Earnings summaries and quarterly performance for Matador Resources.

Executive leadership at Matador Resources.

Joseph Foran

Chief Executive Officer

Brian Willey

Executive Vice President – Midstream

Bryan Erman

Co-President, Chief Legal Officer and Head of M&A

Christopher Calvert

Executive Vice President and Chief Operating Officer

Glenn Stetson

Executive Vice President—Production

Gregg Krug

Executive Vice President—Marketing & Midstream Strategy

Robert Macalik

Executive Vice President and Chief Financial Officer

Thomas Elsener

Executive Vice President—Reservoir Engineering and Senior Asset Manager

Van Singleton

Co-President—Land, Acquisitions & Divestitures and Planning

Board of directors at Matador Resources.

Kenneth Stewart

Director

Monika Ehrman

Director

Paul Harvey

Director

R. Gaines Baty

Deputy Lead Independent Director

Reynald Baribault

Director

Shelley Appel

Director

Susan Ward

Director

Timothy Parker

Lead Independent Director

William Byerley

Director

Research analysts who have asked questions during Matador Resources earnings calls.

Zach Parham

JPMorgan Chase & Co.

10 questions for MTDR

Kevin MacCurdy

Pickering Energy Partners

8 questions for MTDR

Scott Hanold

RBC Capital Markets

8 questions for MTDR

Leo Mariani

ROTH MKM

7 questions for MTDR

John Freeman

Raymond James Financial

6 questions for MTDR

Noah Hungness

Firm Not Mentioned in Transcript

6 questions for MTDR

Phillip Jungwirth

BMO Capital Markets

6 questions for MTDR

Tim Rezvan

KeyBanc Capital Markets

6 questions for MTDR

Oliver Huang

TPH&Co.

5 questions for MTDR

Derrick Whitfield

Texas Capital

3 questions for MTDR

John Abbott

Wolfe Research

3 questions for MTDR

Neal Dingmann

Truist Securities

3 questions for MTDR

Gabriel Daoud

Cowen

2 questions for MTDR

Paul Diamond

Citigroup

2 questions for MTDR

Timothy Rezvan

KeyBanc Capital Markets Inc.

2 questions for MTDR

Michael Scialla

Stephens Inc.

1 question for MTDR

Neal Dingman

William Blair

1 question for MTDR

Neil Dickman

William Blair

1 question for MTDR

Neil Hunknes

Bank of America

1 question for MTDR

Recent press releases and 8-K filings for MTDR.

- Matador Resources Company priced a private offering of $750 million of 6.000% senior unsecured notes due 2034 at 100% of their face value.

- The offering is expected to close on March 5, 2026, with Matador anticipating net proceeds of approximately $736.5 million after deducting discounts and estimated offering expenses.

- The company intends to use the net proceeds to repurchase $500 million of its 6.875% senior notes due 2028 through a cash tender offer and to repay borrowings outstanding under its credit facility.

- Matador Resources Company priced a private offering of $750 million of 6.000% senior unsecured notes due 2034.

- The offering is expected to close on March 5, 2026.

- The net proceeds will be used to repurchase $500 million of its 6.875% senior notes due 2028 through a cash tender offer and to repay outstanding borrowings under its credit facility.

- Matador Resources Company announced an offering of $750 million of senior unsecured notes due 2034 in a private placement.

- The net proceeds from this offering are intended to repurchase all $500 million of its outstanding 6.875% senior notes due 2028 through a cash tender offer, pay related expenses, and repay borrowings under Matador’s credit facility.

- The cash tender offer for the 2028 Notes commenced on February 26, 2026, and is set to expire on March 4, 2026, with tendering holders receiving $1,019.75 per $1,000 principal amount plus accrued interest.

- The tender offer is contingent upon Matador raising at least $500 million in gross proceeds from the new notes offering.

- Matador Resources has privately priced $750 million of senior unsecured notes due 2034, with the offering expected to close on March 5, 2026.

- The company intends to use the net proceeds to repurchase its $500 million 6.875% senior notes due 2028 through a cash tender offer and to repay borrowings under its credit facility.

