Earnings summaries and quarterly performance for VALERO ENERGY CORP/TX.

Executive leadership at VALERO ENERGY CORP/TX.

R. Lane Riggs

Chief Executive Officer and President

Eric A. Fisher

Senior Vice President, Product Supply, Trading and Wholesale

Gary K. Simmons

Executive Vice President and Chief Operating Officer

Homer Bhullar

Senior Vice President and Chief Financial Officer

Jason W. Fraser

Executive Vice President and Chief Financial Officer

Richard J. Walsh

Executive Vice President and General Counsel

Board of directors at VALERO ENERGY CORP/TX.

Deborah P. Majoras

Director

Eric D. Mullins

Director

Fred M. Diaz

Director

H. Paulett Eberhart

Lead Independent Director

Kimberly S. Greene

Director

Marie A. Ffolkes

Director

Randall J. Weisenburger

Director

Rayford Wilkins, Jr.

Director

Robert L. Reymond

Director

Research analysts who have asked questions during VALERO ENERGY CORP/TX earnings calls.

Manav Gupta

UBS Group

10 questions for VLO

Ryan Todd

Simmons Energy

10 questions for VLO

Neil Mehta

Goldman Sachs

9 questions for VLO

Matthew Blair

Tudor, Pickering, Holt & Co.

8 questions for VLO

Paul Cheng

Scotiabank

8 questions for VLO

Theresa Chen

Barclays PLC

8 questions for VLO

Jason Gabelman

TD Cowen

6 questions for VLO

Joseph Laetsch

Morgan Stanley

6 questions for VLO

Phillip Jungwirth

BMO Capital Markets

6 questions for VLO

Jean Ann Salisbury

Bank of America

5 questions for VLO

Paul Sankey

Sankey Research

5 questions for VLO

Douglas George Blyth Leggate

Wolfe Research

4 questions for VLO

Jason Daniel Gabelman

TD Securities

4 questions for VLO

John Royall

JPMorgan Chase & Co.

4 questions for VLO

Roger Read

Wells Fargo & Company

4 questions for VLO

Sam Margolin

Wells Fargo & Company

4 questions for VLO

Douglas Leggate

Wolfe Research

3 questions for VLO

Doug Leggate

Wolfe Research

3 questions for VLO

Joe Laetsch

Morgan Stanley

2 questions for VLO

Matthew Robert Lovseth Blair

Tudor Pickering Holt

2 questions for VLO

Nitin Kumar

Mizuho Securities USA

2 questions for VLO

Paul Chang

Scotiabank

2 questions for VLO

Neel Mehta

Goldman Sachs

1 question for VLO

Neil Singhvi Mehta

Goldman Sachs Group

1 question for VLO

Recent press releases and 8-K filings for VLO.

