Earnings summaries and quarterly performance for MARKEL GROUP.

Executive leadership at MARKEL GROUP.

Thomas S. Gayner

Chief Executive Officer

Brian J. Costanzo

Chief Financial Officer

Michael R. Heaton

Executive Vice President and Chief Operating Officer

Richard R. Grinnan

Senior Vice President, Chief Legal Officer and Secretary

Simon Wilson

Chief Executive Officer, Markel Insurance

Board of directors at MARKEL GROUP.

A. Lynne Puckett

Director

Diane Leopold

Director

Greta J. Harris

Director

Harold L. Morrison, Jr.

Director

Jonathan E. Michael

Director

Lawrence A. Cunningham

Director

Mark M. Besca

Director

Michael O’Reilly

Lead Independent Director

Morgan E. Housel

Director

Steven A. Markel

Chairman of the Board

Research analysts who have asked questions during MARKEL GROUP earnings calls.

Andrew Andersen

Jefferies

7 questions for MKL

Andrew Kligerman

TD Cowen

7 questions for MKL

Mark Hughes

Truist Securities

5 questions for MKL

Scott Heleniak

RBC Capital Markets

2 questions for MKL

Charles Gold

Truist Financial Corporation

1 question for MKL

John Fox

Fenimore Asset Management

1 question for MKL

Maxwell Fritscher

Truist Financial Corporation

1 question for MKL

Maxwell Fritzsche

Truist Securities

1 question for MKL

Tom Litke

Citadel

1 question for MKL

Recent press releases and 8-K filings for MKL.

- Markel Group reported a 10% increase in consolidated adjusted operating income to $2.3 billion for the full year 2025, with operating cash flow growing to $2.8 billion.

- The Markel Insurance segment delivered $1.4 billion in adjusted operating income and a 94.6% combined ratio for 2025, achieving a 14% return on equity. The company also exited underperforming businesses, notably reinsurance, in 2025.

- Other segments also contributed positively, with the financial segment's adjusted operating income increasing 25% to $327 million, industrial earning $343 million, and consumer and other delivering $175 million.

- The company actively managed capital, deploying $1.4 billion in fixed maturity net purchases and repurchasing $430 million of its common shares, while increasing its cash balance by $411 million.

- Looking into 2026, the insurance pricing environment is mixed, with softening in U.S. property and London wholesale markets contrasted by continued rate increases in the casualty market.

