Earnings summaries and quarterly performance for ORRSTOWN FINANCIAL SERVICES.

Executive leadership at ORRSTOWN FINANCIAL SERVICES.

Thomas R. Quinn, Jr.

President and Chief Executive Officer

Adam L. Metz

Senior Executive Vice President and Chief Operating Officer

Amy L. Doll

Executive Vice President and Chief Administrative Officer

Benjamin H. Colvard, IV

Executive Vice President and Chief Operations Officer

Christopher J. Orr

Executive Vice President and Chief Information Officer

David M. Chajkowski

Executive Vice President and Chief Credit Officer

Heather K. Knisely

Executive Vice President and Chief Human Resources Officer

Jeffrey S. Gayman

Executive Vice President, Chief Mortgage and Retail Officer

Matthew Dyckman

Executive Vice President and General Counsel

Michael E. Jaeger

Executive Vice President and Chief Experience Officer

Neelesh Kalani

Executive Vice President and Chief Financial Officer

Philip E. Fague

Executive Vice President and Chief Trust Officer

Robert G. Coradi

Executive Vice President and Chief Risk Officer; Secretary

Board of directors at ORRSTOWN FINANCIAL SERVICES.

Barbara E. Brobst

Director

Brian D. Brunner

Director

Cindy J. Joiner

Director; Audit Committee Chair

Eric A. Segal

Director; Asset-Liability Committee Chair

Glenn W. Snoke

Director; Nominating and Governance Committee Chair

J. Rodney Messick

Vice Chairman

Joel R. Zullinger

Chairman of the Board

John W. Giambalvo

Director; Compensation Committee Chair

Mark K. Keller

Director

Michael J. Rice

Director

Sarah M. Brown

Director

Scott V. Fainor

Director; Enterprise Risk Management Committee Chair

Research analysts who have asked questions during ORRSTOWN FINANCIAL SERVICES earnings calls.

Gregory Zingone

Piper Sandler

5 questions for ORRF

Timothy Switzer

KBW

4 questions for ORRF

David Long

Raymond James Financial, Inc.

3 questions for ORRF

Daniel Cardenas

Janney Montgomery Scott LLC

2 questions for ORRF

Kyle Gierman

Hovde Group

2 questions for ORRF

Tim Switzer

Keefe, Bruyette & Woods (KBW)

2 questions for ORRF

Dan Cardenas

Janney Montgomery Scott

1 question for ORRF

John Schneider

Hovde Group

1 question for ORRF

Recent press releases and 8-K filings for ORRF.

