Earnings summaries and quarterly performance for STANDEX INTERNATIONAL CORP/DE/.

Executive leadership at STANDEX INTERNATIONAL CORP/DE/.

David Dunbar

President and Chief Executive Officer

Ademir Sarcevic

Vice President, Chief Financial Officer & Treasurer

Alan Glass

Vice President, Chief Legal Officer & Secretary

Max Arets

Vice President, Chief Information Officer

Michelle Newbury

Chief Human Resources Officer

Board of directors at STANDEX INTERNATIONAL CORP/DE/.

Andy L. Nemeth

Director

B. Joanne Edwards

Director

Charles H. Cannon, Jr.

Director

Jeffrey S. Edwards

Director

Michael A. Hickey

Lead Independent Director

Robin J. Davenport

Director

Thomas E. Chorman

Director

Thomas J. Hansen

Director

Research analysts who have asked questions during STANDEX INTERNATIONAL CORP/DE/ earnings calls.

Gary Prestopino

Barrington Research

6 questions for SXI

Michael Shlisky

D.A. Davidson

6 questions for SXI

Ross Sparenblek

William Blair & Company

6 questions for SXI

Chris Moore

CJS Securities

3 questions for SXI

Matt Koranda

ROTH Capital Partners

3 questions for SXI

Matthew Koranda

Roth Capital Partners, LLC

1 question for SXI

Michael Legg

Ladenburg Thalmann & Co. Inc.

1 question for SXI

Recent press releases and 8-K filings for SXI.

