Earnings summaries and quarterly performance for Adient.

Executive leadership at Adient.

Jerome Dorlack

President and Chief Executive Officer

Heather Tiltmann

Executive Vice President, Chief Legal and Human Resources Officer, and Corporate Secretary

James Conklin

Executive Vice President, Americas

James Huang

Executive Vice President, APAC

Mark Oswald

Executive Vice President and Chief Financial Officer

Board of directors at Adient.

Research analysts who have asked questions during Adient earnings calls.

Colin Langan

Wells Fargo & Company

6 questions for ADNT

Dan Levy

Barclays PLC

5 questions for ADNT

Emmanuel Rosner

Wolfe Research

5 questions for ADNT

James Picariello

BNP Paribas

4 questions for ADNT

Joseph Spak

UBS Group AG

3 questions for ADNT

Andrew Percoco

Morgan Stanley

2 questions for ADNT

Joe Spak

UBS Group AG

2 questions for ADNT

Andres

Stifel

1 question for ADNT

Edison Yu

Deutsche Bank

1 question for ADNT

John Murphy

Bank of America

1 question for ADNT

Nathan Jones

Stifel

1 question for ADNT

Xin Yu

Deutsche Bank

1 question for ADNT

Recent press releases and 8-K filings for ADNT.

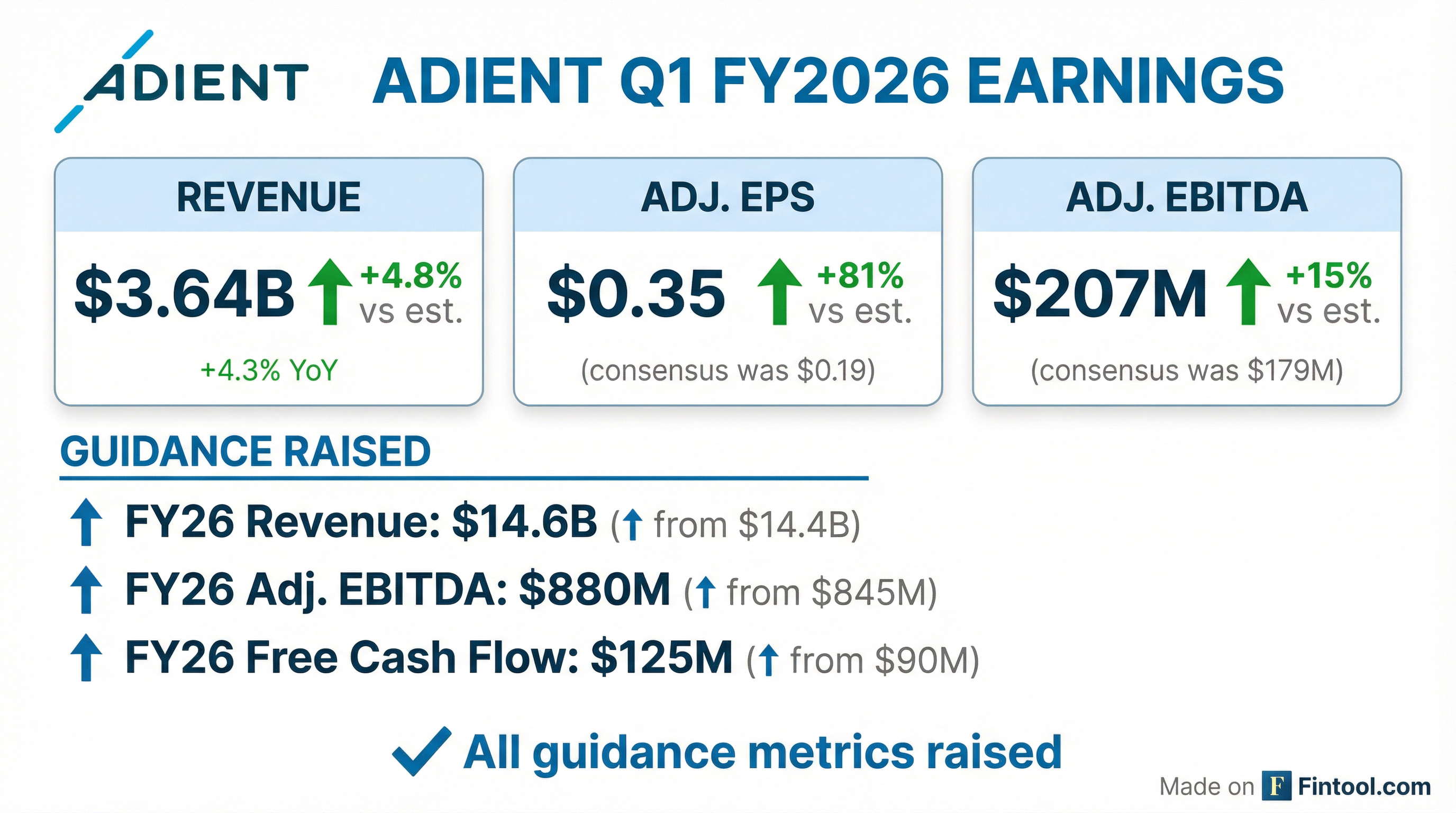

- Adient plc reported a solid Q1 FY26, with Consolidated Revenue of approximately $3.6 billion (up ~4% year-over-year) and Adjusted EBITDA of $207 million (up $11 million year-over-year).

- The company increased its key FY26 financial expectations for Revenue, Adjusted EBITDA, and Free Cash Flow, driven by strong Q1 results and an improved vehicle production forecast.

- Adient returned $25 million to shareholders through share repurchases, buying back approximately 1.2 million shares in Q1 FY26.

- Sales in China significantly outpaced industry production, and the company identified Americas growth opportunities including ~525K units of incremental volume from onshoring and new wins, with an estimated annual revenue of ~$500 million.

- Adient reported Q1 2026 revenue of $3.6 billion, a 4% increase year-over-year, and adjusted EBITDA of $207 million, with a margin of 5.7%. The company also generated $15 million in free cash flow and repurchased $25 million in shares during the quarter.

