Earnings summaries and quarterly performance for UBS Group.

Research analysts who have asked questions during UBS Group earnings calls.

Amit Goel

Mediobanca S.p.A.

4 questions for UBS

Chris Hallam

Goldman Sachs Group Inc.

4 questions for UBS

Giulia Miotto

Morgan Stanley

4 questions for UBS

Jeremy Sigee

BNP Paribas

4 questions for UBS

Kian Abouhossein

JPMorgan Chase & Co.

4 questions for UBS

Andrew Coombs

Citigroup

3 questions for UBS

Anke Reingen

RBC

3 questions for UBS

Benjamin Goy

Deutsche Bank

3 questions for UBS

Piers Brown

HSBC

2 questions for UBS

Stefan Stalmann

Autonomous Research

2 questions for UBS

Antonio Reale

Bank of America

1 question for UBS

Giulia Aurora Miotto

Morgan Stanley

1 question for UBS

Thomas Hallett

Keefe, Bruyette & Woods

1 question for UBS

Recent press releases and 8-K filings for UBS.

- UBS Group AG published its consolidated capital instruments and TLAC-eligible senior unsecured debt information for the fourth quarter of 2025, as of December 31, 2025.

- The company reported total high-trigger loss-absorbing additional tier 1 capital of USD 19,914 million.

- Total TLAC-eligible senior unsecured debt for UBS Group AG amounted to USD 96,105 million.

- This report details instruments contributing to the total loss-absorbing capacity (TLAC) under the Swiss systemically relevant bank (SRB) framework.

- On June 12, 2023, Credit Suisse Group AG merged with UBS Group AG, making its outstanding debt securities obligations of UBS Group AG.

- UBS AG upstreamed CHF 13 billion in 2024 and expects to pay CHF 9 billion in 2025 from the parent bank, with CHF 4.5 billion of the 2025 dividend paid in the first half for share buyback and dividend. This capital repatriation is occurring sooner than anticipated due to faster de-risking and balance sheet restructuring.

- The achievement of an underlying cost-income ratio below 50% by the end of 2026 is likely to be delayed due to Swiss franc interest rate headwinds that have persisted since 2024.

- Net new assets are expected to be around CHF 125 billion in 2026, growing from CHF 100 billion in 2024 and 2025, as previous headwinds have been resolved.

- UBS remains confident in its aim to double Global Banking revenues compared to 2022. Reductions in force will start in the first half of 2026 and continue into the second half of 2026 and early 2027, with efforts to minimize proactive redundancies.

- UBS expects Swiss franc interest rate headwinds to likely delay the achievement of an underlying cost-income ratio below 50% by the end of 2026.

- The company plans to upstream CHF 9 billion from the parent bank in 2025, with CHF 4.5 billion of the accrued dividend to be paid in the first half, following CHF 13 billion upstreamed in 2024.

- Net new assets are projected to reach approximately CHF 125 billion in 2026, up from CHF 100 billion in 2024 and 2025, as prior headwinds have been resolved.

- Management maintains confidence in its goal to double Global Banking revenues compared to 2022 on an annualized basis by the end of 2026.

- Reductions in force in Switzerland are anticipated to begin in the first half of 2026, with the majority occurring in the second half of 2026 and early 2027.

- UBS expects to pay CHF 4.5 billion of its CHF 9 billion accrued dividend in the first half of 2026, following CHF 13 billion upstreamed in 2024 and CHF 9 billion expected in 2025 from the parent bank. This faster capital repatriation was planned and does not reduce the CHF 26 billion capital build-up requirement.

- The achievement of an underlying cost-income ratio below 50% by the end of 2026 is likely to be delayed due to persistent Swiss franc interest rate headwinds since 2024.

- Net new assets are projected to grow to around CHF 125 billion in 2026, up from CHF 100 billion in 2024/2025, with a CHF 200 billion target for 2028.

- UBS remains confident in its goal of doubling Global Banking revenues compared to 2022, supported by a strong 2026 pipeline and selective market share expansion.

