Earnings summaries and quarterly performance for ROGERS COMMUNICATIONS.

Research analysts who have asked questions during ROGERS COMMUNICATIONS earnings calls.

Aravinda Galappatthige

Canaccord Genuity

7 questions for RCI

Drew McReynolds

RBC Capital Markets

7 questions for RCI

Jérome Dubreuil

Desjardins Group

7 questions for RCI

Maher Yaghi

Scotiabank

7 questions for RCI

Vince Valentini

TD Securities

7 questions for RCI

Batya Levi

UBS

6 questions for RCI

Matthew Griffiths

Bank of America

5 questions for RCI

Tim Casey

BMO Capital Markets

5 questions for RCI

Stephanie Price

CIBC World Markets

4 questions for RCI

David McFadgen

Cormark Securities

2 questions for RCI

Batia Levi

UBS

1 question for RCI

David Barden

Bank of America

1 question for RCI

Matt Griffiths

Bank of America Merrill Lynch

1 question for RCI

Patrick Ho

Morgan Stanley

1 question for RCI

Patrick Roe

Morgan Stanley

1 question for RCI

Sebastiano Petti

JPMorgan Chase & Co.

1 question for RCI

Simon Flannery

Morgan Stanley

1 question for RCI

Recent press releases and 8-K filings for RCI.

- Rogers Communications has launched satellite-powered asset tracking technology in partnership with Geotab, a global leader in connected transportation.

- This initiative makes Rogers the first Canadian wireless carrier to offer satellite-to-mobile service for IoT, extending asset visibility to areas beyond traditional cell coverage, which currently covers only 18% of Canada.

- The service, named GO Anywhere Plus, leverages low-earth orbit (LEO) satellites and Rogers' national wireless spectrum, enabling existing IoT devices to seamlessly switch between wireless and satellite service.

- Rogers plans to introduce satellite-enabled GO Anywhere hardware this spring.

