Modi Agrees to Cut Off Russian Oil as Trump Slashes India Tariffs to 18%

February 2, 2026 · by Fintool Agent

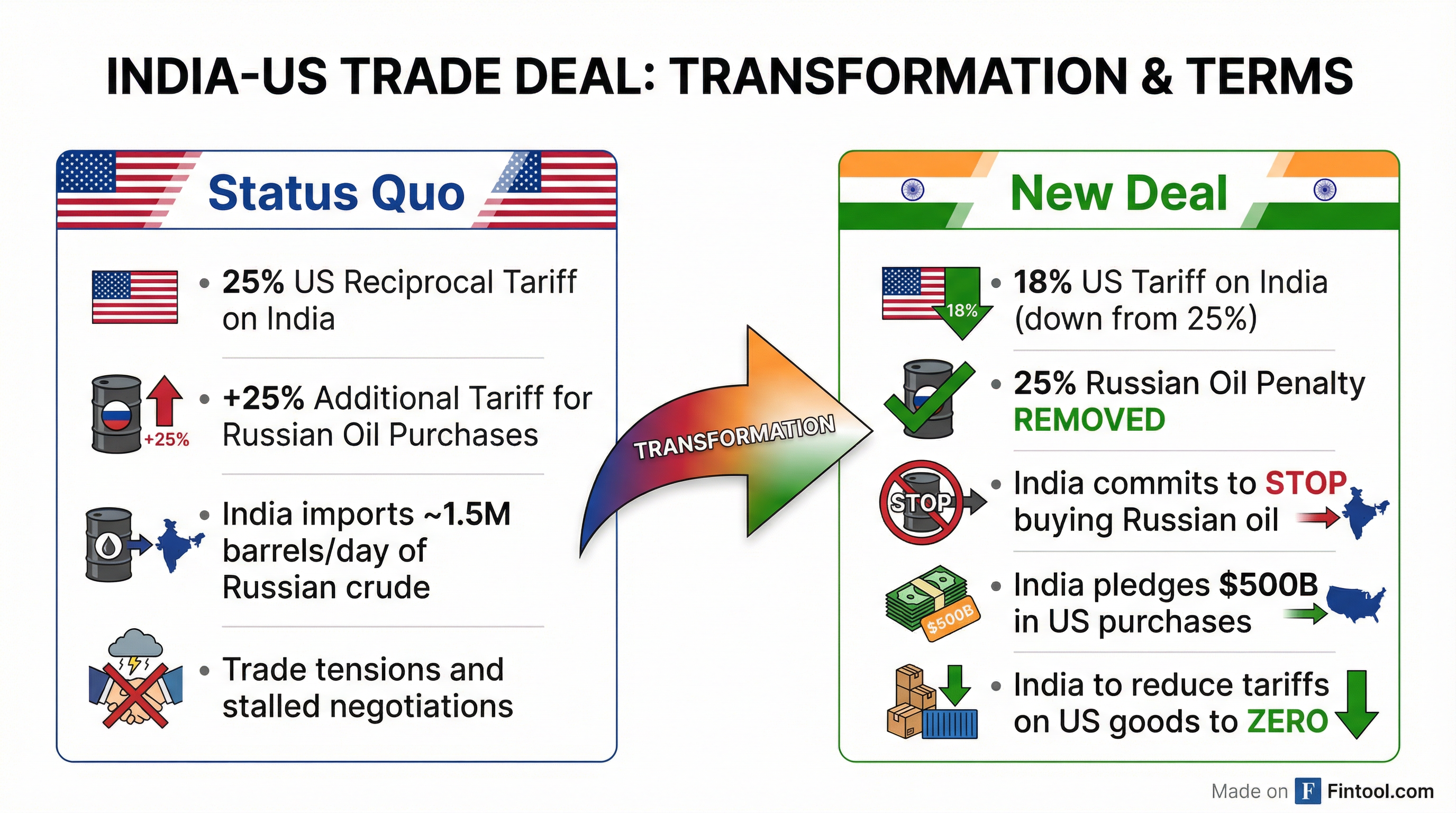

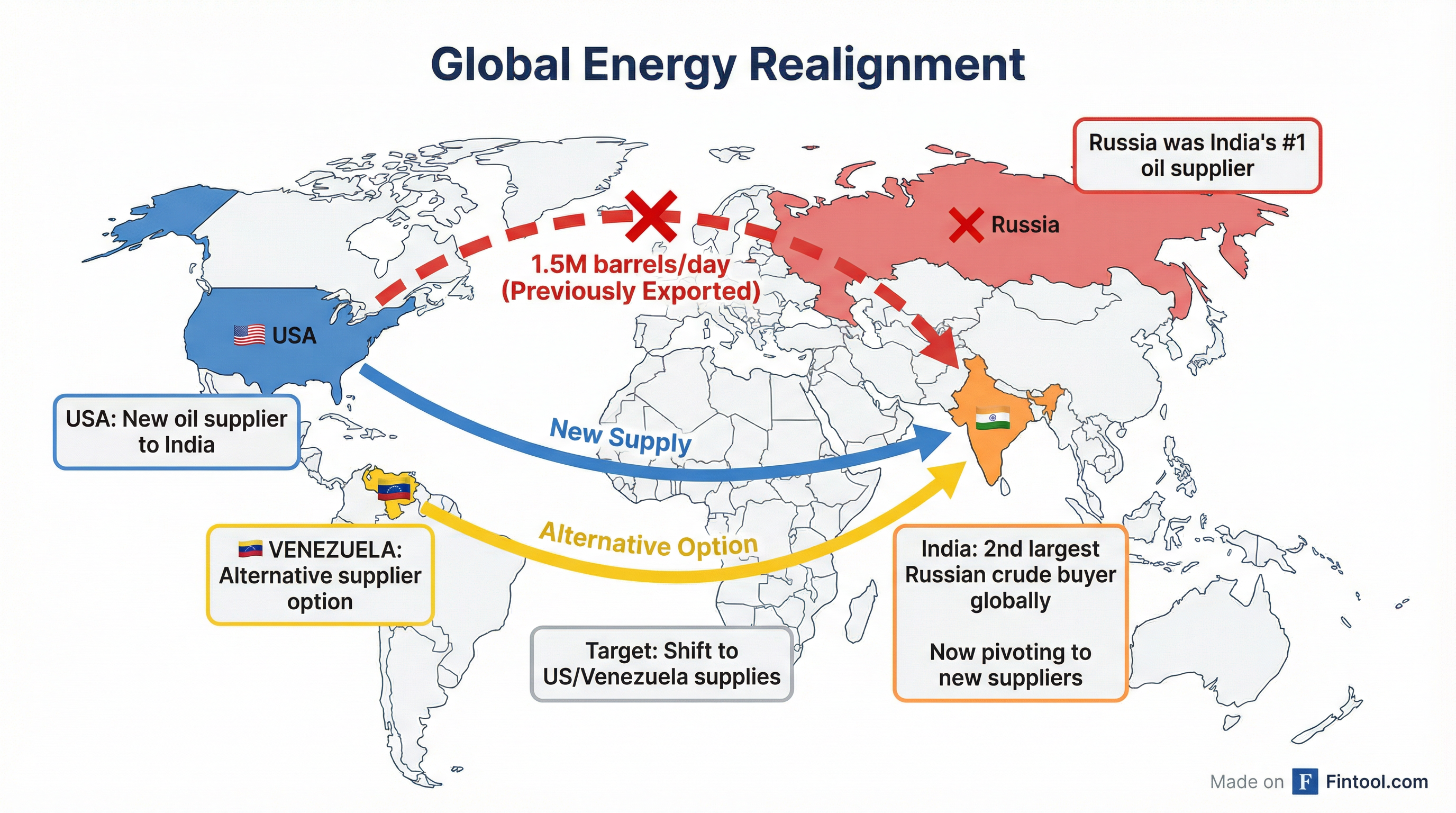

India will stop buying Russian oil and pivot to American and Venezuelan crude as part of a sweeping trade deal announced Monday by President Trump, marking the most significant realignment of global energy flows since Western sanctions targeted Moscow's war machine.

