Earnings summaries and quarterly performance for Sun Country Airlines Holdings.

Executive leadership at Sun Country Airlines Holdings.

Board of directors at Sun Country Airlines Holdings.

Research analysts who have asked questions during Sun Country Airlines Holdings earnings calls.

Brandon Oglenski

Barclays

4 questions for SNCY

Duane Pfennigwerth

Evercore ISI

4 questions for SNCY

Michael Linenberg

Deutsche Bank

4 questions for SNCY

Thomas Fitzgerald

TD Cowen

4 questions for SNCY

Catherine O'Brien

Goldman Sachs

3 questions for SNCY

Christopher Stathoulopoulos

Susquehanna Financial Group

3 questions for SNCY

James Kirby

JPMorgan Chase & Co.

3 questions for SNCY

Scott Group

Wolfe Research

3 questions for SNCY

Ravi Shanker

Morgan Stanley

2 questions for SNCY

Ravi Shankar

Morgan Stanley

1 question for SNCY

Ryan Capozzi

Wolfe Research

1 question for SNCY

Recent press releases and 8-K filings for SNCY.

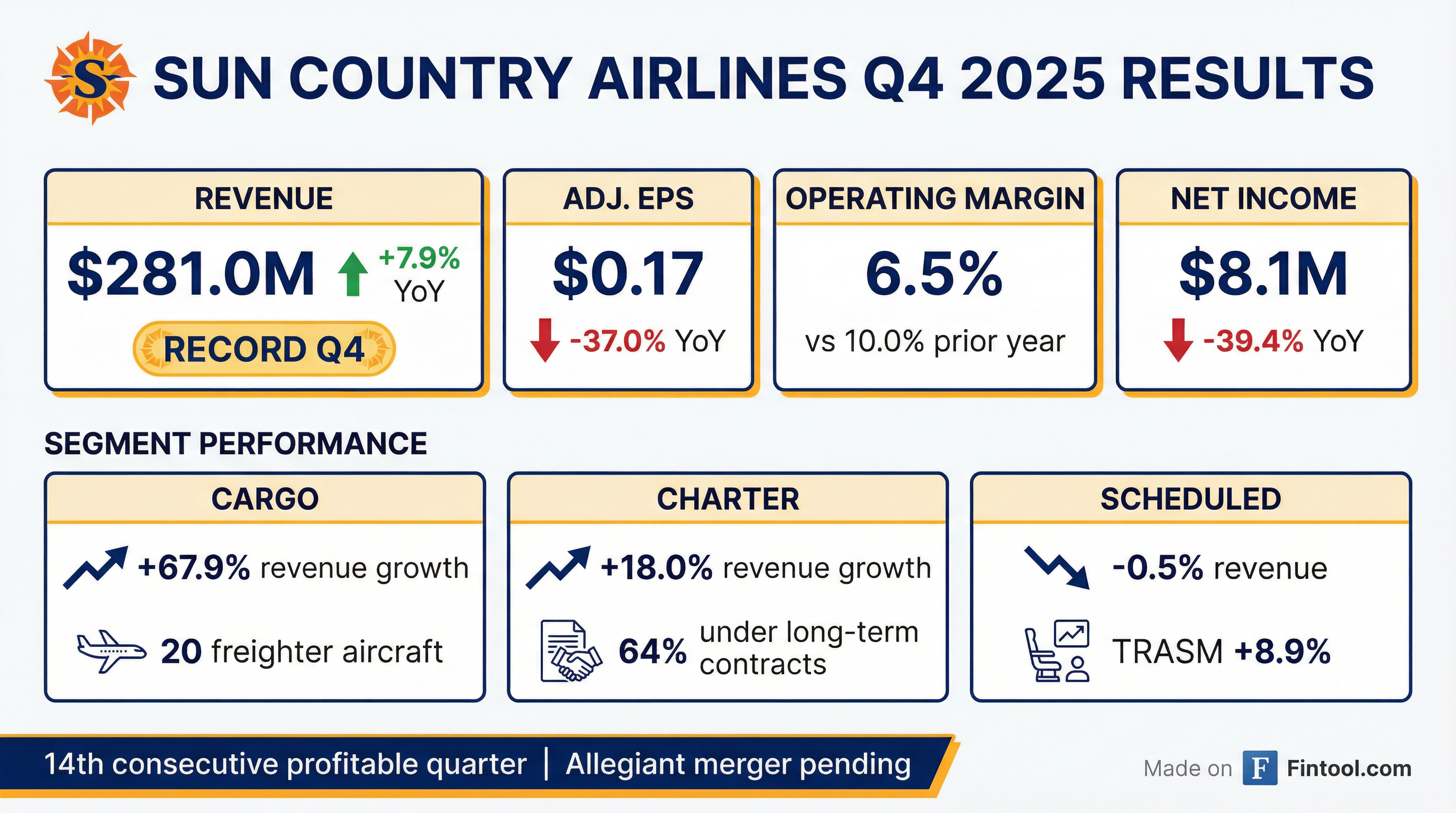

- Sun Country Airlines reported its 14th consecutive profitable quarter and fifth consecutive year of profitability for Q4 and FY 2025.

- For Q4 2025, total revenue was $281.0 million, a record high for a fourth quarter, with GAAP diluted EPS of $0.15 and adjusted diluted EPS of $0.17.

- For the full year 2025, total revenue reached $1.13 billion, a record high, with GAAP diluted EPS of $0.96 and adjusted diluted EPS of $1.10.

- On January 11, 2026, Sun Country and Allegiant entered into a definitive agreement for Allegiant to acquire Sun Country in a cash and stock transaction.

- The company expanded its cargo fleet by eight aircraft in 2025, leading to a 67.9% increase in cargo revenue and a 18.0% increase in charter revenue in Q4 2025, despite a 9.8% decrease in scheduled service capacity. Total liquidity as of December 31, 2025, was $302.8 million, with net debt at $364.0 million.

- Sun Country Airlines reported Q4 2025 total revenue of $281.0 million and FY 2025 total revenue of $1.13 billion, both representing the highest fourth quarter and full year on record, respectively. This marks the company's 14th consecutive profitable quarter and fifth consecutive year of profitability.

- For Q4 2025, GAAP diluted EPS was $0.15 and adjusted diluted EPS was $0.17. For the full year 2025, GAAP diluted EPS was $0.96 and adjusted diluted EPS was $1.10.

- On January 11, 2026, Sun Country and Allegiant entered into a definitive agreement for Allegiant to acquire all outstanding shares of Sun Country in a cash and stock transaction, which is expected to close in the second half of 2026.