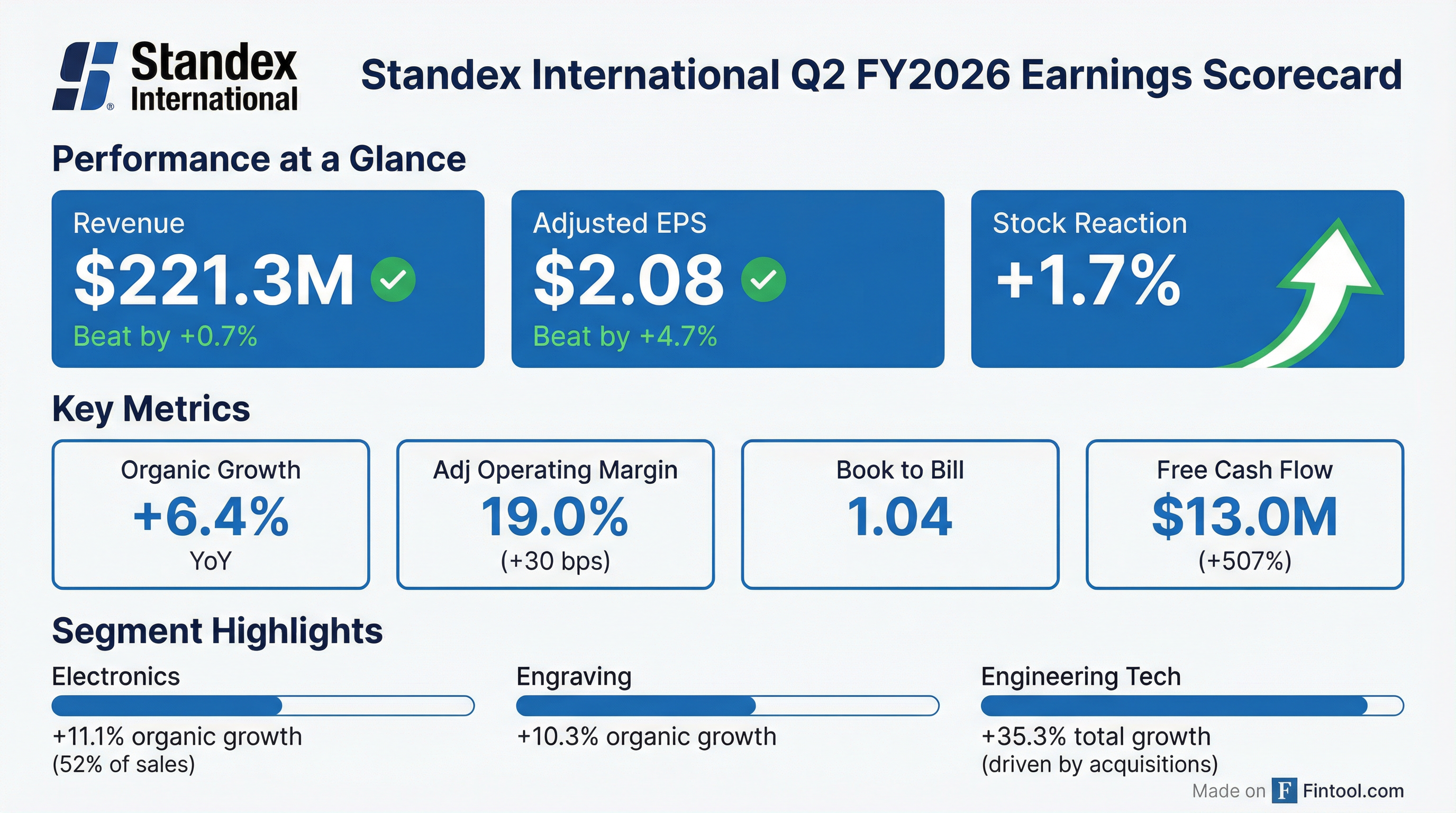

- STANDEX INTERNATIONAL CORPORATION reported Q2 FY26 Net Sales of $221.3 million, an increase of 16.6% year-over-year, driven by 6.4% organic growth and contributions from new products and fast growth markets.

- The company achieved an Adjusted Operating Margin of 19.0% in Q2 FY26, up 30 basis points year-over-year, and Adjusted Diluted EPS of $2.08, an 8.9% increase year-over-year.

- STANDEX INTERNATIONAL CORPORATION reiterated its FY26 sales outlook for growth of over $110 million compared to FY25, with fast growth market sales expected to exceed $270 million and continued adjusted operating margin expansion.

- The company declared a quarterly cash dividend of $0.34 per share for Q2 FY26, representing a 6.3% year-over-year increase.

- Standex International reported strong fiscal second quarter 2026 results, with sales increasing 16.6% year-on-year to $221.3 million and organic growth of 6.4%. Adjusted earnings per share rose 8.9% year-on-year to $2.08.

- The company reiterated its fiscal year 2026 sales outlook, expecting revenue to grow by over $110 million from 2025, driven by new product sales and fast growth markets. They anticipate mid- to high single-digit organic growth in the fiscal third quarter.

- The Electronics segment was a key driver, with revenue increasing 20.6% year-on-year to $115.7 million and 11.1% organic growth, supported by a book-to-bill ratio of 1.08.

- Standex is actively expanding capacity for its Grid business, having increased capacity by 50% since acquisition and planning to more than double it in the next 3-5 years through new sites in Croatia, Mexico, Houston, and India expansion.

- The company paid down approximately $10 million of debt in Q2 2026, reducing its net leverage ratio to 2.3, and increased its quarterly cash dividend by 6.3% to $0.34 per share.

- Standex (SXI) reported strong Q2 2026 results, with total revenue increasing 16.6% year-on-year to $221.3 million, driven by 6.4% organic growth and a 1.04 book-to-bill ratio.

- Profitability improved, with adjusted gross margin at 42.1% (up 120 basis points) and adjusted operating margin at 19% (up 30 basis points) year-on-year, leading to an 8.9% increase in adjusted EPS to $2.08.

- The company reiterated its fiscal year 2026 sales outlook, expecting revenue growth of over $110 million from 2025, with new product sales projected to reach $85 million and fast growth market sales to exceed $270 million.

- Key growth drivers include new product sales, which grew 13% to $16.3 million in Q2, and fast growth markets, which contributed 28% of total sales. The Electronics segment led with 11.1% organic growth.

- SXI is actively expanding capacity for its grid business in Croatia, Mexico, and Houston, aiming to more than double capacity within 3-5 years, and is building M&A pipelines in grid, legacy electronics, and space markets.

- SXI reported strong Q2 FY26 results with total sales increasing 16.6% year-over-year to $221.3 million and organic growth of 6.4%.

- Profitability improved, with adjusted gross margin at 42.1% (up 120 bps YOY) and adjusted operating margin at 19.0% (up 30 bps YOY).

- The company achieved its highest ever quarterly orders of approximately $231 million, leading to a Book to Bill ratio of 1.04.

- SXI reduced its debt by approximately $10 million, bringing its Net Debt to Adjusted EBITDA leverage down to 2.3x.

- Management reiterated its FY26 sales outlook, expecting revenue growth of over $110 million, and anticipates significantly higher year-on-year revenue with mid-to-high single digit organic growth for Q3 FY26.

- Standex International Corporation reported strong Q2 2026 results, with total revenue increasing 16.6% year-on-year to $221.3 million and adjusted earnings per share (EPS) growing 8.9% year-on-year to $2.08.