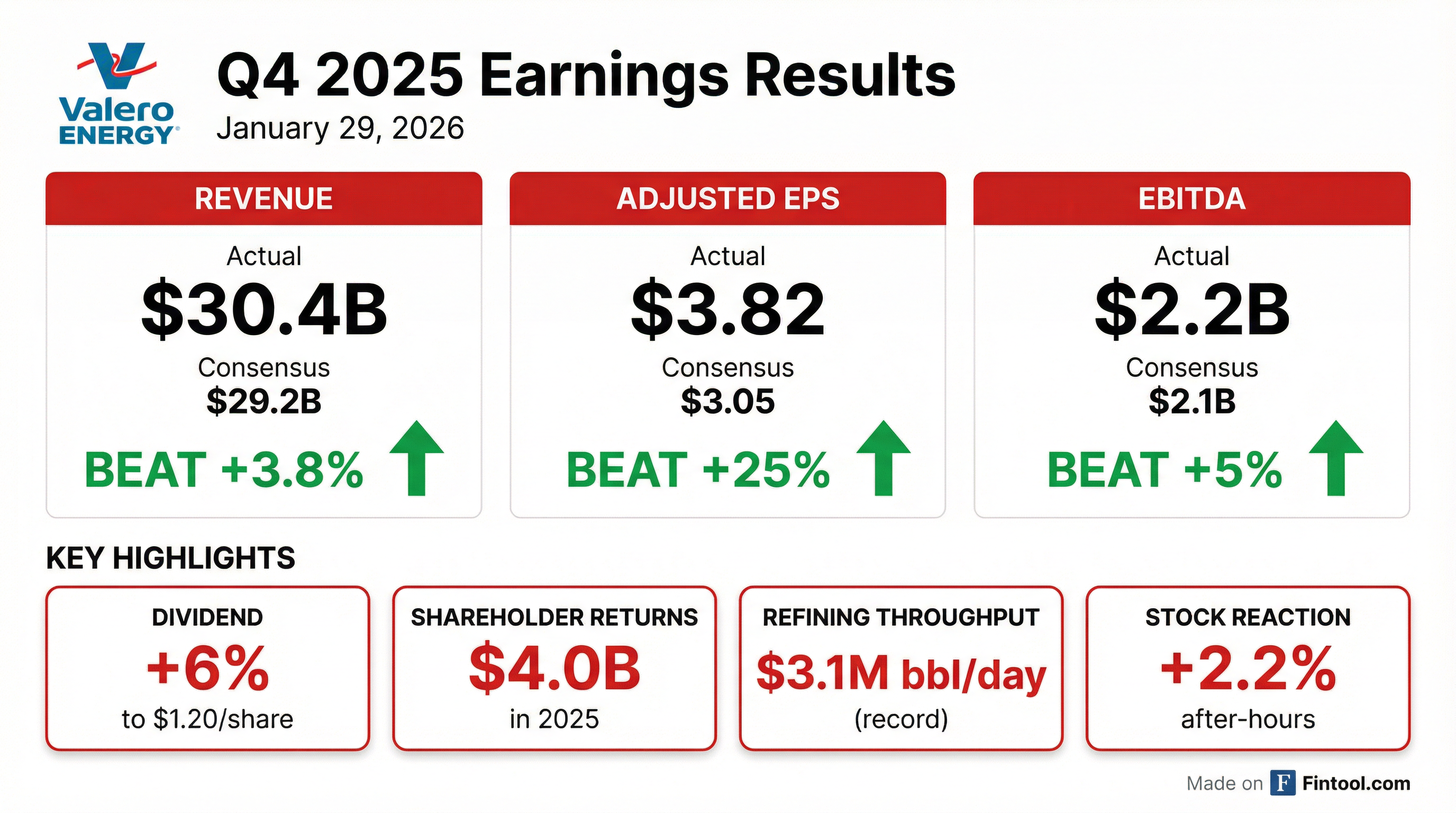

- Valero reported Q4 net income of $1.1 billion ($3.73 per share) and adjusted net income of $1.2 billion ($3.82 per share), compared to $281 million ( $0.88 per share) and $207 million ( $0.64 per share) in Q4 2024; full-year 2025 net income was $2.3 billion ($7.57 per share) and adjusted net income was $3.3 billion ($10.61 per share).

- In Q4, refining operating income was $1.7 billion with throughput of 3.1 million bpd at 98% utilization, while ethanol operating income was $117 million on record production of 4.8 million gallons per day.

- Net cash from operations in Q4 was $2.1 billion, capital investments totaled $412 million, and shareholder returns (dividends plus buybacks) were $1.4 billion (66% payout), with full-year returns of $4 billion (67% payout).

- As of December 31, 2025, Valero had $8.3 billion of debt, $4.7 billion of cash, a net debt-to-capital ratio of 18%, and $5.3 billion of available liquidity; shares outstanding fell 5% in 2025 and the board approved a 6% dividend increase.

- For 2026, Valero guides $1.7 billion of capital spending (≈$1.4 billion sustaining), Q1 refining cash operating cost of $5.17 per barrel, renewable diesel sales of 260 million gallons, ethanol output of 4.6 million gallons per day, net interest of $140 million, D&A of $835 million, and maintains a through-cycle payout ratio of 40–50% and net debt-to-capital target of 20–30%.

- Reported $1.1 billion in Q4 2025 net income (EPS $3.73) and $2.3 billion for full year (EPS $7.57); adjusted Q4 net income was $1.2 billion (EPS $3.82) and full-year adjusted net income was $3.3 billion (EPS $10.61).

- Achieved record refining throughput and ethanol production in Q4 and full year, averaging 3.1 million barrels per day at 98% capacity utilization, and set a new record for mechanical availability in 2025.

- Returned $1.4 billion of cash to shareholders in Q4 2025 (66% payout) and $4 billion for the year (67% payout), approved a 6% dividend increase, and reduced shares outstanding to 299 million (down 5% Y/Y).

- Guided 2026 capital investments of $1.7 billion (≈$1.4 billion sustaining), Q1 2026 refining throughput by region (e.g., Gulf Coast 1.695–1.745 mbpd), cash operating expenses of $5.17/barrel, renewable diesel sales ~260 million gal, ethanol production ~4.6 million gal/day, net interest ~$140 million, and D&A ~$835 million.

- Valero generated $1.1 billion in net income, or $3.73 per share, in Q4 2025 versus $281 million, $0.88 per share in Q4 2024; for the full year, net income was $2.3 billion, or $7.57 per share, with adjusted 2025 net income of $3.3 billion, $10.61 per share.

- The refining segment delivered $1.7 billion of operating income in Q4 2025 on record throughput of 3.1 million barrels per day (98% utilization) and cash operating expenses of $5.03 per barrel.

- In Q4 2025, Valero returned $1.4 billion to shareholders (66% payout ratio), increased its quarterly dividend by 6%, ended the year with $4.7 billion cash, 18% net debt-to-capital, and $5.3 billion of available liquidity.

- For 2026, Valero plans $1.7 billion of capital investments (≈$1.4 billion sustaining), Q1 refining throughput guidance by region, cash op expenses of $5.17 per barrel, renewable diesel volumes of 260 million gallons, ethanol at 4.6 million gallons/day, net interest of $140 million, and D&A of $835 million.

