Earnings summaries and quarterly performance for SUBURBAN PROPANE PARTNERS.

Research analysts who have asked questions during SUBURBAN PROPANE PARTNERS earnings calls.

Recent press releases and 8-K filings for SPH.

Suburban Propane Partners Reports Strong Q1 2026 Results

SPH

Earnings

Dividends

New Projects/Investments

- Adjusted EBITDA for Q1 2026 increased by $8.1 million (nearly 11%) to $83.4 million, driven by a 4.2% increase in retail propane gallons sold to 100 million.

- The company reported net income of $46.6 million for Q1 2026, excluding unrealized mark-to-market adjustments and other non-cash items.

- A quarterly distribution of $0.325 per common unit was declared for Q1 2026, equating to an annualized rate of $1.30 per common unit, with a distribution coverage ratio of 2.19x for December 2025.

- Suburban Propane is advancing its renewable natural gas (RNG) operations, with increased average daily RNG injection, the commissioning of a new anaerobic digester facility in Upstate New York, and substantial progress on gas upgrade equipment in Columbus, Ohio.

- The consolidated leverage rate improved to 4.57x as of December 2025.

2 days ago

Suburban Propane Partners Reports Strong Q1 2026 Results with Increased Volume and Adjusted EBITDA

SPH

Earnings

New Projects/Investments

Dividends

- Suburban Propane Partners reported a 4.2% increase in retail propane gallons sold and an 11% increase in Adjusted EBITDA to $83.4 million for Q1 2026, primarily due to colder weather in the eastern U.S. and customer base growth.

- Net income for the quarter was $38 million, or $0.59 per common unit, with total gross margin increasing by 7.2% to $238.6 million.

- The company advanced its strategic growth plans by acquiring two propane businesses in California and making substantial progress on its renewable natural gas (RNG) projects, including commissioning a new facility in Upstate New York.

- Suburban Propane Partners improved its consolidated leverage rate to 4.57 times by December 2025 and declared a quarterly distribution of $0.325 per common unit for Q1 2026, equating to an annualized rate of $1.30.

2 days ago

Suburban Propane Partners Reports Strong Q1 2026 Results with Increased Adjusted EBITDA and Gallons Sold

SPH

Earnings

New Projects/Investments

Dividends

- Suburban Propane Partners reported a 4.2% increase in retail propane gallons sold and an 11% increase in Adjusted EBITDA to $83.4 million for the first quarter of fiscal 2026, primarily due to colder weather in its northern operating territories.

- Total gross margin, excluding mark-to-market adjustments, increased by 7.2% to $238.6 million.

- The company's renewable natural gas (RNG) operations saw increased average daily injection, with a new facility in Upstate New York beginning commissioning and substantial progress on another in Columbus, Ohio.

- A quarterly distribution of $0.325 per common unit was declared, representing an annualized rate of $1.30 per common unit, with a distribution coverage ratio of 2.19 times for December 2025.

- The consolidated leverage rate was 4.57 times as of December 2025, compared to 4.0 for December 2024.

