Earnings summaries and quarterly performance for Select Water Solutions.

Executive leadership at Select Water Solutions.

John Schmitz

Chairman, President, and Chief Executive Officer

Christina Ibrahim

Senior Vice President, General Counsel, Chief Compliance Officer & Corporate Secretary

Christopher George

Executive Vice President and Chief Financial Officer

Cody Ortowski

Executive Vice President, Business and Regulatory Affairs

Michael Lyons

Executive Vice President, Chief Strategy & Technology Officer

Michael Skarke

Executive Vice President and Chief Operating Officer

Board of directors at Select Water Solutions.

Research analysts who have asked questions during Select Water Solutions earnings calls.

Jeffrey Robertson

Water Tower Research

4 questions for WTTR

Bobby Brooks

Northland Capital Markets

3 questions for WTTR

Derek Podhaizer

Piper Sandler Companies

3 questions for WTTR

Robert Brooks

Northland Capital Markets

3 questions for WTTR

Connor Jensen

Raymond James Financial, Inc.

2 questions for WTTR

Derrick Whitfield

Texas Capital

2 questions for WTTR

Donald Crist

Johnson Rice & Company, L.L.C.

2 questions for WTTR

James Rollyson

Raymond James Financial, Inc.

2 questions for WTTR

Jeff Robertson

Water Tower Research

2 questions for WTTR

Scott Gruber

Citigroup

2 questions for WTTR

Sean Mitchell

Daniel Energy Partners

2 questions for WTTR

Thomas Patrick Curran

Seaport Research Partners

2 questions for WTTR

Blake McLean

Daniel Energy Partners

1 question for WTTR

Don Crist

Johnson Rice & Company L.L.C.

1 question for WTTR

Jim Rollyson

Raymond James Financial

1 question for WTTR

John Daniel

Daniel Energy Partners

1 question for WTTR

Joshua Jayne

Daniel Energy Partners

1 question for WTTR

Recent press releases and 8-K filings for WTTR.

- Select Water Solutions, Inc. (WTTR) announced the pricing of an underwritten public offering of 13,725,491 shares of its Class A common stock at $12.75 per share.

- The company granted the underwriters a 30-day option to purchase up to 2,058,824 additional shares of Class A Common Stock.

- The offering is expected to close on February 23, 2026.

- Net proceeds from the offering are intended for general corporate purposes, including water infrastructure growth capital projects, potential acquisitions, or debt repayment.

- Select Water Solutions, Inc. announced an underwritten public offering of $175.0 million of its Class A common stock on February 19, 2026.

- The company also intends to grant the underwriters an option to purchase up to $26.25 million of additional shares of Class A common stock.

- Net proceeds from the offering are intended for general corporate purposes, including water infrastructure growth capital projects, potential acquisitions, or debt repayment under the company’s sustainability-linked credit facility.

- Select Water Solutions, Inc. announced the commencement of an underwritten public offering of $175.0 million of its Class A common stock.

- The company expects to grant the underwriters a 30-day option to purchase up to $26.25 million of additional shares of Class A common stock.

- The net proceeds from the offering are intended for general corporate purposes, including water infrastructure growth capital projects, potential acquisitions, or debt repayment under the Company's sustainability-linked credit facility.