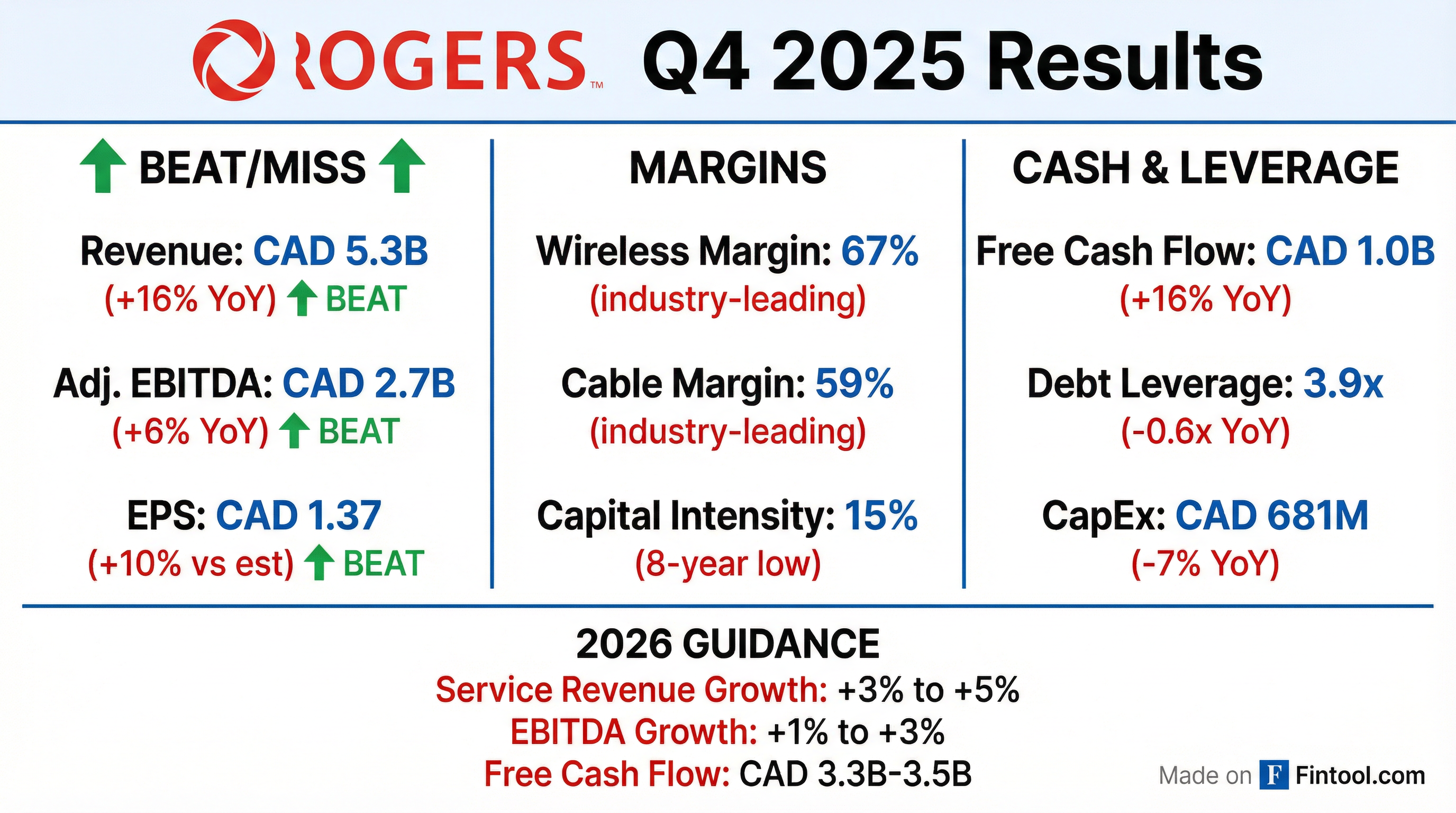

- Rogers Communications (RCI) reported strong Q4 and full-year 2025 results, meeting or exceeding all 2025 guidance targets. Q4 2025 saw consolidated service revenue increase by 16% to CAD 5.3 billion and Adjusted EBITDA rise 6% to CAD 2.7 billion.

- For the full year 2025, RCI achieved revenue of CAD 21.7 billion and EBITDA of CAD 9.8 billion. The company significantly improved capital efficiency, with Q4 capital expenditures down 7% and capital intensity at an eight-year low of 15%.

- RCI's balance sheet strengthened, with debt leverage reduced to 3.9 times by year-end, achieving pre-Shaw levels nine months ahead of target. Full-year 2025 free cash flow exceeded CAD 3.3 billion, up 10% year-over-year.

- The company provided a positive 2026 outlook, projecting total service revenue growth of 3%-5% and Adjusted EBITDA growth of 1%-3%. Capital expenditures are expected to decline further to CAD 3.3 billion-CAD 3.5 billion, with higher free cash flow in the same range.

- Key strategic moves in 2025 included closing the acquisition of a 75% interest in MLSE and launching Rogers Satellite, Canada's first satellite-to-mobile wireless service.

- Rogers Communications reported consolidated service revenue up 16% to CAD 5.3 billion and Adjusted EBITDA up 6% to CAD 2.7 billion in Q4 2025. The media business saw Q4 revenue more than double to CAD 1.2 billion and Adjusted EBITDA increase more than fourfold.

- For the full year 2025, the company exceeded its upgraded guidance metrics, achieving free cash flow over CAD 3.3 billion (up 10% year-over-year) and reducing debt leverage to 3.9 times (a 0.6 times improvement from last year), reaching pre-Shaw levels nine months ahead of schedule.

- Rogers projects a 2026 outlook with total service revenue growth of 3%-5% and Adjusted EBITDA growth of 1%-3%. The company also anticipates lower capital expenditures in the range of CAD 3.3 billion-CAD 3.5 billion and higher free cash flow in the range of CAD 3.3 billion-CAD 3.5 billion.

