Earnings summaries and quarterly performance for USA Compression Partners.

Research analysts who have asked questions during USA Compression Partners earnings calls.

Doug Irwin

Citigroup Inc.

6 questions for USAC

Brian DiRubbio

Robert W. Baird & Co. Incorporated

4 questions for USAC

James Rollyson

Raymond James Financial, Inc.

4 questions for USAC

Connor Jensen

Raymond James Financial, Inc.

3 questions for USAC

Gabriel Moreen

Mizuho Financial Group, Inc.

3 questions for USAC

Robert Mosca

Mizuho Securities Co., Ltd.

3 questions for USAC

Eli Jossen

JPMorgan Chase & Co.

2 questions for USAC

Elvira Scotto

RBC Capital Markets

2 questions for USAC

Gabe Moreen

Mizuho Securities USA

2 questions for USAC

Jeremy Tonet

JPMorgan Chase & Co.

2 questions for USAC

Nate Pendleton

Texas Capital

2 questions for USAC

James Rollinson

Raymond James

1 question for USAC

Recent press releases and 8-K filings for USAC.

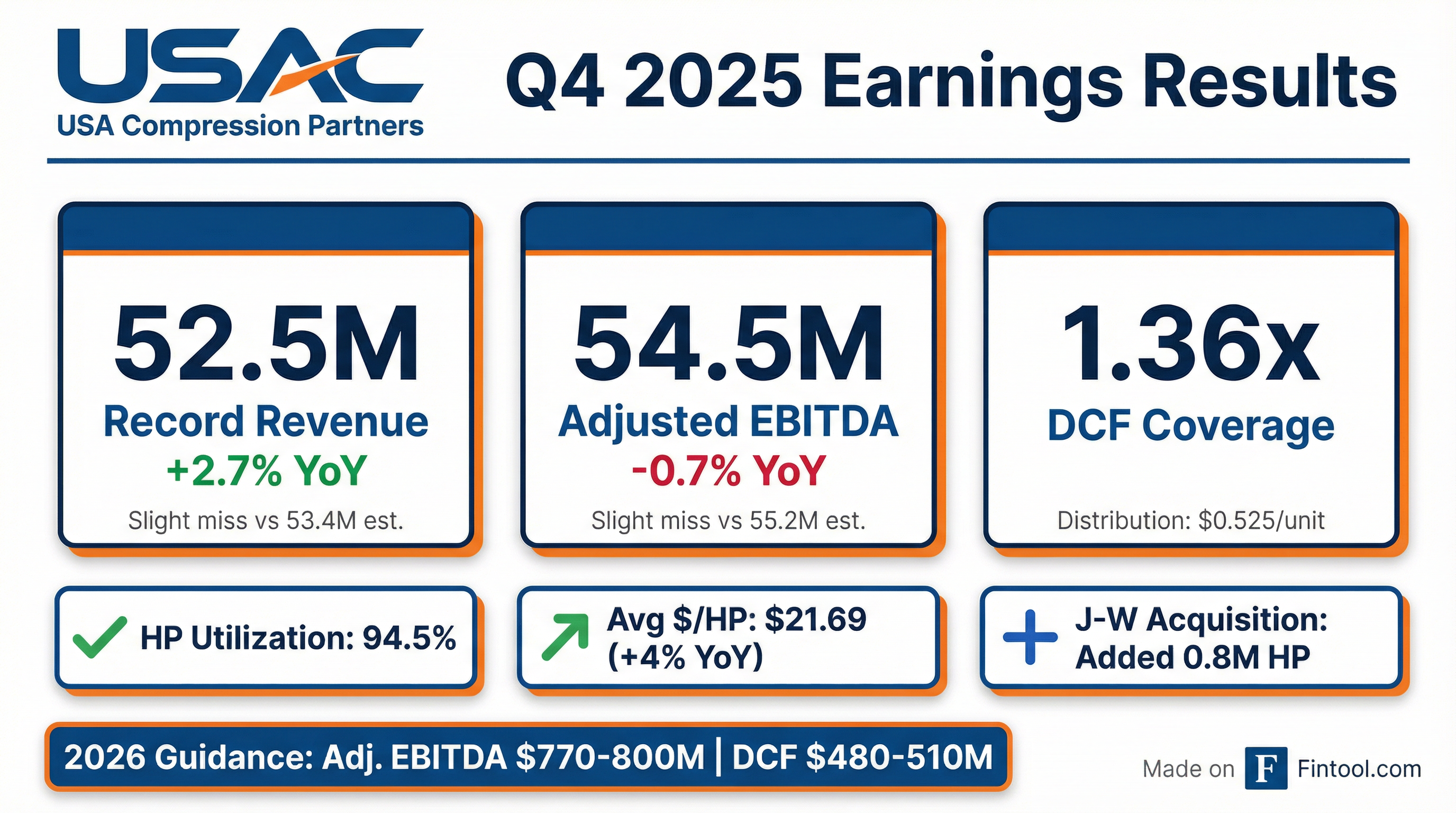

- USA Compression Partners reported record full-year 2025 Adjusted EBITDA of $613.8 million and Distributable Cash Flow (DCF) of $385.7 million.

- For Q4 2025, the company achieved an average pricing of $21.69 per horsepower, a 1% sequential increase, and maintained high average utilization at 94.5%.

- Following the J-W Power acquisition, USA Compression Partners provided 2026 guidance, forecasting Adjusted EBITDA of $770 million-$800 million and DCF of $480 million-$510 million.

- The company anticipates $10 million-$20 million in annual run-rate synergies from the J-W acquisition by the end of 2027 and plans $230 million-$250 million in expansion capital for 2026, including 105,000 new horsepower.

- USA Compression Partners aims for a near-term leverage ratio of 3.75x debt to EBITDA and expects its normalized distribution coverage to be in the 1.6+ range for 2026.

- USA Compression Partners reported record full-year 2025 Adjusted EBITDA of $613.8 million and Distributable Cash Flow of $385.7 million, with average utilization remaining high at 94.5%.

