Earnings summaries and quarterly performance for UNIVEST FINANCIAL.

Executive leadership at UNIVEST FINANCIAL.

Jeffrey Schweitzer

Chair of the Board, President and Chief Executive Officer

Brian Richardson

Senior Executive Vice President and Chief Financial Officer

Megan Santana

Senior Executive Vice President, General Counsel and Chief Risk Officer

Michael Keim

Senior Executive Vice President and Chief Operating Officer; President of Univest Bank and Trust Co.

Patrick McCormick

Senior Executive Vice President and Chief Commercial Banking Officer

Board of directors at UNIVEST FINANCIAL.

Anne Vazquez

Director

Charles Zimmerman

Director

Domenick Cama

Director

Joseph Beebe

Lead Independent Director

Martin Connor

Director

Michael Turner

Director

Natalye Paquin

Director

Robert Wonderling

Director

Suzanne Keenan

Director

Thomas Petro

Director

Todd Benning

Director

Research analysts who have asked questions during UNIVEST FINANCIAL earnings calls.

Frank Schiraldi

Piper Sandler

3 questions for UVSP

Tim Switzer

Keefe, Bruyette & Woods (KBW)

3 questions for UVSP

Tyler Cacciatori

Stephens Inc.

3 questions for UVSP

Emily Noelle Lee

KBW

2 questions for UVSP

Manuel Navas

D.A. Davidson & Co.

2 questions for UVSP

Matthew Breese

Stephens Inc.

1 question for UVSP

Recent press releases and 8-K filings for UVSP.

