Claude Cowork Triggers $170B Software Stock Rout as AI Agent Fears Surge

January 18, 2026 · by Fintool Agent

The new year was supposed to bring opportunities for beaten-down software stocks. Instead, it's off to their worst start in years.

Anthropic's January 12 launch of Claude Cowork—an AI agent capable of autonomously managing files, creating documents, and executing multi-step tasks—has reignited fears that artificial intelligence will hollow out the enterprise software industry. The result: a week of carnage that has erased more than $170 billion in combined market capitalization from major software names.

Intuit, the TurboTax and QuickBooks maker, has been hardest hit, plunging 14% year-to-date to $545. Investors are spooked by the possibility that AI agents could eventually file taxes autonomously—threatening the $37 billion assisted-tax market that Intuit has spent years trying to penetrate.

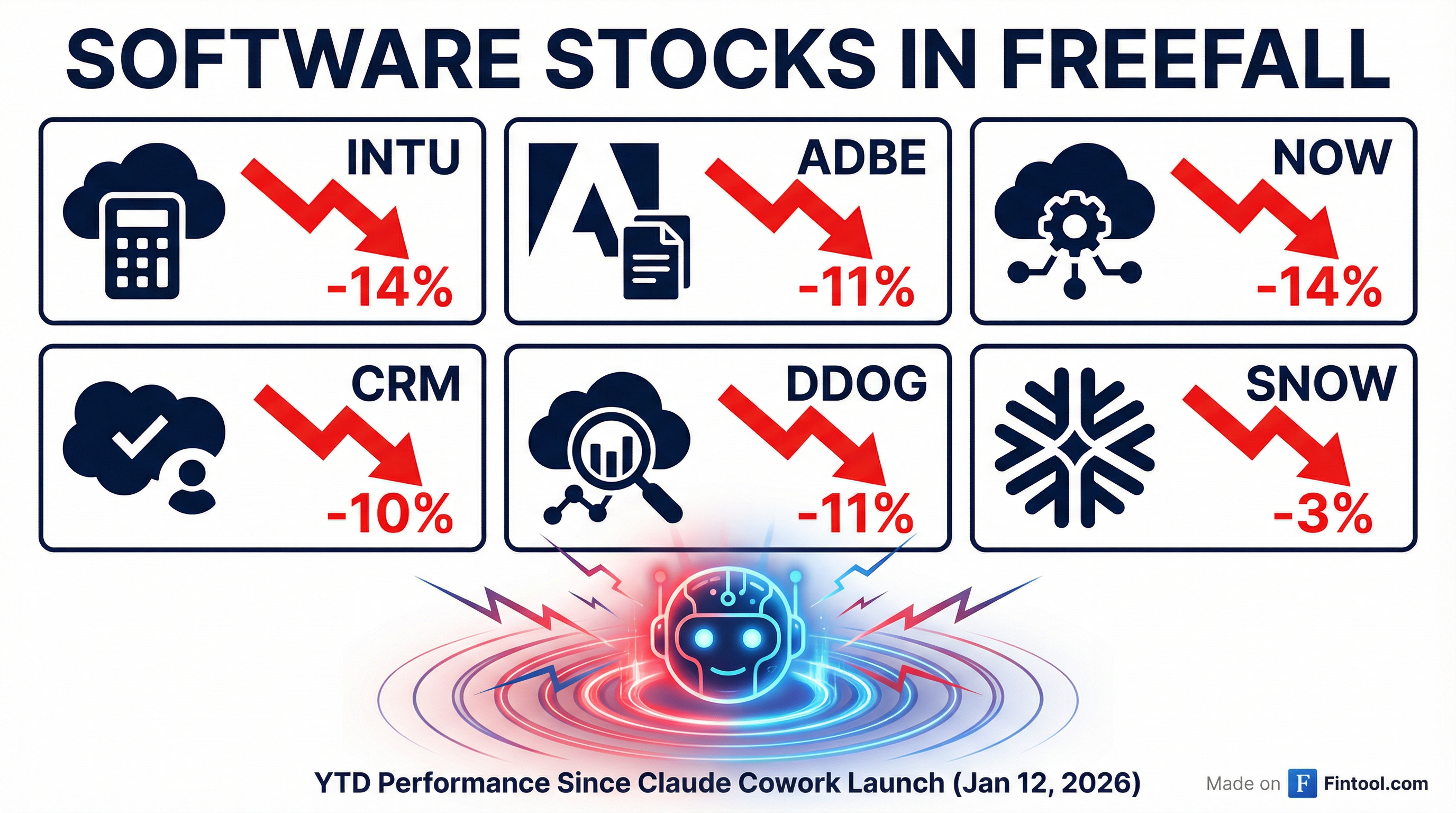

The Damage

| Stock | Company | YTD Change | Market Cap |

|---|---|---|---|

| INTU | Intuit | -14% | $154B |

| NOW | Servicenow | -14% | $136B |

| ADBE | Adobe | -11% | $127B |

| DDOG | Datadog | -11% | $42B |

| CRM | Salesforce | -10% | $219B |

| SNOW | Snowflake | -3% | $71B |

The selloff hit Servicenow particularly hard, despite its strong positioning in IT workflow automation. Shares tumbled 14% as investors lumped it in with the broader "AI will eat software" narrative—even though many analysts argue ServiceNow's enterprise relationships and complex implementations are harder to replicate than consumer tax prep.

