Earnings summaries and quarterly performance for UMB FINANCIAL.

Executive leadership at UMB FINANCIAL.

Board of directors at UMB FINANCIAL.

Brad Henderson

Director

Gordon Lansford

Director

Greg Graves

Lead Independent Director

Janine Davidson

Director

Jennifer Hopkins

Director

John Schmidt

Director

Josh Sosland

Director

Kevin Gallagher

Director

Kris Robbins

Director

Leroy Williams Jr.

Director

Margaret Lazo

Director

Robin Beery

Director

Susan Murphy

Director

Tammy Peterman

Director

Timothy Murphy

Director

Research analysts who have asked questions during UMB FINANCIAL earnings calls.

David Long

Raymond James Financial, Inc.

8 questions for UMBF

Jared Shaw

Barclays

8 questions for UMBF

Nathan Race

Piper Sandler & Co.

8 questions for UMBF

Timur Braziler

Wells Fargo

8 questions for UMBF

Brian Wilczynski

Morgan Stanley

7 questions for UMBF

Jon Arfstrom

RBC Capital Markets

6 questions for UMBF

Christopher McGratty

Keefe, Bruyette & Woods

5 questions for UMBF

Janet Lee

TD Cowen

4 questions for UMBF

Ben Gerlinger

Citigroup

3 questions for UMBF

Brian Foran

Truist Financial

3 questions for UMBF

Chris McGratty

KBW

3 questions for UMBF

Benjamin Gerlinger

Citigroup Inc.

2 questions for UMBF

Brendan Nosal

Hovde Group, LLC

2 questions for UMBF

Brian Foreign

Zurich

1 question for UMBF

John Armstrong

RBC

1 question for UMBF

Recent press releases and 8-K filings for UMBF.