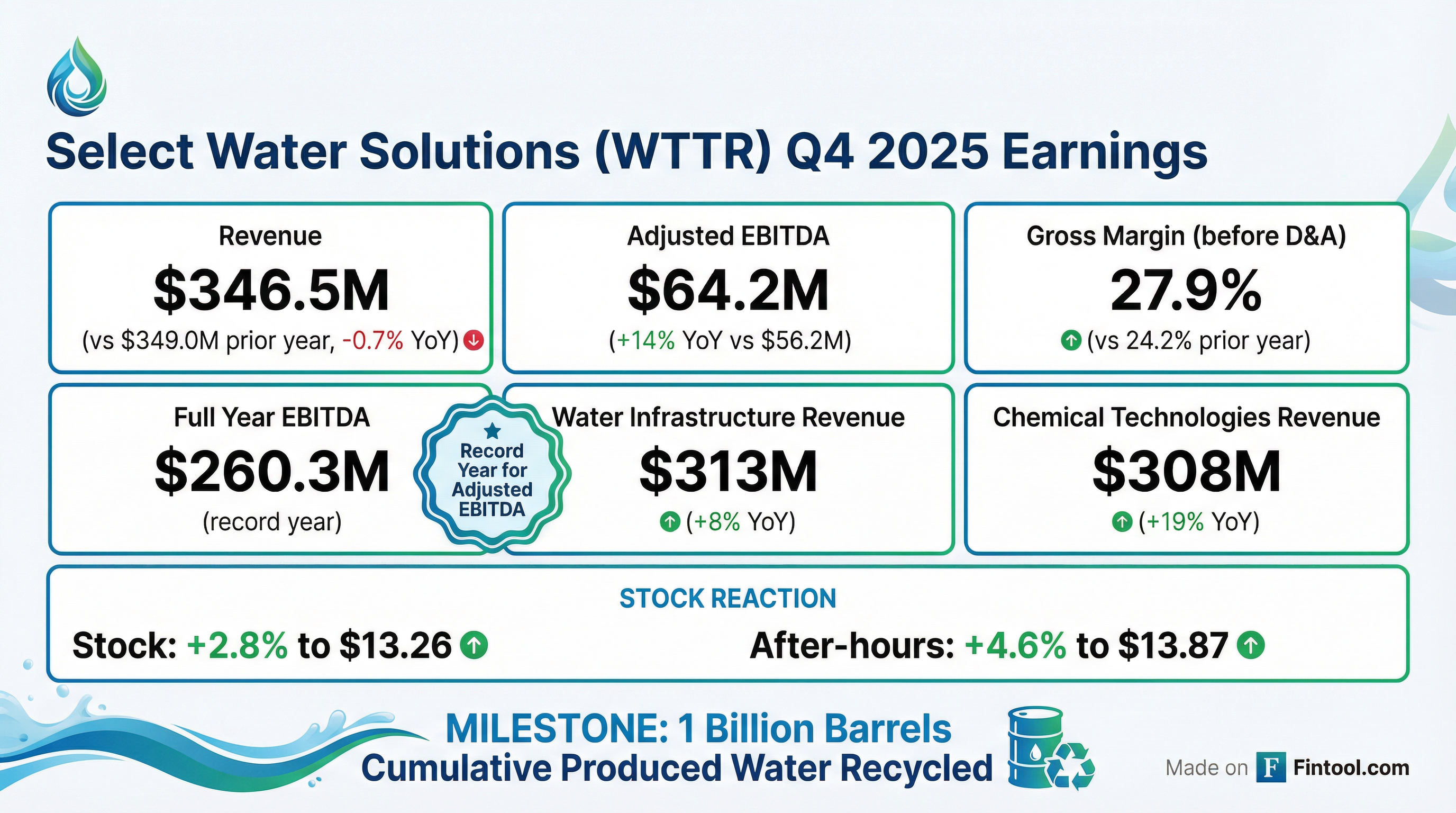

- Select Water Solutions achieved a record-setting year in 2025, with $1.4 billion in consolidated revenue and a record $260 million in Adjusted EBITDA.

- The Water Infrastructure segment grew recycled produced water volumes by 18% in 2025, totaling over 330 million barrels, and is projected to achieve 20%-25% year-over-year growth in 2026.

- The Chemical Technologies segment demonstrated strong performance in 2025 with 19% year-over-year revenue growth and 45% growth in gross profit before D&A, reaching a record quarterly revenue of $87 million in Q4 2025.

- Net capital expenditures for 2026 are anticipated to be between $175 million and $225 million, a reduction from $279 million in 2025, with expectations for further reductions in 2027 to generate long-term free cash flow.

- Select Water Solutions achieved a record-setting 2025, reporting $1.4 billion in consolidated revenue and a record $260 million in adjusted EBITDA.

- The Water Infrastructure segment saw its revenue grow more than 800% since early 2021, becoming the largest segment by profitability, and recycled 330 million barrels of water in 2025.

