Earnings summaries and quarterly performance for NOKIA.

Research analysts who have asked questions during NOKIA earnings calls.

Robert Sanders

Deutsche Bank

5 questions for NOK

Sami Sarkamies

Danske Bank A/S

5 questions for NOK

Simon Leopold

Raymond James

5 questions for NOK

Ulrich Rathe

Sanford C. Bernstein & Co., LLC

5 questions for NOK

Felix Henriksson

Nordea Bank Abp

4 questions for NOK

Francois-Xavier Bouvignies

UBS

4 questions for NOK

Jakob Bluestone

BNP Paribas

4 questions for NOK

Richard Kramer

Arete Research

4 questions for NOK

Daniel Djurberg

Handelsbanken

3 questions for NOK

Sandeep Deshpande

JPMorgan Chase & Co.

3 questions for NOK

Artem Beletski

SEB

2 questions for NOK

Emil Immonen

DNB Carnegie Investment Bank AB

2 questions for NOK

Fredrik Lithell

Handelsbanken Capital Markets

2 questions for NOK

Sébastien Sztabowicz

Kepler Cheuvreux

2 questions for NOK

Alexander Duval

Goldman Sachs

1 question for NOK

Joachim Gunell

DNB Markets

1 question for NOK

Recent press releases and 8-K filings for NOK.

- Nokia Corporation's Annual General Meeting is scheduled for April 9, 2026, to address the 2025 Annual Accounts and other significant proposals.

- The Board proposes to authorize the distribution of an aggregate maximum of EUR 0.14 per share as dividend and/or assets from the reserve for invested unrestricted equity, to be paid in four installments, instead of a direct dividend resolution by the AGM.

- Shareholders will vote on authorizing the Board to repurchase up to 550 million shares and to issue up to 550 million shares, each representing less than 10% of total shares, with both authorizations valid until October 8, 2027.

- The Board proposes ten members, including new candidate Meredith Whittaker, who is considered non-independent due to an advisory role with Nokia Bell Labs, and proposes Timo Ihamuotila as Chair and Thomas Saueressig as Vice Chair.

- The Board of Directors proposes Timo Ihamuotila for election as the new Board Chair, succeeding Sari Baldauf, and Meredith Whittaker as a new Board member.

- The Board proposes authorization to distribute an aggregate maximum of EUR 0.14 per share as dividend and/or assets from the reserve for invested unrestricted equity, to be paid in four installments.

- The Board also proposes authorization to issue a maximum of 550 million shares and repurchase a maximum of 550 million shares, both effective until October 8, 2027.

