Medicare Advantage Rate Shock: Insurers Plunge 10-14% After CMS Proposes Near-Zero Increase

January 26, 2026 · by Fintool Agent

Health insurers were blindsided Monday after the Trump administration proposed an effectively flat rate increase for Medicare Advantage plans—a stunning disappointment that sent shares tumbling in after-hours trading.

Humana crashed nearly 14%, Unitedhealth Group and CVS Health each lost more than 10%, Elevance Health dropped 5%, and Centene and Molina Healthcare fell about 4%.

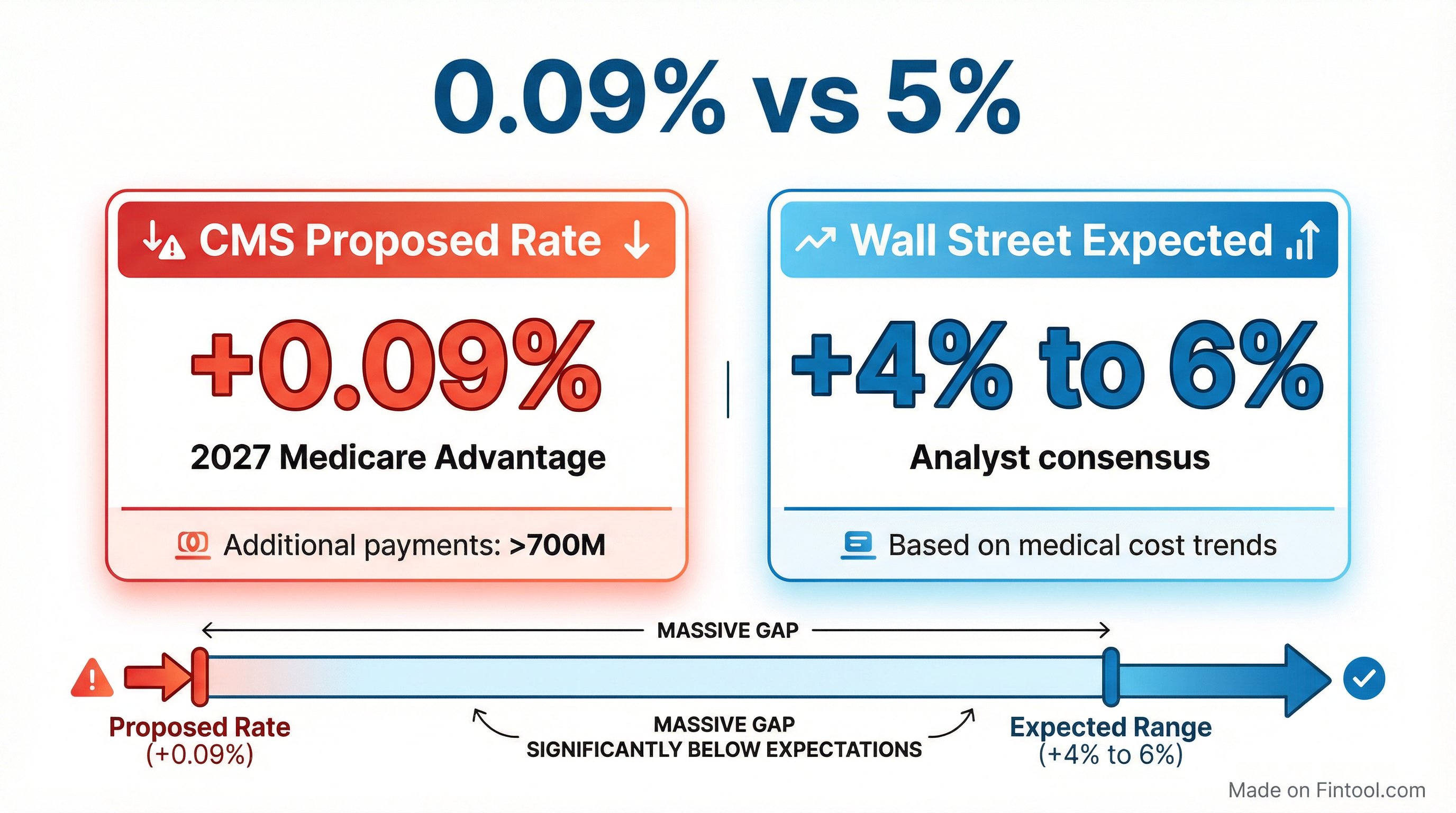

The Centers for Medicare and Medicaid Services proposed a 0.09% average rate increase for Medicare Advantage plans in 2027—Wall Street had expected 4% to 6%.

