Earnings summaries and quarterly performance for REVVITY.

Executive leadership at REVVITY.

Prahlad Singh

President and Chief Executive Officer

Anita Gonzales

Vice President and Chief Accounting Officer

Joel Goldberg

Senior Vice President, Administration, General Counsel and Secretary

Maxwell Krakowiak

Senior Vice President and Chief Financial Officer

Miriame Victor

Senior Vice President and Chief Commercial Officer

Tajinder Vohra

Senior Vice President, Global Operations

Board of directors at REVVITY.

Alexis Michas

Non-Executive Chair

Frank Witney

Director

Michael Klobuchar

Director

Michel Vounatsos

Director

Michelle McMurry-Heath

Director

Pascale Witz

Director

Peter Barrett

Director

Samuel Chapin

Director

Sophie Vandebroek

Director

Research analysts who have asked questions during REVVITY earnings calls.

Vijay Kumar

Evercore ISI

7 questions for RVTY

Luke Sergott

Barclays

6 questions for RVTY

Patrick Donnelly

Citi

5 questions for RVTY

Andrew Cooper

Raymond James

4 questions for RVTY

Catherine Schulte

Baird

4 questions for RVTY

Dan Arias

Stifel Financial Corp.

4 questions for RVTY

Daniel Brennan

TD Cowen

4 questions for RVTY

Dan Leonard

UBS Group AG

4 questions for RVTY

Michael Ryskin

Bank of America Merrill Lynch

4 questions for RVTY

Puneet Souda

Leerink Partners

4 questions for RVTY

Matthew Sykes

Goldman Sachs Group Inc.

3 questions for RVTY

Tycho Peterson

Jefferies

3 questions for RVTY

Brandon Couillard

Wells Fargo

2 questions for RVTY

Dan Brennan

UBS

2 questions for RVTY

Daniel Arias

Stifel, Nicolaus & Company, Incorporated

2 questions for RVTY

Daniel Leonard

Stifel Financial Corp.

2 questions for RVTY

Doug Schenkel

Wolfe Research LLC

2 questions for RVTY

Josh Waldman

Cleveland Research

2 questions for RVTY

Brandon Couillard

Wells Fargo & Company

1 question for RVTY

Catherine Ramsey

BTIG

1 question for RVTY

Douglas Schenkel

Wolfe Research, LLC

1 question for RVTY

Jack Meehan

Nephron Research LLC

1 question for RVTY

Rachel Vatnsdal

JPMorgan Chase & Co.

1 question for RVTY

Subbu Nambi

Guggenheim Securities

1 question for RVTY

Tycho Pedersen

Jefferies

1 question for RVTY

Recent press releases and 8-K filings for RVTY.

- Revvity reported solid Q4 execution and reiterated 2–3% organic growth guidance for 2026, underpinned by cost measures enacted in Q4 2025 to drive outsized margin expansion in 2026 and early 2027.

- The Revvity Signals software platform is positioned as a net beneficiary of AI; three major product launches—Synthetica, BioDesign, and Labgistics—are slated by early 2027 to help double the business within five years.

- In immunodiagnostics, ex-China performance remained strong, with U.S. revenue share rising from 5% to 20% post-acquisition and an objective to double U.S. market penetration, while China diagnostics is conservatively expected to decline mid-20s% in 2026.

- Capital allocation priorities include opportunistic share buybacks—12% of shares repurchased since 2023—servicing a €500 million bond due July, and pursuing bolt-on M&A to fill strategic portfolio gaps.

- Prahlad Singh reiterated 2–3% organic growth guidance for 2026, with cost-saving measures driving margin expansion to 28% by year-end and further gains in early 2027.

- Life Science Solutions saw reagent revenues return to growth in Q4, while instrument order trends are improving; the business is expected to move from low-single-digit declines to modest growth as platforms drive consumable pull-through.

- Diagnostics outperformed on reproductive health and newborn screening, with ex-China immunodiagnostics strong; U.S. immunodiagnostics now represents 20% of sales and is targeted to double, while China diagnostics is conservatively forecast down mid-20% in 2026.

- Revvity Signals is positioned as a net AI beneficiary, with upcoming launches of Synthetica, BioDesign and Logistics aimed at doubling the platform’s revenue over five years.

- Capital allocation remains opportunistic: 12% of shares repurchased since 2023, a €500 million bond due July to be refinanced, and focus on bolt-on M&A after deploying ~$10 billion in strategic transactions.

- At the TD Cowen conference, Revvity reaffirmed 2026 organic growth guidance of 2–3%, assuming pharma-biotech market stability, and outlined cost measures driving outsized margin expansion in H2 2026 and into H1 2027.

- Life Science Solutions: reagent sales have grown in four of the last five quarters despite market weakness, while instrument demand is expected to shift from negative to positive low single-digit growth as installed platforms drive consumable pull-through.

- Software: Revvity Signals is positioned as a regulated AI-ready platform; upcoming NPIs—BioDesign, Synthetica (full launch by late 2026/early 2027), and Labgistics—are key to the goal of doubling Signals revenue over the next five years.

