Earnings summaries and quarterly performance for Immunovant.

Executive leadership at Immunovant.

Board of directors at Immunovant.

Research analysts who have asked questions during Immunovant earnings calls.

Brian Cheng

JPMorgan Chase & Co.

4 questions for IMVT

Yasmeen Rahimi

Piper Sandler & Co.

4 questions for IMVT

Alexander Thompson

Stifel

2 questions for IMVT

Alex Thompson

Stifel Financial Corp.

2 questions for IMVT

Andy Chan

Wolfe Research

2 questions for IMVT

Anthea Li

Jefferies

2 questions for IMVT

Ashwani Verma

UBS Group AG

2 questions for IMVT

Corinne Jenkins

Goldman Sachs

2 questions for IMVT

David Risinger

Leerink Partners

2 questions for IMVT

Derek Archila

Wells Fargo

2 questions for IMVT

Douglas Tsao

H.C. Wainwright & Co.

2 questions for IMVT

Louise Chen

Cantor Fitzgerald

2 questions for IMVT

Prakhar Agrawal

Cantor Fitzgerald

2 questions for IMVT

Samantha Lynn Semenkow

Citigroup

2 questions for IMVT

Samantha Semenkow

Citigroup Inc.

2 questions for IMVT

Samuel Slutsky

LifeSci Capital

2 questions for IMVT

Thomas Smith

Leerink Partners

2 questions for IMVT

Yaron Werber

TD Cowen

2 questions for IMVT

Yatin Suneja

Guggenheim Partners

2 questions for IMVT

Andy Chen

Wolfe Research, LLC

1 question for IMVT

Miriam Funt

JPMorgan Chase & Co.

1 question for IMVT

Recent press releases and 8-K filings for IMVT.

- Immunovant announced positive Phase 2 results for Brepo in cutaneous sarcoidosis (CS), with the 45mg arm demonstrating a 100% response rate (at least a 10-point improvement in CSAMI) and a favorable safety profile with no serious adverse events. A Phase 3 study for Brepo in CS is planned to start in 2026.

- The New Drug Application (NDA) for Brepo in dermatomyositis (DM) has been submitted. Additionally, Phase 2B studies for IMVT-1402 in D2T-RA and mosliciguat in PH-ILD are fully enrolled, with data expected in the second half of 2026.

- The company reported a strong financial position with $4.5 billion in consolidated cash as of Q3 2026.

- A jury trial against Moderna is scheduled for March 9th, following a favorable decision on Section 1498.

- Roivant announced positive Phase 2 results for brepocitinib in cutaneous sarcoidosis, demonstrating a 21.6-point placebo-adjusted delta in CSAMI activity score and 100% of patients on the 45mg dose achieving at least a 10-point improvement.

- The NDA for brepocitinib in dermatomyositis has been submitted, and the Phase 2B study for IMVT-1402 in DGTRA and the Phase 2 study for Moseley in PHLD are fully enrolled.

- For the third quarter ended December 31, 2025, Roivant reported a non-GAAP net loss of $167 million, with adjusted non-GAAP R&D expenses of $147 million and adjusted non-GAAP G&A expenses of $71 million.

- The company holds a strong consolidated cash position of $4.5 billion and expects a catalyst-rich 2026, including pivotal readouts, additional clinical data, and the jury trial against Moderna.

- Roivant announced positive Phase 2 results for brepocitinib (BREPA) in cutaneous sarcoidosis, demonstrating a placebo-adjusted 21.6-point delta in CSAMI and a 100% response rate for the 45mg arm, with the drug being well-tolerated.

- The company plans to initiate a Phase 3 study for BREPA in cutaneous sarcoidosis in 2026 and has submitted the NDA for BREPA in dermatomyositis.

- Roivant anticipates a catalyst-rich 2026, with upcoming pivotal readouts for BREPA NIU, Phase 2b data for mosliciguat, DTT-RA data, and proof of concept data for 1402 in CLE.

- The company reported a strong financial position with $4.5 billion of consolidated cash as of Q3 2026, providing ample capital for future endeavors.

