Earnings summaries and quarterly performance for MACOM Technology Solutions Holdings.

Executive leadership at MACOM Technology Solutions Holdings.

Stephen Daly

Chief Executive Officer

Ambra Roth

Senior Vice President, General Counsel and Secretary

John Kober

Chief Financial Officer

Robert Dennehy

Senior Vice President, Operations

Thomas Hwang

Senior Vice President, Global Sales

Wayne Struble

Senior Vice President, Advanced Semiconductor Technology

Board of directors at MACOM Technology Solutions Holdings.

Research analysts who have asked questions during MACOM Technology Solutions Holdings earnings calls.

David Williams

The Benchmark Company

8 questions for MTSI

Karl Ackerman

BNP Paribas

8 questions for MTSI

Blayne Curtis

Jefferies Financial Group

7 questions for MTSI

Harsh Kumar

Piper Sandler & Co.

7 questions for MTSI

Quinn Bolton

Needham & Company, LLC

6 questions for MTSI

Tore Svanberg

Stifel Financial Corp.

6 questions for MTSI

Tim Savageaux

Northland Capital Markets

5 questions for MTSI

Sean O'Loughlin

TD Cowen

4 questions for MTSI

William Stein

Truist Securities

4 questions for MTSI

Peter Peng

Evercore ISI

3 questions for MTSI

Richard Shannon

Craig-Hallum Capital Group LLC

3 questions for MTSI

Srinivas Pajjuri

Raymond James & Associates, Inc.

3 questions for MTSI

Christopher Rolland

Susquehanna Financial Group

2 questions for MTSI

Kyle Blues

Barclays

2 questions for MTSI

Thomas O’Malley

Barclays Capital

2 questions for MTSI

Tom O'Malley

Barclays

2 questions for MTSI

Torrey Sandler

Stifel

2 questions for MTSI

Vivek Arya

Bank of America Corporation

2 questions for MTSI

Harlan Sur

JPMorgan Chase & Co.

1 question for MTSI

Michael Mani

Bank of America

1 question for MTSI

Neil Young

Needham & Company

1 question for MTSI

Nick Doyle

Needham & Company

1 question for MTSI

Recent press releases and 8-K filings for MTSI.

