Earnings summaries and quarterly performance for QUALYS.

Executive leadership at QUALYS.

Board of directors at QUALYS.

Research analysts who have asked questions during QUALYS earnings calls.

Rudy Kessinger

D.A. Davidson & Co.

7 questions for QLYS

Jonathan Ho

William Blair & Company

6 questions for QLYS

Joshua Tilton

Wolfe Research

5 questions for QLYS

William Kingsley Crane

Canaccord Genuity

5 questions for QLYS

Shrenik Kothari

Robert W. Baird & Co.

4 questions for QLYS

Joe Vandrick

Scotiabank

3 questions for QLYS

Junaid Siddiqui

Truist Securities

3 questions for QLYS

Patrick Colville

Scotiabank

3 questions for QLYS

Roger Boyd

UBS

3 questions for QLYS

Trevor Walsh

Citizens JMP

3 questions for QLYS

Yun Suk Kim

Loop Capital Markets LLC

3 questions for QLYS

Kingsley Crane

Canaccord

2 questions for QLYS

Mike Richardson

RBC Capital Markets

2 questions for QLYS

Nehal Chokshi

Northland Capital Markets

2 questions for QLYS

Oscar Saavedra

Morgan Stanley

2 questions for QLYS

Rahul Chopra

Berenberg

2 questions for QLYS

Yun Kim

Loop Capital Markets

2 questions for QLYS

Aiden

Piper Sandler & Co.

1 question for QLYS

Anik Bamonon

Jefferies

1 question for QLYS

Brian Essex

JPMorgan Chase & Co.

1 question for QLYS

Charlotte Bedick

JPMorgan Chase & Co.

1 question for QLYS

Garrett Brookman

William Blair

1 question for QLYS

Joel Fishbein

Truist Securities

1 question for QLYS

Mark Heatzig

Wolfe Research

1 question for QLYS

Matthew Hedberg

RBC Capital Markets

1 question for QLYS

Michael Richards

RBC Capital Markets

1 question for QLYS

Mike Cikos

Needham & Company, LLC

1 question for QLYS

Mike Sickles

Needham

1 question for QLYS

Robbie Owens

Piper Sandler

1 question for QLYS

Recent press releases and 8-K filings for QLYS.

