Earnings summaries and quarterly performance for REPUBLIC SERVICES.

Executive leadership at REPUBLIC SERVICES.

Jon Vander Ark

President and Chief Executive Officer

Amanda Hodges

Executive Vice President, Chief Commercial Officer

Brian A. Bales

Executive Vice President, Chief Development Officer

Brian M. DelGhiaccio

Executive Vice President, Chief Financial Officer

Catharine D. Ellingsen

Executive Vice President, Chief Legal Officer, Chief Ethics & Compliance Officer, and Corporate Secretary

Courtney Rodriguez

Executive Vice President, Chief Human Resources Officer

Gregg K. Brummer

Executive Vice President, Chief Operating Officer

Julia Arambula

Senior Vice President, Operations

Larson Richardson

Senior Vice President, Operations

Board of directors at REPUBLIC SERVICES.

Brian S. Tyler

Director

James P. Snee

Director

Jennifer M. Kirk

Director

Katharine B. Weymouth

Director

Manny Kadre

Chairman of the Board

Meg Reynolds

Director

Michael A. Duffy

Director

Michael Larson

Director

Norman Thomas Linebarger

Director

Sandra M. Volpe

Director

Thomas W. Handley

Director

Research analysts who have asked questions during REPUBLIC SERVICES earnings calls.

Noah Kaye

Oppenheimer & Co. Inc.

7 questions for RSG

Bryan Burgmeier

Citigroup Inc.

6 questions for RSG

Tobey Sommer

Truist Securities, Inc.

6 questions for RSG

Trevor Romeo

William Blair

6 questions for RSG

David Manthey

Robert W. Baird & Co. Incorporated

5 questions for RSG

Jerry Revich

Goldman Sachs Group Inc.

5 questions for RSG

Kevin Chiang

CIBC Capital Markets

5 questions for RSG

Sabahat Khan

RBC Capital Markets

5 questions for RSG

Stephanie Moore

Jefferies

5 questions for RSG

James Schumm

TD Cowen

4 questions for RSG

Konark Gupta

Scotiabank

4 questions for RSG

Toni Kaplan

Morgan Stanley

4 questions for RSG

Faiza Alwy

Deutsche Bank

3 questions for RSG

Tyler Brown

Raymond James Financial, Inc.

3 questions for RSG

Adam Bubis

Goldman Sachs Group, Inc.

2 questions for RSG

Brian Butler

Stifel, Nicolaus & Company, Incorporated

2 questions for RSG

Patrick Brown

Raymond James

2 questions for RSG

Rob Wertheimer

Melius Research LLC

2 questions for RSG

Seth Weber

Wells Fargo

2 questions for RSG

Shlomo Rosenbaum

Stifel, Nicolaus & Company, Incorporated

2 questions for RSG

Tami Zakaria

JPMorgan Chase & Co.

2 questions for RSG

Tony Bancroft

Gabelli Funds

2 questions for RSG

Yehuda Silverman

Morgan Stanley

2 questions for RSG

Devin Dodge

BMO Capital Markets Corp.

1 question for RSG

Harold Antor

Jefferies Financial Group Inc.

1 question for RSG

John Trevor Romeo

William Blair & Company L.L.C.

1 question for RSG

Michael Feniger

Bank of America

1 question for RSG

Patrick Tyler Brown

Raymond James & Associates Inc.

1 question for RSG

Stephanie Lynn Benjamin Moore

Jefferies LLC

1 question for RSG

Tobey O'Brien Sommer

Truist Securities

1 question for RSG

Recent press releases and 8-K filings for RSG.