- As of December 31, 2025, the company's total liquidity was $302.8 million and net debt was $364.0 million. During 2025, Sun Country expanded its cargo fleet by eight aircraft.

- Allegiant and Sun Country Airlines have entered into a definitive merger agreement, under which Allegiant will acquire Sun Country in a cash and stock transaction.

- Sun Country shareholders will receive $4.10 in cash and 0.1557 shares of Allegiant common stock for each Sun Country share, representing an implied value of $18.89 per share.

- This implied value represents a 19.8% premium over Sun Country’s closing share price of $15.77 on January 9, 2026.

- The transaction values Sun Country at approximately $1.5 billion, inclusive of $0.4 billion of Sun Country’s net debt.

- The merger is expected to generate $140 million in annual synergies by Year 3 Post Close and be accretive to EPS Year 1 Post Closing. The transaction is anticipated to close in the second half of 2026, subject to regulatory and shareholder approvals, after which Sun Country Common Stock will be delisted from The NASDAQ Stock Market LLC.

- Allegiant is set to acquire Sun Country, with Allegiant shareholders owning approximately 67% and Sun Country shareholders 33% of the combined company upon closing, which is anticipated in the second half of 2026.

- Sun Country shareholders will receive 0.1557 shares of Allegiant plus $4.10 in cash for each share, equating to $18.89 per share as of January 9, 2026, and valuing Sun Country at a fully-diluted equity value of $1.1 billion and a transaction value of $1.5 billion.

- The merger is expected to generate $140 million in annual run-rate synergies and be accretive to EPS Year 1 Post Closing.

- The combined company's pro forma financials for the TTM 3Q25 include $3.6 billion in revenues and $640 million in Adjusted EBITDA.

- Allegiant will acquire Sun Country in a cash and stock transaction at an implied value of $18.89 per Sun Country share, representing a 19.8% premium over Sun Country's closing share price of $15.77 on January 9th. The total value of Sun Country is approximately $1.5 billion, inclusive of $400 million of net debt, with a fully diluted equity value of $1.1 billion.

- Sun Country shareholders will receive 0.1557 shares of Allegiant stock plus $4.10 in cash per share. Upon closing, Allegiant shareholders will own roughly 67% and Sun Country shareholders approximately 33% of the combined company.