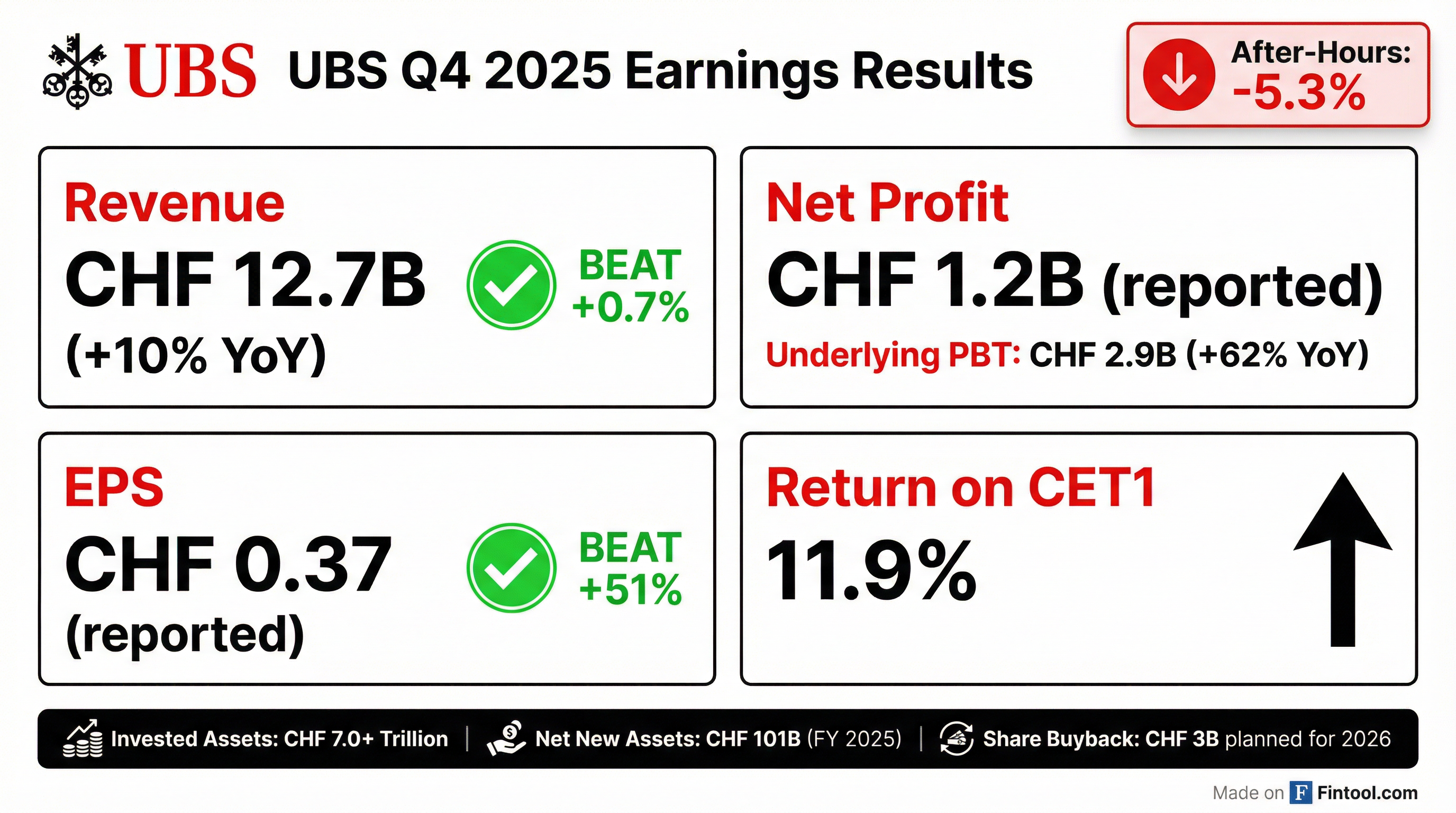

- UBS reported a net profit of CHF 1.2 billion and EPS of CHF 0.37 for Q4 2025, with underlying pre-tax profit increasing 62% year-over-year to CHF 2.9 billion and total revenues up 10%.

- The company achieved a cost-income ratio of 75% and a return on CET1 capital of 11.9% in Q4 2025, with group invested assets exceeding CHF 7 trillion. The CET1 capital ratio stood at 14.4%.

- UBS delivered CHF 700 million in gross cost savings in Q4, bringing the cumulative total to CHF 10.7 billion by year-end 2025, and raised its gross cost savings ambition to CHF 13.5 billion by the end of 2026.

- Shareholder returns include a planned $3 billion share buyback in 2026 (following $3 billion in 2025) and a 22% increase in the full-year 2025 ordinary dividend to $1.10 per share.

- The company targets an underlying return on CET1 capital of around 15% and a cost-income ratio below 70% by the end of 2026, with longer-term ambitions for a reported return on CET1 capital of around 18% and a cost-income ratio of around 67% by 2028.