- Valero reported Q4 2025 net income attributable to stockholders of $1.1 billion (or $3.73 per share) and adjusted net income of $1.2 billion (or $3.82 per share), up from $281 million (or $0.88 per share) and $207 million (or $0.64 per share) in Q4 2024.

- For the full year 2025, net income was $2.3 billion (or $7.57 per share), with adjusted net income of $3.3 billion (or $10.61 per share), versus $2.8 billion (or $8.58 per share) and $2.7 billion (or $8.48 per share) in 2024.

- Stockholder cash returns totaled $1.4 billion in Q4 and $4.0 billion for the year, and the quarterly cash dividend was raised by 6% to $1.20 per share on January 22, 2026.

- The $230 million St. Charles FCC Unit optimization project is still expected to begin operations in the second half of 2026.

- Q4 2025 net income attributable to Valero stockholders was $1.1 billion ($3.73/share), with adjusted net income of $1.2 billion ($3.82/share), versus $281 million ($0.88/share) and $207 million ($0.64/share) in Q4 2024.

- Full-year 2025 net income was $2.3 billion ($7.57/share) and adjusted net income reached $3.3 billion ($10.61/share), compared to $2.8 billion ($8.58/share) and $2.7 billion ($8.48/share) in 2024.

- In Q4 2025, segment operating income included Refining $1.7 billion, Renewable Diesel $92 million, and Ethanol $117 million, alongside record refining throughput and ethanol production.

- Valero returned $1.4 billion of cash to shareholders in Q4 (66% payout ratio) and $4.0 billion for the year (67% payout ratio), and raised its quarterly dividend by 6% to $1.20/share effective January 22, 2026.

- Valero will power down operations at its Benicia refinery beginning in February and fully idle the facility by April, while maintaining production through the wind-down.

- After idling, the company plans to supply Northern California via existing inventories and increased gasoline imports to keep supply and prices stable.

- The decision was driven by high costs and strict state regulations, prompting Gov. Newsom to call the import strategy a “constructive shift”.

- The refinery employs about 400 workers; Valero has filed a WARN notice and is offering transfers to other facilities and outplacement assistance.

- Benicia is one of Valero’s 15 refineries (total throughput ~3.2 million bpd); the company also owns 12 ethanol plants and a 50% stake in Diamond Green Diesel.

- On October 16, 2025, Valero Energy amended and restated its revolving credit agreement, extending the maturity from November 22, 2027 to October 16, 2030.

- The facility provides a $4.0 billion revolving credit line with a $2.4 billion letter of credit subfacility and can be increased by $1.5 billion to a total of $5.5 billion.

- Borrowings bear interest at either Term SOFR + 0.9–1.5% or Alternate Base Rate + 0.0–0.5%, and the Company pays commitment fees of 0.1–0.25% on used and unused commitments, all payable quarterly.

- The agreement includes customary affirmative and negative covenants, events of default, and allows use of proceeds for general corporate purposes.

- Reported record Q2 refining throughput in the U.S. Gulf Coast; diesel sales volumes up 10% and gasoline flat year-over-year on strong demand and low inventories

- Maintained 52% payout ratio in Q2, declared $1.13 per share quarterly dividend and will deploy excess free cash flow to share buybacks

- Q3 guidance: refining throughput of 1.76–1.81 million bpd Gulf Coast, 0.43–0.45 million bpd Mid-Continent, 0.24–0.26 million bpd West Coast, 0.465–0.485 million bpd North Atlantic; cash OpEx $4.8/bbl; renewable diesel sales ~1.1 billion gal at $0.53/gal; ethanol production 4.6 million gal/day at $0.40/gal

- Investing $230 million in FCC optimization at St. Charles for 2026 start-up and expecting sour crude differentials to widen in H2 2025

- Valero reported a Q1 2025 net loss of $595 million (or $1.90 per share) with adjusted net income of $282 million (or $0.89 per share), compared to Q1 2024 performance .

- Shareholder returns remained robust, returning $633 million via dividends and buybacks, with a 6% increase in the quarterly cash dividend to $1.13 per share .

- Operating segments faced significant challenges: the refining segment incurred a loss of $530 million and the renewable diesel segment $141 million, while the ethanol segment posted modest gains .

- Capital investments of $660 million were made in Q1, with full-year 2025 CapEx guidance of approximately $2 billion to support sustaining and growth projects .

- Liquidity was bolstered through a debt issuance of $650 million of 5.15% Senior Notes due 2030 and the repayment of matured senior notes totaling $440 million .

- Valero Refining Company-California announced its intent to idle, restructure, or cease operations at the Benicia Refinery by the end of April 2026.

- The company recorded a combined pre-tax impairment charge of $1.1 billion for the Benicia and Wilmington refineries, which includes $337 million in asset retirement obligations.

- The 8-K filing, signed by Executive Vice President and CFO Jason W. Fraser on April 16, 2025, incorporates detailed financial statements and exhibits.

Quarterly earnings call transcripts for VALERO ENERGY CORP/TX.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more