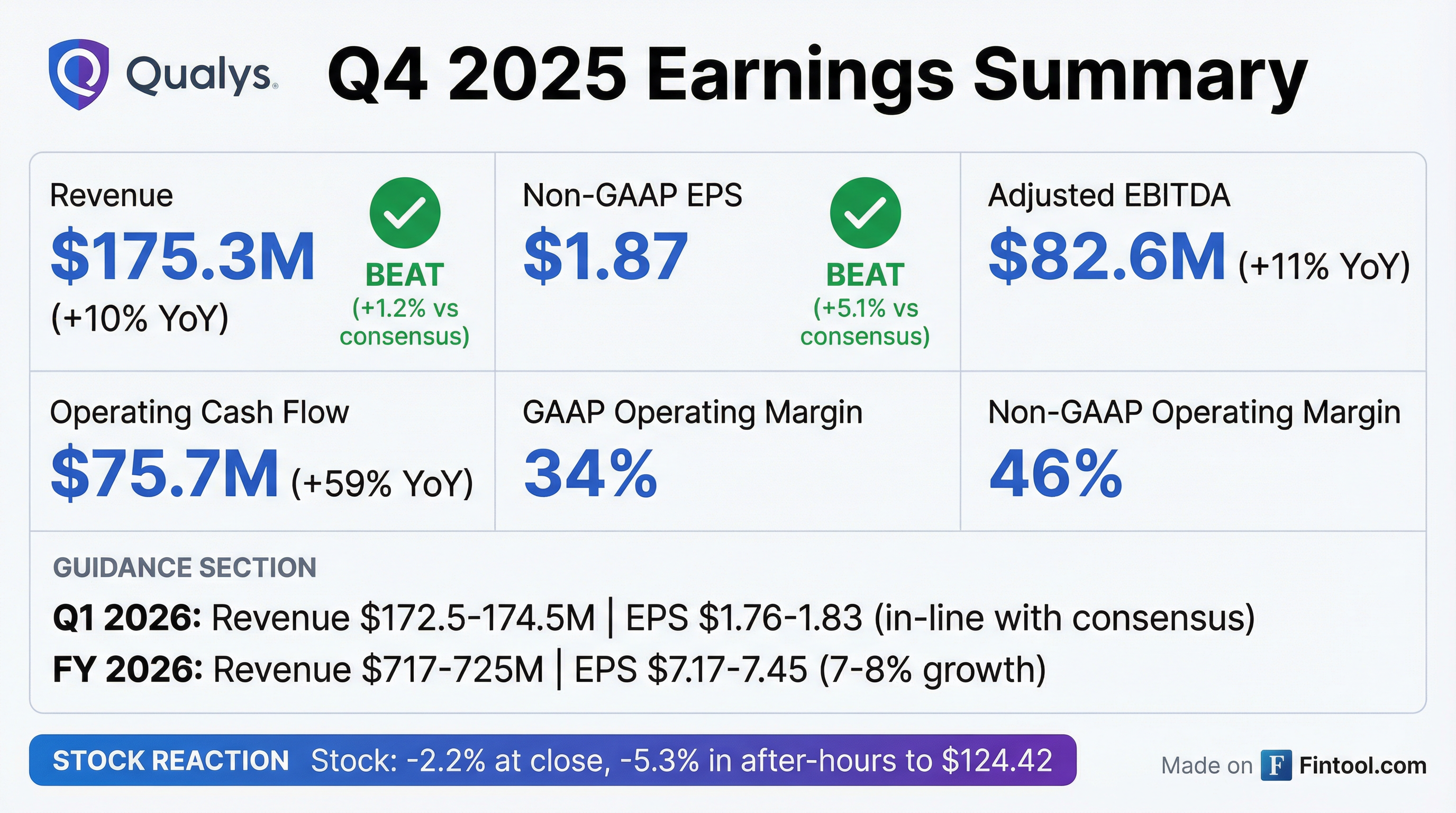

- Qualys reported Q4 2025 revenue of $175.3 million, a 10% increase year-over-year, and full-year 2025 revenue of $669.1 million, also up 10%. Diluted EPS for Q4 was $1.87 and $7.07 for the full year, growing 15%. The board authorized an additional $200 million increase to the share repurchase program, bringing the total available to $360.5 million.

- The company is strategically focused on its agentic AI-driven risk fabric and ETM platform, pioneering an agentic AI-native Risk Operation Center (ROC) that integrates CTEM, exploit confirmation, risk quantification, and remediation. New offerings like Agent Val leverage AI to confirm exploitability and automate remediation, aiming to reduce customer effort.

- For full-year 2026, Qualys expects revenues between $717 million and $725 million, representing 7%-8% growth, with EPS in the range of $7.17-$7.45. They anticipate EBITDA margin in the mid-forties and free cash flow margin in the low forties.

- Qualys reported full year 2025 revenues of $669 million, an increase of 10% year-over-year, with an Adjusted EBITDA of $313 million and a 47% Adjusted EBITDA margin.

- The company introduced and highlighted its Qualys Enterprise TruRisk Platform, designed for comprehensive risk management by leveraging risk analytics to deliver desired business outcomes across areas like CyberSecurity Asset Management (CSAM), VMDR, Threat Detection and Response, and TotalCloud (CNAPP).

- Qualys serves over 10,000 subscription customers, including 74% of the Forbes Global 50.

- The Net Dollar Expansion Rate was 103% for the last twelve months (LTM) ending Q4 2025.

- For LTM Q4 2025 bookings, Vulnerability Management accounted for 51%, while ETM/CSAM contributed 10%.

- Qualys reported Q4 2025 revenues of $175.3 million, an increase of 10% year-over-year, contributing to full-year 2025 revenues of $669.1 million, also up 10%. Diluted EPS for Q4 2025 was $1.87 and $7.07 for the full year.

- For full-year 2026, Qualys expects revenues to be in the range of $717 million-$725 million, representing 7%-8% growth, with EPS projected between $7.17-$7.45.

- The company is advancing its Agentic AI-driven risk fabric and Agentic AI-native Risk Operations Center (ROC), expanding the Qualys ETM platform to unify diverse risk signals, quantify, and automate remediation.

- Qualys continued its share repurchase program, spending $44.7 million in Q4 2025 and authorizing an additional $200 million, bringing the total available for repurchase to $360.5 million.

- Growth was supported by increased channel contribution, which made up 51% of total revenues in Q4 2025, and 15% growth in international revenue.

- Qualys reported Q4 2025 revenue of $175.3 million, a 10% increase year-over-year, and full-year 2025 revenue of $669.1 million, also up 10%.

- Non-GAAP EPS for Q4 2025 was $1.87 per diluted share, with an adjusted EBITDA margin of 47%. Full-year 2025 non-GAAP EPS reached $7.07 per diluted share, a 15% increase.

- The company issued full-year 2026 revenue guidance of $717 million to $725 million (7%-8% growth) and EPS guidance of $7.17 to $7.45.

