Earnings summaries and quarterly performance for LIQUIDITY SERVICES.

Executive leadership at LIQUIDITY SERVICES.

William P. Angrick, III

Chief Executive Officer

John P. Daunt

Chief Commercial Officer

Jorge A. Celaya

Chief Financial Officer

Mark A. Shaffer

Chief Legal Officer and Corporate Secretary

Novelette Murray

Chief Human Resources Officer

Steven J. Weiskircher

Chief Technology Officer

Board of directors at LIQUIDITY SERVICES.

Research analysts who have asked questions during LIQUIDITY SERVICES earnings calls.

Gary Prestopino

Barrington Research

6 questions for LQDT

George Sutton

Craig-Hallum

5 questions for LQDT

Gary Prespettino

Barrington Research

1 question for LQDT

Gary Prestipino

Barrington

1 question for LQDT

Logan Zuanich

Craig-Hallum Capital Group LLC

1 question for LQDT

Recent press releases and 8-K filings for LQDT.

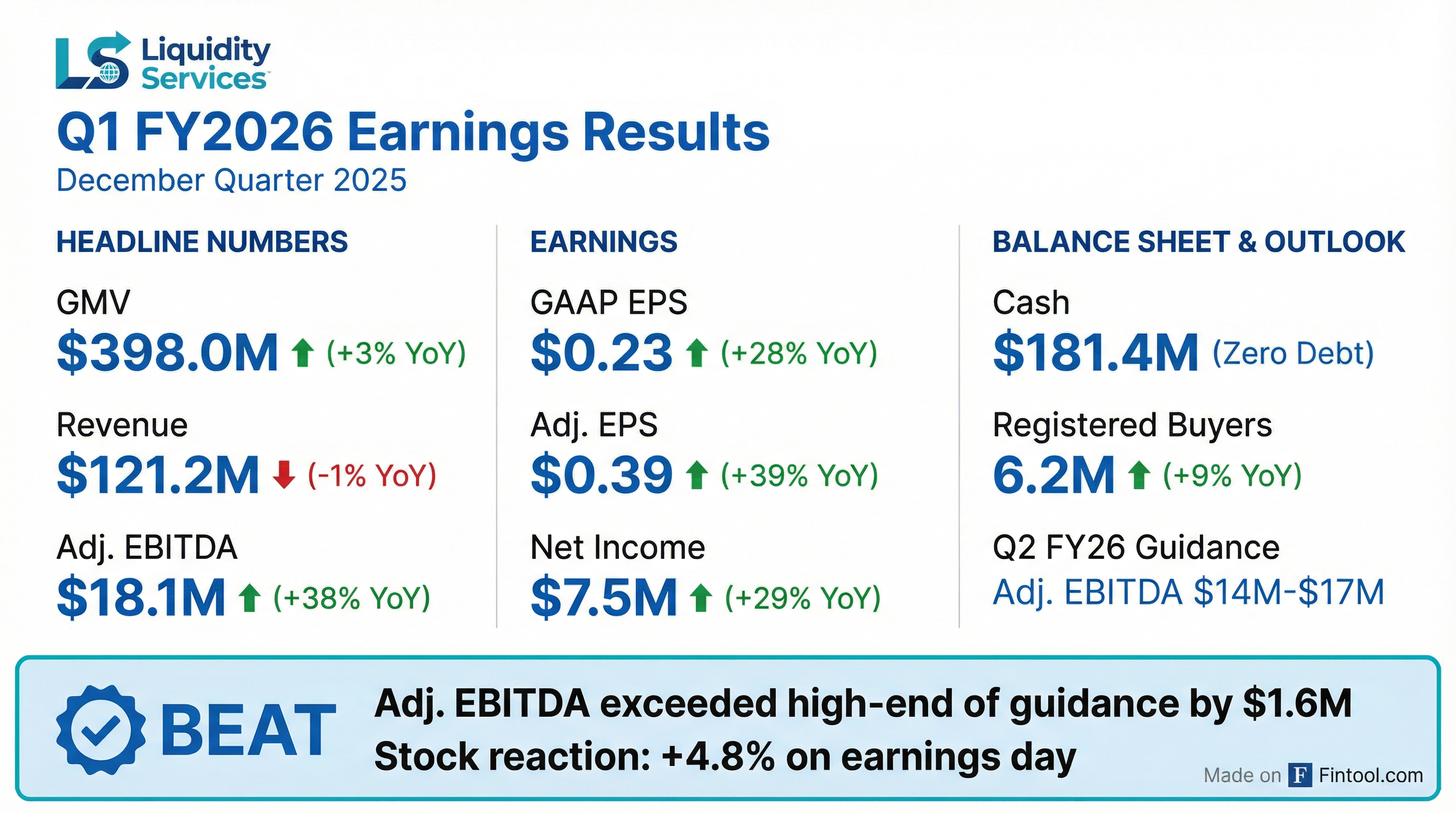

- Liquidity Services reported strong financial results for Q1 fiscal year 2026, with consolidated gross merchandise volume (GMV) increasing 3% to $398 million and non-GAAP adjusted EBITDA growing 38% year-over-year to $18.1 million.