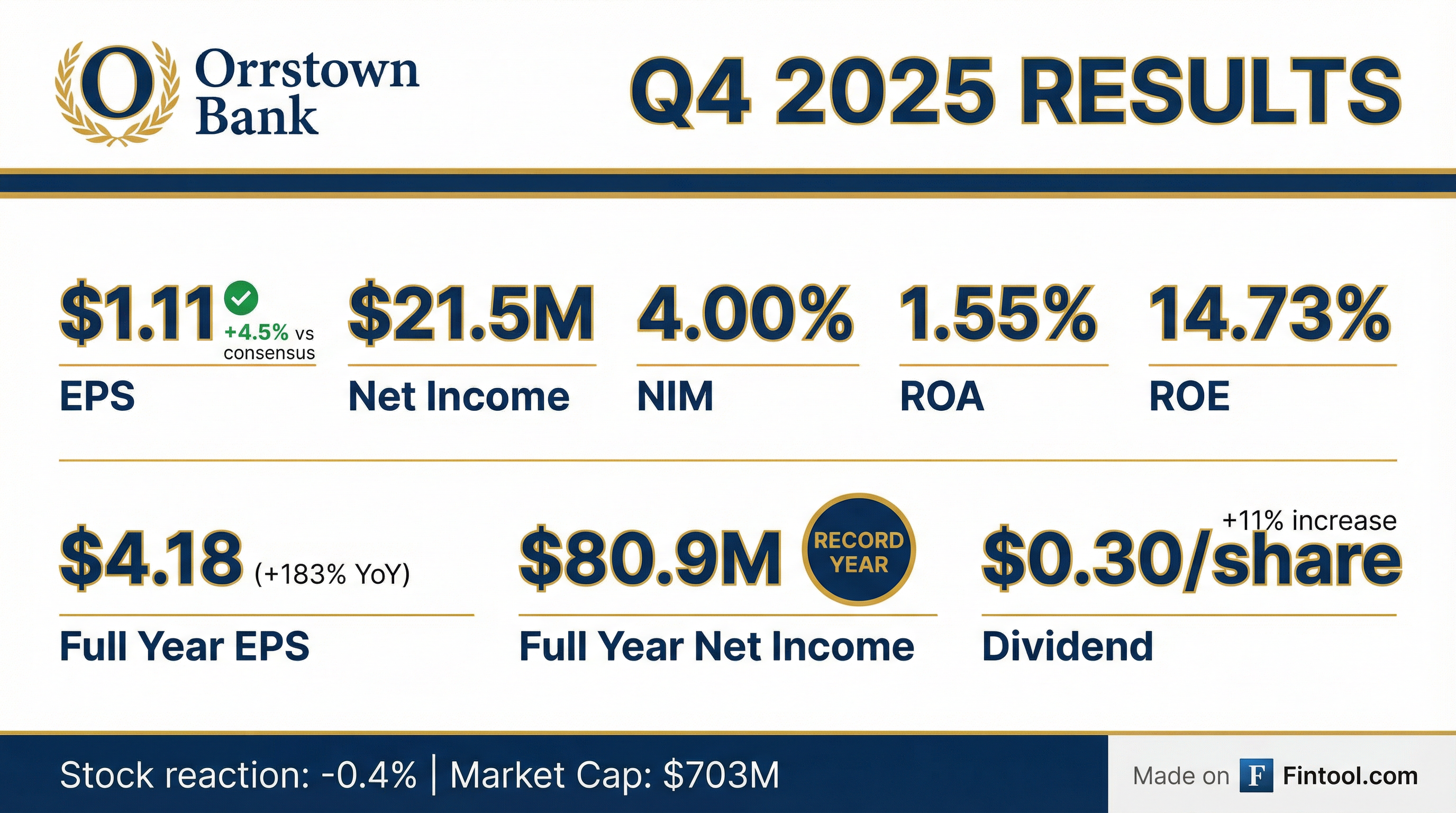

- ORRF reported Net Income of $21.5 million and Diluted EPS of $1.11 for Q4 2025.

- The company achieved solid loan growth for the quarter, with loans held for investment increasing by $41.0 million or 4% annualized, and maintained strong credit quality.

- Net interest income marginally declined to $50.5 million due to reduced short-term interest rates, resulting in a net interest margin of 4.00%, while non-interest income increased by $1.0 million to $14.4 million.

- ORRF's capital ratios remain strong, with the Total Company Total Risk Based Capital Ratio at 13.3% in Q4 2025, exceeding regulatory minimums.

- For 2026, ORRF provided guidance including 5.0% annualized loan growth, a margin range of 3.90% to 4.00%, and annualized non-interest income between $53.0 million and $55.0 million.

- Orrstown Financial Services reported its highest annual net income in 106 years at $80.9 million, or $4.18 per diluted share, for the full year 2025, with Q4 2025 net income at $21.5 million, or $1.11 per diluted share.

- The net interest margin (NIM) for Q4 2025 was 4.00%, with a projected range of 3.90%-4% for 2026. Non-interest income grew to $14.4 million in Q4 2025, contributing over 22% of total revenues.

- The company increased its quarterly dividend by $0.03 to $0.30 per share, representing a 50% increase since the merger date and the fourth increase in 18 months.

- Loan growth was 4% in Q4 2025, and the company anticipates achieving loan growth of 5% or better in 2026.

- Credit quality remained strong, with a minimal provision expense of $0.1 million and net charge-offs of $0.5 million in Q4 2025.

- Orrstown Financial Services achieved its highest reported annual net income in its 106-year history, reaching $80.9 million or $4.18 per diluted share for the full year 2025, with Q4 2025 net income at $21.5 million or $1.11 per diluted share.

- The board approved an increase in the quarterly dividend by $0.03 per share, raising it from $0.27 to $0.30 per share, marking the fourth dividend increase in the past 18 months.

- The net interest margin for Q4 2025 was 4.00%, and management projects a net interest margin in the range of 3.90%-4% for 2026, alongside anticipated loan growth of 5% or better.

- Strategic investments included the purchase of $125 million in Agency MBS and CMOs at an average yield of 4.92% in Q4 2025, and a continued focus on investing in talent, particularly in wealth management and lending, to drive future growth.

- Orrstown Financial Services achieved the highest reported annual net income in its 106-year history for fiscal year 2025, reaching $80.9 million, or $4.18 per diluted share, with a return on average equity of 14.76% and return on average assets of 1.49%.

- For the fourth quarter of 2025, net income was $21.5 million, or $1.11 per diluted share, with a net interest margin of 4.00% and non-interest income contributing 22% of total operating revenue.

- The company projects a net interest margin in the range of 3.90%-4% for 2026, with quarterly non-interest income expected to be between $13 million and $14 million, and anticipates loan growth of 5% or better in 2026.

- Orrstown's board voted to increase the quarterly dividend by $0.03 per share from $0.27 to $0.30 per share, marking the fourth dividend increase in the past 18 months, while maintaining strong credit quality with an allowance for credit losses on loans at 1.19% at December 31, 2025.