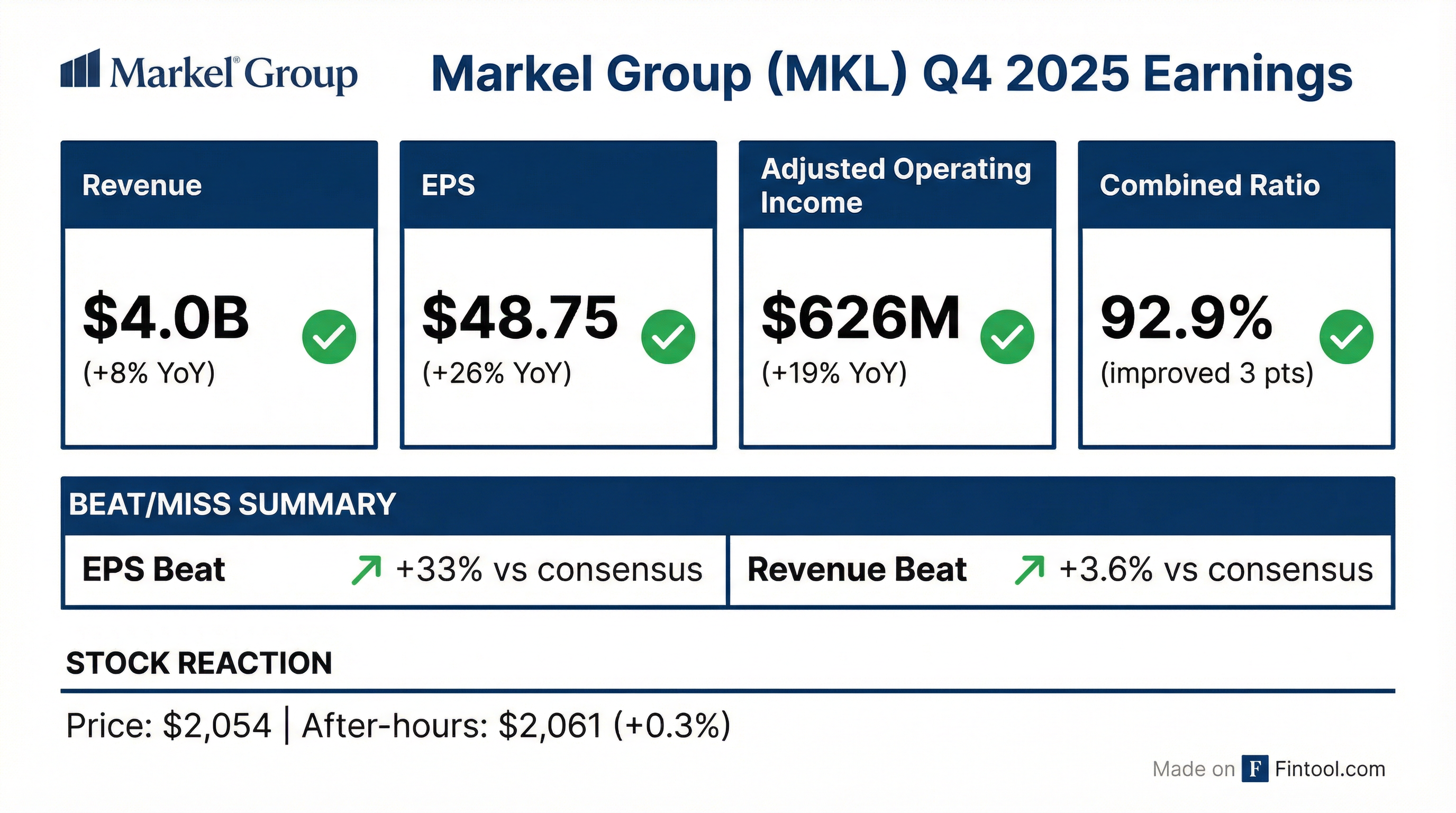

- Markel Group's consolidated operating revenues were up 8% for Q4 2025 and 5% for the full year 2025, with adjusted operating income increasing 19% to $626 million for the quarter and 10% to $2.3 billion for the full year.

- Markel Insurance achieved a 92.9% combined ratio in Q4 2025 and 94.6% for the full year, contributing $399 million and $1.4 billion in adjusted operating income for the respective periods. The segment's return on equity for 2025 was 14%.

- The Financial segment's adjusted operating income grew 25% to $327 million in 2025, while the Industrial segment earned $343 million, and Consumer and Other delivered $175 million.

- The company's operating cash flow increased to $2.8 billion in 2025, and it repurchased $430 million of common shares.

- For 2026, Markel Group anticipates a decrease of approximately $2 billion in underwriting gross written premiums due to the exit of its Global Reinsurance business and the transition of the Hagerty partnership to a pure fronting model, changes expected to benefit future combined ratio, adjusted operating income, and return on equity.

- Markel Group reported a 10% increase in adjusted operating income to $2.3 billion for the full year 2025, up from $2.1 billion in 2024, with consolidated operating revenues up 5% for the year and operating cash flow growing to $2.8 billion.

- Markel Insurance achieved a 92.9% combined ratio in Q4 2025 and $1.4 billion in adjusted operating income for the full year, marking a 14% return on equity for 2025 and 21 consecutive years of favorable reserve development.

- The financial segment's adjusted operating income grew 25% to $327 million, while the industrial segment earned $343 million, and consumer and other delivered $175 million, up from $145 million last year.

- The company returned capital to shareholders by repurchasing $430 million of common shares and redeeming $600 million in preferred shares during 2025.

- Markel Group Inc. reported operating revenues of $15.51 billion for the year ended December 31, 2025, an increase of 5% from the prior year, and adjusted operating income of $2.30 billion, up 10% year-over-year.

- For the fourth quarter of 2025, operating revenues increased 8% and adjusted operating income grew 19%.

- The Markel Insurance segment's adjusted operating income increased 16% for the year and 31% for the quarter ended December 31, 2025, with its combined ratio improving to 95% for the year and 93% for the quarter. The segment's return on equity was 14% for 2025.

- The company repurchased $429.5 million in shares during 2025, resulting in 12.6 million shares outstanding at December 31, 2025, compared to 12.8 million at December 31, 2024.

- In August 2025, the Markel Insurance Global Reinsurance division entered run-off after selling its renewal rights.