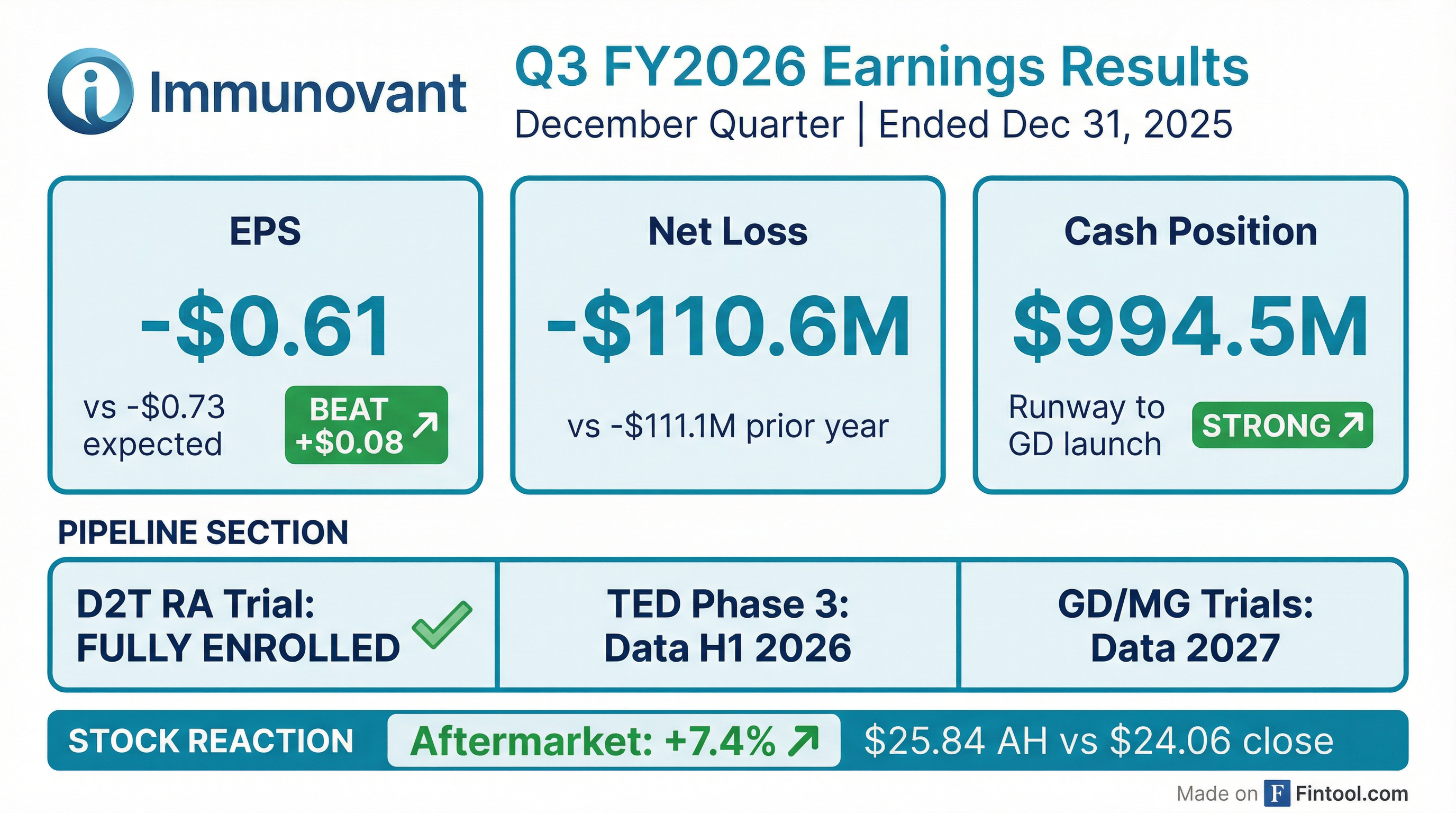

- Immunovant reported a net loss of $110.6 million or $0.61 per common share for the third quarter ended December 31, 2025.

- As of December 31, 2025, the company's cash and cash equivalents totaled $994.5 million. A recent underwritten financing generated approximately $550 million in gross proceeds, extending the cash runway to the potential launch of IMVT-1402 in Graves' disease.

