Earnings summaries and quarterly performance for HOME BANCORP.

Executive leadership at HOME BANCORP.

John W. Bordelon

President and Chief Executive Officer

Darren E. Guidry

Senior Executive Vice President and Chief Risk Officer

David T. Kirkley

Senior Executive Vice President and Chief Financial Officer

John J. Zollinger, IV

Senior Executive Vice President and Chief Banking Officer

Mark C. Herpin

Senior Executive Vice President and Chief Operations Officer

Natalie B. Lemoine

Senior Executive Vice President and Chief Administrative Officer

Board of directors at HOME BANCORP.

Research analysts who have asked questions during HOME BANCORP earnings calls.

Feddie Strickland

Hovde Group

6 questions for HBCP

Joseph Yanchunis

Raymond James

5 questions for HBCP

Stephen Scouten

Piper Sandler & Co.

5 questions for HBCP

Joe Yanchunas

Raymond James

2 questions for HBCP

Christopher Marinac

Janney Montgomery Scott LLC

1 question for HBCP

Recent press releases and 8-K filings for HBCP.

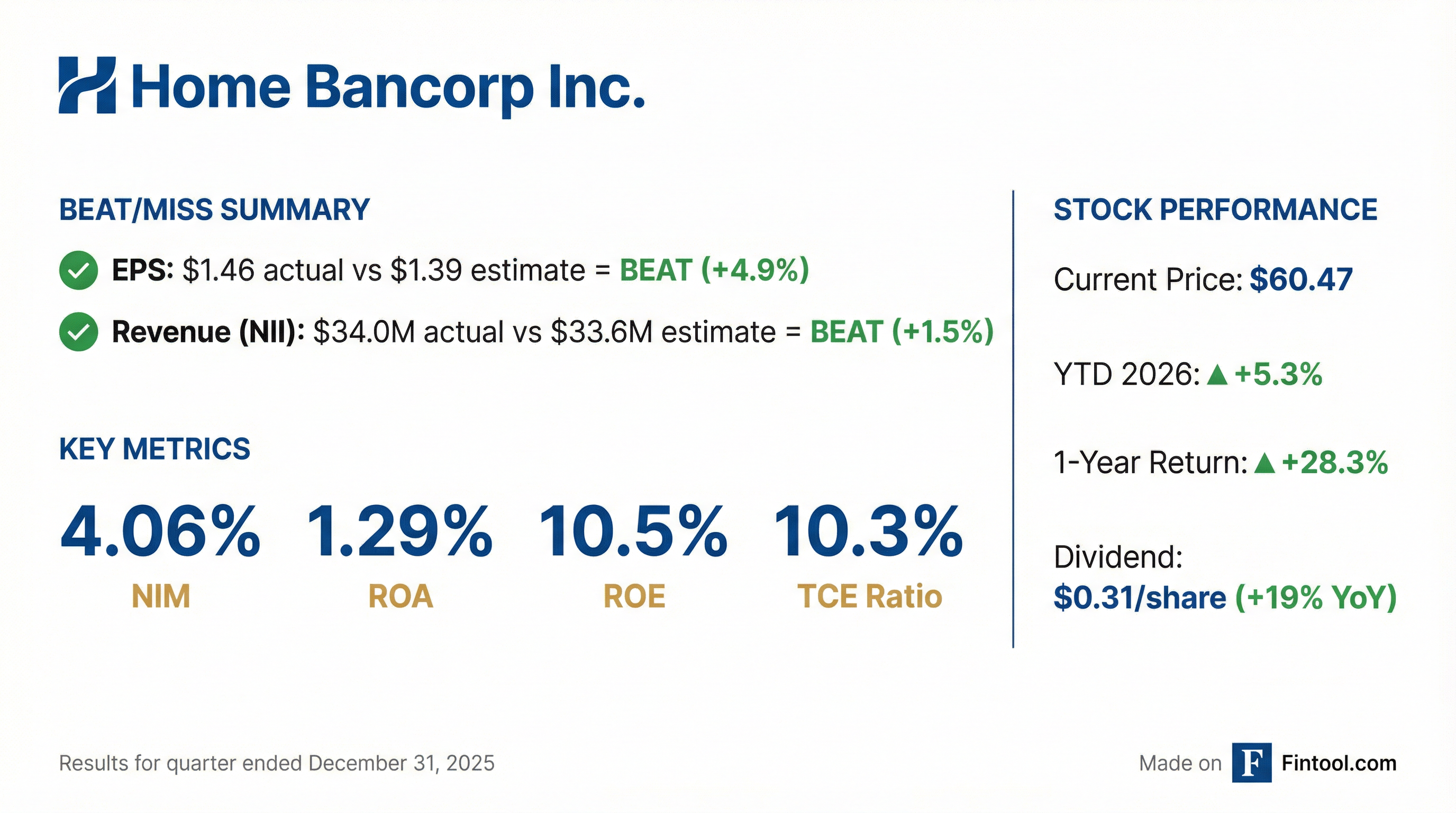

- Home Bancorp, Inc. (HBCP) reported net income of $11,411 thousand and diluted EPS of $1.46 for Q4 2025.

