Earnings summaries and quarterly performance for HOPE BANCORP.

Executive leadership at HOPE BANCORP.

Kevin S. Kim

Chief Executive Officer

Angelee J. Harris

General Counsel and Corporate Secretary

Brent Williams

Chief Commercial Banking Officer

Julianna Balicka

Chief Financial Officer

Kyu S. Kim

Chief Relationship Banking Officer

Peter J. Koh

Chief Operating Officer

Thomas P. Stenger

Chief Risk Officer

Board of directors at HOPE BANCORP.

Daisy Y. Ha

Director

Dale S. Zuehls

Lead Independent Director

David P. Malone

Director

Donald D. Byun

Director

Jinho Doo

Director

Joon Kyung Kim

Deputy Lead Independent Director

Lisa K. Pai

Director

Rachel H. Lee

Director

Scott Yoon-Suk Whang

Director

Steven S. Koh

Honorary Chairman

Research analysts who have asked questions during HOPE BANCORP earnings calls.

Gary Tenner

D.A. Davidson & Co.

8 questions for HOPE

Matthew Clark

Piper Sandler

7 questions for HOPE

Kelly Motta

Keefe, Bruyette & Woods

6 questions for HOPE

Timothy Coffey

Janney Montgomery Scott LLC

5 questions for HOPE

Ahmad Hasan

D.A. Davidson & Co.

2 questions for HOPE

Christopher McGratty

Keefe, Bruyette & Woods

2 questions for HOPE

Andrew Steven Leischner

Keefe, Bruyette & Woods

1 question for HOPE

Recent press releases and 8-K filings for HOPE.