- The potentially registrational trial for IMVT-1402 in difficult-to-treat rheumatoid arthritis (D2T RA) is fully enrolled, with topline data expected in the second half of calendar year 2026.

- Topline data from two Phase 3 studies evaluating batoclimab as a treatment for active, moderate to severe thyroid eye disease (TED) are anticipated in the first half of calendar year 2026.

- Immunovant reported a net loss of $110.6 million ($0.61 per common share) for the third quarter ended December 31, 2025, with cash and cash equivalents totaling $994.5 million as of the same date.

- The company completed an underwritten financing in December 2025, generating approximately $550 million in gross proceeds, which extends its cash runway to the potential launch of IMVT-1402 in Graves' disease.

- The potentially registrational trial for IMVT-1402 in difficult-to-treat rheumatoid arthritis (D2T RA) is fully enrolled, with topline data expected in the second half of calendar year 2026.

- Immunovant anticipates sharing topline data from two Phase 3 studies for batoclimab in thyroid eye disease (TED) in the first half of calendar year 2026.

- The generalized myasthenia gravis (gMG) market in the 7MM (US, EU4, UK, and Japan) is expected to show positive growth during the forecast period (2025–2034), primarily driven by the anticipated launch of novel immunotherapies.

- The United States accounts for the largest market size of gMG among these leading markets.

- In 2024, there were approximately 205,000 prevalent gMG cases in the 7MM, with projections indicating a growing trend.

- Key emerging therapies anticipated to enter the market include Descartes-08 (Cartesian Therapeutics), FABHALTA (iptacopan) (Novartis), and Claseprubart (DNTH103) (Dianthus Therapeutics).

- Immunovant, Inc. entered into an underwriting agreement with Leerink Partners LLC on December 10, 2025, for the issuance and sale of 26,200,000 shares of its common stock.

- The shares were offered at a price of $21.00 per share.

- The offering closed on December 12, 2025, generating approximately $550 million in gross proceeds before deducting underwriting discounts and other expenses.

- Roivant Sciences Ltd., the company's controlling stockholder, participated in the offering.

- Immunovant, Inc. announced the pricing of an underwritten offering of its common stock, with anticipated gross proceeds of approximately $550 million, expected to close around December 12, 2025.

- The company expects its existing cash and the proceeds from the offering to fund operating expenses and capital expenditures through the potential commercial launch of IMVT-1402 in the Graves' Disease indication.

- Initial and top-line results for the potentially registrational trial of IMVT-1402 in difficult-to-treat rheumatoid arthritis (D2T RA) are expected in 2026, while top-line results for the two potentially registrational trials of IMVT-1402 in Graves' Disease are anticipated in 2027.

- Immunovant has commenced discussions with HanAll regarding the potential return of certain rights for batoclimab, which could lead to a dispute, arbitration, or litigation.

- Immunovant announced the pricing of an underwritten offering of its common stock, with anticipated gross proceeds of approximately $550 million.

- The offering consists of 26.2 million shares at an offering price of $21.00 per share.

- Roivant Sciences Ltd., Immunovant’s controlling stockholder, has agreed to purchase shares in the offering.

- The company expects these proceeds, combined with existing cash, to fund its operations through the potential commercial launch of IMVT-1402 in the Graves’ Disease indication.

- The offering is expected to close on or about December 12, 2025.

- Immunovant reported a strong capital position for Q2 2026 with $4.4 billion of cash and cash equivalents and no debt, alongside a $166 million loss from continuing operations, net of tax.

- The company announced positive Valor data for BREPO in dermatomyositis (DM), with an NDA filing planned for the first half of next year, aiming to be the first novel oral therapeutic in DM if approved.

- Durable remission data for batoclimab in Graves' disease demonstrated disease-modifying potential, and the company has initiated multiple potentially registrational trials for IMVT-1402 in various indications, with a pipeline of 11 potentially registrational trials.

- Legal proceedings include a favorable marketing ruling in the Pfizer case and a jury trial in the Moderna case scheduled for March 2026. An Investor Day is scheduled for December 11 to discuss future strategy.

Quarterly earnings call transcripts for Immunovant.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more