- The company's net interest income was $34,048 thousand with a Net Interest Margin (NIM) of 4.06% for Q4 2025.

- As of December 31, 2025, total assets stood at $3,492,626 thousand, total loans were $2,744,023 thousand, and total deposits reached $2,972,806 thousand.

- Credit quality metrics for Q4 2025 showed nonperforming loans at 1.25% of total loans and criticized loans at 2.40% of total loans.

- HBCP declared a cash dividend of $0.31 per share payable on February 20, 2026, and repurchased 321,590 shares in 2025. The TCE ratio was 10.3% and the Common Equity Tier 1 capital ratio was 12.7% as of December 31, 2025.

- Home Bancorp reported record net income of $46 million or $5.87 per share for the full year 2025, representing a 29% increase in EPS over 2024, with Q4 2025 net income of $11.4 million or $1.46 per share.

- The company achieved 7% deposit growth in 2025, reducing its loan-to-deposit ratio to 92% and decreasing the overall cost of deposits to an attractive 1.84% in Q4 2025. Loans grew 6% annualized in Q4, with mid-single digit growth expected for 2026.

- Net interest margin (NIM) for Q4 2025 was 4.06%, and the company anticipates NIM to tick up to 4.1%-4.15% throughout 2026. Non-performing assets increased to $36.1 million or 1.03% of total assets in Q4, though net charge-offs for 2025 remained low at $908,000.

- M&A is a top capital deployment priority, with the company actively looking for deals up to $1.5 billion, alongside an increased quarterly dividend of $0.31 per share and continued share repurchases.

- Home Bancorp reported record net income of $46 million or $5.87 per share for the full year 2025, marking a 29% increase in EPS compared to 2024, and $11.4 million or $1.46 per share for Q4 2025.

- The company achieved 7% deposit growth in 2025, reducing its loan-to-deposit ratio to 92%. However, non-performing assets increased by $5.2 million to $36.1 million, or 1.03% of total assets, in Q4 2025, primarily due to the downgrade of two relationships.

- Home Bancorp expects mid-single-digit loan growth in 2026 and anticipates its Net Interest Margin (NIM) to tick up to 4.1-4.15% throughout the year. The company is also optimistic about M&A opportunities in 2026, considering deals up to half its size or less.

- The Texas franchise continues to expand, with loans growing at a 15% annual rate and now representing 20% of the loan portfolio. A new full-service branch is expected to open in Houston in Q1 2026.

- Home Bancorp reported record net income of $46 million or $5.87 per share for the full year 2025, a 29% increase in EPS over 2024. Fourth quarter 2025 net income was $11.4 million or $1.46 per share, marking a 21% increase from a year ago.

- The company achieved a net interest margin of 4.06% and ROA of 1.29% in Q4 2025, significantly higher than Q4 2024. For the full year 2025, NIM increased 32 basis points to 4.03% and ROA increased 25 basis points to 1.33%.

- Loans grew by $38 million (6% annualized) in Q4 2025, and deposits increased by 7% or $192 million in 2025, reducing the loan-to-deposit ratio to 92%. Loan growth in 2026 is expected to be in the mid-single digits.

- Non-performing assets increased to $36.1 million or 1.03% of total assets in Q4 2025, primarily due to the downgrade of two relationships, but net charge-offs remained low at $908,000 (three basis points of total loans) for 2025.

- Management is optimistic about M&A opportunities in 2026, considering deals up to $1.5 billion, and expects NIM to expand to 4.1-4.15% throughout 2026.

- Home Bancorp, Inc. reported net income of $11.4 million and diluted EPS of $1.46 for the fourth quarter of 2025, a decrease from $12.4 million and $1.59, respectively, in the third quarter of 2025.

- At December 31, 2025, loans totaled $2.7 billion, an increase of 1% from September 30, 2025, while deposits totaled $3.0 billion, a decrease of less than 1%.

- The net interest margin (NIM) decreased to 4.06% for Q4 2025 from 4.10% for Q3 2025, primarily due to lower loan yield.