- The company achieved adjusted EPS of $0.39, up 39% year-over-year, and ended the quarter with $181.4 million in cash and no financial debt.

- Key segments demonstrated growth, with GovDeals GMV up 7% and direct profit up 13%, driven by over 500 new agency clients. The Heavy Equipment category also saw significant expansion with 27% year-over-year organic GMV growth.

- For Q2 fiscal year 2026, Liquidity Services anticipates GMV to range from $375 million to $450 million and non-GAAP adjusted EBITDA to be between $14 million and $17 million, reflecting expected double-digit growth.

- Liquidity Services (LQDT) reported strong Q1 fiscal year 2026 results, with non-GAAP adjusted EBITDA increasing 38% year-over-year to $18.1 million and adjusted EPS growing 39% year-over-year to $0.39. The company ended the quarter with $181.4 million in cash and no financial debt.

- The company repurchased $1.5 million of shares during Q1 fiscal year 2026, with $15 million remaining on its authorization.

- Key segments showed robust performance, including GovDeals achieving 7% GMV growth and the Heavy Equipment category seeing 27% year-over-year organic GMV growth. The company also added an all-time record of over 500 new agency clients for GovDeals.

- For Q2 fiscal year 2026, Liquidity Services provided guidance expecting non-GAAP adjusted EBITDA to range from $14 million to $17 million and non-GAAP adjusted diluted EPS from $0.29 to $0.38.

- Liquidity Services reported a strong start to fiscal year 2026, with Q1 non-GAAP Adjusted EBITDA increasing 38% year-over-year to $18.1 million and adjusted EPS growing 39% to $0.39 per share. Consolidated gross merchandise volume (GMV) rose 3% to $398 million, while GAAP revenue was flat.

- The company maintained a strong financial position, closing Q1 with $181.4 million in cash and no financial debt. It also conducted $1.5 million in share repurchases, with $15 million remaining on the authorization.

- Key segments showed robust performance, with GovDeals delivering 7% GMV growth and 13% direct profit growth, and the heavy equipment category achieving 27% year-over-year organic GMV growth. Machinio and Software Solutions also reported 27% revenue growth.

- For Q2 fiscal year 2026, Liquidity Services anticipates GMV between $375 million-$450 million, non-GAAP adjusted diluted EPS from $0.29-$0.38, and non-GAAP Adjusted EBITDA ranging from $14 million-$17 million.

- Liquidity Services reported Q1 FY26 consolidated Gross Merchandise Volume (GMV) of $398 million, revenue of $121 million, and Non-GAAP Adjusted EBITDA of $18.078 million.

- For Q1 FY26, the company's total marketplace saw buyer registrations increase by 9% over the prior year, with D2C GMV up 40% year-over-year and heavy equipment category GMV up 27% year-over-year.

- Segment performance in Q1 FY26 included GovDeals GMV of $226.9 million, RSCG GMV of $113.5 million, and Machinio & Software Solutions revenue of $5.5 million.

- Liquidity Services reported Q1 FY26 financial results for the quarter ended December 31, 2025, with Gross Merchandise Volume (GMV) of $398.0 million, up 3%, and Revenue of $121.2 million, down 1%.

- For Q1 FY26, GAAP Net Income increased 29% to $7.5 million (or $0.23 diluted EPS) and Non-GAAP Adjusted EBITDA increased 38% to $18.1 million (or $0.39 Non-GAAP Adjusted EPS).

- The company ended Q1 FY26 with cash balances of $181.4 million and zero financial debt.

- Liquidity Services provided Q2 FY26 guidance, projecting GMV between $375 million and $415 million, GAAP Net Income between $6.5 million and $9.5 million, and Non-GAAP Adjusted EBITDA between $14.0 million and $17.0 million.

- As of December 31, 2025, the company had $15.0 million in remaining authorization to repurchase shares.

- Liquidity Services reported Q1 FY2026 financial results with Revenue of $121.2 million, a 1% decrease from the prior year, and GAAP Net Income of $7.5 million, an increase of 29%.