2 days ago

Suburban Propane Partners, L.P. Announces Strong Fiscal Q1 2026 Results

SPH

Earnings

New Projects/Investments

M&A

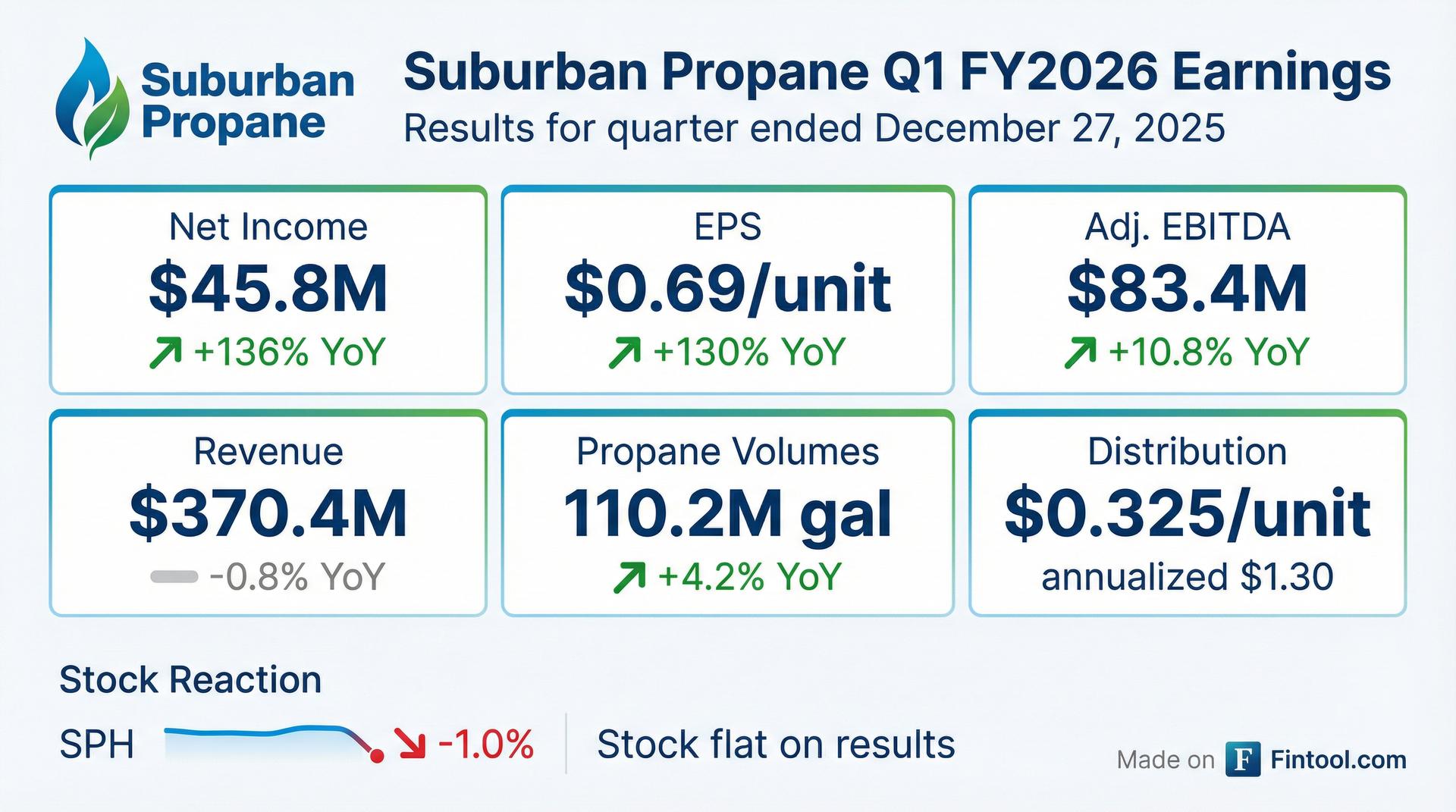

- Suburban Propane Partners, L.P. reported a net income of $45.8 million, or $0.69 per Common Unit, for the first quarter of fiscal 2026, a significant increase from $19.4 million, or $0.30 per Common Unit, in the prior year first quarter. Adjusted EBITDA improved by 10.8% to $83.4 million for the quarter.

- Retail propane gallons sold increased by 4.2% to 110.2 million gallons in the first quarter of fiscal 2026, driven by cooler average temperatures in key operating regions and contributions from recent acquisitions.

- The Partnership acquired two propane businesses in California for $24.0 million and advanced its renewable natural gas (RNG) operations, including starting the commissioning process for a new facility in Upstate New York.

- In December 2025, the Partnership refinanced $350.0 million of 5.875% senior notes due 2027 with new 6.50% senior notes due 2035, extending weighted average debt maturities by nearly three years.

- A quarterly distribution of $0.325 per Common Unit was declared for the first quarter of fiscal 2026, payable on February 10, 2026.

2 days ago

Suburban Propane Partners, L.P. Announces First Quarter Fiscal 2026 Results

SPH

Earnings

M&A

Debt Issuance

- For the first quarter ended December 27, 2025, net income was $45.8 million, or $0.69 per Common Unit, significantly up from $19.4 million, or $0.30 per Common Unit, in the prior year first quarter.

- Adjusted EBITDA for the first quarter of fiscal 2026 improved 10.8% to $83.4 million, primarily driven by a 4.2% increase in retail propane gallons sold to 110.2 million gallons.

- The company acquired two propane businesses in California for $24.0 million and strategically refinanced $350.0 million of 5.875% senior notes due 2027 with new 6.50% senior notes due 2035, extending debt maturities.

- Progress was made in renewable natural gas (RNG) operations, with improved average daily RNG injection and the start of commissioning for a new anaerobic digester in Upstate New York. The Consolidated Leverage Ratio improved to 4.57x for the twelve-month period ended December 27, 2025.