- The company raised its full-year fiscal 2026 guidance, with sales now expected to be approximately $14.6 billion, adjusted EBITDA around $880 million, and free cash flow at $125 million.

- Adient secured approximately 150,000 units of direct onshoring business and 25,000 units of indirect opportunities in North America, projecting an estimated $500 million in additional revenue by fiscal year 2028.

- The company introduced ModuTec, a modular seat design solution expected to deliver up to 20% total value chain savings and enhance its competitive position.

- Adient maintained $1.7 billion in total liquidity at December 31, 2025, and successfully repriced its Term Loan B, achieving a 25 basis point reduction for an annual savings of approximately $1.5 million.

- Adient reported Q1 FY26 consolidated revenue of ~$3.6 billion, a 4% year-over-year increase, and Adjusted EBITDA of $207 million, up $11 million year-over-year.

- The company generated $15 million in Free Cash Flow and returned $25 million to shareholders through share repurchases in Q1 FY26.

- Adient raised its FY26 financial expectations, with consolidated revenue now projected at ~$14.6 billion, Adjusted EBITDA at ~$880 million, and free cash flow at ~$125 million.

- The company's net leverage ratio was 1.7x as of December 31, 2025, which is within its targeted range of 1.5x-2.0x.

- Adient (ADNT) reported Q1 2026 sales of $3.6 billion, a 4% increase year-over-year, and adjusted EBITDA of $207 million, up 6%. The company also returned $25 million to shareholders through share repurchases.

- The company is raising its fiscal year 2026 guidance for revenue, Adjusted EBITDA, and Free Cash Flow, anticipating an improvement in North America vehicle production to 15 million units.

- Adient projects an additional $500 million in estimated revenue from onshoring and conquest wins, with $300 million impacting fiscal year 2027 and the full amount by fiscal year 2028.

- The balance sheet remains strong with $855 million in cash and $1.7 billion in total liquidity at December 31, 2025, and a net leverage of 1.7 times.

