Earnings summaries and quarterly performance for Marathon Petroleum.

Executive leadership at Marathon Petroleum.

Maryann Mannen

President and Chief Executive Officer

John Quaid

Executive Vice President and Chief Financial Officer

Michael Hennigan

Executive Chairman

Molly Benson

Chief Legal Officer and Corporate Secretary

Rick Hessling

Chief Commercial Officer

Timothy Aydt

Executive Vice President, Refining

Board of directors at Marathon Petroleum.

Abdulaziz Alkhayyal

Director

Eileen Paterson

Director

Evan Bayh

Director

Frank Semple

Director

Jeffrey Campbell

Director

John Surma

Lead Independent Director

Jonathan Cohen

Director

Kim Rucker

Director

Kimberly Ellison-Taylor

Director

Michael Stice

Director

Research analysts who have asked questions during Marathon Petroleum earnings calls.

Jason Gabelman

TD Cowen

6 questions for MPC

Manav Gupta

UBS Group

6 questions for MPC

Neil Mehta

Goldman Sachs

6 questions for MPC

Paul Cheng

Scotiabank

6 questions for MPC

Matthew Blair

Tudor, Pickering, Holt & Co.

5 questions for MPC

Theresa Chen

Barclays PLC

5 questions for MPC

Douglas George Blyth Leggate

Wolfe Research

3 questions for MPC

Doug Leggate

Wolfe Research

3 questions for MPC

John Royall

JPMorgan Chase & Co.

3 questions for MPC

Phillip Jungwirth

BMO Capital Markets

3 questions for MPC

Ryan Todd

Simmons Energy

3 questions for MPC

Roger Read

Wells Fargo & Company

2 questions for MPC

Sam Marlin

Wells Fargo

2 questions for MPC

Conor Fitzpatrick

Bank of America Merrill Lynch

1 question for MPC

Joe Laetsch

Morgan Stanley

1 question for MPC

Recent press releases and 8-K filings for MPC.

- The United Steelworkers local at the Whiting, Indiana refinery overwhelmingly authorized a strike with 98% voting in favor, preparing roughly 800 workers for a potential walkout or lockout.

- The 440,000 b/d plant supplies gasoline, diesel and jet fuel across the U.S. Midwest; any outage could tighten regional fuel supplies and lift refining margins and crack spreads.

- The union claims BP proposed eliminating more than 200 jobs, while BP says it’s continuing talks, denies plans to cut positions and has trained replacement workers to keep operations running.

- Maria Khoury joined as CFO, bringing over 25 years of global finance and operational experience.