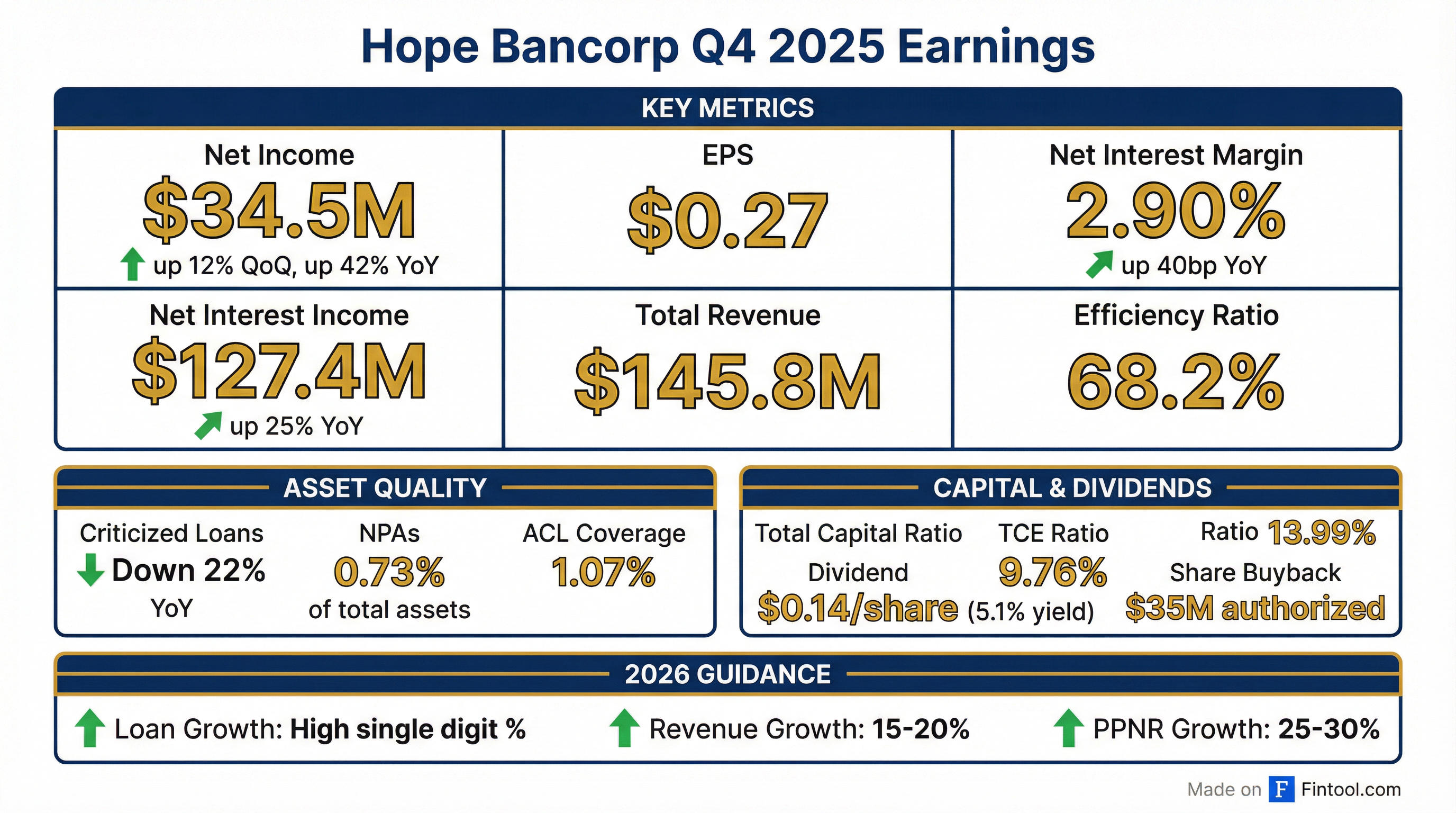

- Hope Bancorp reported net income of $34 million for the fourth quarter of 2025, marking a 42% increase quarter-over-quarter, driven by growth in net interest income, customer fee income, lower provision for credit losses, and lower tax expense.

- At December 31, 2025, gross loans totaled $14.8 billion and deposits reached $15.6 billion.

- The Board of Directors declared a quarterly common stock dividend of $0.14 per share and reinstated a share purchase authorization with $35 million available.

- For 2026, the company anticipates year-over-year pre-provision net revenue growth of 25%-30% and targets loan growth in the high single-digit percentage range.

- The acquisition of Territorial Bancorp closed in April 2025, expanding the company's banking footprint to Hawaii.

- Hope Bancorp reported Q4 2025 GAAP net income of $34.5 million and diluted EPS of $0.27, marking a 12% increase QoQ and 42% YoY. For the full year 2025, net income excluding notable items was $113.3 million or $0.89 per diluted common share.

- The company maintained robust capital ratios with a Total Capital Ratio of 13.99% and a Tangible Common Equity (TCE) Ratio of 9.76% at December 31, 2025. The Board reinstated a share repurchase authorization with $35 million available and declared a quarterly common stock dividend of $0.14 per share.

- Gross loans increased 1% QoQ to $14.8 billion at December 31, 2025, while total deposits were $15.6 billion, down 1% QoQ primarily due to typical fourth-quarter seasonality.

- Asset quality showed improvement, with criticized loans decreasing 6% QoQ to $351 million and the Allowance for Credit Losses (ACL) coverage ratio at 1.07% of loans receivable as of December 31, 2025. Nonperforming assets (NPA) represented 0.73% of total assets.

- Net interest income for Q4 2025 was $127 million, up 1% QoQ, and the net interest margin expanded to 2.90%, up 1 basis point QoQ. Noninterest income also grew 19% QoQ to $18 million.

- Hope Bancorp reported net income of $34 million in Q4 2025, marking a 42% increase quarter-over-quarter, driven by growth in net interest income, customer fee income, and lower credit loss provisions.

- The company's asset quality improved, with criticized loans decreasing 6% quarter-over-quarter to $351 million and net charge-offs at $3.6 million for Q4 2025.

- The Board of Directors declared a quarterly common stock dividend of $0.14 per share and reinstated a $35 million share purchase authorization.

- For 2026, Hope Bancorp expects year-over-year pre-provision net revenue growth of 25%-30% and targets a medium-term return on average assets of approximately 1.2%, high single-digit loan growth, and over 10% annual revenue growth.

- The Territorial Bancorp acquisition, completed in April 2025, expanded the company's footprint to Hawaii and contributed to 8% year-over-year gross loan growth and 9% year-over-year deposit growth.

- Hope Bancorp reported net income of $34 million for the fourth quarter of 2025, marking a 42% increase quarter-over-quarter, driven by growth in net interest income, customer fee income, lower provision for credit losses, and reduced tax expense.

- The company's balance sheet expanded, with gross loans totaling $14.8 billion and deposits at $15.6 billion as of December 31, 2025, both showing year-over-year growth largely due to the Territorial Bancorp acquisition in April 2025.

- The board of directors declared a quarterly common stock dividend of $0.14 per share and reinstated its share purchase authorization, with $35 million available.

- For 2026, Hope Bancorp anticipates year-over-year pre-provision net revenue growth in the range of 25%-30%, excluding notable items, supported by strong fee income growth and expected tailwinds from interest rate dynamics.

- Hope Bancorp reported net income of $34.5 million, or $0.27 per diluted common share, for the fourth quarter of 2025, an increase of 12% quarter-over-quarter. For the full year 2025, net income excluding notable items totaled $113.3 million, or $0.89 per diluted common share, up 10% year-over-year.