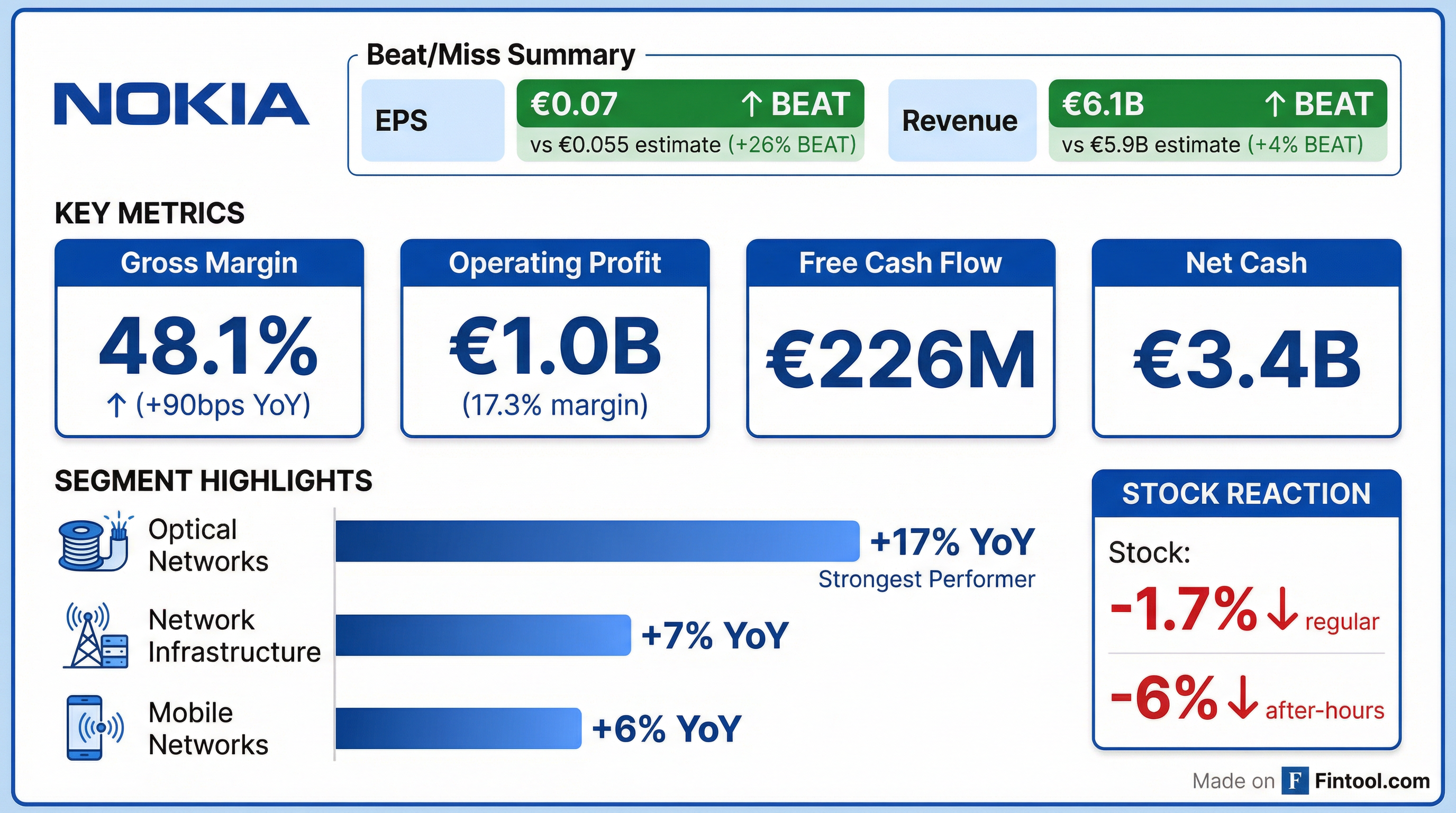

- Nokia reported Q4 2025 comparable net sales growth of 3% year-over-year on a constant currency and portfolio basis, reaching EUR 6.1 billion, with a comparable diluted EPS of EUR 0.16. For the full year 2025, comparable operating profit was EUR 2.0 billion and comparable diluted EPS was EUR 0.29.

- The company introduced financial guidance for 2026, targeting a comparable operating profit of EUR 2.0 to 2.5 billion, and also set a long-term target for 2028 of EUR 2.7 billion to EUR 3.2 billion in comparable operating profit.

- Nokia simplified its operating model into Network Infrastructure and Mobile Infrastructure, effective January 1, 2026, to align with its new strategy focusing on AI-driven network transformation.

- In Q4 2025, NVIDIA Corporation made a USD 1.0 billion (EUR 0.86 billion) equity investment in Nokia, acquiring an approximately 2.90% shareholding, and the Board proposed a dividend authorization of EUR 0.14 per share.

- Nokia reported Q4 2025 net sales of EUR 6.1 billion and operating profit of EUR 1 billion, contributing to full-year 2025 net sales of EUR 19.9 billion and operating profit of EUR 2 billion.

- The company strengthened its portfolio with the acquisition of Infinera and completed the full ownership of Nokia Shanghai Bell, expecting EUR 200 million in run rate cost synergies from the latter.

- Network Infrastructure net sales grew 7% in Q4 2025, driven by a 17% increase in optical networks, with EUR 2.4 billion in orders from AI and cloud customers for the full year.

- For 2026, Nokia is targeting an operating profit in the range of EUR 2 billion-EUR 2.5 billion, with planned CapEx between EUR 900 million and EUR 1 billion to invest in additional manufacturing capacity for Optical Networks.

- Nokia reported Q4 2025 net sales of EUR 6.1 billion, operating profit of EUR 1 billion, and free cash flow of EUR 0.2 billion. For the full year 2025, net sales were EUR 19.9 billion and operating profit was EUR 2 billion, with free cash flow conversion of 72%.

- For 2026, Nokia is targeting an operating profit between EUR 2 billion and EUR 2.5 billion , with CapEx of EUR 900 million to EUR 1 billion for investments including additional manufacturing capacity for Optical Networks.