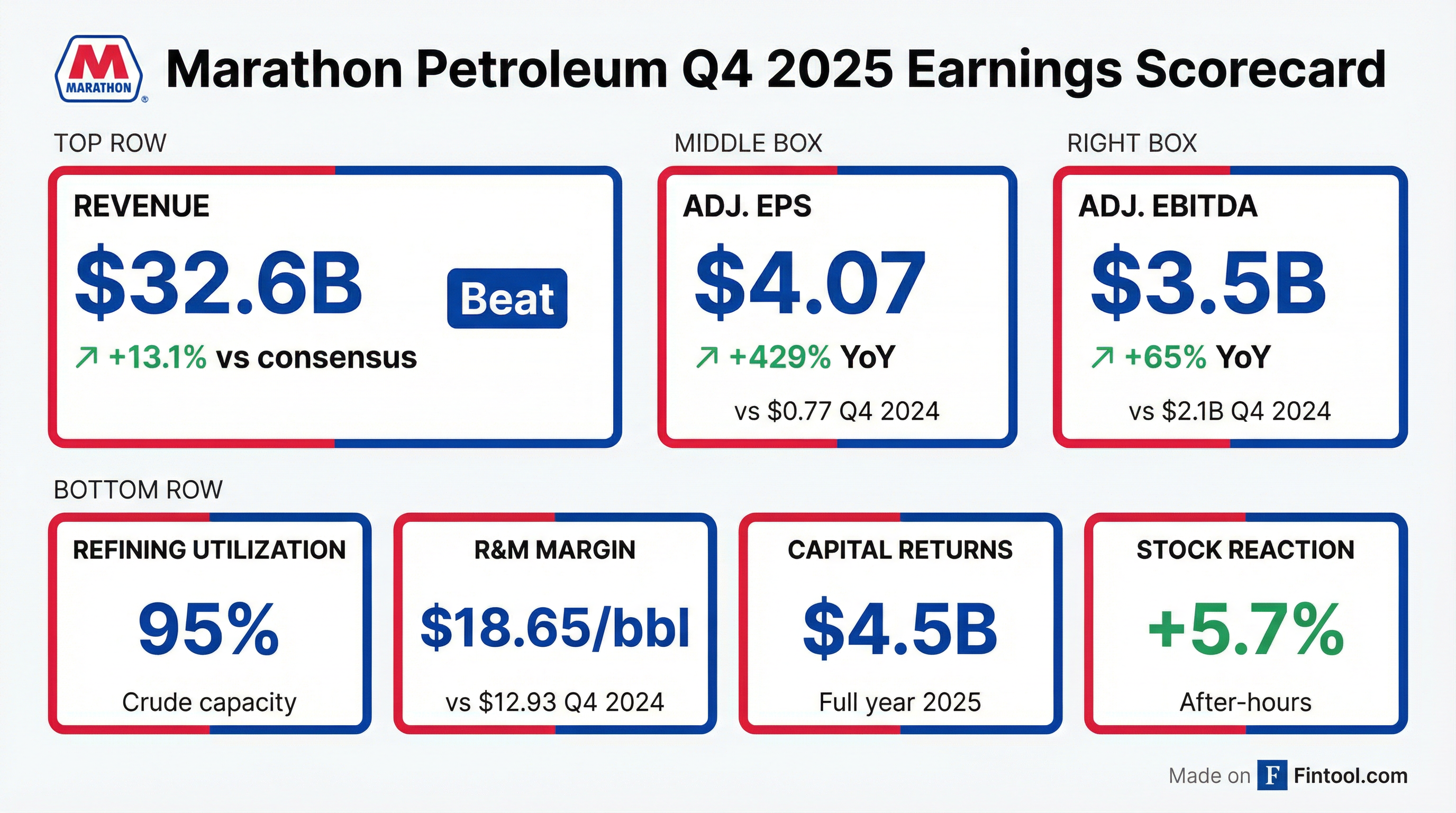

- 2025 results: Q4 adjusted EPS of $4.07 and full-year EPS of $10.70; Q4 adjusted EBITDA of $3.5 billion and full-year EBITDA of $12 billion; full-year refining utilization of 94% and margin capture of 105%.

- Cash generation & returns: Q4 operating cash flow ex-WC of $2.7 billion and full-year of $8.7 billion; returned $4.5 billion to shareholders, reducing shares outstanding by 6.5%.

- 2026 investments: refining capex of $700 million (20% yoy reduction); marketing capex of $250 million; MPLX growth capex of $2.4 billion, with 12.5% distribution growth target implying >$3.5 billion to MPC.

- 2026 outlook: turnaround spend of $1.35 billion; net debt/capital ratio of 25–30%; maintain $1 billion cash balance and return all excess free cash flow to shareholders.

- Marathon Petroleum reported Q4 adjusted EPS of $4.07 and FY 2025 adjusted EPS of $10.70, with Q4 adjusted EBITDA of ~$3.5 billion and FY adjusted EBITDA of $12 billion; refining & marketing EBITDA per barrel was $7.15 in Q4 and $5.63 for the year.

- Generated $2.7 billion in operating cash flow (ex-working capital) in Q4 and $8.7 billion for 2025; returned $4.5 billion via share repurchases and dividends, reducing shares outstanding by 6.5%.

- Q4 refining utilization reached 95% with throughput of >3 million bpd; midstream segment grew to a record ~$7 billion adjusted EBITDA for the year; renewables ran at 94% utilization with a one-time credit sale benefit.

- For 2026, refining capital spending is guiding to ~$700 million (a ~20% YoY reduction) and marketing to $250 million; turnaround expenses are expected at $1.35 billion, with net debt-to-capital targeted at 25–30% and an annual cash balance of $1 billion.

- MPLX plans $2.4 billion of growth capex (90% in gas/NGL services), targeting 12.5% distribution growth over two years (> $3.5 billion cash to MPC); MPC also announced new projects at Garyville and El Paso to add 40,000 bpd of refining capacity by year-end 2027.

- Marathon Petroleum reported adjusted EPS of $4.07 and adjusted EBITDA of $3.489 billion for Q4 2025.

- The Refining & Marketing segment delivered $7.15 per barrel of adjusted EBITDA with 94% utilization, reflecting operational excellence.

- Cash flow from operations excluding changes in working capital was $2.736 billion in Q4, supporting a $1.301 billion capital return including dividends and share repurchases.

- The company forecasts $1.5 billion of standalone capital spending in 2026 and expects Q1 2026 refining throughput of 2.74 mbpd at 85% utilization.