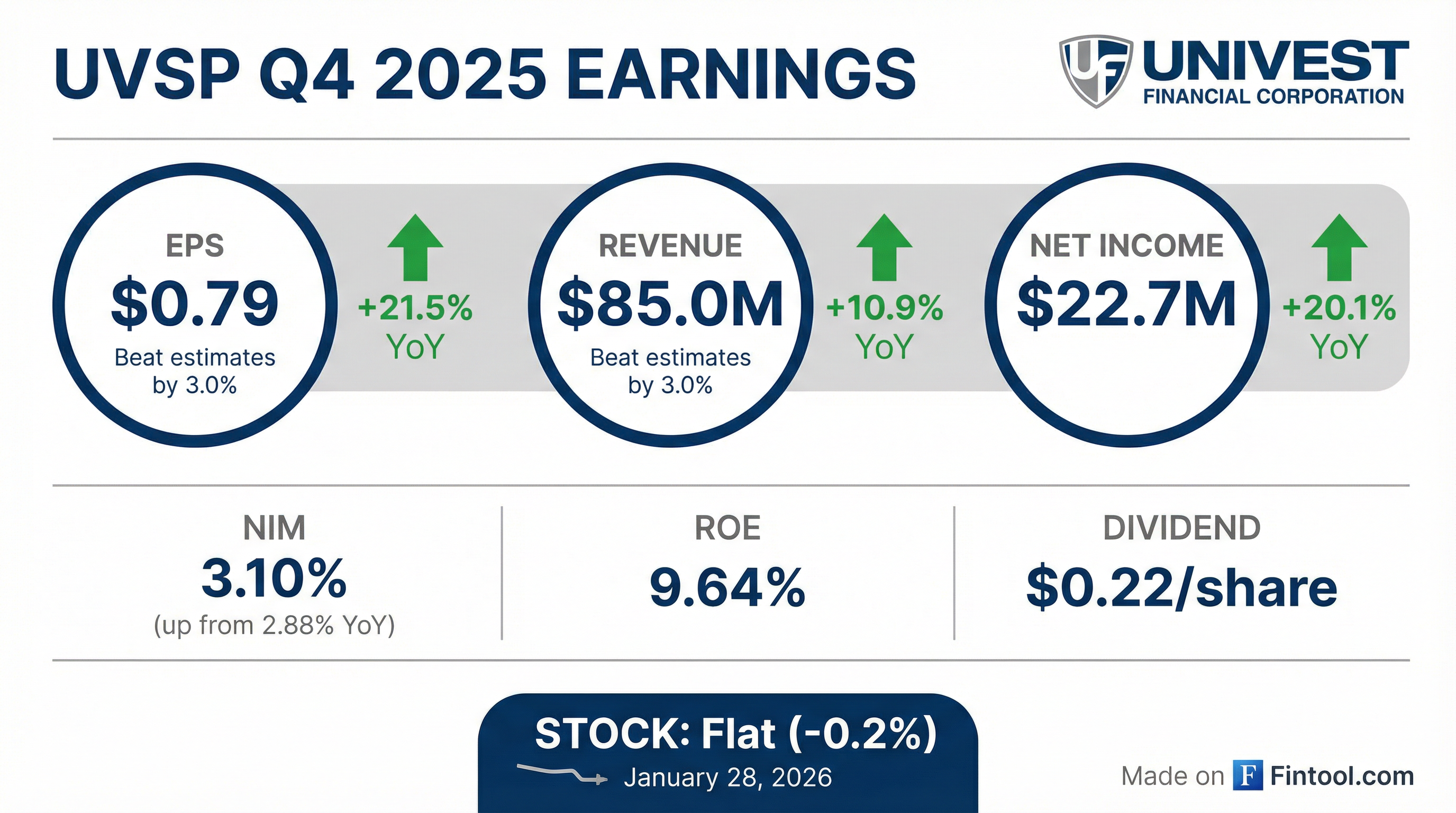

- Univest Financial Corporation reported net income of $22.7 million and EPS of $0.79 for Q4 2025, representing a 21.5% increase in EPS compared to Q4 2024 and achieving record annual EPS of $3.13 for 2025.

- Loans grew by $129.3 million (7.6% annualized) in Q4 2025, contributing to $88.2 million (1.3%) in loan growth for the full year 2025, while deposits decreased by $130.8 million in Q4 but grew $328.1 million (4.9%) for the full year.

- The company provided 2026 guidance, projecting loan growth of approximately 2%-3%, net interest income growth of 4%-6%, non-interest income growth of 5%-7%, and non-interest expense growth of 3%-5%.

- Univest repurchased approximately 400,000 shares in Q4 2025 at an average cost of $32.17 and a total of 1.1 million shares in 2025, with plans to target $10 million-$12 million per quarter in share repurchases for 2026.

- Reported Net Interest Margin (NIM) was 3.10% in Q4 2025, a 7 basis point decrease from Q3, though core NIM increased to 3.37%; the company expects NIM to be relatively in line to slightly up over 2026.

- Univest Financial Corporation reported net income of $22.7 million or $0.79 per share for Q4 2025, representing a 21.5% increase in EPS compared to Q4 2024, and achieved record annual EPS of $3.13 for 2025.

- Loans grew by $129.3 million (7.6% annualized) in Q4 2025, contributing to full-year 2025 loan growth of $88.2 million (1.3%). Deposits decreased by $130.8 million in Q4 2025, primarily due to public fund outflows, but total deposits for 2025 still grew by $328.1 million (4.9%).

- The company repurchased approximately 400,000 shares in Q4 2025 at an average cost of $32.17 per share, bringing the total for 2025 to 1.1 million shares at an average cost of $30.75. As of December 31, 2025, 2.3 million shares are available for repurchase, with a target of $10 million-$12 million per quarter for 2026.

- For 2026, Univest expects loan growth of 2%-3%, net interest income growth of 4%-6% with modest NIM expansion, and non-interest income growth of 5%-7%. The provision for credit losses is projected to be $11 million-$13 million, and non-interest expense growth is anticipated at 3%-5%.

- Univest Financial Corporation reported net income of $22.7 million or $0.79 per share for Q4 2025, contributing to record earnings per share of $3.13 for the full year 2025.

- Loans grew by $129.3 million in Q4 2025, representing 7.6% annualized growth, while deposits decreased by $130.8 million in the quarter, primarily due to public fund outflows.

- The company repurchased approximately 400,000 shares in Q4 2025 at an average cost of $32.17 per share, and a total of 1.1 million shares in 2025. The board approved an additional 2 million share repurchase, with a target of $10 million-$12 million per quarter for 2026.

- For 2026, Univest expects loan growth of 2%-3%, net interest income growth of 4%-6%, non-interest income growth of 5%-7%, and non-interest expense growth of 3%-5%. The provision for credit losses is projected to be in the range of $11 million-$13 million.