- Nonperforming assets increased by 17% to $36.1 million, or 1.03% of total assets, at December 31, 2025, mainly due to two loan relationships moved to nonaccrual status.

- The company declared a quarterly cash dividend of $0.31 per share and repurchased 750 shares of its common stock during the fourth quarter of 2025.

- For the fourth quarter of 2025, Home Bancorp reported net income of $11.4 million, or $1.46 per diluted common share, representing an 8% decrease from the third quarter of 2025.

- Loans totaled $2.7 billion at December 31, 2025, an increase of 1% from September 30, 2025, while deposits totaled $3.0 billion, a decrease of less than 1% from the prior quarter.

- The net interest margin (NIM) decreased 4 basis points to 4.06% in the fourth quarter of 2025, down from 4.10% in the third quarter of 2025.

- Nonperforming assets (NPAs) increased by 17% to $36.1 million, or 1.03% of total assets, at December 31, 2025, compared to $30.9 million at September 30, 2025.

- The Company declared a cash dividend of $0.31 per common share for the fourth quarter of 2025.

- Home Bancorp reported net income of $12,400,000 or $1.59 per share for Q3 2025, marking a 9% increase from the prior quarter and a 31% increase from a year ago. The net interest margin (NIM) expanded for the sixth consecutive quarter to 4.1%, and return on assets (ROA) increased by 10 basis points to 1.41%.

- Loans decreased by $58,000,000 in Q3 2025 due to higher payoffs and paydowns, leading to an updated 2025 loan growth expectation of 1% to 2%, down from an initial hope of 4% to 6%. Conversely, deposits increased 9% annualized in Q3, with the loan-to-deposit ratio now at 91%.

- Nonperforming assets increased by $5,500,000 to $30,900,000, or 88 basis points of total assets, primarily due to the downgrade of five relationships. However, net charge-offs remained low at $376,000 for the quarter, and the allowance for loan loss ratio was stable at 1.21%. Management expects NIM to remain at least flat or grow slightly, and anticipates noninterest income between $3,600,000 and $3,800,000 and noninterest expenses between $22,500,000 and $23,000,000 for the next two quarters.

- Home Bancorp reported net income of $12.4 million and $1.59 earnings per share for Q3 2025, with its net interest margin expanding for the sixth consecutive quarter to 4.10% and return on assets increasing to 1.41%.

- Loans decreased by $58 million in Q3 2025 due to higher-than-average payoffs, leading to a revised 2025 loan growth expectation of 1%-2%, down from the previous 4%-6%.

- Deposits increased 9% annualized in Q3 2025, with non-interest-bearing deposits representing 27% of total deposits and growing 9.4% year-to-date, which helped improve the loan-to-deposit ratio to 91%.

- Non-performing assets increased by $5.5 million to $30.9 million, or 88 basis points of total assets, primarily due to the downgrade of five relationships, though management expects no material losses.

- Management anticipates noninterest income to be between $3.6 million and $3.8 million and noninterest expenses between $22.5 million and $23 million per quarter for the next two quarters, while expecting the net interest margin to remain at least flat or increase slightly.

- HBCP reported net income of $12.357 million and diluted earnings per share (EPS) of $1.59 for the third quarter of 2025.

- The company's Net Interest Margin (NIM) increased to 4.10% in Q3 2025.

- Total deposits reached $2.975 billion as of September 30, 2025, reflecting a quarter-over-quarter increase of $67.269 million.

- Total loans stood at $2.706 billion as of September 30, 2025, with an annualized growth rate of (8)% for Q3 2025.

- HBCP maintained strong capital with a Tier 1 leverage capital ratio of 11.9% and a Total risk-based capital ratio of 14.0% as of Q3 2025.

- Home Bancorp, Inc. reported net income of $12.4 million and diluted EPS of $1.59 for the third quarter of 2025, an increase from $11.3 million and $1.45 diluted EPS in the second quarter of 2025.

- The company announced a 7% increase in its quarterly cash dividend to $0.31 per share, payable on November 14, 2025, and repurchased 100 shares of common stock at an average price of $52.29 during the third quarter of 2025.

- Deposits totaled $3.0 billion at September 30, 2025, up 2.3% from June 30, 2025, while loans decreased by 2.1% to $2.7 billion over the same period.

- The net interest margin (NIM) expanded to 4.10% in the third quarter of 2025, up from 4.04% in the second quarter of 2025, and the company recorded a $229,000 reversal to the provision for loan losses.

- Nonperforming assets increased to $30.9 million, or 0.88% of total assets, at September 30, 2025, compared to $25.4 million, or 0.73% of total assets, at June 30, 2025.

Quarterly earnings call transcripts for HOME BANCORP.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more