Earnings summaries and quarterly performance for Ares Commercial Real Estate.

Executive leadership at Ares Commercial Real Estate.

Board of directors at Ares Commercial Real Estate.

Research analysts who have asked questions during Ares Commercial Real Estate earnings calls.

Jade Rahmani

Keefe, Bruyette & Woods

6 questions for ACRE

Christopher Muller

Citizens JMP

4 questions for ACRE

Richard Shane

JPMorgan Chase & Co.

4 questions for ACRE

Douglas Harter

UBS

3 questions for ACRE

Gabe Poggi

Raymond James

2 questions for ACRE

John Nickodemus

BTIG

2 questions for ACRE

Steven Delaney

Citizens JMP Capital

2 questions for ACRE

Ajene Oden

JPMorgan Chase & Co.

1 question for ACRE

Eric Dray

Bank of America

1 question for ACRE

John Nikodemus

BTIG, LLC

1 question for ACRE

Marissa Lobo

UBS Group

1 question for ACRE

Melissa Lobo

UBS Group AG

1 question for ACRE

Rick Shane

JPMorgan Chase & Co.

1 question for ACRE

Thomas Catherwood

BTIG

1 question for ACRE

Recent press releases and 8-K filings for ACRE.

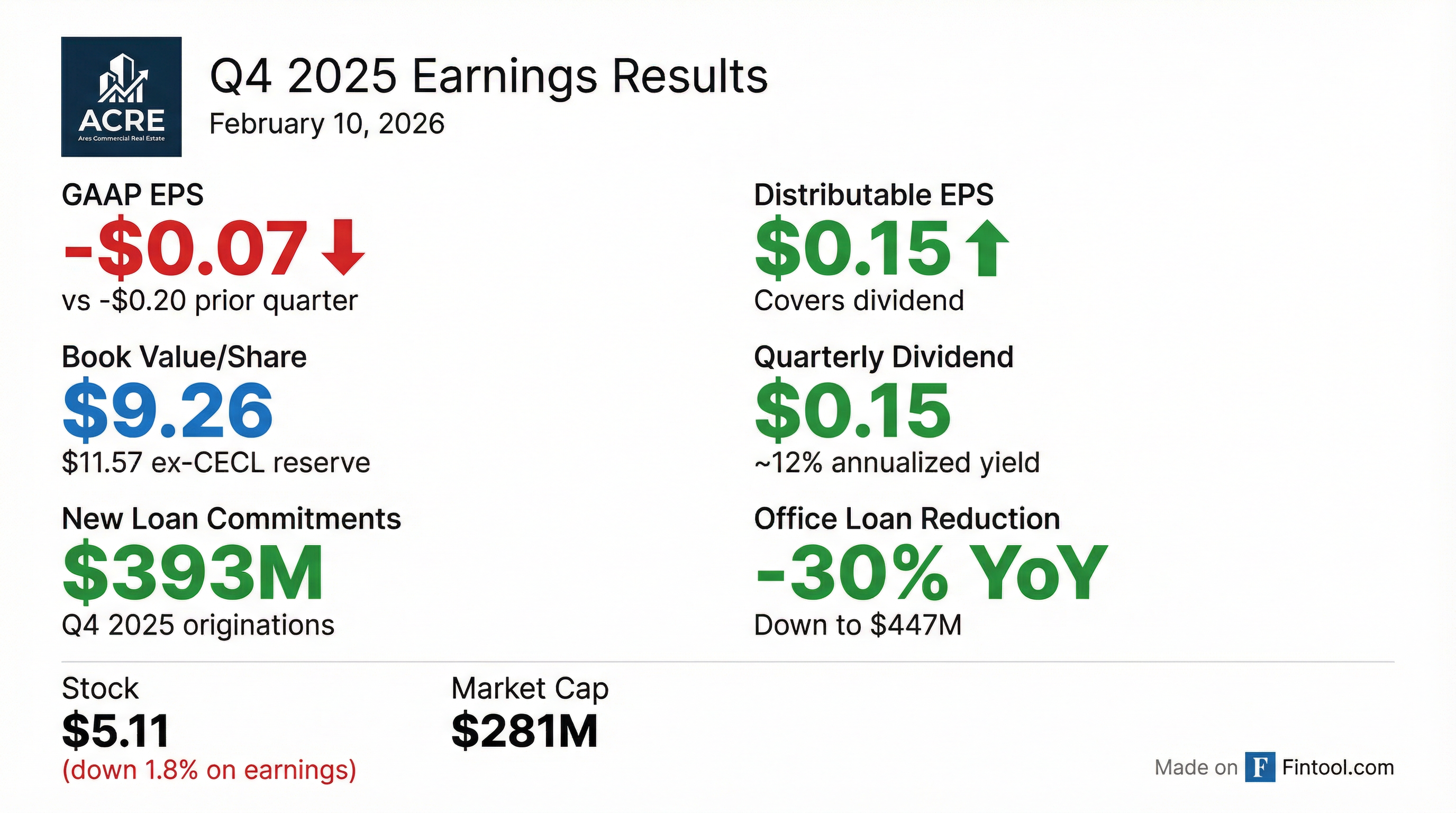

- Ares Commercial Real Estate (ACRE) reported a GAAP net loss of $4 million ($0.07 per diluted common share) and distributable earnings of $8 million ($0.15 per diluted common share) for Q4 2025. For the full year 2025, the company recorded a GAAP net loss of $1 million ($0.02 per diluted common share) and a distributable earnings loss of $7 million ($0.12 per diluted common share).

- The company significantly reduced its office loan exposure by 30% since year-end 2024, bringing the total to $447 million and representing 28% of the total loan portfolio at the end of Q4 2025. Progress was also made on risk-rated 4 and 5 loans, with five remaining at year-end 2025.

- ACRE saw increased investment activity, closing 13 new loan commitments totaling $486 million in the second half of 2025, including 8 new commitments totaling $393 million in Q4 2025. This resulted in the loan portfolio reaching an outstanding principal balance of $1.6 billion, a 24% increase from Q3 2025.

- The company maintained moderate leverage with a Net Debt-to-Equity Ratio of 1.6x at Q4 2025 and declared a Q1 2026 cash dividend of $0.15 per common share. Management aims to resolve remaining risk-rated 4 and 5 loans and targets a long-term debt-to-equity ratio of 3.0x to support a $2 billion loan portfolio.

- Ares Commercial Real Estate reported a GAAP net loss of $4 million or $0.07 per diluted common share and distributable earnings of $8 million or $0.15 per diluted common share for Q4 2025. For the full year 2025, the company had a GAAP net loss of $1 million or $0.02 per diluted common share and a distributable earnings loss of $7 million or $0.12 per diluted common share.

