating margin expansion over its four-year Long-Range Plan (FY22-FY26), with adjusted EPS projected to compound at approximately 17%.

- The company has transformed its portfolio, with 85% of FY26 revenue now coming from core high-growth, high-margin businesses, significantly up from 30% in FY22.

- Haemonetics maintains leadership positions in its three core platforms: plasma apheresis (over 50% global market share), viscoelastic testing (TEG, 45% market share), and vascular closure.

- The company recently acquired Vivasure for approximately $60 million to expand into the $300 million large bore closure market, with the PerQseal Elite product currently under FDA review for a planned FY27 launch.

- Capital allocation priorities include organic growth, opportunistic share buybacks ($225 million in the past year), and debt repayment for a $300 million convertible debt maturity in March. Future operating margin expansion is projected at 50-100 basis points annually.

- Haemonetics reported FY25 revenue of $1.36 billion , adjusted EPS of $4.57 , and an adjusted operating margin of 24.0%.

- The company issued FY26 guidance, projecting total reported revenue growth of (1-4%) (or organic, ex-CSL revenue growth of 7-10% ), adjusted EPS between $4.80 and $5.00 , and an adjusted operating margin of 26-27%.

- Strategic growth is driven by its Plasma business, with a ~$1 billion Serviceable Addressable Market (SAM) and ~50% global share , and Interventional Technologies, including the Electrophysiology market with a ~$600 million SAM and ~40% US share.

- Haemonetics acquired Vivasure for up to €185 million , which is expected to unlock a $300 million Total Addressable Market (TAM) and strengthen its vascular closure leadership.

- The business model features 94% recurring revenue and a capital allocation strategy that includes ~$515 million (40%) for M&A out of $1.3 billion total.

- Haemonetics (HAE) is nearing the completion of its FY22-FY26 Long-Range Plan, expecting an 8% total revenue compound annual growth rate and 770 basis points of adjusted operating margin expansion at the midpoint of its current guidance. This performance is attributed to a portfolio shift, with 85% of FY26 revenue now derived from high-growth, high-margin businesses, up from 30% in FY22.

- The company recently acquired Vivasure for approximately $60 million to expand its vascular closure portfolio into the large bore segment, with the PerQseal Elite product currently under FDA review for a planned FY27 launch.

- Capital allocation priorities include organic growth, M&A (currently paused for IVD improvements), and shareholder returns, with $225 million in share buybacks in the past year and a focus on addressing a $300 million convertible debt maturity by the end of March.

- The plasma franchise, a global leader with over 50% market share and 80% share in the U.S. DMS market, is experiencing significant growth from share gains, price premiums, and normalizing collection volumes, providing a durable source of earnings and free cash flow.

- Haemonetics reported strong progress on its FY22-FY26 Long-Range Plan, with an expected 8% total revenue compound annual growth rate (13% organic) and 770 basis points of adjusted operating margin expansion at the midpoint of current guidance.

- The company has successfully transformed its portfolio, with 85% of FY26 revenue now derived from core high-growth, high-margin businesses, up from 30% in FY22.

- Haemonetics recently acquired Vivasure for approximately $60 million, expanding its vascular closure offering into the large bore segment, which adds an estimated $300 million addressable market.

- Capital allocation priorities include organic growth, opportunistic share buybacks ($225 million in the past year), and addressing a $300 million convertible debt maturity in March.

- Management expects continued operating margin expansion of 50-100 basis points in future years, driven by operating leverage.

Quarterly earnings call transcripts for HAEMONETICS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more