Medicare Rate Shock Wipes $80 Billion From Health Insurers in Single Day

January 27, 2026 · by Fintool Agent

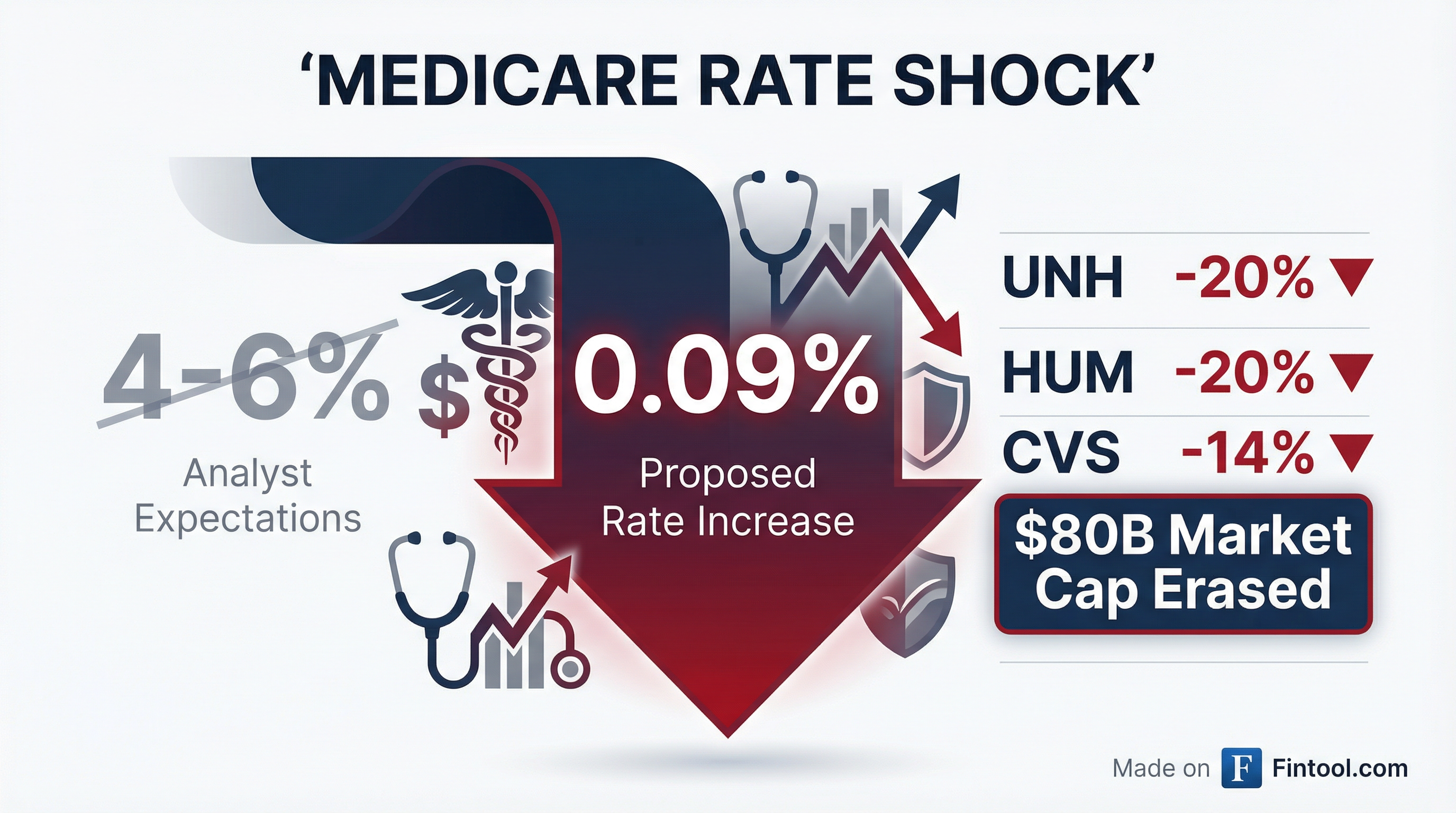

The Trump administration dropped a bombshell on health insurers Monday night: proposed Medicare Advantage payment rates for 2027 will rise by just 0.09%—not the 4-6% Wall Street had priced in. The result was an $80 billion bloodbath in insurer market caps, with Unitedhealth and Humana both crashing roughly 20% in a single session.

For Unitedhealth, the nation's largest health insurer, the rate shock arrived alongside an equally stunning disclosure: the company now expects its first annual revenue decline in more than three decades, forecasting 2026 revenues of approximately $440 billion versus $448 billion in 2025.

"The Advance Notice published yesterday simply doesn't reflect the reality of medical utilization and cost trends," Tim Noel, CEO of UnitedHealthcare, said on this morning's earnings call.

The Market Carnage

The selloff was swift and brutal across the managed care sector:

| Company | Ticker | Price Change | Market Cap Lost |

|---|---|---|---|

| Unitedhealth | UNH | -19.9% | $64B |

| Humana | HUM | -20.2% | $6B |

| CVS Health | CVS | -14.3% | $15B |

| Elevance Health | ELV | -13.1% | $11B |

| Centene | CNC | -11.3% | $3B |

| Molina Healthcare | MOH | -7.2% | $0.7B |

UnitedHealth shares hit their lowest level since early 2024, now down over 20% from the 52-week high.