- The company expects Network Infrastructure to grow 6%-8% compound annual growth rate (CAGR) between 2025 and 2028, with Optical and IP Networks growing 10%-12%.

- In Q4 2025, Nokia took full ownership of Nokia Shanghai Bell, anticipating EUR 200 million in run rate cost synergies. The company also highlighted EUR 2.4 billion in orders from AI and cloud customers for full year 2025 , reinforcing its focus on these growth areas.

- Nokia reported Q4 2025 net sales of EUR 6.1 billion, a 3% increase year-over-year, with an operating profit of EUR 1 billion and EUR 0.2 billion in free cash flow. For the full year 2025, net sales reached EUR 19.9 billion and operating profit was EUR 2 billion, aligning with guidance.

- The company completed the acquisition of Infinera and took full ownership of Nokia Shanghai Bell, expecting to achieve approximately EUR 200 million in run rate cost synergies from the latter's integration.

- For 2026, Nokia targets an operating profit between EUR 2 billion and EUR 2.5 billion. Network Infrastructure is projected to grow 6%-8% compound annually from 2025 to 2028, with optical and IP networks specifically targeting 10%-12% growth.

- Nokia is investing in optical networking, including a new indium phosphide fab, to support strong demand, particularly from AI and cloud customers, who contributed 16% of Q4 net sales and 30% of Optical Networks sales.

- Nokia's Network Infrastructure (NI) segment is focused on capitalizing on the AI superstructure, particularly in IP switching and optical networking, with guidance for 10%-12% growth in these areas, contributing to an overall NI growth of 6%-8%.

- The company's Mobile Networks strategy aims for operating profit to be flat or up by 2028 , transforming to a software-driven business model and leveraging a critical partnership with NVIDIA, with initial commercial deployment expected in 2027 and volume in 2028.

- CEO Justin Hotard emphasized a disciplined approach to profitability and capital allocation, stating that the company will not aggressively chase market share at the expense of profit margins, particularly in radio network swap-outs.

- Nokia is strategically expanding its manufacturing footprint through regionalization, including U.S. semiconductor manufacturing under the CHIPS Act and new factories in Europe, to enhance resiliency and support localized demand.

- Nokia is focusing on capitalizing on the AI superstructure within its Network Infrastructure (NI) segment, particularly in IP switching and optical networking, targeting AI and cloud markets.

- The company projects 10%-12% growth in IP and optical within NI, contributing to an overall NI growth guidance of 6%-8%.

- For Mobile Networks, Nokia aims for flat or increased operating profit by 2028 and is shifting towards a software-driven business model, anticipating radio hardware commoditization.

- A strategic partnership with NVIDIA for AI RAN is expected to yield Proof of Concepts (POCs) in 2026, initial commercial deployment in 2027, and volume in 2028.

- Nokia is committed to disciplined revenue and profit management, targeting a 48%-50% gross margin in mobile networks, prioritizing profitability over market share.

- Nokia is strategically focusing its Network Infrastructure (NI) division on AI and cloud demand, particularly in IP switching and optical networking, targeting 10%-12% growth in these areas and 6%-8% overall NI growth.

- In Mobile Networks, Nokia aims for flat or increased operating profit by 2028, driven by anticipated demand for persistent connectivity from physical AI and a shift towards a software-driven business model.

- A key initiative in mobile is the partnership with NVIDIA for AI RAN, with proof-of-concepts expected in 2026, initial commercial deployment in 2027, and volume in 2028.

- The company emphasizes disciplined profitability, targeting 48%-50% gross margins, and will prioritize profit over market share in certain situations, such as avoiding unprofitable swap-out deals.

- Nokia's backlog is growing with longer-duration orders in optical, and the company is focused on converting orders into revenue rather than making customer announcements.

- Nokia announced a $4 billion investment in the United States to expand its research, development, and manufacturing capabilities for AI-ready network technologies.

- This investment includes $3.5 billion dedicated to R&D and $500 million towards manufacturing in states like Texas, New Jersey, and Pennsylvania.

- Nokia is collaborating with Nvidia to co-develop AI-native radio access network (RAN) technologies, with Nvidia providing a $1 billion investment to create a standalone AI division within Nokia.

- The initiative aims to accelerate innovation in AI-optimized connectivity, enhance U.S. security, and expand Nokia's U.S. footprint in the AI market.

Quarterly earnings call transcripts for NOKIA.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more