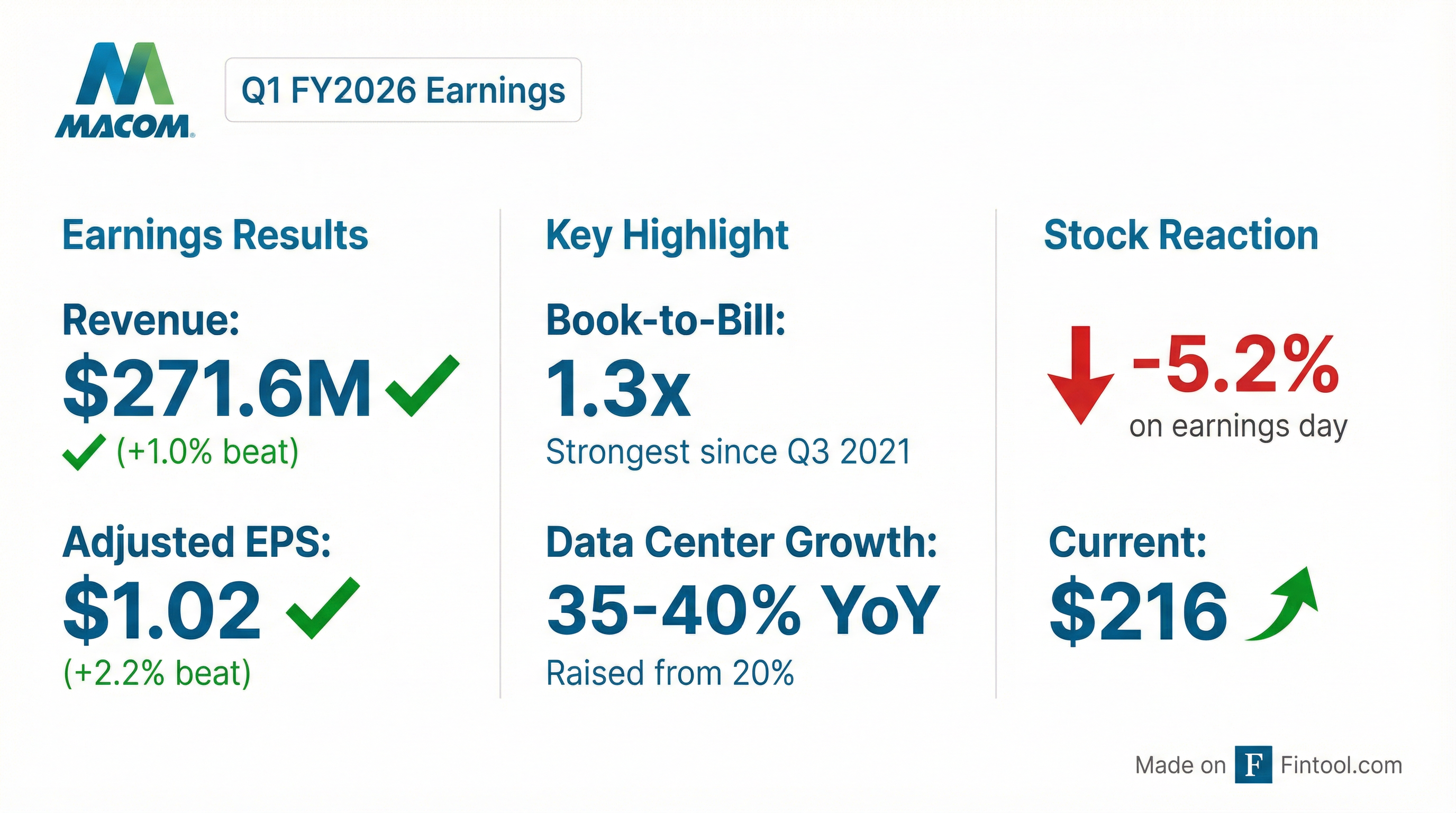

- MACOM Technology Solutions Holdings Inc. reported Q1 fiscal year 2026 revenue of $271.6 million and adjusted EPS of $1.02 per diluted share, with revenue growing 4% sequentially and 24.5% year-over-year.

- For Q2 fiscal year 2026, the company expects revenue between $281 million and $289 million and adjusted EPS between $1.05 and $1.09.

- The fiscal year 2026 data center revenue growth forecast was raised from 20% to 35%-40% year-over-year, primarily due to strong demand for 1.6T applications and LPO adoption by hyperscalers.

- The Q1 2026 book-to-bill ratio was 1.3-to-1, indicating strong bookings, and the company expects sequential quarterly gross margin improvements of 25-50 basis points through FY26.

- MACOM plans to retire $161 million of 2021 convertible notes in mid-March 2026 and reported $768 million in cash and short-term investments at quarter-end.

- For Q1 FY26, MTSI reported revenue of $271.6 million and adjusted EPS of $1.02 per diluted share, with a book-to-bill ratio of 1.3-to-1. The company ended the quarter with approximately $768 million in cash and short-term investments.

- For Q2 FY26, the company expects revenue to be in the range of $281-$289 million, adjusted gross margin between 57%-59%, and adjusted EPS between $1.05 and $1.09.

- The year-over-year revenue growth outlook for the data center segment in FY26 was raised from 20% to 35%-40%, driven by robust hyperscaler capital investments and demand for 1.6T optical products.

- MTSI anticipates sequential quarterly gross margin improvements of 25-50 basis points through the remainder of fiscal 2026. The company plans to retire $161 million of convertible notes principal value in mid-March 2026.

- For fiscal Q1 2026, MACOM Technology Solutions Holdings Inc. reported revenue of $271.6 million and adjusted EPS of $1.02 per diluted share, with a book-to-bill ratio of 1.3-to-1.

- The company provided guidance for fiscal Q2 2026, expecting revenue between $281 million and $289 million, adjusted gross margin of 57%-59%, and adjusted EPS between $1.05 and $1.09 per diluted share.

- MACOM raised its fiscal year 2026 data center revenue growth forecast to 35%-40% year-over-year, driven by strong demand for 1.6T products, and noted that its backlog remains at record levels.

- The company anticipates sequential quarterly gross margin improvements of 25-50 basis points throughout the remainder of fiscal year 2026.

- MACOM expects to retire $161 million of its 2021 convertible notes in mid-March 2026 by paying the principal value in cash and settling any conversion premium with shares of common stock.

- MACOM Technology Solutions Holdings, Inc. reported revenue of $271.6 million for the fiscal first quarter ended January 2, 2026, which represents a 24.5% increase compared to the previous year's fiscal first quarter and a 4.0% increase from the prior fiscal quarter.

- GAAP net income for the fiscal first quarter 2026 was $48.8 million, or $0.64 per diluted share, a significant improvement from a net loss of $167.5 million ($2.30 loss per diluted share) in the previous year's fiscal first quarter.

- Adjusted net income for the quarter was $78.2 million, or $1.02 per diluted share, compared to $59.5 million ($0.79 per diluted share) in the previous year's fiscal first quarter and $71.4 million ($0.94 per diluted share) in the prior fiscal quarter.

- For the fiscal second quarter ending April 3, 2026, MACOM expects revenue to be in the range of $281 million to $289 million and adjusted earnings per diluted share to be between $1.05 and $1.09.

- MACOM Technology Solutions Holdings reported fiscal first quarter 2026 revenue of $271.6 million, an increase of 24.5% compared to the previous year's fiscal first quarter and 4.0% compared to the prior fiscal quarter.