- The company completed the J-W Power acquisition on January 12, 2026, which is expected to generate $10 million-$20 million in annual run-rate synergies by the end of 2027 and significantly increase active horsepower in key basins.

- For full-year 2026, USA Compression Partners forecasts Adjusted EBITDA of $770 million-$800 million and Distributable Cash Flow of $480 million-$510 million, with expansion capital budgeted at $230 million-$250 million to add approximately 105,000 new horsepower.

- The company aims to improve its leverage ratio to 3.75x in the near term and expects distribution coverage to be 1.6x+ in 2026, following a normalized 1.55x in Q4 2025.

- USA Compression Partners achieved record full-year 2025 Adjusted EBITDA of $613.8 million and Distributable Cash Flow of $385.7 million, maintaining high average utilization in excess of 94% throughout the year and ending Q4 2025 at 94.5%.

- Following the J-W Power acquisition on January 12, 2026, the company forecasts 2026 Adjusted EBITDA of $770 million-$800 million and Distributable Cash Flow of $480 million-$510 million.

- The acquisition is expected to generate $10 million-$20 million in annual run-rate synergies by the end of 2027 and adds approximately 200,000 idle horsepower, with 50,000 horsepower readily deployable.

- The company's Q4 2025 leverage ratio was 4.0 times, with a near-term target of 3.75x, and a normalized distribution coverage of 1.55x for Q4 2025, projected to be in the 1.6+ range for 2026.

- USA Compression Partners reported record revenues of $252.5 million for Q4 2025, alongside a record average revenue-generating horsepower of 3.58 MM.

- Adjusted EBITDA for the quarter was $154.5 million.

- The company announced the acquisition of J-W Power, which is expected to grow pro forma active horsepower to 4.4MM, and converted all $500 million Series A Preferred Units into Common Units by December 31, 2025.

- Operational highlights include a total utilization rate of 94.7% and a large horsepower utilization of 97%.

- The company maintained a distribution coverage of 1.36x and a leverage ratio of 4.00x.