- Non-GAAP Adjusted EBITDA for Q1 FY2026 increased 38% to $18.1 million, with GAAP Diluted EPS at $0.23 (up 28%) and Non-GAAP Adjusted EPS at $0.39 (up 39%).

- The company ended the quarter with $181.4 million in cash balances and zero financial debt.

- For Q2 FY2026, Liquidity Services provides guidance anticipating GMV between $375 million and $415 million, GAAP Net Income between $6.5 million and $9.5 million, and Non-GAAP Adjusted EBITDA between $14.0 million and $17.0 million.

- Liquidity Services (LQDT) announced strong financial results for Q4 and fiscal year 2025, with Q4 adjusted EBITDA increasing 28% and adjusted EPS rising 16% year-over-year, both above guidance. For the full fiscal year 2025, the company achieved a record $1.57 billion in GMV and $60.8 million in adjusted EBITDA, up 25% year-over-year.

- The company issued guidance for Q1 fiscal year 2026, projecting GMV between $370 million and $405 million, non-GAAP adjusted diluted EPS from $0.25 to $0.35, and non-GAAP adjusted EBITDA from $13.5 million to $16.5 million.

- Strategic initiatives contributing to growth include a focus on higher-margin consignment services and software solutions, the integration of a new payment solution, and the deployment of AI-assisted technologies to improve efficiency and customer experience.

- LQDT ended Q4 2025 with a robust balance sheet, holding $185.8 million in cash and zero debt, and authorized an additional $15 million for share repurchases.

- Liquidity Services reported strong financial performance for fiscal year 2025, with annual revenue of $477 million, annual Gross Merchandise Volume (GMV) of $1571 million, and annual Non-GAAP Adjusted EBITDA of $60.8 million. For Q4 2025, revenue was $118 million, GMV was $404 million, and Non-GAAP Adjusted EBITDA was $18.5 million.

- The company achieved significant marketplace growth in Q4 2025, including a 9% increase in buyer registrations year-over-year, bringing the total to over 6.0 million registered buyers.

- Fiscal Year 2025 highlights included a record 4.1 million auction participants and the company surpassed $15 billion in cumulative GMV.

- Key segments achieved record quarterly direct profits in Q4 2025, with GovDeals reaching $22.3 million and Liquidation.com reaching $20.3 million.

- Liquidity Services reported strong Q4 2025 results with GMV up 12% to $404.5 million, revenue up 10% to $118.1 million, and adjusted EBITDA up 28% to $18.5 million year-over-year. For the full fiscal year 2025, the company achieved a record $1.57 billion in GMV and $60.8 million in adjusted EBITDA, marking its highest EBITDA in 11 years.

- The company generated $59 million of free cash flow in fiscal 2025 and ended Q4 2025 with $185.8 million in cash and zero debt, providing flexibility for strategic plans and M&A opportunities.

- Strategic initiatives in fiscal 2025 included the integration of a new payment solution, deployment of AI-assisted technologies, expansion of the GovDeals and CAG heavy equipment segments, and the launch of the Retail Rush consumer auction channel.

- For Q1 fiscal year 2026, Liquidity Services expects GMV to range from $370 million to $405 million, and non-GAAP adjusted EBITDA to range from $13.5 million to $16.5 million. The board also authorized an additional $15 million for share repurchases.

- Liquidity Services reported strong Q4 2025 results, with GMV up 12% to $404.5 million, revenue up 10% to $118.1 million, and adjusted EBITDA up 28% to $18.5 million year-over-year. For the full fiscal year 2025, the company achieved a record $1.57 billion in GMV and $60.8 million in adjusted EBITDA, marking its highest EBITDA in 11 years.

- The company's growth reflects its RISE strategy, prioritizing low-touch consignment services and software solutions, with every business segment growing both top and bottom line in FY 2025. The GovDeals segment achieved a record $903 million in GMV, and the CAG heavy equipment fleet category grew 35% organically.

- LQDT demonstrated strong profitability with Q4 adjusted EBITDA margins at 32.8% and generated $59 million in free cash flow for FY 2025. The company ended Q4 2025 with $185.8 million in cash and zero debt, and authorized an additional $15 million for share repurchases.

- For Q1 2026, Liquidity Services expects GMV to range from $370 million to $405 million, and non-GAAP adjusted EBITDA to range from $13.5 million to $16.5 million. The company aims for midterm goals of $2 billion in annual GMV and $100 million in annual adjusted EBITDA.

Quarterly earnings call transcripts for LIQUIDITY SERVICES.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more