- Immunodiagnostics ex-China posted strong growth; the U.S. now represents ~20% of immunodiagnostics revenues (vs. 5% at acquisition), with plans to double share and expand into esoteric autoimmune testing.

- Capital allocation: Revvity repurchased 12% of shares (~15 million) since 2023, will repay a €500 million bond in July, and remains opportunistic on bolt-on M&A.

- Revvity is a $3 billion company split 50% between life sciences and diagnostics, with 85% of revenue recurring.

- Management highlighted four innovation pillars: major software NPIs (Xynthetica, BioDesign, Signals LabGistics), integrated life sciences/diagnostics workflows, a growing GMP reagents pipeline, and U.S. immunodiagnostics expansion.

- 2026 guidance calls for 2–3% organic growth on ~$3 billion revenue, an adjusted operating margin of 28% (up ~100 bps), and high single-digit EPS growth.

- Operational excellence initiatives have driven 90% free cash flow conversion, repurchased 10% of shares since launch, and target 100 bps margin expansion in 2026 with further gains in 2027.

- AI is viewed as a net tailwind for both software (via Xynthetica) and reagents, expected to accelerate discovery and create a wet-lab validation bottleneck.

- Portfolio split: Revvity is a $3 billion business, equally weighted between life sciences and diagnostics, with ~85% recurring revenue and a long‐range organic growth target of 6%–8%.

- 2026 guidance: Revenue of ~$3 billion, 2%–3% organic growth, and an 28% adjusted operating margin (≈100 bps expansion), driving high single-digit EPS growth.

- Four growth pillars: 1) Software innovation (Xynthetica launched Q4 2025; BioDesign and Signals LabGistics due H2 2026), 2) integrated life sciences/diagnostics partnerships (e.g., Sanofi T1D, Genomics England), 3) GMP reagents pipeline acceleration, and 4) U.S. immunodiagnostics expansion toward a 40% market share.

- Operational excellence: Achieved ~90% free cash flow conversion (vs. 70% pre-Revvity), repurchased nearly 10% of shares since 2023, and plans ~100 bps margin expansion in 2026 via headcount, supply chain, and footprint synergies.

- Revvity reported a $3 billion portfolio split 50% life sciences/50% diagnostics with 85% recurring revenue, following its March 2023 launch and analytical business divestiture.

- Management highlighted four growth pillars: software innovation (Xynthetica, BioDesign, Signals LabGistics), integrated life sciences-diagnostics partnerships (e.g., Sanofi T1D, Genomics England), GMP reagents capacity build-out and US immunodiagnostics expansion.

- For 2026, Revvity targets $3 billion revenue, 2–3% organic growth, 28% adjusted operating margin and high-single-digit EPS growth.

- Plans include ~100 bps margin expansion in 2026 and further 2027 leverage via productivity initiatives (headcount optimization, supply chain synergies, footprint consolidation).