- USA Compression reported record Q4 2025 revenue of $252.5 million and full-year 2025 revenue near $998.1 million, achieving all-time high distributable cash flow, though it missed Q4 GAAP EPS of $0.22 and revenue expectations.

- The company maintained its quarterly cash distribution at $0.525 per unit despite distributable cash flow coverage narrowing to 1.36x in Q4 2025.

- The J-W Power acquisition expanded active Permian horsepower to approximately 1.7 million and added a manufacturing business, contributing 200,000 idle horsepower.

- For 2026, management guided adjusted EBITDA of $770–$800 million and distributable cash flow of $480–$510 million, with $230–$250 million budgeted for expansion capital to add 105,000 new horsepower. The company also plans to prioritize deleveraging towards a 3.75x debt/EBITDA target.

- USA Compression Partners reported record total revenues of $252.5 million for fourth-quarter 2025, an increase from $245.9 million in fourth-quarter 2024, with net income reaching $27.8 million.

- For the full year 2025, the company achieved record Adjusted EBITDA of $613.8 million and Distributable Cash Flow of $385.7 million.

- The Partnership announced a cash distribution of $0.525 per common unit for fourth-quarter 2025, consistent with fourth-quarter 2024.

- The J-W acquisition, closed in January 2026, added approximately 0.8 million in active horsepower.

- For full-year 2026, USA Compression Partners projects Adjusted EBITDA between $770.0 million and $800.0 million and Distributable Cash Flow between $480.0 million and $510.0 million.

- USA Compression Partners reported record total revenues of $252.5 million for fourth-quarter 2025, an increase from $245.9 million in Q4 2024, with net income of $27.8 million and Distributable Cash Flow of $103.2 million for the same period.

- The Partnership achieved record Adjusted EBITDA and Distributable Cash Flow for the full year 2025.

- For full-year 2026, USA Compression Partners projects Adjusted EBITDA between $770 million and $800 million and Distributable Cash Flow between $480 million and $510 million.

- A cash distribution of $0.525 per common unit was paid for fourth-quarter 2025, consistent with the prior year.

- USA Compression Partners, LP completed the acquisition of J-W Power Company on January 12, 2026.

- The total consideration for the transaction was approximately $860 million.

- The acquisition was funded by $430 million in cash from USA Compression's revolving credit facility and the issuance of approximately 18.2 million common units at an effective price of $23.50 per common unit.

- This transaction adds over 0.8 million active horsepower, bringing the combined fleet to approximately 4.4 million active horsepower, and is expected to deliver meaningful near-term accretion on a Distributable Cash Flow basis and improve pro forma debt metrics.

- As part of the acquisition, J-W Energy and J-W Power became wholly owned subsidiaries and guarantors under USA Compression's existing credit agreements and indentures.

- USA Compression Partners, LP (USAC) has completed its previously announced acquisition of J-W Power Company.

- The total consideration for the transaction was approximately $860 million.

- USAC funded $430 million of the purchase price in cash and issued approximately 18.2 million common units at an effective price of $23.50 per unit for the balance.

- The acquisition adds over 0.8 million active horsepower, increasing USA Compression's combined fleet to approximately 4.4 million active horsepower.

- This transaction is expected to deliver meaningful near-term accretion on a Distributable Cash Flow basis and improve pro forma debt metrics.

- USA Compression Partners (USAC) announced the acquisition of J-W Power Company, a largely privately-held provider of compression services.

- The transaction is valued at approximately 5.8 times 2026 estimated adjusted EBITDA and will be funded with $430 million in cash and approximately 18.3 million USAC common units.

- The acquisition is expected to increase USAC's active fleet to roughly 4.4 million horsepower on a pro forma basis, adding approximately 1.05 million total horsepower from J-W, with over 900,000 readily deployable.

- This acquisition is anticipated to be meaningfully accretive in 2026 on a DCF basis and move USAC below 4x leverage on a pro forma basis.

- The transaction is expected to close in the first quarter of 2026, subject to customary closing conditions including regulatory approval.

Quarterly earnings call transcripts for USA Compression Partners.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more