- The company made significant progress in reshaping its portfolio, reducing office loans by 30% since year-end 2024 to $447 million, now comprising 28% of the total loan portfolio. This was accompanied by increased investment activity, with 13 new loan commitments totaling $486 million closed in the second half of 2025, resulting in a 24% increase in the loan portfolio's outstanding principal balance to $1.6 billion by Q4 2025.

- ACRE ended Q4 2025 with a Net Debt-to-Equity Ratio of 1.6 times and $110 million in available capital. The total CECL reserve was $127 million, and book value stood at $9.26 per share.

- The board declared a regular cash dividend of $0.15 per common share for Q1 2026. The company's strategic focus for 2026 is on resolving the five remaining risk-rated 4 and 5 loans and aims to return to a long-term target of 3.0 debt-to-equity ratio.

- Ares Commercial Real Estate reported a GAAP net loss of $4 million or $0.07 per diluted common share and distributable earnings of $8 million or $0.15 per diluted common share for Q4 2025. For the full year 2025, the company reported a GAAP net loss of $1 million or $0.02 per diluted common share and a distributable earnings loss of $7 million or $0.12 per diluted common share.

- The company significantly reduced its office loan exposure by 30% since year-end 2024 to $447 million, now representing 28% of the total loan portfolio at the end of Q4 2025. Progress was also made on risk-rated 4 and 5 loans, including the restructuring of an $81 million Arizona office loan and ongoing efforts for the $140 million Chicago office loan and $130 million Brooklyn residential condominium loan.

- Investment activity increased, with 8 new loan commitments totaling $393 million closed in Q4 2025, growing the outstanding principal balance to $1.6 billion, a 24% increase from Q3 2025. The board declared a regular cash dividend of $0.15 per common share for Q1 2026.

- The Net Debt-to-Equity Ratio (excluding CECL) stood at 1.6 times at the end of Q4 2025, with a near-term target of 2.0 times and a long-term target of 3.0 times to support a $2 billion loan portfolio size. The company also enhanced its liquidity and borrowing capacity, ending Q4 2025 with $110 million in available capital.

- Ares Commercial Real Estate (ACRE) reported a GAAP net loss of $(0.07) per diluted common share and Distributable Earnings of $0.15 per diluted common share for Q4 2025.

- The company declared a cash dividend of $0.15 per common share for Q1 2026.

- ACRE reduced office loans by $48 million in Q4 2025, contributing to a $193 million reduction for FY 2025, and collected $572 million in total repayments for FY 2025.

- The company originated $393 million in new loan commitments in Q4 2025, bringing the total for FY 2025 to $486 million.