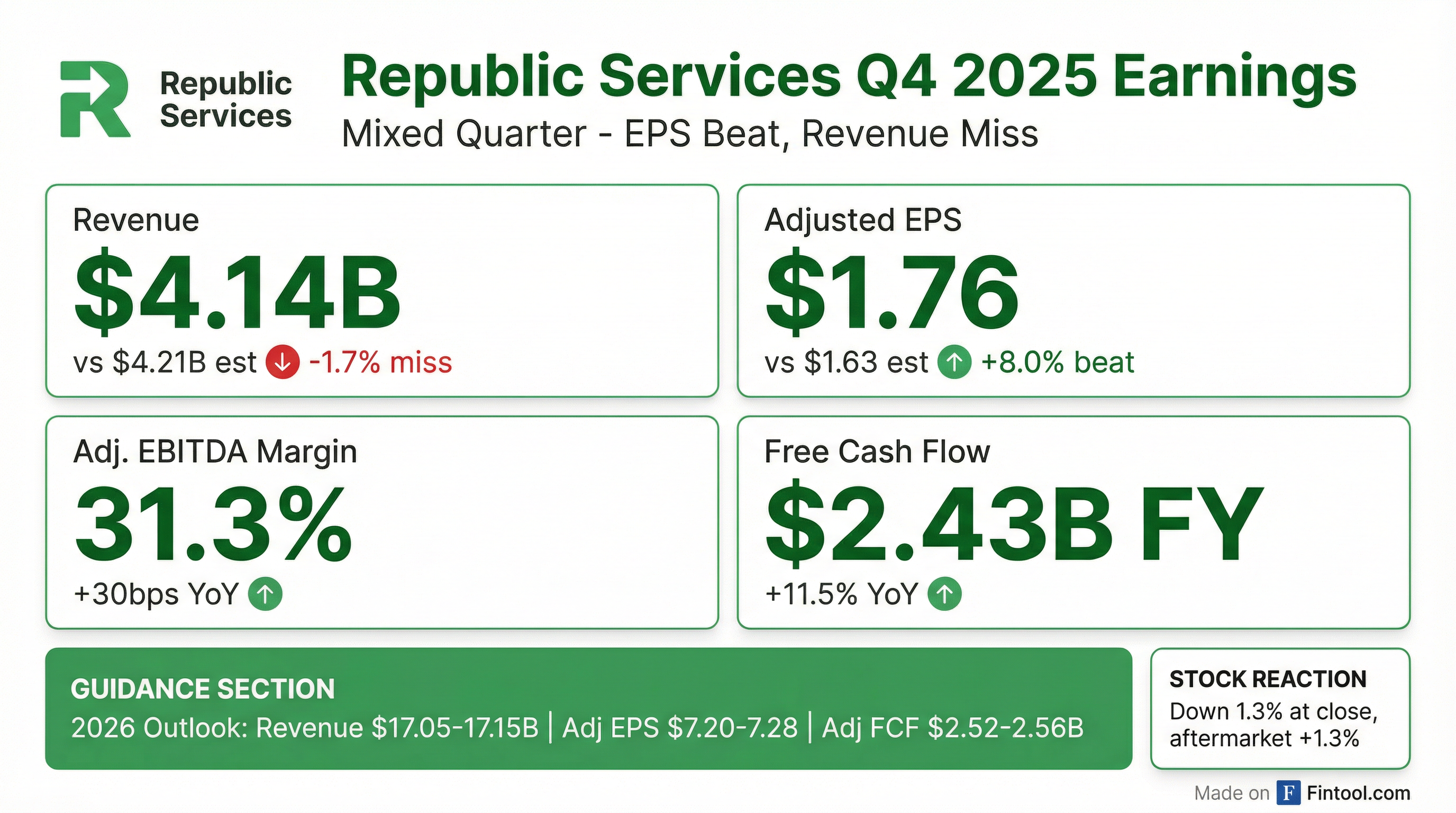

- Republic Services delivered 3.5% revenue growth, 7% adjusted EBITDA growth, adjusted EPS of $7.02, and $2.43 billion of adjusted free cash flow (45.8% conversion) in 2025.

- In Q4, organic volume reduced total revenue by 1% and related revenue by 1.2%, while core price rose 5.8% on total revenue and 7.1% on related revenue.

- Adjusted EBITDA margin expanded 90 bps to 32.0% for the full year and was 31.3% in Q4.

- 2026 guidance calls for revenue of $17.05–17.15 billion, Adj. EBITDA of $5.475–5.525 billion, Adj. EPS of $7.20–7.28, and FCF of $2.52–2.56 billion.