- Key strategic initiatives in 2025 included acquiring a 75% controlling interest in MLSE and launching Rogers Satellite, Canada's first wireless carrier to offer satellite-to-mobile services. The company also plans to purchase the remaining 25% stake in MLSE later in 2026.

- Rogers Communications Inc. (RCI) reported strong Q4 2025 and full-year 2025 financial and operating results, meeting or exceeding all upgraded 2025 guidance metrics.

- For Q4 2025, consolidated service revenue increased by 16% to CAD 5.3 billion, and Adjusted EBITDA grew 6% to CAD 2.7 billion. Full-year 2025 revenues reached CAD 21.7 billion (up 5%) and EBITDA was CAD 9.8 billion (up 2%).

- The company demonstrated improved capital efficiency, with Q4 capital expenditures down 7% and capital intensity at an eight-year low of 15%. Full-year 2025 free cash flow was over CAD 3.3 billion, exceeding guidance and up 10% year over year.

- Debt leverage improved to 3.9 times by year-end 2025, down 0.6 times from the previous year, achieving the pre-Shaw level ahead of schedule.

- The 2026 outlook projects total service revenue growth of 3%-5% and Adjusted EBITDA growth of 1%-3%. Capital expenditures are targeted to decline to the CAD 3.3 billion-CAD 3.5 billion range, with Free Cash Flow also projected to be in the CAD 3.3 billion-CAD 3.5 billion range.

- Rogers Communications launched Rogers Satellite, a new service offering coast-to-coast connectivity in Canada, including voice and video calling via popular apps like WhatsApp and Google Maps, in areas lacking traditional cell coverage.

- The company also introduced a satellite-to-mobile IoT service for businesses, providing connectivity in remote Canadian regions for applications such as fleet tracking and automated sensors.

- During a beta trial, customers sent over one million satellite text messages, and the service is priced at $15/month for all Canadians, with promotional offers for existing customers and discounts for beta trial participants.

- Rogers Communications (RCI) is observing a stabilizing Canadian wireless pricing environment and has achieved churn improvements throughout the year, with the sector anticipating approaching 3% subscriber growth. The company is implementing add-a-line promotions and bundling services, including the Rogers Bank credit card and wireline/wireless bundles following the Shaw acquisition, to enhance customer relationships and reduce churn.

- The company completed the acquisition of the remaining 75% stake in MLSE in early July and intends to acquire the 25% minority stake held by Larry Tanenbaum around early July 2026, or potentially sooner. The combined MLSE and Rogers Sports & Media (100% interest) is currently valued at approximately $20 billion Canadian, with plans to introduce minority investors after securing the remaining stake.

- Rogers has significantly reduced its leverage from 5.3 times in April 2023 to 3.5 times at mid-year. After debt reduction from the Blackstone-led investment and data center sales, the company projects to conclude the year with leverage in the range of 3.9 to four times.

- Cable margins are currently at 58%, with expectations to reach 59% again, while wireless margins are in the 64-66% range. The company is focused on driving growth in subscribers, revenues, earnings, and free cash flow, anticipating further synergies from the MLSE consolidation.

- Rogers Communications has significantly improved its cable business, increasing combined margins with Shaw from 50% to 58%-59%, and is expanding its Fixed Wireless Access (FWA) product to address approximately 7 million additional homes.

- The company has made substantial progress in deleveraging, reducing its leverage from 5.3x post-Shaw acquisition to just under 3.6x at mid-year, with further reductions anticipated from a $300 million bond tender benefit and data center sale.

- Rogers now holds a 75% stake in MLSE, alongside 100% ownership of the Toronto Blue Jays and Rogers Centre, with these sports assets collectively valued at approximately CAD 15 billion. The company intends to acquire the remaining minority stake in MLSE by next summer and is exploring strategies to maximize and surface this value for shareholders.

- Rogers anticipates a declining capital intensity for both its wireless and wireline businesses in the coming years.

Quarterly earnings call transcripts for ROGERS COMMUNICATIONS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more