- Univest Financial Corporation reported net income of $22.7 million and diluted earnings per share of $0.79 for the fourth quarter ended December 31, 2025, marking a 21.5% increase in diluted EPS compared to the fourth quarter of 2024. For the full year 2025, net income totaled $90.8 million, or $3.13 diluted earnings per share.

- Net interest income for the fourth quarter of 2025 was $62.5 million, an increase of $7.1 million (12.8%) from the fourth quarter of 2024, with a tax-equivalent net interest margin of 3.10%.

- Nonperforming assets totaled $37.8 million at December 31, 2025 , and the provision for credit losses for the three months ended December 31, 2025, was $3.1 million.

- The company declared a quarterly cash dividend of $0.22 per share to be paid on February 25, 2026. During the fourth quarter of 2025, Univest repurchased 479,690 shares of common stock at an average price of $31.82 per share.

- Univest Financial Corporation reported net income of $22.7 million, or $0.79 diluted earnings per share, for the quarter ended December 31, 2025, compared to $18.9 million, or $0.65 diluted earnings per share, for the same quarter in 2024.

- For the full year ended December 31, 2025, net income totaled $90.8 million, or $3.13 diluted earnings per share, an increase from $75.9 million, or $2.58 diluted earnings per share, in 2024.

- Gross loans and leases increased $88.2 million, or 1.3%, from December 31, 2024, while total deposits increased $328.1 million, or 4.9%, over the same period.

- Net interest income for the fourth quarter of 2025 was $62.5 million, an increase of 12.8% from the fourth quarter of 2024, with a tax-equivalent net interest margin of 3.10%.

- The company declared a quarterly cash dividend of $0.22 per share and repurchased 479,690 shares of common stock during the quarter ended December 31, 2025.

- Univest Financial Corporation announced the completion of a $50.0 million private placement of fixed-to-floating rate subordinated notes on November 6, 2025.

- The proceeds from this offering will be used to redeem $80.0 million of outstanding callable subordinated notes and for general corporate purposes.

- The new notes have a maturity date of November 15, 2035, carry a fixed interest rate of 6.00% for the first five years, and qualify as Tier 2 capital for regulatory purposes.

- As of September 30, 2025, the Corporation reported approximately $8.6 billion in assets and $5.7 billion in assets under management and supervision.

- For YTD Q3 2025, reported earnings were $68.0 million or $2.36 per share, with a Net Interest Margin (tax-equivalent) of 3.15% and a Total Capital Ratio of 14.28%.

- Univest Financial Corporation (UVSP) announced the closing of a $50.0 million private placement of fixed-to-floating rate subordinated notes.

- The proceeds from this offering will be used to redeem $80.0 million of outstanding callable subordinated notes and for general corporate purposes.

- The new notes have a maturity date of November 15, 2035, and will pay a fixed interest rate of 6.00% for the first five years, transitioning to a floating rate thereafter.

- These notes are structured to qualify as Tier 2 capital for regulatory purposes.

- Univest Financial Corporation reported net income of $25.6 million, or $0.89 diluted earnings per share, for the quarter ended September 30, 2025, an increase from $18.6 million, or $0.63 diluted earnings per share, in the prior year's comparable quarter.

- Total deposits increased by $635.5 million, or 9.7%, from June 30, 2025, reaching $7.218 billion at September 30, 2025.

- Net interest income for the third quarter of 2025 was $61.3 million, up 15.3% from the third quarter of 2024, with a tax-equivalent net interest margin of 3.17%.

- The company declared a quarterly cash dividend of $0.22 per share and repurchased 255,010 shares of common stock during the quarter ended September 30, 2025.

- Univest Securities, LLC completed a warrant inducement for its client, PMGC Holdings Inc.

- The inducement resulted in the exercise of 827,900 shares of PMGC Holdings Inc. common stock at an amended exercise price of $2.015 per share, generating approximately $1.67 million in gross proceeds.

- PMGC Holdings Inc. also agreed to issue new unregistered warrants to purchase an aggregate of 827,900 shares of common stock with an exercise price of $1.89 per share, exercisable upon shareholder approval.

Quarterly earnings call transcripts for UNIVEST FINANCIAL.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more