- The company invested $1.1 billion in acquisitions and returned $1.6 billion to shareholders in 2025 (incl. $854 million of buybacks) and expects ~$1 billion of acquisitions in 2026, with $400 million deployed to date.

- 2025 financial performance: Revenue up 3.5%, adjusted EBITDA +7% (adj. EBITDA margin +90 bp to 32%), adjusted EPS $7.02, and adjusted free cash flow $2.43 B with conversion at 45.8%.

- Q4 2025 dynamics: Organic pricing drove 3.7% yield on total revenue and 4.5% on related revenue; volumes declined 1%, and Environmental Solutions organic revenue fell 2% largely due to a non-recurring emergency response project.

- 2026 outlook: Guided revenue $17.05 B–$17.15 B, adjusted EBITDA $5.475 B–$5.525 B, EPS $7.20–$7.28, and free cash flow $2.52 B–$2.56 B, implying mid-point growth of ~3–4% across key metrics (ex-wildfire/hurricane comps ~4% top-line).

- Sustainability & digital: Commenced commercial production at a new Polymer Center and Blue Polymers facility; nine RNG projects online in 2025 (four more in 2026); 180+ EV trucks and 32 charging sites, with 150 additional EV trucks planned.

- Capital allocation: Invested $1.1 B in acquisitions in 2025, returned $1.6 B to shareholders (including $854 M of buybacks); $400 M of acquisitions closed YTD contributing ~70 bp to growth, with $1 B planned for 2026.

- 2025 results: Revenue grew 3.5%, adjusted EBITDA rose nearly 7%, margin expanded 90 bps to 32%, adjusted EPS was $7.02, and free cash flow reached $2.43 B with a 45.8% conversion.

- 4Q25 drivers: Average yield on total revenue was 3.7% (related revenue 4.5%); organic volume declined 1% (total) and 1.2% (related) due to end-market softness and residential contract shedding.

- 2026 guidance: Revenue of $17.05 B–$17.15 B, adjusted EBITDA of $5.475 B–$5.525 B, adjusted EPS of $7.20–$7.28, and free cash flow of $2.52 B–$2.56 B.

- Sustainability & technology: Began commercial production at Indianapolis Polymer Center and co-located Blue Polymers, brought 9 RNG projects online (4 more in 2026), and ended 2025 with 180 electric collection vehicles and 32 charging facilities.

- Capital allocation: Invested $1.1 B in acquisitions, returned $1.6 B to shareholders (including $854 M of buybacks), with a robust M&A pipeline supporting $1 B planned 2026 investments.

- Q4 2025 EPS of $1.76 (up 8.0% YoY) on net income of $545 million (13.2% margin) and expanded adjusted EBITDA margin by 30 bps.

- Full-year 2025 net income of $2.14 billion, EPS of $6.85 (up 5.5% YoY), and generated $2.43 billion in adjusted free cash flow (up 11.5%).

- Declared a regular quarterly dividend of $0.625 per share for shareholders of record April 2, 2026.

- 2026 guidance: revenue $17.05–17.15 billion, adjusted EBITDA $5.475–5.525 billion, adjusted EPS $7.20–7.28, and adjusted free cash flow $2.52–2.56 billion .

- Republic Services delivered Q4 2025 net income of $545 million ($(1.76) per diluted share), up from $512 million ($1.63), with adjusted EBITDA of $1.30 billion and a 31.3% margin.

- For full-year 2025, net income was $2.14 billion ($6.85 per diluted share), adjusted EPS of $7.02, and adjusted EBITDA of $5.31 billion at a 32.0% margin.

- The company generated $4.30 billion of operating cash flow and $2.43 billion of adjusted free cash flow, investing $1.1 billion in acquisitions and returning $1.6 billion to shareholders via $854 million of share repurchases and $738 million of dividends.

- 2026 guidance includes revenue of $17.05–17.15 billion, adjusted EBITDA of $5.475–5.525 billion, adjusted EPS of $7.20–7.28, and adjusted free cash flow of $2.52–2.56 billion.