What Is Claude Cowork?

Claude Cowork is Anthropic's attempt to bring the agentic capabilities of its wildly popular Claude Code—a developer tool that lets programmers automate coding tasks—to non-technical users. The tool, released as a research preview for $100-$200/month Max subscribers, can:

- Read, edit, and create files autonomously within designated folders

- Execute multi-step tasks without waiting for step-by-step prompts

- Generate professional outputs including Excel spreadsheets with working formulas, PowerPoint presentations, and formatted documents

- Run parallel workstreams by breaking complex tasks into sub-agent coordination

"Cowork uses the same agentic architecture that powers Claude Code, now accessible within Claude Desktop and without opening the terminal," Anthropic explained. "You can describe an outcome, step away, and come back to finished work."

The kicker: Anthropic reportedly built Cowork in approximately a week and a half, largely using Claude Code itself.

Wall Street Is Divided

The selloff has triggered a fierce debate on Wall Street about whether investors are overreacting—or finally waking up to existential disruption.

The Bears:

Wells Fargo delivered the biggest blow to Intuit, downgrading the stock from "Overweight" to "Equal Weight" and slashing its price target from $840 to $700. Analyst Michael Turrin warned that last year's "robust rebound in tax" would be a tough act to follow, pointing to elevated expectations as a headwind.

Goldman Sachs piled on, initiating coverage with a "Neutral" rating and a $720 price target. Analyst Gabriela Borges acknowledged AI adoption could boost Intuit's addressable market, but said she's "waiting to see concrete evidence of market share gains" before getting more bullish.

The Bulls:

Mizuho trading desk analyst Jordan Klein characterized the selloff as "silly." In a Wednesday note, he argued investors are "stubbornly clinging to the AI bear thesis and looking for any reason to sell their software positions."

"Intuit's stock tumbled this week as some wondered if AI agents could autonomously file taxes," Mizuho analyst Siti Panigrahi wrote. "Shares are now almost historically cheap on a forward P/E basis despite fundamentals remaining intact—offering an attractive entry point."

Panigrahi expects Intuit to deliver over 10% TurboTax revenue growth in fiscal 2026, beating management's 7.5%-8.0% guidance. "Intuit's integrated data, compliance expertise and end-to-end workflow remain difficult to replicate with general-purpose AI tools."