- Markel Group reported operating revenues of $15.513 billion for the year ended December 31, 2025, marking a 5% increase compared to the prior year.

- Adjusted operating income grew by 10% to $2.304 billion for the full year 2025.

- The Markel Insurance segment's combined ratio improved by one point to 95% for the year, and its adjusted operating income increased by 16%.

- The company returned capital to shareholders through $429.5 million in share repurchases during 2025, contributing to $2.6 billion in comprehensive income to shareholders for the year.

Markel Group reported a significant improvement in its Markel Insurance segment, with the combined ratio decreasing to 93% in Q3 2025 from 97% in the comparable period. Consolidated revenues increased by 7% for the quarter and 4% year to date, while adjusted operating income grew 24% to $621 million in Q3 2025.

The company continued its capital return strategy, repurchasing $344 million in shares during Q3 2025. From the end of 2020 through Q3 2025, approximately $1.9 billion of capital was returned to shareholders via repurchases, reducing the share count from 13.8 million to 12.6 million.

New financial disclosures were implemented, reorganizing business results into four segments: Insurance, Industrial, Financial, and Consumer Other, and introducing adjusted operating income as a key performance metric.

| Metric | Q3 2024 | Q3 2025 | YTD 2025 |

|---|---|---|---|

| Markel Insurance Combined Ratio (%) | 97 | 93 | 95 |

| Consolidated Revenues (% Change YoY) | N/A | +7% | +4% |

| Adjusted Operating Income ($USD Millions) | $500 | $621 | N/A |

| Adjusted Operating Income (% Change YoY) | N/A | +24% | N/A |

| Share Repurchases ($USD Millions) | N/A | $344 | N/A |

- Markel Group reported consolidated revenues up 7% for the quarter and 4% year to date for Q3 2025, with the new metric of adjusted operating income totaling $621 million, a 24% increase compared to the same period last year.

- The Markel Insurance segment demonstrated significant improvement, achieving a combined ratio of 93% in Q3 2025, down from 97% in the prior year, and saw underwriting gross written premiums grow by 11% for the quarter.

- The company implemented enhanced financial disclosures, reorganizing business results into four segments: Insurance, Industrial, Financial, and Consumer Other, and introducing adjusted operating income as a primary performance metric.

- Markel Group continued its capital return program, repurchasing $344 million in shares year-to-date through Q3 2025, reducing the share count to 12.6 million. Since the end of 2020, $1.9 billion has been returned to shareholders through repurchases.

- Markel Group reported strong financial performance for Q3 2025, with consolidated revenues up 7% for the quarter and adjusted operating income increasing 24% year-over-year to $621 million.

- The company enhanced its financial disclosures, reorganizing business results into four reportable segments: Insurance, Industrial, Financial, and Consumer and Other, and introduced adjusted operating income as a new metric.

- Markel Insurance demonstrated improved profitability, achieving a combined ratio of 93% in Q3 2025, an improvement from 97% in the comparable period, and saw gross written premiums increase 11% for the quarter.

- Markel Group returned approximately $1.9 billion to shareholders through share repurchases from the end of 2020 through Q3 2025, reducing the share count from 13.8 million to 12.6 million.

- Markel Group Inc. reported a 7% increase in operating revenues and a 24% increase in adjusted operating income for the third quarter of 2025.

- The Markel Insurance segment's adjusted operating income grew by 55% for the quarter, and its combined ratio improved by more than four points to 93%.

- The company generated $2.1 billion in operating cash flows year-to-date and repurchased $344 million of its shares, with 12.6 million shares outstanding as of September 30, 2025.

- Markel Group implemented notable changes to its financial reporting in Q3 2025, including re-segmentation of businesses and updating the presentation of operating revenues to exclude net investment gains and losses, with prior periods recast.

- Markel Group's operating revenues increased 7% to $3,934,549 thousand for Q3 2025 and 4% to $11,505,268 thousand year to date.

- Adjusted operating income rose 24% to $621,017 thousand for Q3 2025 and 7% to $1,677,884 thousand year to date.

- The Markel Insurance combined ratio improved by more than four points to 93% in Q3 2025, with the year-to-date ratio consistent at 95%.

- Year to date, operating cash flows reached $2.1 billion, and the company repurchased $344 million in shares, with 12.6 million shares outstanding as of September 30, 2025.

Quarterly earnings call transcripts for MARKEL GROUP.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more