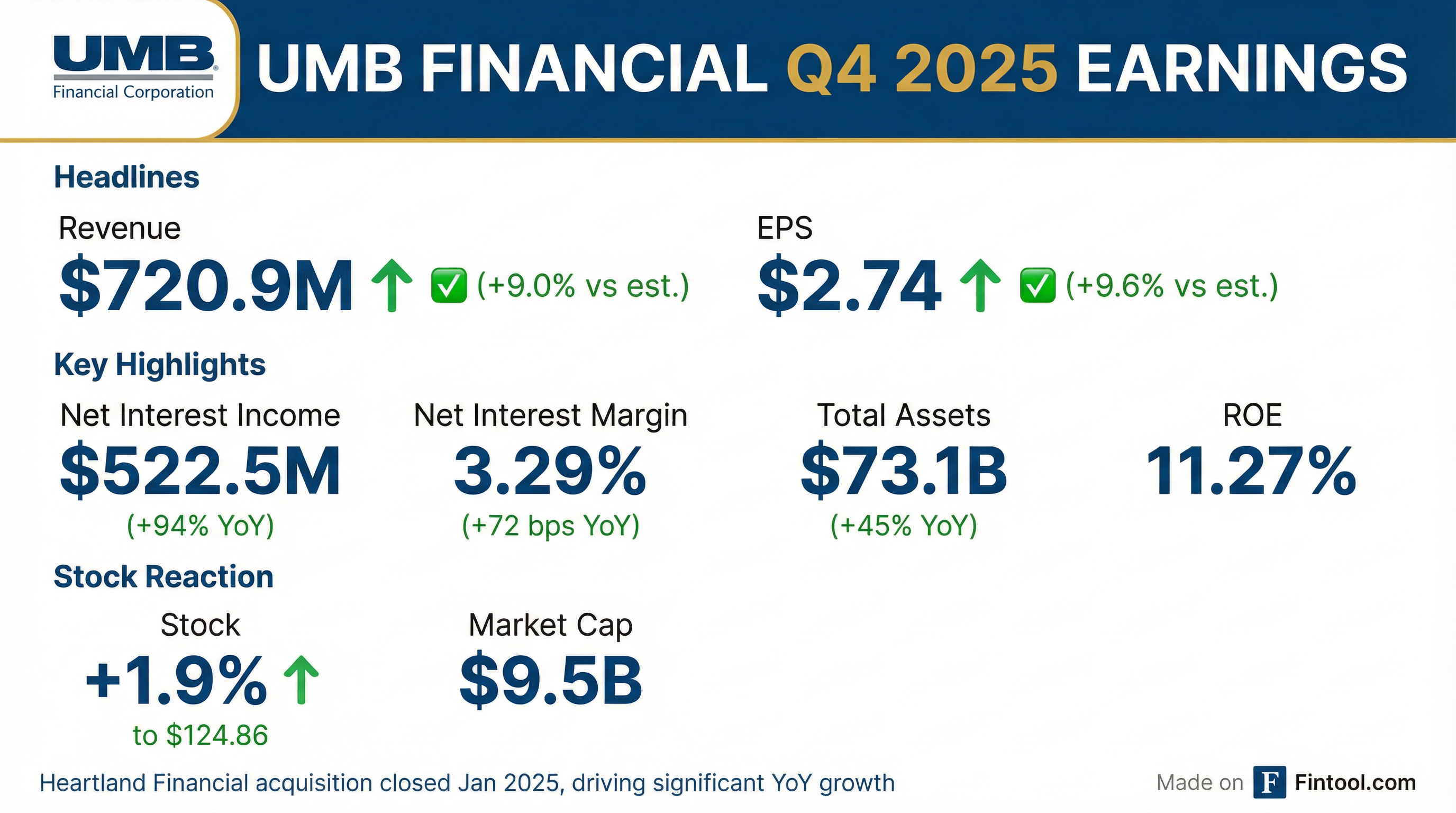

- UMBF reported strong Q4 2025 financial results, with net income available for common shareholders of $209.5 million or $2.74 per share, and improved metrics including a return on average assets of 1.20% and an efficiency ratio of 55.5%.

- The company demonstrated robust organic growth in Q4 2025, with 13% linked-quarter annualized growth in average loans and 5.6% in average deposits, significantly outpacing peer banks.

- Asset quality remained exceptional, with total net charge-offs of just 13 basis points in Q4 2025 and 23 basis points for the full year, well below historical averages.

- Looking ahead, UMBF expects to achieve positive operating leverage in 2026 and prioritizes organic growth, while considering strategic tuck-in acquisitions and remaining cautious about larger deals.

- UMBF reported strong Q4 2025 earnings, with net income available for common shareholders of $209.5 million or $2.74 per share, an increase of 16.1% from the third quarter, and full-year earnings of $684.6 million or $9.29 per share. Profitability metrics improved, with return on average assets at 1.20%, return on average common equity at 11.27%, and an efficiency ratio of 55.5%.

- The company demonstrated significant growth, achieving 13% linked-quarter annualized growth in average loans and 5.6% in average deposits, with quarterly top-line loan production of $2.6 billion. All identified cost savings from the Heartland acquisition have been realized.

- Credit quality remained robust, with total net charge-offs at 13 basis points for Q4 2025 and 23 basis points for the full year 2025, below the long-term historical average of 27 basis points. The common equity Tier One ratio stood at 10.96% as of December 31st.

- For Q1 2026, operating expenses are projected to be in the $385 million-$390 million range, and the effective tax rate for 2026 is expected to be between 20%-22%. The company anticipates positive operating leverage in 2026 and a relatively flat net interest margin in Q1.

- UMB Financial reported strong Q4 2025 net income of $209.5 million, or $2.74 per share, marking a 16.1% increase from the prior quarter, and achieved record earnings for the full year 2025 of $684.6 million, or $9.29 per share.

- Key profitability metrics improved, with Return on Average Assets at 1.20%, Return on Average Common Equity at 11.27%, and an efficiency ratio of 55.5% in Q4 2025.

- The company successfully completed the Heartland Financial acquisition, realizing all identified cost savings and expecting positive operating leverage in 2026. The acquisition was described as "flawless" and exceeded expectations for deposit growth.

- Loan growth was robust, with 13% linked-quarter annualized growth in average loans and 5.6% in average deposits for Q4 2025, significantly outpacing peer banks.

- Net interest income totaled $522.5 million, a 10% increase from Q3, and the core net interest margin (excluding purchase accounting adjustments) was 2.96%, up 18 basis points sequentially. The company anticipates a generally stable core NIM going forward, with potential upside from future rate cuts.

- UMB Financial Corporation reported GAAP net income available to common shareholders of $209.5 million, or $2.74 per diluted common share, for Q4 2025, representing a 74.6% increase compared to Q4 2024. Total revenues for the quarter reached $720.9 million, a 66.0% increase year-over-year.

- The board of directors declared a quarterly dividend of $0.43 per share on the company’s common stock, payable on April 1, 2026, and $193.75 per share on the Series B 7.75% preferred stock, payable on April 15, 2026.

- The company achieved 13.0% linked-quarter annualized loan growth to $38.3 billion and 5.6% linked-quarter annualized deposit growth to $57.6 billion.

