Earnings summaries and quarterly performance for Bancorp.

Executive leadership at Bancorp.

Damian Kozlowski

Chief Executive Officer

Dominic Canuso

Executive Vice President, Chief Financial Officer

Erika Caesar

Executive Vice President, General Counsel and Corporate Secretary

Gregor Garry

Executive Vice President, Chief Operating Officer

Jeff Nager

Executive Vice President, Head of Commercial Lending

Jennifer Terry

Executive Vice President, Chief Human Resources Officer

John Leto

Executive Vice President, Head of Institutional Banking

Maria Wainwright

Executive Vice President, Chief Marketing Officer

Mark Connolly

Executive Vice President, Head of Credit Markets and Chief Credit Officer

Martin Egan

Chief Accounting Officer

Matt Wallace

Executive Vice President, Chief Information Officer

Olek DeRowe

Executive Vice President, Head of Commercial Real Estate

Ryan Harris

Executive Vice President, Head of Fintech Solutions

Board of directors at Bancorp.

Cheryl Creuzot

Director

Dwayne Allen

Director

Hersh Kozlov

Director

James McEntee III

Director and Chair of the Board

Mark Tryniski

Director

Matthew Cohn

Director

Stephanie Mudick

Director

Todd Brockman

Director

William Lamb

Director

Research analysts who have asked questions during Bancorp earnings calls.

Frank Schiraldi

Piper Sandler

4 questions for TBBK

Joseph Yanchunis

Raymond James

4 questions for TBBK

Timothy Switzer

KBW

4 questions for TBBK

Emily Lee

Keefe, Bruyette & Woods, Inc.

2 questions for TBBK

Joe Yanchunas

Raymond James

2 questions for TBBK

Stephen Farrell

Oppenheimer & Co. Inc.

2 questions for TBBK

David Feaster

Raymond James

1 question for TBBK

Eric Longach

Cygnus Capital

1 question for TBBK

Tim Switzer

Keefe, Bruyette & Woods (KBW)

1 question for TBBK

Recent press releases and 8-K filings for TBBK.