- Delivered 3.3% revenue growth, 6.1% adjusted EBITDA growth, 80 bp margin expansion, $1.90 adjusted EPS, and $2.19 B YTD adjusted free cash flow on persistent construction and manufacturing headwinds.

- Organic revenue aided by strong pricing: 4.0% average yield on total revenue and 4.9% on related revenue, partially offset by 30 bp volume decline on total revenue and 40 bp on related revenue.

- Environmental Solutions segment weighed on results with a 140 bp revenue headwind, driven by softer manufacturing and event-driven volumes, but demand stabilized exiting the quarter.

- Advanced sustainability: commercial production began at Indianapolis polymer center; six RNG projects commenced in 2025 with a seventh expected; fleet electrification reached 137 EVs with >150 targeted by year-end.

- Year-to-date invested >$1 B in acquisitions and returned $1.13 B to shareholders via dividends and share repurchases.

- Republic Services reported Q3 2025 net income of $550 million ($1.76 EPS) and adjusted EPS of $1.90, with a 13.1% net income margin.

- Q3 revenue was $4.212 billion, up 3.3% year-over-year (1.7% organic, 1.6% from acquisitions).

- Adjusted EBITDA reached $1.383 billion with a 32.8% margin, an 80 bps improvement versus Q3 2024.

- Year-to-date cash flow from operations was $3.32 billion, and adjusted free cash flow was $2.19 billion.

- The Board declared a $0.625 quarterly dividend per share (payable January 15, 2026) and repurchased $539 million of stock in Q3, leaving approximately $1.9 billion of buyback capacity.

- Recorded EPS of $1.76 and adjusted EPS of $1.90, with net income of $550 million and adjusted EBITDA of $1.38 billion at a 32.8% margin (+80 bps)

- Achieved 3.3% total revenue growth (1.7% organic; 1.6% acquisitions), driven by a 5.9% core price increase and 4.0% average yield, offset by a 0.3% volume decline

- Generated $3.32 billion YTD cash from operations and $2.19 billion of adjusted free cash flow, while investing over $1 billion in acquisitions YTD

- Declared a $0.625 per share quarterly dividend, payable January 15, 2026

- Expects 2025 revenue near the low end of its guidance range and reiterates all other financial components

- A cradle-to-gate study of rPET flake produced at the Las Vegas Polymer Center (first seven months of 2024) shows a 54% lower global warming potential versus representative rPET alternatives and 82% lower versus virgin PET in the U.S. market.

- The Las Vegas facility uses a patented, energy-efficient equipment line and benefits from a lower-carbon regional utility grid, reducing electricity and thermal energy per kilogram of flake.

- Republic Services operates two Polymer Centers (Las Vegas and Indianapolis) with a third under construction in Allentown, PA; each center will have capacity to produce 120 million pounds of bottle-grade recycled plastics annually.

- The bottle-grade rPET enables true bottle-to-bottle circularity and helps customers decarbonize their supply chains, reducing Scope 3 emissions.

- In Q2, revenue grew 4.6%, adjusted EBITDA rose 8% to a 32.1% margin, adjusted EPS was $1.77, and YTD adjusted free cash flow reached $1.42 B.

- Updated 2025 guidance: revenue $16.675–$16.75 B, adjusted EBITDA $5.275–$5.325 B, adjusted EPS $6.82–$6.90, and free cash flow $2.375–$2.415 B.

- YTD capital allocation included $900 M in acquisitions (pipeline > $1 B) and $400 M returned to shareholders via dividends and buybacks; dividend increased for the 22nd consecutive year.

- Sustainability and operations: Indianapolis Polymer Center commenced commercial production in July; six RNG projects online (seven expected in 2025); fleet electrification at 114 EVs, targeting > 150 by year-end.

- Environmental Solutions faced volume headwinds from sluggish construction/manufacturing, with Q2 revenue down $11 M and EBITDA margin stable at 23.7%.

Quarterly earnings call transcripts for REPUBLIC SERVICES.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more