- The GAAP efficiency ratio improved to 55.5% in Q4 2025, compared to 61.8% in Q4 2024.

- The year 2025 was marked by the successful completion of the acquisition of Heartland Financial, contributing to record earnings and significant improvements in profitability metrics.

- UMB Financial Corporation reported GAAP net income available to common shareholders of $209.5 million, or $2.74 per diluted common share, for the fourth quarter of 2025, marking a 74.6% increase compared to the fourth quarter of 2024.

- Fourth quarter revenues totaled $720.9 million, representing a 66.0% increase compared to the fourth quarter of 2024. For the full year 2025, GAAP net income available to common shareholders was $684.617 million, with diluted EPS of $9.29.

- The company's total assets grew 45.0% year-over-year to $73.1 billion at December 31, 2025, from $50.4 billion at December 31, 2024.

- This growth was supported by a 51.6% increase in average loans to $38.3 billion and a 5.6% linked-quarter annualized increase in average deposits to $57.6 billion.

- The successful acquisition of Heartland Financial on January 31, 2025, was highlighted as a significant factor contributing to record earnings and improved profitability metrics.

- UMB Financial reported Q3 2025 net operating income of $206.5 million, or $2.70 per share, excluding acquisition and other non-recurring items.

- The company achieved 8% linked quarter annualized growth in both average loans and deposits, with quarterly top line loan production surpassing $2 billion for the first time.

- The full systems and brand conversion for the Heartland Financial USA, Inc. acquisition was successfully completed in early October, with all cost savings from the acquisition expected to materialize by the end of Q1 2026.

- UMB Financial expects Q4 2025 operating expenses to be in the range of $375 million to $380 million and the core net interest margin to be essentially flat compared to Q3's 2.78%.

- Management anticipates the Common Equity Tier 1 (CET1) ratio to return to 11% within one or two quarters.

- UMBF reported Q3 2025 net operating income of $206.5 million or $2.70 per share, excluding acquisition expenses and nonrecurring items.

- The company achieved 8% linked quarter annualized growth in both average loans and deposits, with quarterly top-line loan production surpassing $2 billion for the first time. Loan growth outpaced peer banks, which reported a 5.5% median annualized increase.

- Credit quality remained strong with an allowance for credit losses at 1.07% of total loans and total net charge-offs at 20 basis points for the quarter. The common equity tier 1 ratio increased by 31 basis points to 10.70%.

- The Board of Directors declared a quarterly dividend of $0.43 per share, marking a 7.5% increase from the prior quarter and the 23rd dividend increase in the past 20 years.

- UMB Financial successfully completed the full systems and brand conversion of all Heartland Financial (HTLF) locations in early October 2025. The company reported net operating income for Q3 2025 of $206.5 million or $2.70 per share, excluding acquisition and other nonrecurring items.

- The company experienced 8% linked quarter annualized growth in both average loans and deposits, with quarterly top line loan production surpassing $2 billion for the first time. Fee income also saw a strong increase of 12.4% on a linked quarter basis, excluding market valuation changes on equity positions.

- Credit quality remained solid, with an allowance for credit losses at 1.07% of total loans and total net charge-offs at 20 basis points for Q3 2025. The common equity Tier 1 ratio increased by 31 basis points from Q2 to 10.70%.

- UMB Financial's Board of Directors declared a quarterly dividend of $0.43 per share, representing a 7.5% increase from the prior quarter. For Q4 2025, the core net interest margin is expected to be essentially flat compared to Q3's 2.78%, and operating expenses are projected to be in the $375 million-$380 million range.

- UMB Financial Corporation reported GAAP net income available to common shareholders of $180.4 million, or $2.36 per diluted common share, for Q3 2025, an increase of 64.5% compared to Q3 2024.

- Net operating income available to common shareholders for Q3 2025 was $206.5 million, or $2.70 per diluted common share, an 87.2% increase from Q3 2024.

- The company's efficiency ratio improved to 58.1% in Q3 2025 from 61.7% in Q3 2024, and the net interest margin on a fully taxable equivalent basis was 3.04%, up 58 basis points from Q3 2024.

- Average loans increased 52.3% to $37.1 billion, and total assets grew 51.3% to $71.9 billion at September 30, 2025, compared to September 30, 2024, reflecting strong organic growth and the impact of the Heartland Financial acquisition.

- A quarterly common stock dividend of $0.43 per share was declared, marking a 7.5% increase from the prior quarter and the 23rd dividend increase in the past 20 years.

Quarterly earnings call transcripts for UMB FINANCIAL.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more