- Qualys is focused on accelerating the adoption of its Agentic AI-native Risk Operation Center (ROC) and ETM solution, leveraging its partner ecosystem and Q-Flex model, with early momentum in federal business.

- The board authorized an additional $200 million for the share repurchase program, increasing the total available to $360.5 million.

- Qualys reported revenues of $175.3 million for the fourth quarter of 2025 and $669.1 million for the full year 2025, both reflecting 10% year-over-year growth.

- For Q4 2025, non-GAAP net income per diluted share was $1.87, and for the full year 2025, it was $7.07.

- The company's Adjusted EBITDA reached $82.6 million in Q4 2025 and $313.4 million for the full year 2025.

- Qualys announced a $200 million increase to its share repurchase program.

- For the first quarter of 2026, the company expects revenues in the range of $172.5 million to $174.5 million, and for the full year 2026, revenues are projected to be between $717.0 million and $725.0 million.

- Qualys reported Q4 2025 revenues of $175.3 million, a 10% year-over-year increase, with GAAP net income per diluted share of $1.47 and non-GAAP net income per diluted share of $1.87. For the full year 2025, revenues reached $669.1 million, also a 10% increase, with GAAP net income per diluted share of $5.44 and non-GAAP net income per diluted share of $7.07.

- The company announced a $200 million increase to its share repurchase program.

- For Q1 2026, Qualys expects revenues between $172.5 million and $174.5 million, and full year 2026 revenues are projected to be in the range of $717.0 million to $725.0 million.

- Key business highlights include enhancing its Enterprise TruRisk Management (ETM) solution with new features like identity security and exploit validation, and achieving FedRAMP High Authorization for the Qualys GovCloud Platform.

- Qualys reported strong financial results for Q3 2025, with revenues growing 10% to $169.9 million and EPS increasing 19% to $1.86. The adjusted EBITDA margin was 49% and free cash flow margin was 53%.

- The company raised its full-year 2025 guidance, now expecting revenues between $665.8 million and $667.8 million (10% growth) and EPS in the range of $6.93 to $7.00. Q4 2025 revenue is projected to be $172 million to $174 million.

- Qualys is advancing its Risk Operations Center (ROC), powered by its Enterprise TruRisk Management (ETM) solution, which integrates agentic AI for proactive risk management and includes new capabilities like TrueConfirm for exploitability validation. The company also introduced a new QFlex flexible platform pricing model.

- Net dollar retention remained 104% , and the company repurchased 366,000 shares for $49.4 million in Q3 2025, with $205 million remaining in the share repurchase program.

- For Q3 2025 year-to-date, Qualys reported $554 million in revenues, reflecting 10% year-over-year growth, and achieved an Adjusted EBITDA of $230.8 million with a 47% margin.

- The company demonstrated strong cash flow generation, with $229.5 million in Non-GAAP Free Cash Flows and a 46% FCF Margin for Q3 2025 year-to-date, alongside $140 million in share repurchases.

- Qualys introduced the Qualys Enterprise TruRisk Platform, a strategic initiative aimed at leveraging risk analytics for comprehensive risk management and IT-security stack consolidation.

- The company operates within a $55 billion Total Addressable Market (CY2025E) and boasts a blue-chip customer base of over 10,000 subscription customers, including 72% of the Forbes Global 50.

- Qualys reported strong Q3 2025 financial results, with revenue growing 10% to $169.9 million, adjusted EBITDA of $82.6 million (49% margin), and EPS increasing 19% to $1.86.

- The company raised its full-year 2025 guidance, now expecting revenues between $665.8 million and $667.8 million (10% growth) and EPS in the range of $6.93 to $7.00.

- Qualys is advancing its Enterprise TruRisk Management (ETM) solution, which integrates CRQ, CTEM, and native remediation, with early adoption showing 28 POCs converting to commercial success. ETM is anticipated to drive an uplift of up to 100% for every $1 of VMDR.

- Strategic initiatives like the QFlex flexible pricing model and increased partner-led deal registration are contributing to platform growth and customer adoption, alongside significant wins in the federal and state government sectors.

- In Q3 2025, Qualys repurchased 366,000 shares for $49.4 million, with $205 million remaining in its share repurchase program.

- Qualys, Inc. reported revenues of $169.9 million for the third quarter ended September 30, 2025, marking a 10% increase year-over-year.

- For Q3 2025, the company achieved non-GAAP net income of $67.4 million and non-GAAP diluted earnings per share of $1.86.

- The company raised its full-year 2025 revenue guidance to a range of $665.8 million to $667.8 million.

- Qualys also increased its full-year 2025 non-GAAP diluted earnings per share guidance to a range of $6.93 to $7.00.

Quarterly earnings call transcripts for QUALYS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more