Earnings summaries and quarterly performance for ITRON.

Executive leadership at ITRON.

Tom Deitrich

President and Chief Executive Officer

Christopher Ware

Senior Vice President, General Counsel and Corporate Secretary

Donald Reeves

Senior Vice President, Outcomes

Joan Hooper

Senior Vice President and Chief Financial Officer

John Marcolini

Senior Vice President, Networked Solutions

Justin Patrick

Senior Vice President, Device Solutions

Board of directors at ITRON.

Research analysts who have asked questions during ITRON earnings calls.

Jeffrey Osborne

TD Cowen

6 questions for ITRI

Noah Kaye

Oppenheimer & Co. Inc.

6 questions for ITRI

Scott Graham

Seaport Research Partners

6 questions for ITRI

Chip Moore

EF Hutton

5 questions for ITRI

Ben Kallo

Robert W. Baird & Co.

4 questions for ITRI

Joseph Osha

Guggenheim Partners

4 questions for ITRI

Austin Moeller

Canaccord Genuity

3 questions for ITRI

Mark W. Strouse

J.P. Morgan Chase & Co.

3 questions for ITRI

Davis Sunderland

Baird

2 questions for ITRI

Alfred Moore

C.L. King & Associates

1 question for ITRI

Kashy Harrison

Piper Sandler

1 question for ITRI

Martin Malloy

Johnson Rice

1 question for ITRI

Moses Sutton

BNP Paribas

1 question for ITRI

Pavel Molchanov

Raymond James

1 question for ITRI

Recent press releases and 8-K filings for ITRI.

- Itron, Inc. announced the pricing of an upsized $700.0 million aggregate principal amount of 0.00% convertible senior notes due 2032, with an option for initial purchasers to buy an additional $105.0 million.

- The notes will not bear regular interest and are expected to settle on February 26, 2026.

- The initial conversion price is approximately $123.77 per share, representing a 30.0% conversion premium over the common stock's last reported sale price of $95.21 per share on February 23, 2026.

- Itron plans to use approximately $100.0 million of the net proceeds to repurchase 1,050,309 shares of its common stock and the remainder for repayment of its 0.00% Convertible Senior Notes due 2026 and general corporate purposes.

- Itron, Inc. priced an upsized private offering of $700.0 million aggregate principal amount of its 0.00% convertible senior notes due 2032, with settlement expected on February 26, 2026.

- The notes feature an initial conversion price of approximately $123.77 per share, representing a 30.0% premium over the common stock's last reported sale price of $95.21 per share on February 23, 2026.

- The company expects to use approximately $80.7 million of the net proceeds for capped call transactions and $100.0 million to repurchase 1,050,309 shares of its common stock concurrently with the pricing.

- The remainder of the proceeds will be allocated to the repayment of Itron's 0.00% Convertible Senior Notes due 2026 and for general corporate purposes.