- The tender offer for the 2028 notes, which offers $1,019.75 per $1,000 principal plus accrued interest, is contingent on raising at least $500 million and expires on March 4, 2026.

- This refinancing is an effort to re-time maturities and preserve financial flexibility for the oil and gas exploration and production company.

- Matador Resources Company has initiated a cash tender offer to acquire any and all of its $500 million outstanding aggregate principal amount of 6.875% senior notes due 2028.

- The tender offer is being funded by a portion of the net proceeds from a concurrent private placement of $750 million in aggregate principal amount of new senior unsecured notes due 2034.

- Noteholders whose 2028 Notes are accepted will receive $1,019.75 per $1,000 principal amount, plus accrued and unpaid interest.

- The offer is contingent on Matador raising at least $500 million from the new notes offering and is scheduled to expire on March 4, 2026.

- Matador Resources Company announced its intention to offer $750 million of senior unsecured notes due 2034 in a private placement.

- The net proceeds from this offering will be used to repurchase all $500 million of its outstanding 6.875% senior notes due 2028 through a cash tender offer, cover related expenses, and repay borrowings outstanding under its credit facility.

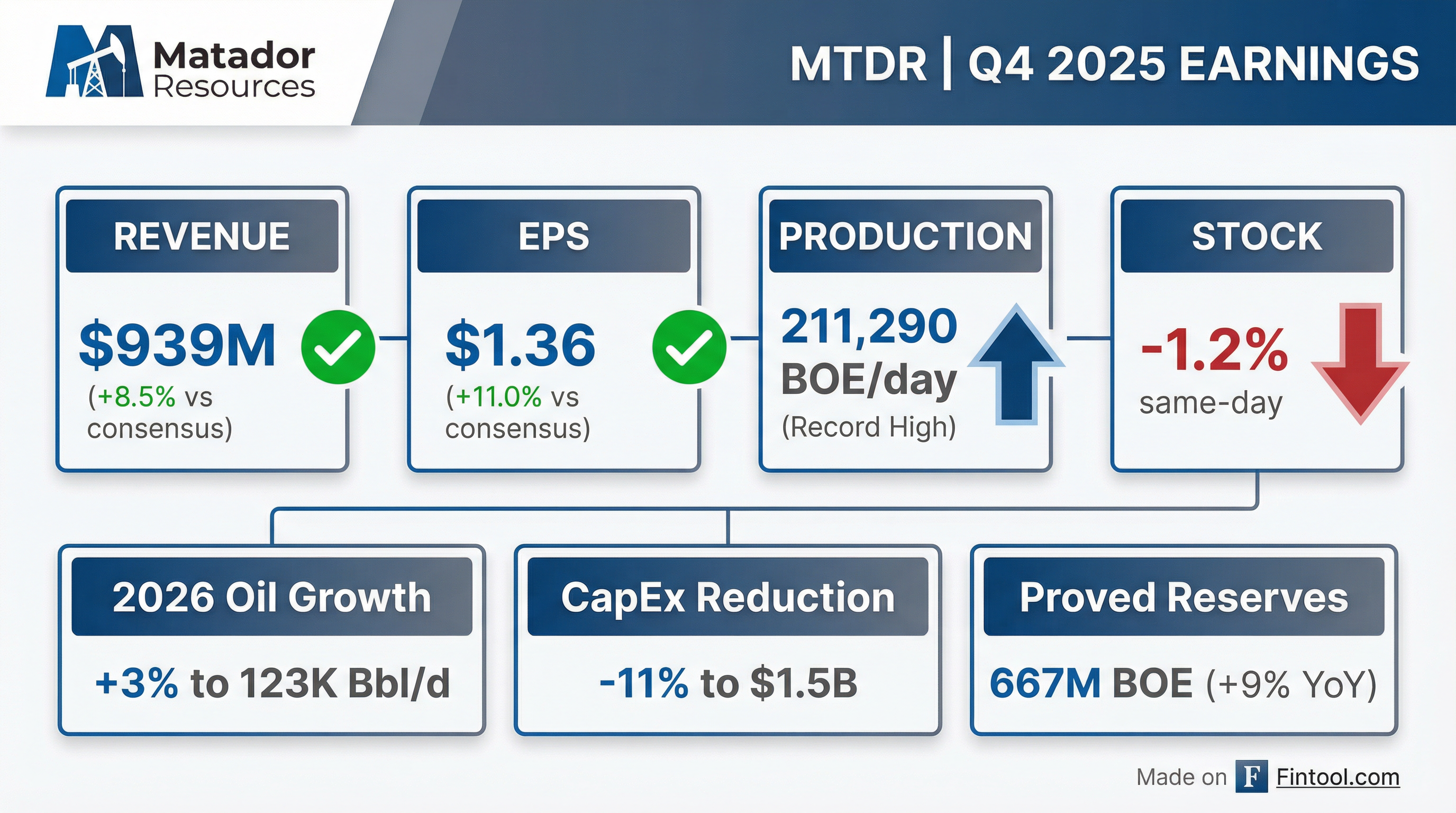

- Matador Resources achieved record Q4 2025 oil equivalent production of 211,290 BOE/d, surpassing its guidance, and reported $437 million in adjusted free cash flow for the full year 2025.

- The company's proved reserves increased by 9% to 667.0 MMBOE as of December 31, 2025, with a 170% replacement ratio, and it allocated 2025 free cash flow towards 88% dividend per share growth, debt reduction, and share repurchases.

- Matador maintains a strong balance sheet with approximately $1.9 billion in total liquidity and a leverage ratio of ~1.1x as of February 24, 2026, with no near-term debt maturities.

- For 2026, the company provided guidance for total production of 209.5-215.0 MBOE/d and projected total capital expenditures between $1,450-$1,550 million, emphasizing continued capital efficiencies.

- Matador Resources reported increased production, reduced debt, and a 9% increase in reserves (as measured by Midland and Sewell) in Q4 2025, maintaining a strong balance sheet with a leverage ratio around 1.