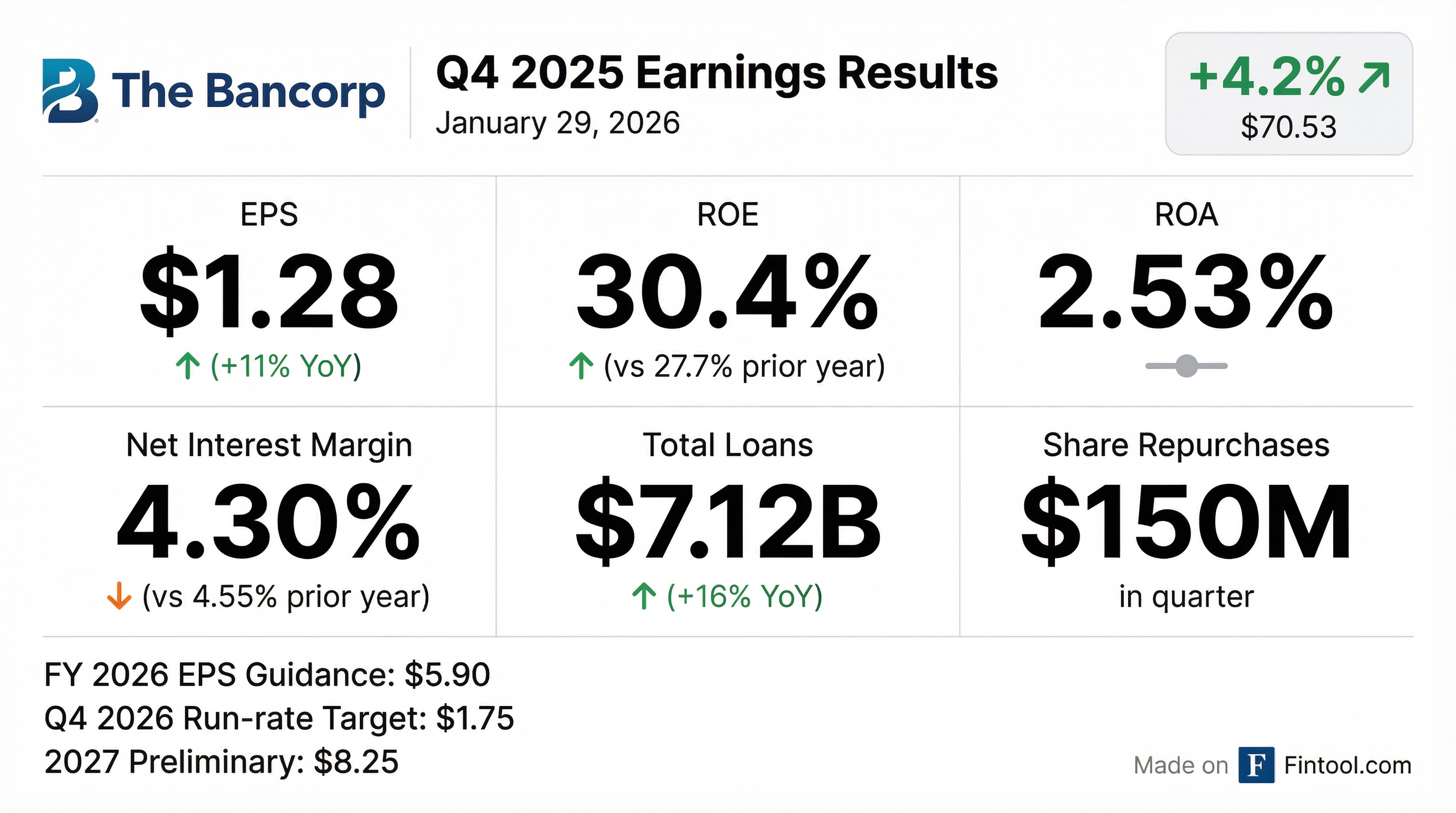

- The Bancorp reported Q4 2025 EPS of $1.28 a share, an 11% year-over-year increase, and achieved a record ROE of 30.4% for the quarter and 28.9% for the full year.

- The company initiated 2026 EPS guidance of $5.90 and maintained preliminary 2027 EPS guidance of $8.25 a share, targeting at least $1.75 a share in Q4 2026.

- Credit sponsorship balances reached $1.1 billion in Q4 2025, exceeding the $1 billion goal and representing a 142% year-over-year increase. The company plans to add at least two new partners in 2026, with credit sponsorship loans potentially doubling to $2 billion to $3 billion by year-end 2026.

- TBBK plans $200 million in stock buybacks for 2026, or $50 million per quarter, following $375 million in repurchases for the full year 2025.

- The company expects Net Interest Margin (NIM) to compress near 4% as fee income grows to 35% of total revenue (excluding credit enhancement), driven by fintech business growth and balance sheet optimization.

- The Bancorp reported Q4 2025 EPS of $1.28, an 11% year-over-year increase, with full-year 2025 GDV growth up 17% over 2024 and total fee growth up 21%.

- The company initiated 2026 EPS guidance of $5.90, targeting at least $1.75 per share in Q4 2026, and provided preliminary 2027 guidance of $8.25 per share.

- Credit sponsorship balances reached $1.1 billion in Q4 2025, a 142% year-over-year increase, and are targeted to at least double to $2 billion (potentially up to $3 billion) by the end of 2026.

- The company repurchased $150 million of its stock in Q4 2025, contributing to $375 million in full-year repurchases (12% of outstanding shares), and plans $200 million in buybacks for 2026.

- Ending assets grew 7% year-over-year to $9.4 billion, with a record ROE of 30.4% in Q4 2025, while criticized assets declined 28% quarter-over-quarter to $194 million.

- The Bancorp reported diluted EPS of $4.92 for 2025, with 2026 guidance of $5.90 and preliminary 2027 guidance of $8.25, targeting a Q4 2026 annualized run rate of $7.00.

- For 2025, the company achieved a Return on Equity of 29% and a Return on Assets of 2.5%.

- The Bancorp returned 102% of Net Income to shareholders over the last four years, amounting to $785 million through share buybacks, which repurchased 30% of shares.

- The company maintains its position as the #1 U.S. Issuer of Prepaid cards and #6 Debit and prepaid issuer by volume , with its Fintech Solutions generating $141 million in fee income and holding $7.2 billion in deposits in 2025.

- The Bancorp reported Q4 2025 earnings per share of $1.28 and achieved a full-year 2025 Return on Equity (ROE) of 28.9%.

- The company issued 2026 EPS guidance of $5.90, with a target of $1.75 per share for Q4 2026, and preliminary 2027 EPS guidance of $8.25.

- Growth was driven by a 16% year-over-year increase in Gross Dollar Volume (GDV) for Q4 2025 and credit sponsorship balances reaching $1.1 billion, a 142% increase year-over-year.

- The company plans $200 million in stock buybacks for 2026 and reported significant improvements in credit metrics, with criticized assets declining 28% quarter-over-quarter to $194 million.

- Net Interest Margin (NIM) is expected to compress to around 4%, while fee income is projected to grow to 35% of total revenue (excluding credit enhancement).