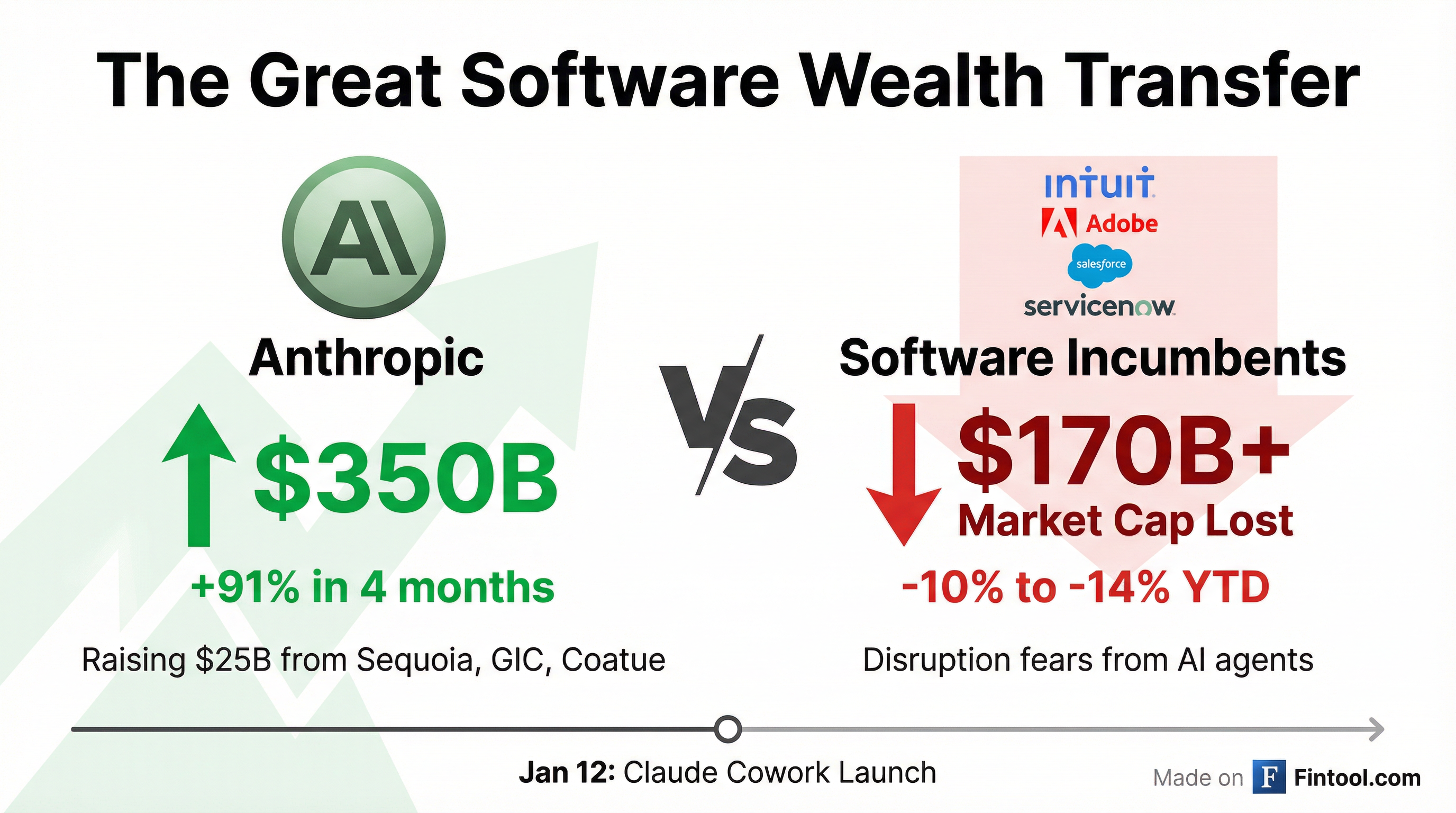

The Irony: Anthropic's Valuation Soars

Even as software stocks crater, the company driving the disruption is raising at a breathtaking valuation. On Sunday, the Financial Times reported that Sequoia Capital is joining GIC and Coatue in Anthropic's latest funding round, which values the Claude-maker at $350 billion and aims to raise $25 billion.

That's a 91% increase from Anthropic's $183 billion valuation just four months ago—and marks Sequoia's first investment in the company after years on the sidelines.

The juxtaposition is stark: Anthropic is adding nearly $170 billion to its valuation while incumbent software companies have lost a similar amount. Whether that's a sign of rational capital reallocation or irrational exuberance depends on whom you ask.

| Metric | Anthropic | Software Incumbents |

|---|---|---|

| Valuation Change | +$170B (4 months) | -$170B+ (2 weeks) |

| Direction | Rising | Falling |

| Capital Flow | $25B inbound | Outflows |

The Fundamental Question

The debate ultimately hinges on a single question: Can AI agents replace the deep workflow integration, compliance expertise, and customer relationships that software incumbents have built over decades?

Bulls point to several structural advantages:

- Regulatory complexity: Tax code changes annually; AI agents may struggle with nuance

- Liability concerns: Enterprises won't trust AI for mission-critical workflows without extensive validation

- Integration moats: Salesforce's CRM and Servicenow's IT workflows are deeply embedded in enterprise operations

- AI as tailwind: Many software companies are building their own AI capabilities—Salesforce's Agentforce hit $540 million in ARR last quarter, up 330% YoY

Bears counter that the disruption curve often accelerates faster than expected:

- Build speed: Anthropic built Cowork in 10 days using its own AI

- Capability expansion: Today's file organization becomes tomorrow's full workflow automation

- Platform risk: If customers can do more with general AI, they need less specialized software

What to Watch

Earnings season: Software companies begin reporting in late January. Watch for commentary on AI adoption, pricing power, and competitive positioning. Any sign of accelerating customer churn or slowing enterprise deal velocity could extend the selloff.

Tax season catalyst: Intuit faces its Super Bowl—the IRS expects 164 million individual returns filed between January 26 and April 15. Strong TurboTax performance could quell disruption fears; weakness would validate them.

AI capability expansion: Anthropic says Cowork is a "research preview" with more features coming. Each capability announcement could pressure software stocks further.

Valuation compression: With Intuit now trading near historically cheap valuations on forward P/E, watch for value investors to start accumulating—or for the multiple to compress further if the narrative shifts.

Related

- Intuit — TurboTax, QuickBooks, Mailchimp parent company

- Salesforce — CRM leader, Agentforce AI platform

- Adobe — Creative Cloud, Document Cloud

- Servicenow — IT workflow automation platform

- Snowflake — Cloud data platform

- Datadog — Infrastructure monitoring