- Adient reported Q1 2026 revenue of $3.6 billion, a 4% increase year-over-year, and adjusted EBITDA of $207 million, improving 10 basis points to 5.7%.

- The company generated $15 million in free cash flow in Q1 2026 and returned $25 million to shareholders through share repurchases.

- Adient raised its fiscal year 2026 guidance, now expecting revenue of approximately $14.6 billion, adjusted EBITDA of around $880 million, and free cash flow of $125 million.

- New business wins and anticipated onshoring opportunities are projected to add an estimated $500 million in revenue, with $300 million impacting fiscal year 2027 and the full amount impacting fiscal year 2028.

- Net sales for Adient plc in Q1 2026 reached $3,644 million, an increase from $3,495 million in the comparable prior year period.

- The company reported a net loss attributable to Adient of $(22) million, translating to a diluted loss per share of $(0.28) for the first quarter ended December 31, 2025, compared to break-even results in the prior year.

- Adjusted EBITDA for Q1 2026 was $207 million, an improvement from $196 million in Q1 2025.

- Free cash flow decreased to $15 million for the three months ended December 31, 2025, down from $45 million in the prior year period.

- Net debt increased to $1,536 million as of December 31, 2025, compared to $1,439 million as of September 30, 2025.

- Adient reported a Q1 GAAP net loss of $(22)M and diluted EPS of $(0.28), alongside an Adjusted-EPS diluted of $0.35 for the first quarter of 2026.

- The company achieved Q1 Adjusted-EBITDA of $207M, representing an $11M year-over-year improvement, with Adjusted-EBITDA margins increasing from 5.6% to 5.7%.

- Adient returned $25M to shareholders in Q1 FY2026 by repurchasing approximately 1.2 million shares.

- Management raised its FY26 guidance for revenue to $14.6B, Adjusted-EBITDA to $880M, and Free Cash Flow (FCF) to $125M.

- Adient reported Q4 FY25 consolidated sales of $3.7 billion (up 4% year-over-year) and Adjusted EBITDA of $226 million, contributing to full year FY25 consolidated sales of $14.5 billion (down 1% year-over-year) and Adjusted EBITDA of $881 million.

- The company generated $204 million in free cash flow for FY25, including $134 million in Q4, and returned $125 million in capital through share repurchases, reducing shares outstanding by approximately 7%.

- As of September 30, 2025, Adient maintained a cash balance of $958 million, with gross debt at approximately $2.4 billion and net debt at approximately $1.4 billion.

- For FY26, Adient forecasts consolidated sales of approximately $14.4 billion, Adjusted EBITDA of approximately $845 million, and free cash flow of approximately $90 million.

- For the full year fiscal 2025, Adient reported sales of $14.5 billion and adjusted EBITDA of $881 million, achieving an adjusted EBITDA margin of 6.1%.

- The company generated $204 million in free cash flow for fiscal year 2025, surpassing its previous guidance, and returned $125 million to shareholders through share buybacks, reducing the beginning year share count by 7%.

- Adient forecasts a net sales decline of approximately $480 million for fiscal year 2026 and expects free cash flow of around $90 million, attributing this to lower volumes and increased investments in future growth.

- Strategic initiatives include winning $1.2 billion of new business in China, with nearly 70% of those wins with domestic China OEMs, and a new unconsolidated joint venture in China targeted to close in Q1 fiscal year 2026.

- The company maintains a long-term outlook for 2027, targeting double-digit growth over market in China and mid-single-digit growth over market in North America, with an 8% midterm EBITDA margin target.

- Adient plc reported net sales of $3,688 million for the three months ended September 30, 2025, and $14,535 million for the twelve months ended September 30, 2025.

- For the fourth quarter of 2025, net income attributable to Adient was $18 million, with diluted earnings per share of $0.22.

- For the full fiscal year ended September 30, 2025, the company reported a net loss attributable to Adient of $(281) million, resulting in a diluted loss per share of $(3.39).

Quarterly earnings call transcripts for Adient.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more