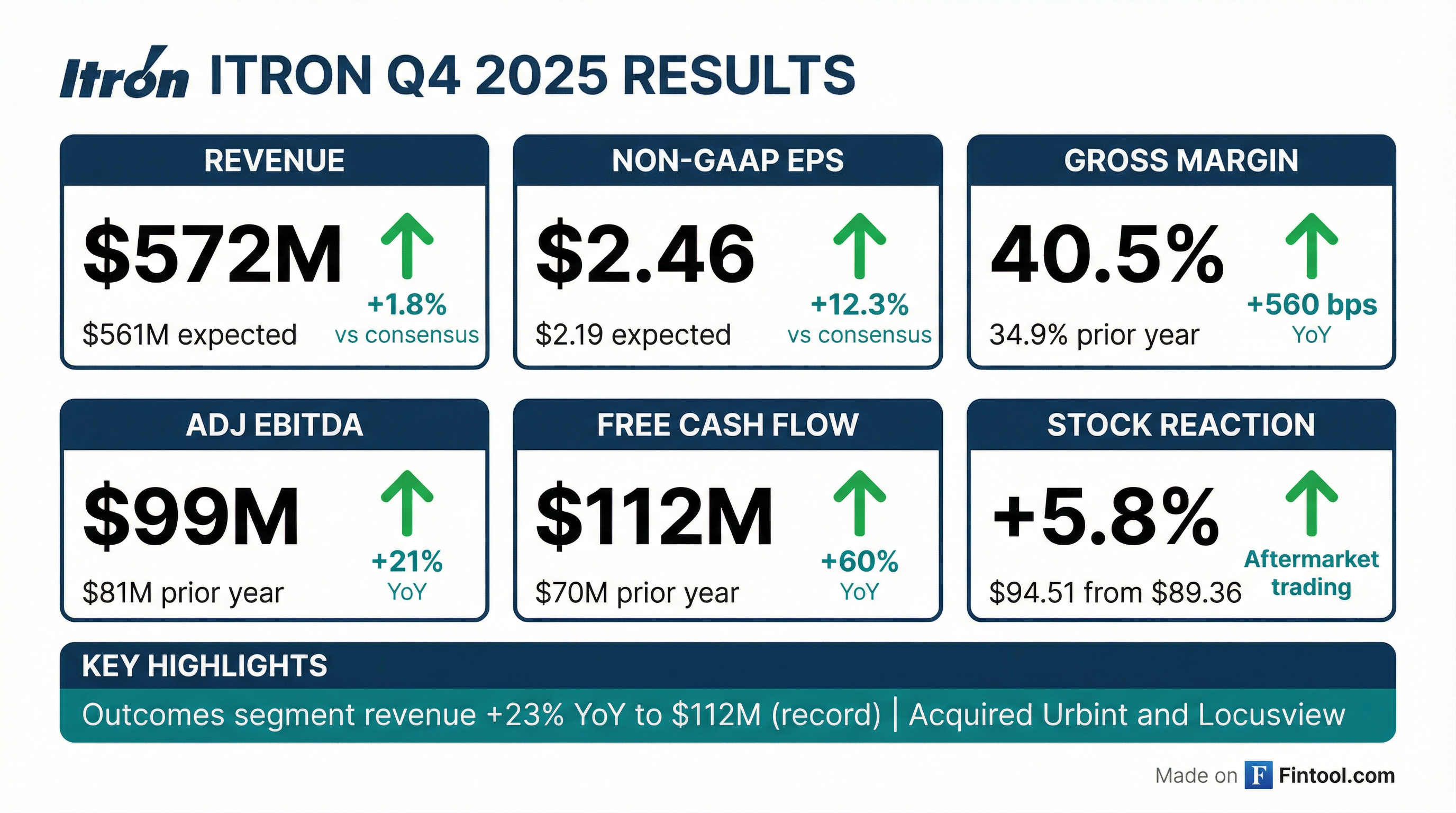

- Itron reported record financial results for Q4 2025, including revenue of $572 million, adjusted EBITDA of $99 million, and non-GAAP EPS of $2.46. Full year 2025 also achieved record adjusted EBITDA of $374 million and non-GAAP EPS of $7.13.

- The company secured Q4 bookings of $737 million, leading to a total backlog of $4.5 billion at quarter-end, with a record backlog in its Outcomes segment. Annual Recurring Revenue (ARR) grew 20% year-over-year to $368 million by the end of 2025.

- Itron expanded its portfolio by acquiring Urbint (closed Q4 2025) and Locusview (closed Q1 2026), establishing a new Resiliency Solutions reporting segment.

- For full year 2026, Itron projects revenue between $2.35 billion and $2.45 billion and non-GAAP EPS of $5.75 to $6.25. The recent acquisitions are anticipated to be dilutive to 2026 EPS by approximately $0.38 per share, becoming accretive by the end of 2027.

- Itron reported Q4 2025 revenue of $572 million and full year 2025 revenue of $2.4 billion.

- For Q4 2025, non-GAAP diluted EPS was $2.46 and adjusted EBITDA was $99 million. For the full year 2025, non-GAAP diluted EPS was $7.13 and adjusted EBITDA was $374 million, both setting annual records.

- The company recorded Q4 2025 bookings of $0.7 billion and an ending backlog of $4.5 billion.

- Itron provided 2026 revenue guidance of $2.35 - $2.45 billion and non-GAAP diluted EPS guidance of $5.75 - $6.25.

- The Outcomes segment achieved a record $112 million revenue with 23% year-over-year growth in Q4 2025, and a new Resiliency Solutions segment was formed to include Urbint and Locusview acquisitions.

- Itron achieved record financial performance for Q4 and full year 2025, with Q4 non-GAAP diluted EPS reaching $2.46 and full year non-GAAP EPS at $7.13. The company also reported record gross margin, adjusted EBITDA, and free cash flow for both periods.

