Earnings summaries and quarterly performance for Vaxcyte.

Executive leadership at Vaxcyte.

Board of directors at Vaxcyte.

Research analysts who have asked questions during Vaxcyte earnings calls.

Joseph Stringer

Needham & Company

4 questions for PCVX

Roger Song

Jefferies

3 questions for PCVX

Thomas Shrader

BTIG

3 questions for PCVX

Asad Haider

Goldman Sachs

2 questions for PCVX

Carter L. Gould

Barclays

2 questions for PCVX

David Risinger

Leerink Partners

2 questions for PCVX

Dina Ramadane

Bank of America

2 questions for PCVX

Edward

Leerink

2 questions for PCVX

Eric

JMP Securities

2 questions for PCVX

Evan Wang

Guggenheim Securities

2 questions for PCVX

Jonathan Miller

Evercore ISI

2 questions for PCVX

Seamus Fernandez

Guggenheim Partners

2 questions for PCVX

Tara Bancroft

TD Cowen

2 questions for PCVX

Jason Gerberry

Bank of America Merrill Lynch

1 question for PCVX

Jiale Song

Jefferies Financial Group Inc.

1 question for PCVX

Louise Chen

Cantor Fitzgerald

1 question for PCVX

Salim Syed

Mizuho Securities

1 question for PCVX

Tom Shrader

BTIG

1 question for PCVX

Umer Raffat

Evercore ISI

1 question for PCVX

Recent press releases and 8-K filings for PCVX.

- Vaxcyte, Inc. entered into a sales agreement with Leerink Partners LLC on February 24, 2026, to sell shares of its common stock.

- The company may sell shares with an aggregate offering price of up to $500,000,000 through Leerink Partners LLC.

- Leerink Partners LLC will receive compensation of up to 3.00% of the gross proceeds from the sale of shares.

- This new agreement replaces a prior sales agreement with Jefferies LLC, which was terminated on the same date, and under which Vaxcyte had sold approximately $270.3 million of common stock.