- For the full year ended December 31, 2025, Orrstown Financial Services, Inc. reported net income of $80.9 million and diluted earnings per share of $4.18, a substantial increase from $22.1 million and $1.48 respectively, for the year ended December 31, 2024.

- For the fourth quarter of 2025, net income was $21.5 million, or $1.11 per diluted share.

- The Board of Directors declared a cash dividend of $0.30 per common share, representing a $0.03 per share increase in the Company's quarterly cash dividend.

- Total loans increased by $41.0 million to $4.0 billion at December 31, 2025, an approximate 4% annualized growth from September 30, 2025.

- Tangible book value per common share increased to $25.21 at December 31, 2025, from $24.12 at September 30, 2025, and the Tier 1 leverage ratio increased to 9.5% at December 31, 2025, with all capital ratios above regulatory minimums.

- Orrstown Financial Services reported net income of $21.5 million and diluted earnings per share of $1.11 for the three months ended December 31, 2025.

- For the full year ended December 31, 2025, the company achieved its highest reported annual net income of $80.9 million and diluted earnings per share of $4.18.

- The Board of Directors declared a cash dividend of $0.30 per common share, representing a $0.03 per share increase.

- Total loans increased by $41.0 million from September 30, 2025, to December 31, 2025.

- Tangible book value per common share increased to $25.21 at December 31, 2025, from $24.12 at September 30, 2025.

- For Q3 2025, ORRF reported Net Income of $21.9 million and Diluted EPS of $1.13. The company achieved an annualized Return on Average Assets (ROAA) of 1.60% and Return on Average Equity (ROAE) of 15.72%.

- The Net Interest Margin improved to 4.11% in Q3 2025, a four basis point increase from the prior quarter, contributing to Net Interest Income of $51.0 million.

- Non-Interest Income rose to $13.4 million, while Non-Interest Expenses decreased to $36.3 million, resulting in an improved Efficiency Ratio of 56.4% for Q3 2025.

- Total Loans reached $3,980 million and Deposits totaled $4,534 million at the end of Q3 2025, with a loan-to-deposit ratio of 88%.

- ORRF provided guidance through 2026, projecting annualized loan growth of 5.0% and a Net Interest Margin in the range of 4.00% to 4.15%.

- Orestown Financial Services Inc. (ORRF) reported record diluted EPS of $1.13 and net income of $21,900,000 for Q3 2025.

- The company achieved 4.9% annualized loan growth in Q3 2025, with the net interest margin (NIM) improving to 4.11% from 4.07% in the previous quarter.

- Non-interest expense declined by $1,300,000 quarter-over-quarter, leading to an improved efficiency ratio of 56.4% from 60.3%.

- Classified loans decreased by $1,700,000 to $64,100,000, though non-accrual loans increased by $3,800,000 to $26,200,000.

- Management projects the NIM to be in the 4.00% to 4.15% range going forward, anticipating potential contraction due to expected rate cuts, which they aim to mitigate through pricing strategies.

- Orrstown Financial Services reported diluted EPS of $1.13 for Q3 2025, with a return on assets of 1.60% and return on equity of nearly 16%. The company also saw non-interest expense decline by $1.3 million quarter-over-quarter, leading to an improved efficiency ratio of 56.4%.

- The company achieved 4.9% annualized loan growth in Q3 2025, with net interest margin (NIM) increasing to 4.11% from 4.07% in the prior quarter.

- Credit quality remains sound, with nominal net charge-offs and classified loans decreasing by $1.7 million to $64.1 million. Non-accrual loans increased by $3.8 million to $26.2 million, primarily due to one commercial construction and development relationship.

- Management expects the NIM to remain in the 4.0% to 4.15% range despite potential rate cuts, due to proactive deposit pricing adjustments and competitive loan pricing. The company also provided an early 5% loan growth guide for next year, focusing on CRE and C&I segments.

- Orrstown Financial Services, Inc. reported net income of $21.9 million and diluted earnings per share of $1.13 for the three months ended September 30, 2025, which the CEO noted as the strongest quarter of earnings on record.

- The company's profitability metrics improved, with return on average assets at 1.60% and return on average equity at 15.72% for the third quarter of 2025, and the efficiency ratio decreased to 56.4%.

- Loans increased by $48.4 million to $4.0 billion at September 30, 2025, and deposits grew by $16.9 million to $4.5 billion.

- Orrstown redeemed $32.5 million in subordinated notes on September 30, 2025, while maintaining strong capital ratios, with tangible common equity at 8.8% and a Tier 1 leverage ratio of 9.3% at quarter-end.

- The Board of Directors declared a cash dividend of $0.27 per common share, payable November 12, 2025.

Quarterly earnings call transcripts for ORRSTOWN FINANCIAL SERVICES.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more