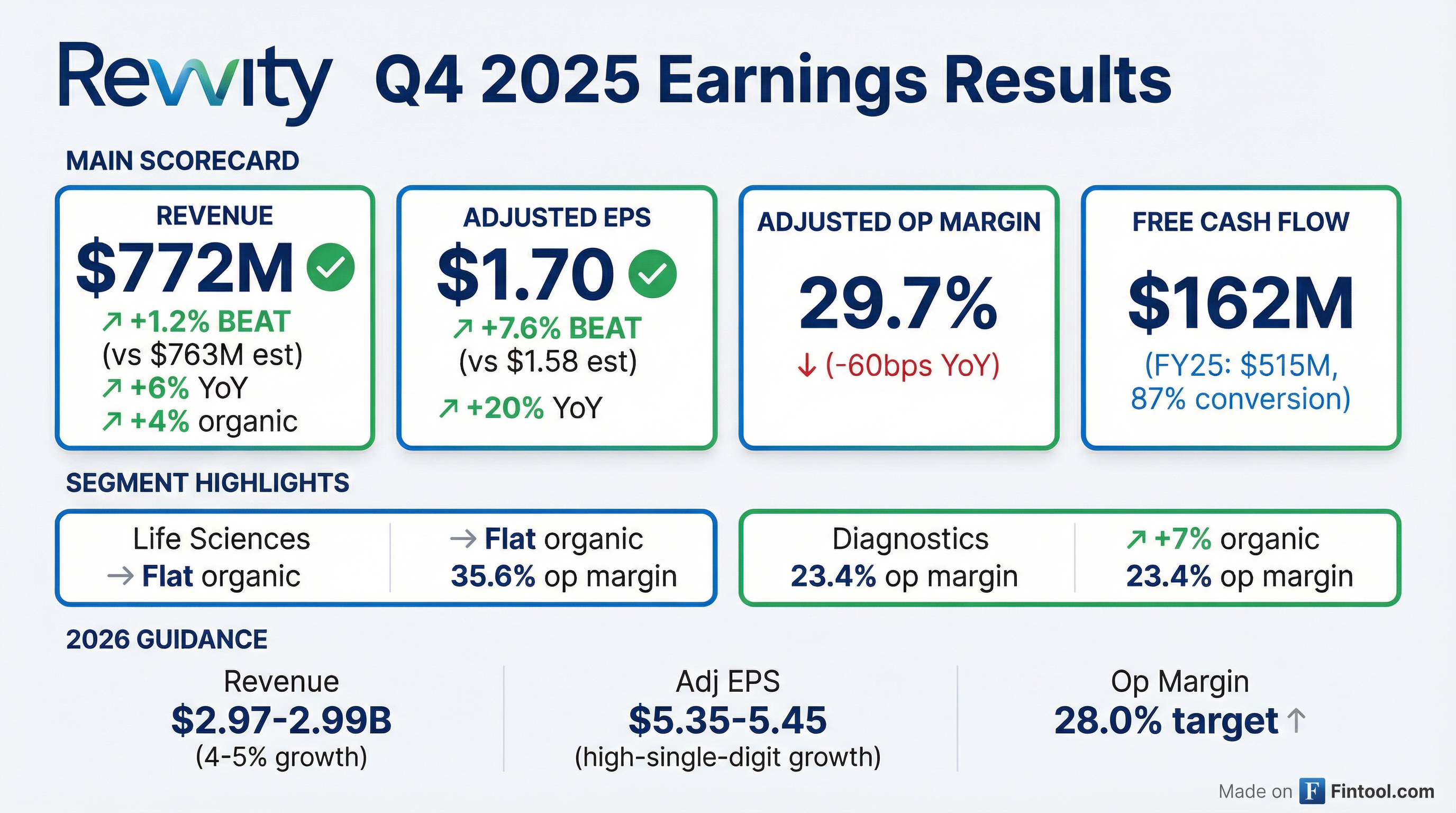

- Revvity beat Q4 expectations with $1.70 adjusted EPS (FY $5.06, +3% YoY)

- Q4 organic revenue growth of 4% (7% diagnostics, flat life sciences); FY organic growth 3%

- Q4 adjusted operating margin 29.7%; generated $162 M free cash flow (84% conversion), FY $515 M FCF (87% conversion); net debt/EBITDA 2.7×

- Repurchased $800 M of shares in 2025 (over $1.5 B since mid-2023), reducing share count by 8.5 M

- Acquired ACD/Labs adding $20 M revenue (~75 bps growth); 2026 guidance: 2–3% organic growth, revenue $2.96–$2.99 B, adjusted EPS $5.35–$5.45, margin 28%

- Revenue of $772 million in Q4 2025 (+4% organic), driven by 7% diagnostic growth and flat life sciences

- Q4 adjusted EPS of $1.70, boosting full-year adjusted EPS to $5.06 alongside 3% organic full-year growth on $2.86 billion revenue

- Reiterated 2026 organic growth guidance of 2–3%, with expected revenue of $2.96 billion–$2.99 billion and adjusted EPS of $5.35–$5.45

- Repurchased >$800 million of shares in 2025 (including $168 million in Q4), reducing share count by 8.5 million; total buybacks since mid-2023 exceed $1.5 billion

- Closed ACD/Labs acquisition, expected to add ~$20 million in 2026 revenue (+75 bps growth) ; introduced AI platform Signals Synthetica to accelerate drug R&D workflows

- Revvity delivered Q4 2025 revenue of $772 M (+6% y/y), adjusted operating margin of 29.7%, EPS of $1.70 (+20% y/y) and free cash flow of $162 M.

- For FY 2025, revenue was $2.856 B (+4% y/y), adjusted operating margin 27.1%, EPS $5.06 (+3% y/y) and free cash flow $515 M.

- Diagnostics led segment growth, with immunodiagnostics organic revenue up +7% y/y and reproductive health posting mid-single-digit growth, though margins were pressured by tariffs and FX.

- 2026 guidance calls for revenue of $2.968–2.99 B (+4–5%), adjusted operating margin ~28% and EPS of $5.35–5.45.

- Revvity delivered Q4 revenue of $772 million (+4% organic) and adjusted EPS of $1.70, exceeding guidance; for the full year, organic growth was 3% and adjusted EPS was $5.06.

- Diagnostics segment organic growth was 7% in Q4, led by reproductive health and immunodiagnostics, while life sciences organic growth was flat.

- The company reiterated 2026 guidance of 2–3% organic growth, revenue of $2.96 billion–$2.99 billion, and adjusted EPS of $5.35–$5.45 with a 28% operating margin target.

- In 2025, Revvity repurchased over $800 million of shares (8.5 million shares), bringing total buybacks since mid-2023 to $1.5 billion (15 million shares).

- Completed the acquisition of ACD/Labs in mid-January (adding ~$20 million revenue) and launched the AI platform Signals Synthetica to enhance its software offerings.

Quarterly earnings call transcripts for REVVITY.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more