- The company achieved 6.4% organic growth in Q2 2026, fueled by new product sales and fast growth markets. Standex reiterated its fiscal year 2026 sales outlook, projecting revenue growth of over $110 million from 2025 and fast growth market sales exceeding $270 million.

- Standex maintained a healthy financial position, reducing net debt by approximately $10 million in Q2 2026, bringing the net leverage ratio to 2.3. The company also declared its 246th consecutive quarterly cash dividend of $0.34 per share, a 6.3% increase year-on-year.

- Strategic investments continue, with plans to more than double capacity in the Grid business (Amran/Narayan) over the next 3-5 years through new sites in Croatia, Mexico, Houston, and India. The company is also actively building an M&A pipeline focused on grid, expanding its sensor and switch business, and the space market.

- Standex International Corporation reported Q2 FY26 sales of $221.3 million, a 16.6% year-over-year increase, with adjusted operating margin expanding 30 basis points year-on-year to 19.0% and adjusted diluted EPS of $2.08.

- The company reiterated its fiscal year 2026 sales outlook, expecting revenue to grow by over $110 million compared to FY25, driven by fast growth markets projected to exceed $270 million and the release of over 15 new products.

- For Q3 FY26, Standex anticipates significantly higher revenue with mid-to-high single-digit organic growth and slightly higher adjusted operating margin.

- The company declared a quarterly cash dividend of $0.34 per share for Q2 FY26, an approximately 6.3% year-on-year increase, and has approximately $28 million remaining on its share repurchase authorization.

- Standex International Corporation reported Net Sales of $217.4 million for the first quarter of fiscal year 2026, marking a 27.6% increase year-over-year, and achieved an Adjusted Operating Margin of 19.1%, up 210 basis points year-over-year.

- The company recorded record quarterly order intake of approximately $226 million in Q1 FY26 and an Adjusted Diluted EPS of $1.99.

- Standex raised its fiscal year 2026 sales outlook, now expecting revenue to grow by over $110 million compared to the prior outlook of over $100 million, with sales from fast growth markets projected to exceed $270 million.

- The company paid down approximately $8 million of debt in Q1 FY26, lowering its Net Debt to EBITDA ratio to 2.4x, and declared a quarterly cash dividend of $0.34 per share, representing a 6.3% year-over-year increase.

- Standex International Corporation reported solid Q1 FY26 results, with sales increasing 27.6% to $217.4 million and adjusted operating margin reaching 19.1%, up 210 basis points year-over-year.

- The company raised its FY26 sales outlook, now expecting revenue to grow >$110 million, an increase from the prior expectation of >$100 million.

- Key growth drivers included new product sales, which grew >35% to ~$14.5 million in Q1, and fast growth markets, contributing ~30% of total sales.

- SXI paid down ~$8 million of debt, reducing its net debt to adjusted EBITDA leverage to 2.4x as of September 30, 2025.

- For Q2 FY26, the company anticipates significantly higher revenue year-on-year with mid-single-digit organic growth and a similar adjusted operating margin.

- Standex International (SXI) reported a strong Fiscal First Quarter 2026, with total revenue increasing 27.6% year-on-year to $217.4 million, primarily driven by recent acquisitions and new product sales.

- The company achieved an adjusted operating margin of 19.1%, an increase of 210 basis points year-on-year, and adjusted earnings per share of $1.99, up 8.2% from the prior year.

- SXI raised its Fiscal Year 2026 sales outlook, now expecting revenue to grow by over $110 million, which is $10 million higher than previous guidance, fueled by strong momentum in new product sales and fast-growth markets.

- Net debt stood at $446 million at the end of Q1 2026, resulting in a net leverage ratio of 2.4, and the company paid down approximately $8 million of debt during the quarter.

- Strategic initiatives include the renaming of Amran Narain Group to Standex Electronics Grid, the launch of four new products in Q1 2026, and the commencement of operations in Croatia and Mexico.

- Standex International Corporation reported Q1 FY26 sales of $217.4 million, a 27.6% year-over-year increase, and achieved record quarterly order intake of approximately $226 million.

- The company's Adjusted Operating Margin expanded 210 basis points year-over-year to 19.1%, with Adjusted Diluted EPS at $1.99 for Q1 FY26.

- Standex paid down approximately $8 million of debt in Q1 FY26, reducing the Net Debt to EBITDA ratio to 2.4x.

- The FY26 sales outlook was raised to grow by over $110 million compared to FY25, with sales from fast growth markets projected to exceed $270 million.

- A quarterly cash dividend of $0.34 per share was declared, representing a 6.3% year-over-year increase.

Quarterly earnings call transcripts for STANDEX INTERNATIONAL CORP/DE/.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more