- Fourth-quarter net income attributable to MPC was $1.5 billion or $5.12 per diluted share, with adjusted net income of $1.2 billion or $4.07 per diluted share, up significantly year-over-year.

- Adjusted EBITDA was $3.5 billion in Q4 and $12.0 billion for full-year 2025, reflecting robust segment performance.

- Cash from operations totaled $8.3 billion in 2025, enabling $4.5 billion of capital returns, and year-end available liquidity included $3.7 billion in cash with no revolver borrowings.

- Refining utilization averaged 94% for 2025 with 105% margin capture, and Q4 refining utilization reached 95%, underpinning strong margins.

- 2026 standalone capital spending is projected at $1.5 billion (65% value-enhancing) and MPLX capital at $2.7 billion, supporting dividend and buyback capacity.

- Q4 net income attributable to MPC was $1.5 billion, or $5.12 per diluted share, up from $371 million, or $1.15 per share, in Q4 2024.

- Adjusted Q4 net income was $1.2 billion, or $4.07 per diluted share, versus $249 million, or $0.77 per share, in the year-ago quarter.

- Full-year net income was $4.0 billion, or $13.22 per diluted share, and adjusted net income was $3.3 billion, or $10.70 per share.

- Cash from operations totaled $8.3 billion in 2025, enabling $4.5 billion of capital returns, including about $1.3 billion returned in Q4.

- Full-year refining utilization reached 94% with margin capture of 105%, underscoring strong operational performance.

- Adjusted net income of $3.01 per share, adjusted EBITDA of $3.2 billion, and $2.4 billion of operating cash flow (excl. working capital) in Q3; refineries ran at 95% utilization with 96% capture (102% YTD vs 95% prior year).

- Returned over $900 million to shareholders in Q3—$650 million in buybacks and $276 million in dividends—and announced a 10% dividend increase.

- Exited an ethanol joint venture; MPLX acquired a Delaware Basin sour gas treating business and the remaining 55% of the Banegas NGL pipeline, positioning MPC to receive $2.8 billion annually from MPLX, with MPLX targeting 12.5% distribution growth over the next couple of years.

- Q4 2025 guidance: throughput of 2.7 million bpd (90% utilization), $420 million in turnaround expenses, operating costs of $5.80/bbl, distribution costs of $1.6 billion, and corporate costs of $240 million.

- Mike Hennigan to step down as Executive Chairman at year-end.

- Marathon Petroleum generated $2.4 billion of operating cash flow (excluding working capital changes) in Q3, delivered adjusted EBITDA of $3.2 billion, and reported adjusted net income of $3.01 per share.

- The refining system ran at 95% utilization, processing 2.8 million barrels per day, and achieved 96% crude capture in Q3 (YTD capture 102% vs. 95% prior year).

- Through Q3, MPC has returned $3.2 billion to shareholders, including $650 million of share repurchases and $276 million of dividends, and announced a 10% dividend increase.

- Q4 2025 guidance includes 2.7 million bpd throughput (90% utilization), $420 million of turnaround expense, and $5.80 per barrel operating cost.

- Marathon reported Q3 adjusted EPS of $3.01, adjusted EBITDA of $3.2 billion, and $2.4 billion in operating cash flow ex-WC, with 95% refinery utilization and 96% capture (YTD capture 102%).

- Returned $900 million to shareholders in Q3 via $650 million of share repurchases and $276 million of dividends, and announced a 10% dividend increase.

- Completed strategic portfolio actions, including exiting an ethanol JV and supporting MPLX’s acquisition of gas-treating and pipeline interests, which underpin $2.8 billion in annual distributions to MPC and target 12.5% growth.

- Provided Q4 guidance for 2.7 million bpd throughput (90% utilization), $420 million in turnaround expense, $5.80/bbl operating cost, $1.6 billion distribution cost, and $240 million corporate cost.

- Executive Chairman Mike Hennigan will retire at year-end, with CEO Maryann Mannen succeeding him as board chair.

- Adjusted EPS of $3.01 and Adjusted EBITDA of $3.206 billion in Q3 2025.

- $2.387 billion of cash flow from operations excluding working capital, with $926 million returned to shareholders and a 10% quarterly dividend increase.

- Refining & Marketing segment achieved 95% utilization, 96% margin capture and $1.762 billion of adjusted EBITDA.

- Durable midstream growth underpinned by $2.8 billion of expected annual distributions from MPLX, covering MPC’s capital needs.

Quarterly earnings call transcripts for Marathon Petroleum.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more