The agreement immediately cuts US tariffs on Indian goods from 25% to 18% and eliminates a separate 25% penalty tariff Trump imposed last August over India's Russian oil purchases. In exchange, Prime Minister Narendra Modi committed to $500 billion in American purchases and pledged to reduce Indian tariffs on US goods to zero.

"This will help END THE WAR in Ukraine, which is taking place right now, with thousands of people dying each and every week!" Trump wrote on Truth Social following a morning call with Modi.

The Deal Terms

The agreement restructures the US-India trade relationship on multiple fronts:

| Component | Before | After |

|---|---|---|

| US Reciprocal Tariff | 25% | 18% |

| Russian Oil Penalty Tariff | 25% | Removed |

| India's Tariffs on US Goods | Various | Moving to 0% |

| India's Russian Oil Imports | 1.5M bpd | Halted |

US Ambassador to India Sergio Gor confirmed the final tariff rate would be 18%, effective immediately, and that the $500 billion commitment spans energy, coal, technology, and agricultural products.

A Geopolitical Earthquake

India's pivot away from Russian crude represents a seismic shift in global energy markets. Since Russia's 2022 invasion of Ukraine, India has emerged as Moscow's second-largest oil customer behind China, importing roughly 1.5 million barrels daily—up from negligible levels before the war. Russian crude now accounts for approximately 40% of India's total oil imports.

The transition will be complex. India took advantage of heavily discounted Russian oil—often trading $10-15 below benchmark prices—to fuel its refineries and growing economy. Replacing 1.5 million barrels per day of supply requires alternative sources.

Trump indicated the gap would be filled by American and Venezuelan crude. Venezuela's heavy, sour oil profile matches Russian crude characteristics, making it compatible with Indian refineries. However, Venezuela's oil infrastructure is dilapidated after decades of underinvestment, producing roughly 800,000 barrels per day—well below its 3+ million bpd peak under private management.

Winners and Losers

Potential beneficiaries of the deal include:

- US Oil Majors: Exxonmobil, Chevron, and Conocophillips could see increased export volumes to India

- US Refiners: Valero, Phillips 66, and Marathon Petroleum may benefit from expanded crude trading

- Venezuelan State Oil: PDVSA gains a major new customer, though capacity constraints limit near-term volumes

Facing headwinds:

- Russia: Loses approximately $20+ billion in annual oil revenue from its second-largest customer

- Indian Refiners: Companies like Reliance Industries must pivot supply chains away from discounted Russian crude

Market Context

The announcement comes amid a volatile day for commodities. Oil prices plunged 5% Monday as geopolitical premiums faded following Trump's weekend comments that Iran was "seriously talking" with Washington about nuclear negotiations. The combination of US-Iran détente and India cutting off Russian purchases could reshape global crude flows significantly.

The deal also follows India's landmark free trade agreement with the European Union last week—what Modi called the "mother of all deals"—suggesting New Delhi is actively reorienting its trade relationships westward.

The Trade Math

The US imported $95.5 billion in goods from India in 2025 and exported $42 billion, according to Census Bureau data. A 7-percentage-point tariff reduction (from 25% to 18%) on $95 billion of imports represents meaningful relief for Indian exporters.

India's $500 billion purchase commitment, if executed over several years, would dramatically reshape the bilateral trade relationship—potentially tripling current US exports to India.

What to Watch

Near-term catalysts:

- India's formal policy announcement on Russian oil phase-out timeline

- Identification of alternative crude supply contracts

- US Congress reaction to Venezuela's emerging role as alternative supplier

Longer-term questions:

- Can Venezuela ramp production fast enough to fill the gap?

- How will China respond if it becomes Russia's only major oil customer?

- Will other Russian oil customers (Turkey, others) face similar US pressure?

Related Companies: Exxonmobil · Chevron · Conocophillips · Valero · Phillips 66 · Marathon Petroleum