How Medicare Advantage Works—And Why Rates Matter So Much

Medicare Advantage is a privately run alternative to traditional Medicare, now covering more than half of the 65-and-older population—over 35 million Americans. Private insurers like UnitedHealth, Humana, and CVS Aetna contract with CMS to manage benefits, receiving monthly per-member payments from the government.

The annual rate-setting process is the single most important variable for insurer profitability. Here's what CMS proposed Monday night:

- Net payment increase: 0.09%

- Total increase (including risk score trends): 2.54%

- Additional payments: ~$700 million industry-wide

- Wall Street expectation: 4-6% headline increase

The gap between reality and expectation is enormous. Analysts at Truist noted that "this is below our and Street expectations" and warned that "MA rates for 2027 are only expected to increase +0.09%, well below the Street's expectations of ~+5.0%."

CMS Administrator Oz Defends the Proposal

CMS Administrator Mehmet Oz—the former TV personality appointed by President Trump—framed the proposal as protecting taxpayers and seniors:

"These proposed payment policies are about making sure Medicare Advantage works better for the people it serves. By strengthening payment accuracy and modernizing risk adjustment, CMS is helping ensure beneficiaries continue to have affordable plan choices and reliable benefits, while protecting taxpayers from unnecessary spending that is not oriented towards addressing real health needs."

The proposal also takes aim at a lucrative insurer practice: adding diagnoses after reviewing patients' medical records, which has drawn regulatory scrutiny for inflating payments. CMS estimates eliminating these "chart review" payments would reduce the 2027 rate by 1.53 percentage points.

UnitedHealth's Perfect Storm: Rate Shock + Revenue Decline

For UnitedHealth, the Medicare rate news arrived at the worst possible moment. On this morning's Q4 2025 earnings call, CEO Stephen Hemsley delivered guidance that no Wall Street analyst expected: revenue contraction.

Key details from the earnings call:

| Metric | 2025 Actual | 2026 Guidance |

|---|---|---|

| Revenue | $448B | $440B |

| Adjusted EPS | $16.35 | >$17.75 |

| Medicare Advantage Members | — | Down 1.3-1.4M |

| Medical Care Ratio | 89.1% | 88.8% ±50bps |

The company took a $1.6 billion net-of-tax charge in Q4, primarily related to Optum restructuring and lingering cyber-attack impacts.

UnitedHealthcare CEO Tim Noel was blunt about the implications: "If rates are in this range, membership growth will remain low as MA plans need to cut benefits and tighten networks to enable continued margin improvement in this low-rate environment," echoing warnings from analysts.

Industry Response: Benefit Cuts Are Coming

The industry trade group America's Health Insurance Plans (AHIP) warned that the proposal would hurt seniors directly:

"Health plans welcome reforms to strengthen Medicare Advantage. However, flat program funding at a time of sharply rising medical costs and high utilization of care will impact seniors' coverage. If finalized, this proposal could result in benefit cuts and higher costs for 35 million seniors and people with disabilities when they renew their Medicare Advantage coverage in October 2026."

Bernstein analyst Lance Wilkes laid out what insurers will have to do: "If rates are in this range, membership growth will remain low as MA plans need to cut benefits and tighten networks to enable continued margin improvement in this low-rate environment."

UnitedHealth is already projecting 1.3-1.4 million Medicare Advantage member losses in 2026, greater than originally anticipated. Looking ahead to 2027, the company warned it may need to further reduce its geographic footprint and product offerings.

What Happens Next: The Path to April

The proposed rates are not final. CMS typically publishes an "Advance Notice" in late January and finalizes rates in early April. This year, the final announcement is scheduled for April 6.

Leerink analyst Whit Mayo noted: "Generally, the proposed update is better in the final, certainly some politics could be at play, but this update falls well below expectations." He added it was "highly unlikely" the release timing—just before UnitedHealth's earnings—was a coincidence.

Key dates to watch:

- Now through April: Industry lobbying and CMS comment period

- April 6, 2026: Final rate announcement

- October 2026: 2027 plan year enrollment begins

Truist analysts remain cautiously optimistic that the final rate could improve, maintaining Buy ratings on CNC, CVS, ELV, and UNH. But they acknowledged the regulatory uncertainty is now a "near-term headwind" for the sector.

The Bigger Picture: Three Years of Funding Cuts

Today's proposal doesn't exist in a vacuum. UnitedHealthcare's Tim Noel emphasized that Medicare Advantage has now faced three consecutive years of funding pressure:

"It's a further reduction for a program that has experienced $130 billion in benefit or, pardon me, in funding reductions over the last three years under the prior administration, which is particularly concerning for a program that provides excellent choice, access, and affordability for America's seniors and does so with satisfaction rates north of 95% while saving money for taxpayers."

The cumulative impact is forcing insurers to fundamentally rethink their Medicare businesses. UnitedHealth has already exited plans in 109 counties affecting 180,000 members for 2026. More exits appear likely for 2027.