The Policy

CMS Administrator Dr. Mehmet Oz defended the proposal as a move to protect taxpayers and modernize the program:

"These proposed payment policies are about making sure Medicare Advantage works better for the people it serves. By strengthening payment accuracy and modernizing risk adjustment, CMS is helping ensure beneficiaries continue to have affordable plan choices and reliable benefits, while protecting taxpayers from unnecessary spending that is not oriented towards addressing real health needs."

The near-zero increase reflects CMS's assessment of underlying cost trends, 2026 Star Ratings, and changes to the risk-adjustment model. If finalized, the proposal would result in approximately $700 million in additional Medicare Advantage payments in 2027.

CMS typically finalizes Medicare Advantage rates in early April—leaving a narrow window for insurers to push back on the proposal.

Why This Matters

Medicare Advantage is the cornerstone of managed care. More than half of Medicare beneficiaries are enrolled in these privately-run plans, drawn by lower monthly premiums and extra benefits like dental, vision, and hearing coverage.

For insurers, the government payment rate directly determines how much they can charge for premiums, what benefits they can offer, and ultimately, their profits. A near-flat rate in an environment of elevated medical costs is a serious margin headwind.

The timing couldn't be worse. The managed care industry has been grappling with elevated medical cost trends throughout 2025, forcing insurers to cut benefits, exit markets, and focus intensively on margin recovery.

The Industry Was Already Under Pressure

Unitedhealth's CEO of Medicare & Retirement, Timothy Noel, acknowledged the challenges in a recent earnings call: "We are approaching our business with greater humility, greater transparency, and a renewed determination to meet your expectations and our standards."

UnitedHealth disclosed that its 2025 medical costs came in $6.5 billion higher than anticipated, with over half—$3.6 billion—concentrated in Medicare. The company assumed Medicare Advantage cost trend of just over 5% when setting 2025 bids but now expects full-year trend to approach 7.5%.

For 2026 pricing, UnitedHealth assumed trend approaching 10%—and made the difficult decision to exit plans serving over 600,000 members to protect margins.

Humana, the most Medicare-dependent of the large insurers, has seen its margins compress sharply:

| Metric | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|

| Revenue ($B) | $28.0 | $30.8 | $31.0 | $31.0 |

| Net Income ($M) | $(693)* | $1,244* | $545* | $195* |

| EBITDA Margin | 0.1% | 7.0% | 4.2% | 2.7% |

*Values retrieved from S&P Global

The trajectory tells the story: a Q4 2024 loss, followed by margin compression through 2025 as medical cost pressure mounted.

CVS Health's Aetna unit has been on a multiyear margin recovery journey. Management noted that group Medicare Advantage contracts "tend to be multiyear agreements and reprice less frequently," leaving them exposed to elevated trends. CVS recorded a $470 million premium deficiency reserve in Q2 2025 for its group MA business alone.

The Political Backdrop

The rate proposal comes amid a broader push by Dr. Mehmet Oz's CMS to clamp down on billing practices that have drawn bipartisan scrutiny.

Earlier this month, a Senate Judiciary staff report concluded UnitedHealth employed "aggressive strategies, supported by a robust workforce augmented with artificial intelligence, to capture diagnoses that increase payments under Medicare Advantage." The probe followed Wall Street Journal reporting and was launched by Sen. Chuck Grassley.

UnitedHealth has pushed back on the narrative, commissioning independent actuarial studies from Milliman showing Medicare Advantage costs the federal government 9% less than traditional Medicare while delivering 53% lower out-of-pocket costs for beneficiaries.

What to Watch

April Finalization: CMS typically publishes final Medicare Advantage rates in early April. Insurers will lobby hard for adjustments, and the final number could differ from the proposal.

Q4 Earnings: UnitedHealth, Humana, CVS, and Elevance will report Q4 2025 results in the coming weeks. Management commentary on the rate proposal and 2026 bid positioning will be closely scrutinized.

Benefit Cuts: If the flat rate holds, expect further benefit reductions and market exits for 2027. Members may see higher out-of-pocket costs or fewer supplemental benefits.

Election Year Dynamics: With midterms approaching, the political calculus around Medicare is complex. The administration appears focused on "protecting taxpayers," but insurers will frame benefit cuts as harming seniors.