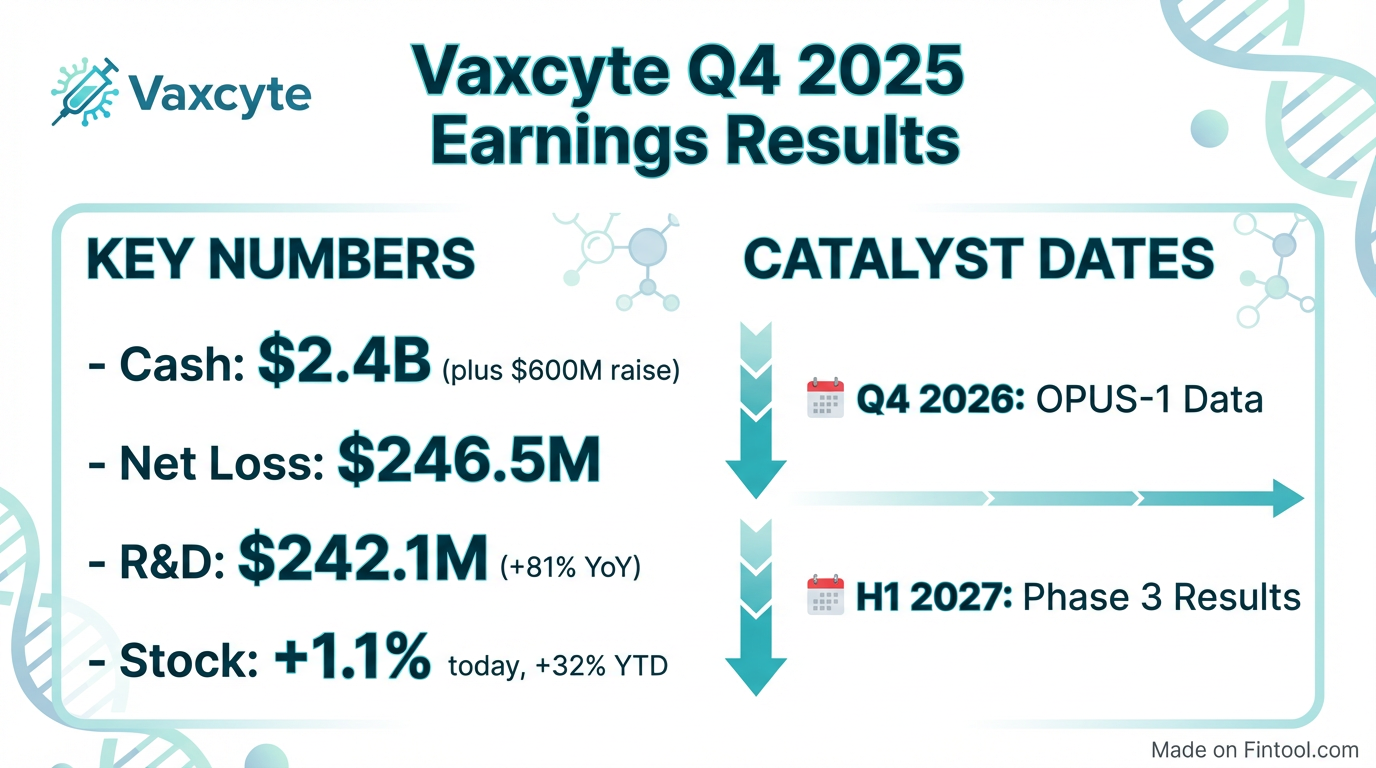

- Vaxcyte reported $2.4 billion in cash, equivalents, and investments as of December 31, 2025, and subsequently raised approximately $600.2 million in net proceeds from a public equity offering, extending its cash runway to at least the end of 2028.

- The OPUS Phase 3 program for VAX-31 is underway, with top-line data for OPUS-1 expected in the fourth quarter of 2026, and readouts for OPUS-2 and OPUS-3 anticipated in the first half of 2027.

- The dedicated large-scale manufacturing facility has been completed on time and on budget. Total expenses, particularly R&D, are projected to increase meaningfully in 2026 due to commercial manufacturing readiness and expanded clinical trials.

- Top-line data for the VAX-31 infant phase 2 study is expected by the end of the first half of 2027, and clinical development for VAX-A1 (Group A Streptococcus) is set to begin in 2026.

- Vaxcyte reported $2.4 billion in cash equivalents and investments as of December 31, 2025, and subsequently raised $600.2 million in net proceeds from a public equity offering, extending its cash runway to at least the end of 2028.

- The company initiated its OPUS-1 pivotal Phase III study for VAX-31 in adults in December 2025, with top-line data expected in Q4 2026, and anticipates readouts for OPUS-2 and OPUS-3 in H1 2027.

- Enrollment is complete for the VAX-31 infant Phase II study, with top-line data expected by the end of H1 2027.

- Vaxcyte completed construction of its dedicated large-scale manufacturing facility and is building a high-volume fill-finish production line, projecting a meaningful increase in total expenses, particularly R&D, in 2026 due to commercial readiness and clinical program advancement.

- Development of the VAX-A1 Group A Strep vaccine candidate will resume, with a Phase 1 study in adults expected to initiate in 2026.

- Vaxcyte reported $2.4 billion in cash, equivalents, and investments as of December 31, 2025, and subsequently raised approximately $600.2 million in net proceeds from a public equity offering, providing a cash runway to at least the end of 2028.

- The company's VAX-31 adult phase 3 program (OPUS-1, OPUS-2, OPUS-3) is underway, with top-line data for OPUS-1 expected in Q4 2026 and readouts for OPUS-2 and OPUS-3 in the first half of 2027.

- Enrollment for the VAX-31 infant phase 2 study is complete, with top-line data anticipated by the end of the first half of 2027.

- Vaxcyte completed the construction of its dedicated large-scale manufacturing facility on time and on budget, and expects total expenses, particularly R&D, to increase meaningfully in 2026 due to manufacturing scale-up and clinical trial advancements.

- Vaxcyte, Inc. reported a net loss of $766.6 million for the full year 2025 and $246.5 million for the fourth quarter of 2025.

- The company's cash, cash equivalents, and investments totaled $2,442.6 million as of December 31, 2025, which was further strengthened by approximately $600.2 million in net proceeds from a February 2026 equity offering.