- The transaction is expected to close in the second half of 2026 and is anticipated to generate $140 million in annual synergies (net of dissynergies) at approximately three years post-close.

- The acquisition is expected to be accretive to EPS in the first full year post-closing, which is projected to be 2027.

- The combined company will operate under the Allegiant name, be headquartered in Las Vegas, and maintain a significant presence in Minnesota. Greg Anderson will continue as CEO, and Jude Bricker will join the combined company board and serve as an advisor.

- Allegiant will acquire Sun Country in a cash and stock transaction valued at approximately $1.5 billion, including $400 million of Sun Country's net debt.

- The deal implies a value of $18.89 per Sun Country share, representing a 19.8% premium over its closing share price of $15.77 on January 9th, 2026.

- Sun Country shareholders will receive 0.1557 shares of Allegiant stock plus $4.10 in cash per share, and will own approximately 33% of the combined company.

- The acquisition is expected to generate $140 million in annual synergies and be accretive to EPS in the first full year post-closing.

- The transaction is anticipated to close in the second half of 2026, subject to customary closing conditions, including regulatory and shareholder approvals.

- Allegiant will acquire Sun Country in a cash and stock transaction at an implied value of $18.89 per Sun Country share, representing a 19.8% premium over its January 9th closing price of $15.77.

- The transaction values Sun Country at approximately $1.5 billion, inclusive of $400 million of net debt, with a fully diluted equity value of $1.1 billion.

- Sun Country shareholders will receive 0.1557 shares of Allegiant stock plus $4.10 in cash per share, and will own approximately 33% of the combined company.

- The acquisition is expected to close in the second half of 2026 and is projected to generate $140 million in annual synergies, becoming accretive to EPS in the first full year post-closing (2027).

- The combined company will operate under the Allegiant name, headquartered in Las Vegas, and will maintain a significant presence in Minnesota.

- Allegiant will acquire Sun Country in a cash-and-stock transaction valued at approximately $1.5 billion, including about $400 million of net debt.

- Sun Country shareholders are set to receive 0.1557 Allegiant shares plus $4.10 per share, representing a 19.8% premium over the company’s Friday closing price.

- The merger is projected to generate approximately $140 million in annual synergies by year three and be accretive to earnings in the first year.

- The combined airline will operate roughly 195 aircraft and expand international service, with the deal expected to close in the second half of 2026, pending shareholder and regulatory approvals.

- The transaction values Sun Country at roughly a 7.2x multiple of its $207 million adjusted EBITDA before synergies.

- Sun Country Airlines reported its 13th consecutive profitable quarter in Q3 2025, with GAAP EPS of $0.03 and adjusted EPS of $0.07. Total revenue for the quarter was $255.5 million, a 2.4% increase year-over-year.

- The company completed its cargo expansion, with all 20 cargo aircraft now operational, leading to a 50.9% increase in cargo segment revenue to $44 million in Q3. This growth, however, resulted in a 10.2% decrease in scheduled service ASMs for the quarter.

- For Q4 2025, Sun Country anticipates total revenue between $270 million and $280 million and an operating margin of 5% to 8%. The company expects positive year-on-year scheduled service growth by Q3 2026 and aims for $300 million of run rate EBITDA after Q2 2027.

- In Q3 2025, $10 million was spent on share repurchases, with $15 million remaining in the current authorization. Net debt decreased to $406.1 million at quarter-end, down from $438.2 million at the beginning of the year.

- Sun Country Airlines reported Q3 2025 revenue of $255.5 million, a 2.4% increase year-over-year, marking its highest third quarter on record.

- The company achieved its thirteenth consecutive profitable quarter, with GAAP diluted EPS of $0.03 and adjusted diluted EPS of $0.07 for Q3 2025.

- A significant operational milestone was reached with the completion of its cargo segment transformation, deploying the full fleet of 20 freighter aircraft for Amazon by September 2025. Cargo revenue increased 50.9% to $44 million in Q3 2025 compared to Q3 2024.

- Sun Country Airlines repurchased $10 million in stock during Q3 2025, with $15 million in share repurchase authority remaining.

- For Q4 2025, the company expects total revenue between $270 million and $280 million, representing a 4% to 8% increase year-over-year, and an operating income margin of 5% to 8%.

Quarterly earnings call transcripts for Sun Country Airlines Holdings.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more