- As of December 31, 2025, total assets were $18.53 billion, with gross loans at $14.8 billion and total deposits at $15.6 billion. The company's asset quality improved, with criticized loans decreasing 6% quarter-over-quarter to $351 million and nonperforming assets at $136 million, representing 0.73% of total assets.

- The company maintained strong capital ratios, with a total capital ratio of 13.99% and a tangible common equity (TCE) ratio of 9.76% at December 31, 2025. A quarterly cash dividend of $0.14 per common share was declared, and a $35 million share repurchase authorization was reinstated.

- For full year 2026, Hope Bancorp anticipates approximately high single-digit percentage growth in end-of-period gross loans, 15-20% growth in total revenue (excluding notable items), and 25-30% growth in pre-provision net revenue (excluding notable items).

- Hope Bancorp reported net income of $34.5 million for the fourth quarter of 2025, representing a 12% increase quarter-over-quarter, and $61.6 million for the full year 2025. Diluted earnings per common share were $0.27 for Q4 2025 and $0.49 for the full year 2025.

- Net interest income before provision for credit losses increased by 1% quarter-over-quarter to $127.4 million in Q4 2025, with the net interest margin expanding to 2.90%. Noninterest income also grew by 19% quarter-over-quarter to $18.4 million.

- Total assets stood at $18.53 billion and total deposits at $15.60 billion as of December 31, 2025. Gross loans increased by 1% quarter-over-quarter to $14.79 billion.

- Credit quality improved, with criticized loans decreasing by 6% quarter-over-quarter to $351.1 million at December 31, 2025, and the criticized loan ratio improving to 2.39% of total loans receivable.

- The company completed the acquisition of Territorial Bancorp in April 2025, which expanded its banking footprint to Hawaii.

- Hope Bancorp reported net income of $31 million for the third quarter of 2025, marking a 28% increase year-over-year, and its net interest margin expanded 20 basis points quarter-over-quarter to 2.89%.

- The company achieved loan growth of 1.2% quarter-over-quarter, with gross loans totaling $14.6 billion, and demonstrated significant asset quality improvement, including a 57% reduction in net charge-offs.

- Deposits totaled $15.8 billion as of September 30, 2025, a 1% decrease quarter-over-quarter, primarily due to a $139.5 million reduction in brokered deposits, while non-interest-bearing deposits increased by 1%.

- For the full year 2025, Hope Bancorp anticipates high single-digit loan growth, approximately 10% net interest income growth, and around 30% non-interest income growth (excluding Q2 notable items).

- Hope Bancorp reported net income of $31 million for Q3 2025, a 28% increase year-over-year, and saw its net interest margin expand by 20 basis points quarter-over-quarter to 2.89%.

- The company achieved loan growth of 1.2% quarter-over-quarter, or 5% annualized, across all major segments, while deposits decreased 1% to $15.8 billion, primarily due to a $139.5 million reduction in brokered deposits.

- Asset quality improved significantly, with a 57% reduction in net charge-offs and a 10% decline in criticized loans to $373 million at September 30, 2025.

- For the full year 2025, the company projects high single-digit loan growth, approximately 10% net interest income growth, and about 30% non-interest income growth (excluding a Q2 securities repositioning loss).

- A quarterly common stock dividend of $0.14 per share was declared, payable on November 21st to stockholders of record as of November 7th, 2025.

- Hope Bancorp reported net income of $31 million for the third quarter of 2025, marking a 28% increase year-over-year from $24 million in Q3 2024, and a significant improvement from a net loss of $28 million in the second quarter of 2025.

- The company achieved loan growth across all major segments, with gross loans totaling $14.6 billion as of September 30, 2025, representing a 1.2% increase quarter-over-quarter.

- Asset quality showed significant improvement, with a 57% reduction in net charge-offs to $5 million for Q3 2025, and criticized loans declining 10% quarter-over-quarter to $373 million.

- Net interest margin expanded by 20 basis points quarter-over-quarter to 2.89% in Q3 2025, which was the best linked-quarter expansion since 2012.

- For the full year 2025, Hope Bancorp anticipates high single-digit loan growth and approximately 10% net interest income growth.

- Hope Bancorp reported diluted earnings per share (EPS) of $0.24 for Q3 2025, or $0.25 excluding notable items.

- Gross loans increased by 1.2% quarter-over-quarter to $14.6 billion, and total deposits were $15.8 billion as of September 30, 2025.

- Net interest income grew 8% quarter-over-quarter to $127 million, with the net interest margin expanding by 20 basis points quarter-over-quarter to 2.89% in Q3 2025.

- Nonperforming assets totaled $112 million, representing 0.61% of total assets at September 30, 2025.

- The company updated its full-year 2025 outlook, projecting net interest income growth of approximately 10% and noninterest income growth of approximately 30%.

Quarterly earnings call transcripts for HOPE BANCORP.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more