- As of December 31, 2025, the book value was $9.26 per common share, and the total portfolio stood at $1.7 billion, including $316 million in risk rated 4 and 5 loans.

- Ares Commercial Real Estate Corporation reported a GAAP net loss of $(0.07) per diluted common share and Distributable Earnings of $0.15 per diluted common share for the fourth quarter of 2025.

- For the full year 2025, the company reported a GAAP net loss of $(0.02) per diluted common share and Distributable Earnings (Loss) of $(0.12) per diluted common share.

- The Board of Directors declared a first quarter 2026 dividend of $0.15 per common share, payable on April 15, 2026.

- Subsequent to the year ended December 31, 2025, the company closed $150 million of new loan commitments.

- In 2025, ACRE collected $572 million in loan repayments, which further increased its balance sheet flexibility.

- Ares Commercial Real Estate Corporation (ACRE) reported a GAAP net loss of $(3.9) million or $(0.07) per diluted common share and Distributable Earnings of $8.5 million or $0.15 per diluted common share for the fourth quarter of 2025. For the full year 2025, GAAP net loss was $(0.9) million or $(0.02) per diluted common share, and Distributable Earnings (Loss) was $(6.7) million or $(0.12) per diluted common share.

- The Board of Directors declared a first quarter 2026 dividend of $0.15 per common share, payable on April 15, 2026, to common stockholders of record as of March 31, 2026.

- The company collected $572 million in loan repayments for the full year 2025 and reduced office loans by $193 million in FY 2025. Subsequent to the year ended December 31, 2025, ACRE closed $150 million of new loan commitments.

- As of December 31, 2025, the total portfolio was $1.7 billion, with risk rated 4 and 5 loans accounting for 19% of the carrying value, and the total Current Expected Credit Loss (CECL) reserve stood at $127 million.

- On December 18, 2025, Ares Commercial Real Estate Corporation's subsidiaries and the company entered into an amendment to the Third Amended and Restated Master Repurchase and Securities Contract with Wells Fargo Bank, National Association.

- The purpose of this amendment was to increase the commitment amount of the facility from $450.0 million to $600.0 million.

- This agreement creates a direct financial obligation for the registrant.

- For Q3 2025, ACRE reported GAAP net income of $5 million or $0.08 per diluted common share and distributable earnings of $6 million or $0.10 per diluted common share. Excluding a $1.6 million realized loss from a loan restructuring, distributable earnings were $7 million or $0.13 per diluted common share.

- The company strengthened its balance sheet, reducing its net debt-to-equity ratio (excluding CECL) to 1.1 times from 1.2 times quarter-over-quarter and 1.8 times year-over-year, and decreasing outstanding borrowings to $811 million. The total CECL reserve declined by approximately $2 million to $117 million as of September 30, 2025, with 95% of this reserve related to risk-rated 4 and 5 loans.

- ACRE continued to reduce its office portfolio to $495 million, a 6% quarter-over-quarter and 26% year-over-year decrease. The company also accelerated investment activity, closing five new loan commitments totaling $93 million in Q3 2025, and over $270 million across five new loan commitments in Q4 2025 (post-Q3).

- A regular cash dividend of $0.15 per common share was declared for Q4 2025, payable on January 15, 2026. ACRE aims to return to portfolio growth in the first half of 2026.

- For Q3 2025, ACRE reported GAAP net income of $5 million or $0.08 per diluted common share and Distributable Earnings of $6 million or $0.10 per diluted common share.

- As of September 30, 2025, the company's book value was $521 million or $9.47 per common share, with $173 million of available capital.

- ACRE reduced its net debt to equity ratio (excluding CECL reserve) to 1.1x and decreased office loans by $29 million quarter-over-quarter to $495 million.

- A cash dividend of $0.15 per common share was declared for 4Q 2025.

- Ares Commercial Real Estate Corporation reported GAAP net income of $4.7 million (or $0.08 per diluted common share) and Distributable Earnings of $5.5 million (or $0.10 per diluted common share) for the third quarter of 2025.

- The company's Board of Directors declared a fourth quarter 2025 dividend of $0.15 per common share, payable on January 15, 2026.

- Subsequent to the third quarter, ACRE closed $271 million of new loan commitments, contributing to over $360 million in new commitments since the beginning of Q3 2025.

- As of September 30, 2025, the company had approximately $173 million of available capital and collected nearly $500 million of repayments year to date.

- ACRE continued to make progress on its risk-rated 4 and 5 loans, including the Chicago Office loan with a $141 million carrying value and the Brooklyn Residential/Condo loan with a $120 million carrying value as of September 30, 2025.

Quarterly earnings call transcripts for Ares Commercial Real Estate.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more