- For the fiscal first quarter 2026, GAAP net income was $48.8 million, or $0.64 income per diluted share, a significant improvement from a net loss of $167.5 million, or $2.30 loss per diluted share, in the previous year's fiscal first quarter.

- Adjusted net income for Q1 FY2026 was $78.2 million, or $1.02 per diluted share, up from $59.5 million, or $0.79 per diluted share, in the previous year's fiscal first quarter.

- For the fiscal second quarter ending April 3, 2026, MACOM expects revenue to be in the range of $281 million to $289 million and adjusted earnings per diluted share between $1.05 and $1.09.

- MACOM reported Q4 2025 revenue of $261.2 million and adjusted EPS of $0.94 per diluted share. For the full fiscal year 2025, revenue reached a record $967 million, a more than 32% increase year over year, with adjusted EPS of $3.47, a more than 35% increase year over year.

- For Q1 2026, the company expects revenue to be in the range of $265-$273 million and adjusted EPS between $0.98 and $1.02. With this guidance, MACOM anticipates achieving $1 billion in annual revenues based on trailing 12-month performance, with expectations for improving gross margins.

- Strategic initiatives include securing an exclusive license for HRL's 40-nanometer GaN on silicon carbide process (T3L) to address higher-frequency applications , launching over 200 new products in FY25 , and planning to open two additional IC design centers.

- The company is focused on capitalizing on data center growth through 1.6T and 800G solutions, with three customers now in production for LPO solutions , and sees the LEO satellite communications business as a ramping market potentially worth hundreds of millions of dollars.

- MTSI reported record fiscal year 2025 revenue of $967 million, a 32% increase year over year, and adjusted EPS of $3.47, a 35% increase year over year. The company generated $193 million in free cash flow and ended the year with approximately $786 million in cash and short-term investments.

- For the fourth quarter of fiscal 2025, revenue was $261.2 million and adjusted EPS was $0.94 per diluted share. The Q4 book-to-bill ratio was just over 1.0-1, with the full fiscal year 2025 book-to-bill at 1.1-1.

- The company provided Q1 2026 revenue guidance of $265-$273 million and adjusted EPS guidance of $0.98-$1.02. MTSI anticipates achieving $1 billion in annual revenues based on trailing 12-month performance with its Q1 2026 guidance.

- MTSI expects double-digit top-line growth in fiscal year 2026, with a base case of no less than mid-teens growth, primarily driven by the data center business. The company also anticipates sequential quarterly gross margin improvements of 25 to 50 basis points throughout fiscal 2026.

- Strategically, MTSI announced an agreement with HRL to transfer their 40-nanometer GaN on silicon carbide process (T3L), enhancing its GaN portfolio for higher frequency applications. The company launched over 200 new products in FY 2025 and is expanding its IC design capabilities.

- For the fourth quarter of fiscal 2025, MACOM reported $261.2 million in revenue and $0.94 adjusted EPS per diluted share. For the full fiscal year 2025, revenue was $967 million, a 32% increase year over year, with adjusted EPS of $3.47, a 35% increase year over year.

- MACOM expects revenue in fiscal Q1 2026 to be in the range of $265 million-$273 million, with adjusted gross margin between $56.5 million-$58.5 million, and adjusted earnings per share between $0.98 and $1.02.

- The company announced an agreement to become an exclusive licensee for HRL's 40-nanometer GaN on silicon carbide process (T3L), which complements its existing GaN portfolio for higher frequencies.

- Strong demand from the data center portfolio, particularly 800G and 1.6T applications, is expected to drive growth, with Q1 2026 data center revenue projected to be up approximately 5% sequentially.

- For fiscal year 2026, MACOM anticipates double-digit growth with no less than mid-teens on the top line, primarily driven by the data center business.

- MACOM reported fiscal Q4 2025 revenue of $261.2 million, an increase of 30.1% compared to the previous year fiscal fourth quarter, and fiscal year 2025 revenue of $967.3 million, up 32.6% from fiscal year 2024.

- For fiscal Q4 2025, GAAP net income was $0.59 per diluted share, while adjusted net income was $0.94 per diluted share.

- The fiscal year 2025 GAAP net loss was $0.73 per diluted share, primarily due to a $193.1 million loss on extinguishment of debt, whereas adjusted net income was $3.47 per diluted share.

- For the fiscal first quarter ending January 2, 2026, MACOM anticipates revenue between $265 million and $273 million and adjusted earnings per diluted share between $0.98 and $1.02.

- MACOM Technology Solutions Inc. has entered into an agreement with HRL Laboratories to license and exclusively manufacture HRL's proprietary 40nm T3L GaN-on-silicon carbide (GaN-on-SiC) process technology.

- This agreement involves a rapid process transfer to one of MACOM's U.S. Trusted Foundries, with MACOM expecting the advanced technology to enhance its product portfolio and accelerate its roadmap for commercial and defense applications.

Quarterly earnings call transcripts for MACOM Technology Solutions Holdings.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more