- Vaxcyte initiated three Phase 3 clinical trials (OPUS-1, OPUS-2, OPUS-3) for its VAX-31 adult program in late 2025 and early 2026, with topline data from OPUS-1 anticipated in Q4 2026 and OPUS-2/OPUS-3 in H1 2027.

- Enrollment was completed in the VAX-31 infant Phase 2 dose-finding study in January 2026, with topline data expected by the end of H1 2027.

- The company completed construction of a dedicated manufacturing facility with Lonza and initiated the buildout of a high-volume fill-finish line in North Carolina to support future commercialization.

- Vaxcyte reported a net loss of $766.6 million for the full year ended December 31, 2025, and held $2,442.6 million in cash, cash equivalents and investments as of that date.

- The company completed an equity offering in February 2026, adding approximately $600.2 million in net proceeds to its balance sheet.

- The VAX-31 adult Phase 3 clinical program is underway with three studies, with topline data from OPUS-1 expected in Q4 2026 and OPUS-2/OPUS-3 results in H1 2027.

- Enrollment for the VAX-31 infant Phase 2 dose-finding study is complete, with topline data anticipated by the end of H1 2027.

- Vaxcyte has advanced its manufacturing capabilities, completing a dedicated Lonza facility and initiating a North Carolina fill-finish line buildout to support commercialization.

- Vaxcyte is focused on its 31-valent pneumococcal conjugate vaccine (VAX-31), which has shown strong Phase 2 data in adults by expanding coverage without sacrificing immunogenicity.

- The company has initiated a Phase 3 program for VAX-31 in adults, including a pivotal study (OPUS 1) of 4,000 subjects over age 50, comparing it to current standard-of-care vaccines.

- Vaxcyte plans to submit the Biologics License Application (BLA) for VAX-31 in adults by the end of 2027, targeting approval and launch in 2028.

- The pneumococcal vaccine market is an $8 billion segment and is expected to grow, with the adult market currently at $2 billion and expanding due to broader recommendations.

- Following a recent financing round, Vaxcyte holds over $3 billion in cash, positioning the company to achieve key milestones, including the potential launch of VAX-31.

- Vaxcyte is focused on its pneumococcal conjugate vaccine franchise, particularly the 31-valent VAX-31 program, which has shown the best data ever generated in this class in adults during Phase 2.

- The Phase 3 program for VAX-31 in adults is underway, anchored by the OPUS 1 pivotal study involving 4,000 subjects over the age of 50.

- The company plans to submit the Biologics License Application (BLA) for VAX-31 in adults by the end of 2027, with a target for approval and launch in 2028.

- Following recent financing, Vaxcyte has over $3 billion in cash, which is expected to fund the company through several key milestones, including the potential launch of VAX-31.

- Vaxcyte is advancing its pneumococcal conjugate vaccine franchise, with the 31-valent VAX-31 program positioned as a potential best-in-class solution for an $8 billion market.

- The Phase 3 program for VAX-31 in adults is underway, including the pivotal OPUS-1 study, with plans to submit the Biologics License Application (BLA) by the end of 2027 and target approval and launch in 2028.

- Vaxcyte anticipates receiving Phase 2 data for its VAX-31 infant program next year (2027), aiming for a significant improvement in coverage compared to current vaccines.

- Following a recent financing, Vaxcyte holds over $3 billion in cash, which is expected to fund the company through several key milestones, including the potential approval and launch of the VAX-31 adult program.

- Vaxcyte has dosed the first participants in its OPUS-3 Phase 3 trial for VAX-31, a 31-valent pneumococcal conjugate vaccine candidate, in adults previously vaccinated against pneumococcal disease.

- The OPUS-3 trial is part of a comprehensive Phase 3 adult clinical program for VAX-31, finalized in consultation with the U.S. Food and Drug Administration (FDA), to support a planned Biologics License Application (BLA) submission.

- Topline data from the OPUS-3 and OPUS-2 Phase 3 trials are anticipated in the first half of 2027, while data from the OPUS-1 trial are expected in the fourth quarter of 2026.

- VAX-31 is designed to cover approximately 95% of Invasive Pneumococcal Disease (IPD) and 88% of Pneumococcal Pneumonia in U.S. adults aged 50+, and received FDA Breakthrough Therapy designation in May 2025.

Quarterly earnings call transcripts for Vaxcyte.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more