- The company projects 20%-25% year-over-year growth for the Water Infrastructure segment in 2026, supported by planned net capital expenditures of $175 million-$225 million.

- For Q1 2026, consolidated Adjusted EBITDA is expected to be between $65 million-$68 million.

- Select Water Solutions achieved a record-setting 2025 both operationally and financially, with $1.4 billion in consolidated revenue and a record $260 million in adjusted EBITDA.

- The Water Infrastructure segment demonstrated significant growth, with revenue increasing more than 800% from 2021 to 2025, becoming the largest segment by profitability, and is projected to grow 20%-25% year-over-year in 2026.

- The Chemical Technology segment achieved 19% year-over-year revenue growth and 45% growth in gross profit before D&A in 2025, with record quarterly revenue of $87 million in Q4 2025.

- For Q1 2026, the company anticipates consolidated Adjusted EBITDA to increase to $65 million-$68 million, with full-year 2026 net capital expenditures projected between $175 million-$225 million.

- Strategic initiatives include expanding the Northern Delaware infrastructure, adding 55,000 barrels per day of new disposal capacity in Q4 2025, and developing new revenue streams like produced water lithium extraction, expected to contribute by early 2027.

- Select Water Solutions reported full year 2025 consolidated revenue of $1.4 billion and $346.5 million for the fourth quarter of 2025. The company generated full year net income of $21 million and Adjusted EBITDA of $260 million.

- For the first quarter of 2026, the company expects consolidated Adjusted EBITDA of $65 million to $68 million. The target for full year 2026 net capital expenditures is $175 million to $225 million, with a focus on Water Infrastructure growth.

- The Water Infrastructure segment generated full year 2025 revenues of $313 million, up 8% year-over-year, and is projected to achieve 20% to 25% year-over-year revenue growth for full year 2026.

- The company secured multiple new long-term contracted Water Infrastructure projects supported by 15 million barrels of minimum volume commitments and approximately 180,000 acres of new leasehold and ROFR acreage dedications.

- Select Water Solutions reported full year 2025 consolidated revenue of $1.4 billion and net income of $21 million, with Adjusted EBITDA of $260 million. For the fourth quarter of 2025, consolidated revenue was $347 million, and the company reported a net loss of ($2.1) million.

- The Water Infrastructure segment generated full year 2025 revenues of $313 million, an 8% increase year-over-year, and the Chemical Technologies segment generated $308 million, up 19% year-over-year.

- For 2026, the company anticipates Q1 consolidated Adjusted EBITDA of $65 – $68 million and expects the Water Infrastructure segment to grow revenue by 20% to 25% year-over-year.

- Net capital expenditures for full year 2026 are targeted between $175 million and $225 million, primarily for growth capital projects within the Water Infrastructure segment.

- Select Water Solutions and LibertyStream Infrastructure Partners have entered into a definitive agreement to deploy commercial lithium carbonate production facilities in the Midland Basin, Texas.

- The initial facility (Stage 1) will have a nameplate capacity of 1,000 tonnes of lithium carbonate per year and is scheduled for commissioning by December 2026.

- Select will leverage its existing water treatment expertise and pipeline infrastructure for the extraction process and will receive a royalty on lithium carbonate production.

- The project involves a three-stage deployment, with Stage 2 commissioning a second facility by June 2027 and Stage 3 adding at least two more facilities starting July 2027.

- Select Water Solutions (WTTR) and LibertyStream Infrastructure Partners have entered a definitive agreement to deploy commercial lithium carbonate production facilities at Select's water treatment and recycling sites in the Midland Basin, Texas.

- The first commercial facility, with a nameplate capacity of 1,000 tonnes of lithium carbonate per year, is slated for commissioning by December 2026 at Select's Howard County site.

- Select will leverage its existing water treatment expertise and pipeline infrastructure, receiving a royalty on lithium carbonate production.

- The agreement includes a three-stage development program, with subsequent facilities planned for commissioning by June 2027 (Stage 2) and starting July 2027 (Stage 3).

Quarterly earnings call transcripts for Select Water Solutions.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more