2 days ago

Suburban Propane Partners Completes $350 Million Senior Notes Offering

SPH

Debt Issuance

- Suburban Propane Partners, L.P. (SPH) completed the offering of $350,000,000 aggregate principal amount of 6.500% Senior Notes due 2035 on December 22, 2025.

- The notes bear an interest rate of 6.500% per year, payable semi-annually, commencing on June 15, 2026.

- The net proceeds of approximately $344.3 million from the offering will be used to redeem all of the Issuers' 5.875% senior notes due 2027 and cover related expenses.

- The 2027 Senior Notes were satisfied and discharged on December 22, 2025, with the actual redemption date scheduled for January 7, 2026.

Dec 22, 2025, 9:15 PM

Suburban Propane Partners Prices $350 Million Senior Notes Offering

SPH

Debt Issuance

- Suburban Propane Partners, L.P. (SPH) priced a private offering of $350,000,000 aggregate principal amount of 6.500% senior notes due 2035.

- The notes will bear interest at 6.500% per year, payable semi-annually, with the offering expected to close on December 22, 2025.

- The net proceeds from this offering, combined with borrowings under its revolving credit facility, will be used to redeem all outstanding $350,000,000 of its 5.875% senior notes due 2027.

Dec 8, 2025, 10:30 PM

Suburban Propane Partners Prices Senior Notes Offering

SPH

Debt Issuance

- Suburban Propane Partners, L.P. announced the pricing of an offering of $350,000,000 aggregate principal amount of 6.500% senior notes due 2035.

- The 2035 Senior Notes will mature on December 15, 2035, with interest payable semi-annually starting June 15, 2026.

- The sale of the 2035 Senior Notes is expected to close on December 22, 2025.

- The net proceeds from the offering will be used to redeem all outstanding $350,000,000 aggregate principal amount of the Issuers' 5.875% senior notes due 2027.

Dec 8, 2025, 10:14 PM

Suburban Propane Partners Reports Strong Fiscal 2025 Results and Outlines 2026 Capital Plans

SPH

Earnings

New Projects/Investments

Dividends

- For fiscal year 2025, Suburban Propane Partners reported Adjusted EBITDA of $278 million, an 11.2% increase year-over-year, and net income of $128.4 million, or $1.97 per common unit. Retail propane gallons sold increased 5.9% to 400.5 million gallons.

- The company improved its consolidated leverage ratio to 4.29 times at the end of fiscal 2025, down from 4.76 times in the prior year, supported by increased earnings and a $1.8 million reduction in outstanding borrowings.

- Strategic growth initiatives in fiscal 2025 included the acquisition of a propane business for $53 million , investment of over $25 million in RNG growth projects , and raising $23.5 million in net proceeds through an at-the-market equity program.

- For the fourth quarter of fiscal 2025, the company reported a net loss of $35.7 million, or $0.54 per common unit, and Adjusted EBITDA of $700,000, both essentially flat compared to the prior year. A quarterly distribution of $0.325 per common unit was declared.

- Looking ahead to fiscal 2026, capital spending for propane operations is projected to be $40-$45 million, while RNG projects are expected to require $30-$35 million, with an anticipated $7-$9 million in investment tax credits for the upstate New York RNG facility.

Nov 13, 2025, 2:00 PM

Suburban Propane Partners, L.P. Announces Fiscal Year and Fourth Quarter 2025 Results

SPH

Earnings

Dividends

M&A

- Suburban Propane Partners, L.P. reported net income of $106.6 million, or $1.64 per Common Unit, for fiscal year 2025, an increase from $74.2 million, or $1.15 per Common Unit, in fiscal 2024.

- Adjusted EBITDA for fiscal year 2025 increased by 11.2% to $278.0 million, driven by a 5.9% increase in retail propane gallons sold to 400.5 million gallons.

- For the fourth quarter of fiscal 2025, the company recorded a net loss of $35.1 million, or $0.53 per Common Unit, and Adjusted EBITDA of $0.7 million.

- The Partnership declared a quarterly distribution of $0.325 per Common Unit for the three months ended September 27, 2025, which was paid on November 12, 2025.

- The Consolidated Leverage Ratio improved to 4.29x for fiscal year 2025, compared to 4.76x for fiscal year 2024.

Nov 13, 2025, 12:54 PM

Quarterly earnings call transcripts for SUBURBAN PROPANE PARTNERS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more