- Annual Recurring Revenue (ARR) grew 20% year-over-year to $368 million at the end of Q4 2025, and the Outcomes backlog surpassed $1 billion, representing a 58% year-over-year increase. Q4 2025 bookings were $737 million.

- The company completed the acquisition of Urbint for $325 million in Q4 2025 and Locusview for $525 million in Q1 2026, which are expected to be dilutive to 2026 EPS by approximately $0.38 per share but accretive by the end of 2027.

- For full year 2026, Itron anticipates revenue between $2.35 billion and $2.45 billion and non-GAAP EPS between $5.75 and $6.25.

- Itron reported record Q4 2025 non-GAAP EPS of $2.46 on $572 million in revenue, contributing to full-year 2025 non-GAAP EPS of $7.13 and $2.37 billion in revenue.

- Q4 bookings reached $737 million, with the total backlog standing at $4.5 billion and a record Outcomes backlog exceeding $1 billion. Annual Recurring Revenue (ARR) grew 20% year-over-year to $368 million by the end of 2025.

- The company completed the acquisitions of Urbint and Locusview, forming a new Resiliency Solutions segment that contributed $3 million in Q4 2025 revenue. These acquisitions are expected to be dilutive to 2026 EPS by approximately $0.38 per share but accretive by the end of 2027.

- Itron provided full-year 2026 revenue guidance of $2.35 billion to $2.45 billion and non-GAAP EPS guidance of $5.75 to $6.25 per diluted share.

- Management noted a normalization of utility ordering patterns and continued strong demand for Grid Edge Intelligence, with pipeline growth up 27% year-over-year.

- Itron reported Q4 2025 revenue of $572 million (down 7%) and full-year 2025 revenue of $2.4 billion (down 3%), while achieving record financial results including GAAP diluted EPS of $2.21 and Non-GAAP diluted EPS of $2.46 for Q4, driven by 23% growth in Outcomes revenue.

- The company announced the acquisition of Urbint and Locusview, with the Locusview acquisition closing in January 2026 for $525 million, aimed at enhancing AI software solutions and recurring revenue.

- Itron provided a full-year 2026 financial outlook with revenue projected between $2.35 to $2.45 billion and Non-GAAP diluted EPS between $5.75 to $6.25.

- Itron and Pacific Gas and Electric Company (PG&E) are expanding their collaboration to integrate and deploy Itron’s Grid Edge Intelligence solutions.

- The initiative aims to make home electrification, including EV charging, easier and more affordable for customers by enabling devices to automatically adjust charging speeds based on home electrical limits and local grid conditions, potentially avoiding costly electrical upgrades.

- This collaboration will enhance grid management by providing real-time grid awareness, wildfire mitigation capabilities, and improved load management for PG&E.

- PG&E intends to install up to 1,000 new Itron devices through 2026, with plans for scaling to hundreds of thousands of devices.

- SEEQC has established a US-Taiwan quantum technology ecosystem through strategic partnerships with Kinpo Group, Industrial Technology Research Institute (ITRI), and National Taiwan University to accelerate the commercialization of its single flux quantum (SFQ)-based quantum computing platform.

- The collaborations involve Kinpo Group developing scalable room-temperature electronic systems and acting as a strategic investor, ITRI supporting superconducting chip manufacturing and mass production, and National Taiwan University (along with UC Berkeley) advancing high-speed CMOS interface technology for SEEQC's SFQ processors.

- SEEQC completed a new round of equity financing with participation from Taiwanese strategic partners.

- SEEQC will retain its core quantum architecture and intellectual property in the United States while strategically leveraging Taiwan's world-class capabilities in semiconductor and electronics manufacturing.

- The global smart meter market was valued at USD 30.19 billion in 2025 and is projected to reach USD 112.71 billion by 2035, growing at a CAGR of 14.08% during the forecast period of 2026–2035.

- Hardware components are the primary revenue driver, accounting for 62.99% of the total market value in 2025.

- Itron Inc. achieved full-year revenue of USD 2.4 billion for 2024, with its total backlog reaching a record USD 4.7 billion and new bookings of USD 2.7 billion in the same year.

- Itron posted a net income of USD 239 million and free cash flow of USD 208 million for the full year 2024, and projects Q1 2025 revenue of at least USD 610 million.

Quarterly earnings call transcripts for ITRON.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more