- The Bancorp, Inc. reported diluted earnings per share (EPS) of $1.28 for Q4 2025, an 11% increase from Q4 2024, with net income of $56.3 million.

- The company achieved a Return on Assets (ROA) of 2.53% and a Return on Equity (ROE) of 30.4% in Q4 2025, driven by a Net Interest Margin (NIM) of 4.30%.

- Total loans, net of deferred fees and costs, reached $7.12 billion at December 31, 2025, a 16% increase from Q4 2024, with consumer fintech loans growing to $1.10 billion.

- The Bancorp repurchased $150.0 million in shares during Q4 2025, contributing to a total of $375.0 million in share repurchases for the full year 2025, and authorized $200 million for 2026.

- The company provided 2026 EPS guidance of $5.90 and a preliminary 2027 EPS outlook of $8.25, noting a $2.0 million legal settlement cost in Q4 2025.

- The Bancorp reported diluted EPS of $1.28 for the fourth quarter of 2025, an 11% increase from 4Q 2024, with a Return on Assets (ROA) of 2.53% and Return on Equity (ROE) of 30.43%.

- The company executed $150.0 million in share repurchases, acquiring 2,173,518 shares during 4Q 2025.

- Ending Loans, net of deferred fees and costs, increased 16% year-over-year to $7.12 billion at 4Q 2025, significantly driven by a 142% increase in ending consumer fintech loans to $1.10 billion.

- Fintech fees grew 48% to $4.5 million for 4Q 2025 compared to 4Q 2024, contributing to a Gross Dollar Volume (GDV) of $45.87 billion, up 16% from 4Q 2024.

- Endeavor Bancorp reported net income of $1.70 million, or $0.45 per diluted share, for the fourth quarter of 2025.

- The company's net interest margin expanded to 4.22% in the fourth quarter of 2025, an increase of 13 basis points from 4.09% in the prior quarter and 25 basis points year-over-year from 3.97% in Q4 2024.

- Total assets increased to $770.6 million, total loans to $643.4 million, and total deposits to $682.7 million as of December 31, 2025.

- Shareholders' equity grew to $53.1 million, and tangible book value per share increased to $14.68 at December 31, 2025.

- American Bancorp Inc. completed its merger with New Republic Partners Inc. on November 7, resulting in New Republic Bank becoming a sister bank under American Bancorp.

- Following the merger, American Bancorp now has approximately $900 million in total assets and more than $150 million in equity.

- The transaction was structured as a stock-for-stock exchange.

- Ralph Strayhorn, Chairman of New Republic Partners, will join the American Bancorp Board of Directors, and Jason Grooters, New Republic's CEO and CFO, has joined American Bancorp as Chief Operating Officer.

- Over the past 12 months, American Bancorp more than doubled its total assets from $373 million to approximately $900 million and raised over $100 million of growth capital.

- The Bancorp reported Q3 2025 earnings per share of $1.18 and revenue growth of 23%, including both fee and related interest income.

- The company lowered its 2025 EPS guidance to $5.10 but initiated preliminary 2027 EPS guidance of $8.25, targeting a minimum $7 EPS run rate by the end of 2026.

- Key fintech initiatives are progressing, with credit sponsorship balances reaching $785 million, an increase of 180% year-over-year, and Cash App revenue anticipated in Q1 2026. The embedded finance platform is also expected to launch in 2026.

- The Bancorp plans a restructuring of its institutional banking business in Q4 2025, reducing headcount by 30 to cut run rate expenses by approximately $8 million, and will implement an AI tool in Q1 2026 to save $1.5 million in run rate expenses.

- Criticized and substandard assets declined 14% quarter-over-quarter, from $216 million to $185 million.

- The Bancorp reported Q3 2025 earnings per share of $1.18, representing 13% year-over-year EPS growth on 7% revenue growth (excluding consumer fintech loan credit enhancement income) and 6% expense growth.

- The company lowered its 2025 EPS guidance to $5.10 but initiated preliminary 2027 EPS guidance of $8.25, targeting a minimum $7 EPS run rate by Q4 2026.

- Key fintech initiatives are progressing, with credit sponsorship balances growing 15% quarter-over-quarter to $785 million, embedded finance platform development continuing for a next year launch, and Cash App revenue expected in Q1 2026.

- Criticized and substandard assets declined 14% quarter-over-quarter from $216 million to $185 million, with further reductions anticipated in Q4 2025.

- Under Project 7, the company is restructuring its institutional banking business, reducing headcount by 30 to cut run rate expenses by approximately $8 million, and implementing an AI tool expected to avoid approximately $1.5 million in run rate expenses over time.

Quarterly earnings call transcripts for Bancorp.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more