- The company forecasts an 11% reduction in CapEx for 2026, projecting $130 million in savings, while also achieving 10% improvements in Estimated Ultimate Recovery (EUR) at lower investment costs.

- Matador continues its "brick by brick" land strategy, acquiring 17,500 net acres through 690 individual transactions in the past year, and prioritizes midstream value realization, with the FivePoint continuation vehicle for San Mateo expected to be resolved in the near term.

- Shareholder returns include a dividend that has been raised 6 times in the last 4 years, currently offering a 3% yield, and an opportunistic share buyback program instituted in 2025.

- Matador Resources reported increased reserves by 9%, increased production, and reduced debt for Q4 and full year 2025, maintaining strong cash flow.

- The company projects an 11% reduction in capital expenditures for 2026, totaling $130 million in savings, primarily due to efficiency improvements.

- Operational efficiencies, including a 10% increase in lateral lengths and 20% year-over-year completion efficiency improvements, are expected to reduce D&C cost per foot to $795 and drive moderate organic oil volume growth of 2% to 3% in 2026.

- Matador reduced its debt by $200 million in the past year, achieving a leverage ratio of approximately 1.

- The company plans to drill its first well in the Woodford formation in the first half of 2026, representing a new incremental inventory opportunity.

- Matador Resources Company reported record fourth quarter 2025 production of 211,290 BOE per day and achieved record total proved oil and natural gas reserves of 667.0 million BOE at year-end 2025, representing a 173% reserve replacement ratio.

- For 2026, the company projects 3% oil production growth to approximately 123,000 barrels of oil per day while reducing total capital expenditures by 11% to $1.50 billion.

- The midstream segment (San Mateo and wholly-owned assets) generated $332 million in Adjusted EBITDA for full-year 2025, with an 8% growth forecast to $360 million in 2026.

- Matador ended 2025 with a leverage ratio of 1.1 times and $1.8 billion in liquidity under its RBL, and has hedged approximately 50% of its projected 2026 oil production.

Quarterly earnings call transcripts for Matador Resources.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more