- UBS reported a net profit of CHF 1.2 billion and EPS of CHF 0.37 for Q4 2025, with underlying pre-tax profit up 62% year-over-year to CHF 2.9 billion and total revenues increasing 10%.

- For the full year 2025, Global Wealth Management (GWM) pre-tax profits grew 23% to CHF 6.1 billion, and the Investment Bank achieved record revenues of CHF 11.8 billion, up 18%.

- The company's CET1 capital ratio was 14.4% at year-end 2025, with plans to repurchase CHF 3 billion in shares in 2026 and an increased full-year 2025 ordinary dividend of $1.10 per share.

- UBS increased its gross cost savings ambition to CHF 13.5 billion and targets a 15% underlying return on CET1 capital and a cost-income ratio below 70% by the end of 2026.

- Global Wealth Management aims to deliver more than $200 billion in net new assets per annum by 2028, expecting to exceed $125 billion in 2026.

- UBS reported a net profit of CHF 1.2 billion and earnings per share of CHF 0.37 for Q4 2025, with underlying pre-tax profit up 62% year-over-year to CHF 2.9 billion.

- Total revenues increased 10% year-over-year in Q4 2025, driven by strong top-line growth in Global Wealth Management and the Investment Bank.

- The company delivered CHF 10.7 billion in cumulative gross run rate cost saves by year-end 2025, including CHF 3.2 billion in 2025, and increased its gross cost savings ambition to CHF 13.5 billion by the end of 2026.

- UBS's CET1 capital ratio was 14.4% at the end of December 2025, and it plans to buy back CHF 3 billion in shares in 2026, following $3 billion in 2025. The full-year 2025 ordinary dividend increased 22% to $1.10 per share.

- The company targets an underlying return on CET1 capital of around 15% and a cost-income ratio below 70% by the end of 2026, with ambitions for a reported return on CET1 capital of around 18% and a cost-income ratio of around 67% by 2028.

- UBS Group AG submitted its response on January 12, 2026, to the consultation on amendments to the Swiss Banking Act and Capital Adequacy Ordinance, rejecting the proposed full deduction of foreign subsidiaries from Common Equity Tier 1 (CET1) capital.

- The company estimates this proposal would lead to additional CET1 capital requirements of approximately USD 23 billion, contributing to a total of approximately USD 39 billion in additional capital required due to new regulations and the Credit Suisse acquisition.

- UBS warns that these measures would result in at least 50% higher capital requirements compared to its European and US competitors, placing it at a significant international disadvantage and potentially weakening the Swiss financial center.

- The document provides information on UBS Group AG's consolidated capital instruments and TLAC-eligible senior unsecured debt as of September 30, 2025, under the Swiss systemically relevant bank (SRB) framework.

- As of September 30, 2025, the total high-trigger loss-absorbing additional tier 1 capital for UBS Group AG was $20,296 million.

- The total TLAC-eligible senior unsecured debt for UBS Group AG amounted to $104,379 million as of September 30, 2025.

- Total Tier 2 capital was reported as $0 million as of September 30, 2025.

- UBS reported a strong third quarter 2025, with net profit of $2.5 billion, an increase of 74%, and earnings per share of $0.76. The underlying pre-tax profit was $3.6 billion, up 50% on 5% revenue growth, and the return on CET1 capital was 16.3%, which included $668 million in net litigation reserve releases.

- The company achieved $10 billion in cumulative gross run-rate cost saves, reaching this milestone one quarter ahead of schedule. Technology is expected to contribute close to 40% of the remaining $3 billion in gross run-rate cost saves anticipated over 2026.

- UBS's capital position remains robust, with a CET1 capital ratio of 14.8% and a CET1 leverage ratio of 4.6%, both above target levels. The company expects to accrue for share repurchases to be executed during 2026.

- Divisional performance highlights include the Investment Bank's pre-tax profit more than doubling to $787 million , Asset Management's invested assets surpassing $2 trillion for the first time , and Global Wealth Management's pre-tax profit (excluding litigation) increasing 21% year-over-year.

- Strategic advancements include filing an application for a national bank charter in the U.S., with approval expected in 2026 , and the ongoing Swiss platform migration, which has involved migrating 40 PB of data and 700,000 clients. UBS also intends to appeal the AT1 ruling alongside FINMA to safeguard the credibility of AT1 instruments.

Fintool News

In-depth analysis and coverage of UBS Group.

Quarterly earnings call transcripts for UBS Group.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more